According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July.

Balance Sheet

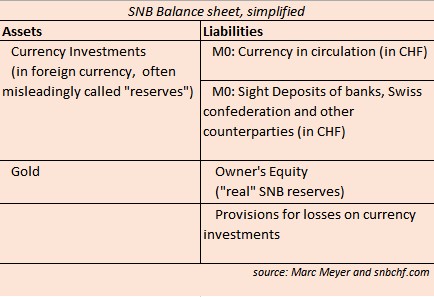

The SNB balance sheet looks as follows. In this post we concentrate on liabilities and owner’s equity (latest data here)

For an overview of the assets see here.

Liabilities:

SNB liabilities have two important components:

— Owner’s Equity: The real reserves for the SNB are the owners’ equity. The SNB is a public company (symbol SNBN:SW)

Changes in FX markets contribute most to movements in SNB profit & loss and in owners’ equity.

— Sight Deposits: In times of low inflation the principal mean of financing interventions.

Latest update

The latest SNB balance sheet data show that the Fed is helping the Swiss National Bank. The Fed is moving towards a rate hike, and consequently the dollar is appreciating. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF since July.

Still one should remember that all these gains are paper gains. For two reasons one should be suspicious:

- A big speculative position dollar against CHF is building up.

- The SNB continues to intervene. Buying dollars is currently not useful, because the SNB would sell them a lower price. We remember that the summer 2011 interventions were focused on the dollar at around 0.80 CHF.

The following table gives an overview of the balance sheet, with focus on liabilities, owner’s equity and interventions.

| Year/Quarter | Total Liabilities | Owner's Equity (&provisions) | FX Trends | EUR/CHF | USD/CHF | Gold (in CHF) | SNB Interventions | SNB results in period | Major driver of results |

|---|---|---|---|---|---|---|---|---|---|

| November 2015 | 635 bln. CHF | 68.9 bln. | Spec. pos. against CHF rising | 1.0840 | 1.01 | 1115 | 1 bln. CHF | Gain: 10 bln | USD stronger |

| October 2015 | 621 bln. CHF | 58.1 bln. | Fed moves towards rate hike | 1.0873 | 0.9880 | 1127 | 2 bln. CHF | Gain: 7.4 bln | USD stronger |

| Q3/2015 | 613 bln. CHF | 50.4 bln. | Speculative pos. against CHF building | 1.0877 | 0.9732 | 1107 | 5 bln. CHF | Gain: 16 bln | USD & EUR stronger |

| Q2/2015 | 577 bln. | 34.2 bln. | Greek crisis | 1.0419 | 0.9355 | 1088 | 15 bln CHF | Loss: 22 bln. | European stocks & US Treasuries |

| Q1/2015 | 581 bln. | 56 bln. | Draghi QE leads to end of EUR/CHF peg | 1.0437 | 0.9726 | 1168 | 67 bln. CHF | Loss: 30 bln. | High loss on EUR |

| Q4/2014 | 561 bln. | 86 bln. | Rouble crisis trigger new SNB interventions | 1.2029 | 0.9942 | 1179 | 20 bln. CHF | Gain: 10 bln. | Most on USD |

| Q3/2014 | 522 bln. | 76 bln. | Oil price starts collapse | 1.2067 | 0.9552 | 1139 | None | Gain: 12 bln. | USD, GBP stronger |

| Q2/2014 | 508 bln. | 64 bln. | Draghi talks of QE | 1.2143 | 0.8869 | 1171 | None | Gain: 12 bln. | all types of assets: gold, bonds, stocks |

| Q1/2014 | 495 bln. | 52.3 bln. | Ukraine crisis | 1.2184 | 0.8847 | 1153 | None | Gain: 4 bln. | |

| 2013 | 490 bln. | 48 bln. | Fed ending Quantiative Easing | 1.2276 | 0.8931 | 1107 | None | Loss: 10 bln. | Heavy losses on gold |

| 2012 | 499 bln. | 58 bln. | Massive SNB interventions | 1.2040 | 0.9205 | 1528 | 160 bln. CHF | Gain: 5 bln. | Gains on gold and equities. |

| 2011 | 346 bln. | 53 bln. | EUR/CHF peg introduction, | 1.25 | 0.9442 | 1640 | Focus on USD intervention | Gain: 10 bln. | Strong gains on gold |

| 2010 | 270 bln. | 43 bln. | EUR falls from 1.40 to 1.24. | 1.2040 | 0.9340 | 1246 | interventions until April 2010 | Loss: 23 bln. | Gold reduced FX loss |

| 2009 | 207 bln. | 66 bln. | Rising JPY, Falling USD after QE | 1.4837 | 1.0354 | 1121 | interventions with sight deposits and swaps | Gain: 8 bln. | Gains on swaps, treasuries |

| 2008 | 214 bln. | 58 bln. | Falling USD with sub prime crisis. EUR unchanged | 1.4850 | 1.0673 | 989 | interventions with swaps | Loss: 7 bln. | Loss on USD |

| 2007 | 126 bln. | 65 bln. | Subprime crisis: EUR and USD start falling vs. CHF | 1.6547 | 1.1329 | 1046 | None | Gain: 5 bln. | Gains on swaps, treasuries |

| 2006 | 112 bln. | 60 bln. | 1.6082 | 1.2265 | 800 | None |

June 2015:

The SNB lost 23 bln. of owners’ equity.

Falling prices of the bonds and stocks porfolio let to further losses. Two examples:

- the yield of 5 Year US Treasuries fell from 1.37% at end March to 1.61% at the end of June. This implied falling bond prices.

- The German DAX fell from over 12000 points still in April to 10944 at the end of June.

May 2015:

A loss of 1.5% in euro and Canadian dollar and falling bond prices let to another loss of 8 billion Francs in owners’ capital.

The Stronger Dollar Helped in 2014

The EUR fell from 1.38$ in Q2/2014 to 1.24$ in Q3/2014 and close to 1.10$ in Q4. During the times of the peg, it implied that the USD/CHF improved similarly, from 0.87 in March 2014 to 0.89 in Q2/2014, 0.95 in Q3 and to parity at the end of 2014. The stronger US Dollar helped to increase the value of the SNB assets and of the whole balance sheet.

Between the first and the third quarter of 2014, the SNB did not intervene. Thanks to the stronger dollar and the peg to the euro, the owners’ equity rose and let to the very good 2014 results of 38 billion CHF. However, the losses until end May amount to 46 billion, more than the profit of 2014.

The SNB had to intervene again, with the Russia crisis in November/December. When European QE was looming in January, the SNB decided to exit from the peg.

References:

- the latest SNB balance sheet

- See more on the history of sight deposits

See more for