Currency in circulation in the balance sheet

In the following we want to know if the bank also increases the second type of debt, currency in circulation.

When we look at the balance sheet for March 2015, we discover that currency in circulation did not move a lot, there was even some “monetary deflation”.

In April the currency in circulation rose to 67.2 bln. CHF.

SNB Liabilities Debt March 2015 (source SNB Balance sheet)

If we look on the FX rates in the table, then the SNB should have incentives to sell dollars. The bank bought most of them in August 2011 at a rate of 0.80 CHF, but in March the dollar was at parity to the franc. At the time, EUR/USD was above 1.40.

February 21: No change in total sight deposits. All currency movements are caused by traders, but not by the SNB.

On February 20, the Swiss minister of economics said that there would not be a recession. This confirmed our view uttered below. The Swiss franc saw strong gains and rose 1% against both USD and EUR on Friday. On Twitter I added an additional point: If Greece remains in the euro zone, then their purchasing power is higher. This implies that they are able to buy more products, in particular Swiss ones. This is positive for Swiss stocks and therefore CHF-positive (as opposed to USD). This is consistent with my view that CHF is not a safe-haven currency but a safe proxy for global growth (and not to forget: in the future for higher Swiss purchasing power).

Sight Deposits in the SNB balance sheet

Currency in circulation is currently the second financing method for the SNB, the typical “money printing” of debt, it is at 67.6 billion CHF. This printing is today far less important than the electronic printing of debt called “sight deposits”. But recently there was rapidly rising demand for CHF cash, possibly by Russian oligarchs. 60% of bank notes in circulation are notes of 1000 francs.

As also visible in our overview table, the balance sheet the “other sight deposits” of the weekly monetary data are split into more details:

- foreign banks and institutions are shown separately (we list them also above): 17.5 billion.

- loans from the Swiss Federation to the SNB: 9 billion

- misleadingly again an item called “other sight deposits”, these are other sight deposits according to weekly monetary data minus 1) and minus 2)

Full Background and Explanation

We wrote the following explanation before the end of the peg.

Reading one: “Central banks create money – SNB decides on its own about interventions.

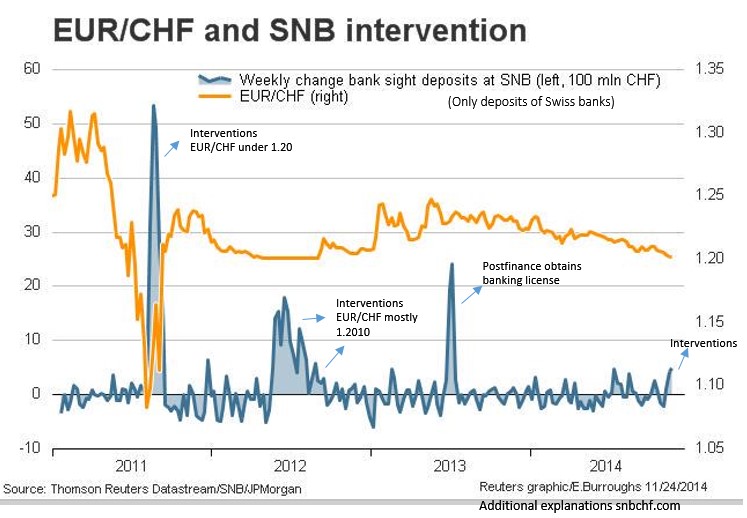

Overview: Sight deposits are currently the by far most important means of financing for SNB currency purchases. Sight deposits are assets for commercial banks that deposit money at the SNB, but for the SNB they are liabilities, debt. The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. Therefore the weekly monetary data gives an far earlier indication of of SNB interventions than the relatively late releases of balance sheet data.

Total sight deposits have increased to a total of 449 billion francs from 220 bln. at the beginning of 2012 and only 28 bln in 2011.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. Therefore the weekly monetary data gives an far earlier indication of of SNB interventions than the relatively late releases of balance sheet data.

Total sight deposits have increased to a total of 449 billion francs from 220 bln. at the beginning of 2012 and only 28 bln in 2011.

Together with around 65 billion CHF in bank notes, the sight deposits provided by Swiss banks build up the so-called “central bank money” or ”monetary base” M0. This central bank money M0 is combined with sight deposits owned by other counter parties and SNB owners’ equity to obtain the total of 522 bln. SNB Liabilities, the means of financing the total of 522 billion SNB reserves, its assets.

If the CHF exchange rate could freely float then sight deposits at the SNB would not increase, but the FX rate would adjust until there is less desire to hold CHF deposits. With a stronger CHF it would make sense for Swiss investors to buy foreign assets because those assets would become cheaper in CHF. Some critics (e.g. here Marc Meyer at Inside Paradeplatz) say that the SNB weakens the Swiss economy, because it buys foreign assets. This is not exactly true, because the SNB makes Swiss investments like houses and stocks cheap. But the SNB also weakens the price of CHF loans for investment abroad. They are cheaper than they would be in a free market, simply because CHF is cheap for foreigners.

This is the first way of looking at it: The SNB prints more money, it increased its debt in order to buy more foreign reserves and to keep the EUR over 1.20.

Reading two: “Commercial banks create money – inflows in CHF on bank accounts trigger SNB interventions”.

There is a second way of looking at it, it represents somehow an opposite explanation, namely “commercial banks and foreign investors create M0 money”:The Swiss do not know how to invest their money obtained by huge trade and current account surpluses. Foreigners that seek safe-havens have the same problem. Instead of investing money abroad they leave existing funds and newly generated income on their Swiss bank account.

By simple balance sheet logic, the Swiss bank needs to book an asset for the obtained cash liability to the client. The bank could decide to create a big cash vault or it could lend the funds to somebody. But nowadays, the Swiss bank does not want to take risks neither: it does like to lend more than necessary in CHF for Swiss mortgages or to lend in foreign currency, e.g. to a foreign bank in the weak euro members. As opposed to this lending, depositing these funds at the central bank neither weaken the Basel 3 ratios nor require additional counter-cyclical capital. The bank also opts against a big cash vault because it would have costs of maybe 0.1% of the total. In the Swiss case there is a big economies of scale effect.

The bank finally deposits the funds at the central bank as an (electronic) CHF sight deposit. From 2015 on, holding high sight deposits above a threshold will be punished by a 0.75% “fine”.

Since it not worth leaving francs as cash at the SNB, the Swiss stock market and CHF lending for mortgages become interesting and have strongly improved. Investing in Swiss stocks or Swiss real estate, however, implies that the funds remain in CHF It is also worth mentioning that the M0 money creation via currency inflows is not contained in the< href= http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf “Money creation in the modern economy” that the Bank of England proposed.

Some Older Headlines, in particular the ones when the peg ended, are on the next page.

Further references:

Definitions of money supply in the context of the SNB

Swiss Franc History: The Financial Crisis and SNB Interventions until 2012

See more for