Central Bank data shows that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with Foreign Exchange interventions, while such “physical” interventions by the Bank of Japan remain very limited. The recent Japanese FX interventions were purely verbal, while hedge funds and FX

Central Bank data shows that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with Foreign Exchange interventions, while such “physical” interventions by the Bank of Japan remain very limited. The recent Japanese FX interventions were purely verbal, while hedge funds and FX traders warriors acted on behalf of the Japanese on the FX battle field.

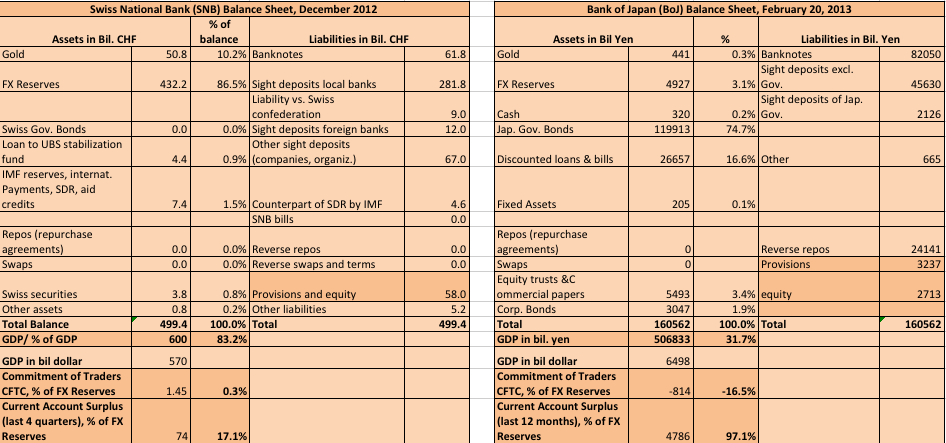

SNB Balance sheet vs. the Bank of Japan’s one

This is the latest SNB balance compared the one of the Bank of Japan. The latest SNB balance sheet can be obtained here on the SNB site.

(click to expand), sources SNB monthly bulletins and Bank of Japan weekly accounts)

The following is the SNB balance sheet as of December 2011, compared to the BoJ before the latest monetary easing program (as of September 30, 2012).

(click to expand), sources (SNB monthly bulletins and BoJ)

The data shows that prime minister Shinzo Abe, his Ministry of Finance (MoF) and its “department”, the Bank of Japan (BoJ), were just generals and commanders that directed verbally. Different American hedge funds and FX traders fought in the name of the sacred Japanese matter; they were the currency warriors, while the MoF preferred not to soil their hands with foreign assets. None-withstanding private Japanese investors possibly continued to buy US treasuries.

We attributed the behaviour of traders to sharply reduced risk aversion and a potential new boom of U.S. housing.

Effectively the BoJ balance sheet for February 20th, 2013 shows that the share of Japanese government bonds (JGBs) and Discounted Japanese Treasury Bills compared to the total balance sheet rose from 68.6% to 74.7% since the end of September, while assets in foreign currency remained stable at 3.1%.

The SNB, however, holds foreign reserves for 86.5% of its balance sheet. This balance makes up 83.2% of Swiss GDP, up from 57.7% in 2011. The BoJ balance sheet amounts to 31.7% of Japanese GDP. This percentage has risen only slightly since September.

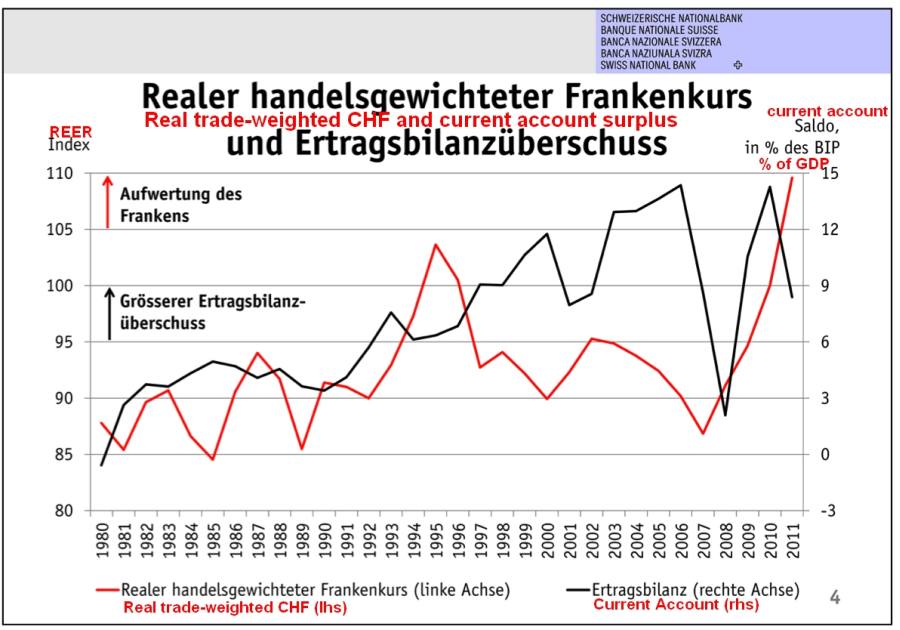

While the Japanese surplus is slowly shrinking (and not quickly like Kyle Bass might suggest), the Swiss have increased their current account surplus thanks to the depreciation stopped appreciation of their currency. The EUR/CHF 1.20 level was comfortable enough for Swiss companies to increase the surplus in 2012: it rose to 74 bln. CHF or 12% of GDP in the last 4 quarters (Q4/2011 to Q3/2012), while the sharp rise of the franc caused it to shrink from 82 bln francs in 2010 (14% of GDP) to 50 bln. (8%) in 2011.

And oh wonder, a strengthening of the Swiss current account surplus bizarrely coincides with the key tasks of the SNB, namely price stability taking into account economic developments – the external component is still a part of GDP.

Mr Jordan explicitly denies that the current account surplus is important to the SNB. But he clarifies that the Swiss current account is strongly driven by global growth.

Deliberately he has left out the 12% of GDP current account surplus for 2012 in his latest marketing event for the Swiss market manipulation. Instead he gives excuses that 40% of the shares of Swiss multi-national companies are held by foreigners and that the balance of payments (BoP) only mirrors outflows in the form of dividends to these foreign investors but not stock price gains. Moreover he claims that Swiss shopping in neighbour countries were a big source of errors for the BoP.

FX traders will have little chance to stop a sharp Swiss franc revaluation caused by SNB franc buying when one day growing Swiss surpluses, wealth and home prices drive Swiss inflation towards the SNB price stability target of 2%.

The BoJ possesses FX reserves for the equivalent of the Japanese current account surplus of one year, while the SNB has foreign assets for nearly 6 years of current account surpluses in her books. This difference shows again that the Japanese are no real currency manipulators, but the Swiss are.

Read why Swiss investors might require a sufficiently big gap between global and Swiss yield of return in order to invest in foreign assets again: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

See more for

2 comments

Domenico Laruccia

2013-03-16 at 18:59 (UTC 2) Link to this comment

this is cler to everyone, but “market expectations” just sized the excess and usual path of previous forward expectation of flows into JPY as repair currency, that’s what. Now BOJ have to demonstrate in real if they are able and want to manipulate currencies, but this is clear to everyone, not needed such a long and complicate explication

Domenico Laruccia

2013-03-16 at 19:01 (UTC 2) Link to this comment

the reason why a lot think JPY will be deflated is because Japan due to a number of reasons will not be able anymore to finance its outstanding govt debt. They will do it by printing money, that’s themain reason they will devaluate JPY