Found 1,868 search results for keyword: label

1 in 10 Swiss hospitals facing financial difficulty

Around one hospital in ten in Switzerland could end up in financial difficultly, according to a report by PWC. In addition, 37 of the 44 hospitals surveyed will not be profitable enough to remain competitive over the next five to ten years, predict the authors of the report.

Read More »

Read More »

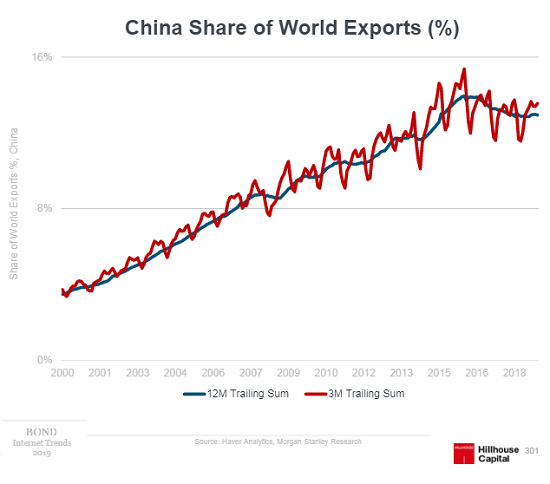

A China Trade Deal Just Finalizes the Divorce

Each party will continue to extract whatever benefits they can from the other, but the leaving is already well underway. Beneath the euphoric hoopla of a trade deal with China is the cold reality that the divorce has already happened and any trade deal just signs the decree. The divorce of China and the U.S. was mutual; each had used up whatever benefits the tense marriage had offered, and each is looking forward to no longer being dependent on the...

Read More »

Read More »

Politicians Want Thanksgiving To Be Political. Ignore Them.

Often, government-created holidays begin with a good premise — i.e., Independence Day, Armistice Day — and get worse from there. On Independence Day, instead of celebrating armed rebellion and secession, we now sing the praises of the government. Similarly, Armistice Day — a day designed to commemorate the end of a war — became Veterans Day, a day designed to honor government employees.

Read More »

Read More »

Euro Area 2020 Macro Outlook

After an estimated 1.2% in 2019, we expect GDP growth of 1.0% in the euro area in 2020. Country wise, we expect more manufacturing-intense countries to underperform more domestically driven ones. Thus, we project weak growth of 0.7% in Germany and 0.4% in Italy in 2020, while we expect France and Spain to remain relatively resilient, growing by 1.2% and 1.7%, respectively.

Read More »

Read More »

Federal Council paves way for VAT refund on Billag fee

At its meeting on 27 November 2019, the Federal Council set out its plan for the refund of value-added tax (VAT) on Switzerland’s radio and television licence, formerly known as Billag. Between 2010 and 2015, VAT was charged on Swiss television and radio licences.

Read More »

Read More »

Capital Accumulation, Not Government, Is the Key To Technological Innovation

According to Mariana Mazzucato, the RM Phillips Professor in the Economics of Innovation at the University of Sussex, government is an important factor in the promotion of innovation and thus economic growth. In particular, she challenges the popular view that innovation happens in the private sector, with governments playing a limited role. Many commentators regard her as a revolutionary thinker that challenges the accepted dogma regarding the...

Read More »

Read More »

FX Daily, November 27: In Search of New Incentives

Overview: The global capital markets are subdued. There have been few developments to induce activity. Even President Trump's claims that the talks with China are in the "final throes" failed to excite. Equities are extending their advance. Bonds are little changed, and the dollar is mostly firmer. The MSCI Asia Pacific Index and Europe's Dow Jones Stoxx 600 advanced for the fourth consecutive session.

Read More »

Read More »

The $31 million watch and other Swiss price world records

A CHF640 ($645) bar of chocolate is a sign of either the end of civilisation or a healthy market economy. Whatever your view, Switzerland holds several world records when it comes to expensive goods. “As the hammer came down on $31 million (CHF30.6 million), the audience leapt as one to its feet, erupting in wild cheering and thunderous applause,” the Financial Times wrote on November 11 as a world record was set in Geneva for the highest price of...

Read More »

Read More »

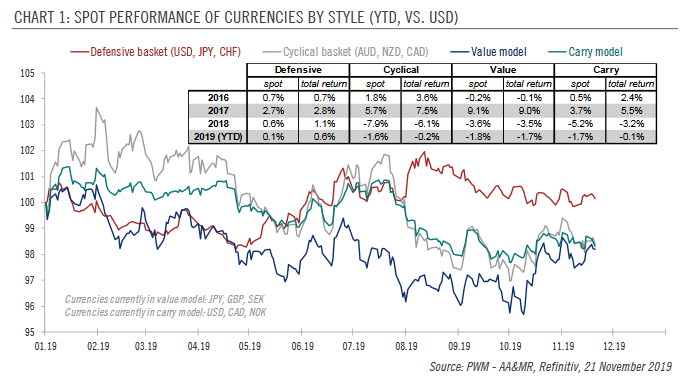

Currencies: do it with style

Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter.

Read More »

Read More »

There Is No End to History, No Perfect Existence

All doctrines that have sought to discover in the course of human history some definite trend in the sequence of changes have disagreed, in reference to the past, with the historically established facts and where they tried to predict the future have been spectacularly proved wrong by later events.

Read More »

Read More »

Don’t Want a Liquidity Trap? More Saving Is the Answer

With interest rates in many countries close to zero or even negative, some commentators are of the view that monetary policy of the central banks are likely to become less effective in navigating the economy. In fact it is held that we have most likely reached a situation that the economy is approaching a liquidity trap. But what does this mean?

Read More »

Read More »

Why Friedman Is Wrong on the Business Cycle

According to an article in Bloomberg on November 5, 2019, Milton Friedman’s business cycle theory seems to be vindicated. According to Milton Friedman, strong recoveries are just natural after particularly deep recessions. Like a guitar string, the harder the string is plucked down, the faster it should come back up.

Read More »

Read More »

French-speaking cantons biggest winners from next year’s fiscal transfers

The amount of money paid by “rich” cantons to “poor” ones will rise by CHF 61 million to CHF 5.3 billion in 2020, according to a recent government press release. The only French-speaking canton paying will be Geneva. All of the rest will see the sums they receive rise compared to 2019. In 2020, Geneva will pay CHF 275 million, down slightly from the CHF 300 million it paid in 2019.

Read More »

Read More »

More than 100 members of Extinction Rebellion convicted in Switzerland

In September 2019, groups of people belonging to the group Extinction Rebellion blocked two road bridges in Lausanne. Local police cleared the bridges by removing, in some cases carrying, protesters away. On 7 November 2019, 117 of the people involved in the bridge protests were convicted and fined for breaking Switzerland’s penal code, according to RTS.

Read More »

Read More »

Geneva to ban Uber if it doesn’t change its operating model

After a legal analyis the government of the canton of Geneva has decided that drivers of the ride hailing service are employees rather than independent contractors, effectively banning Uber from operating under its current model. In an interview with RTS, Mauro Poggia, a lawyer and Geneva state councillor, said that Uber is a transport company and as such must employ its drivers.

Read More »

Read More »

Why is solar power struggling to take off in Switzerland?

Solar energy is the main source of renewable energy in Switzerland, after hydroelectric power. But its potential is far from being exploited, according to industry experts. In 1982 Switzerland became the first country in Europe to connect a photovoltaic plant to the electricity network. Ten years later it inaugurated what at the time was the continent’s largest solar power station.

Read More »

Read More »

Sound Money Scholarship Winners Announced – 7 Outstanding Thinkers Earn Nearly $10,000 in Tuition Assistance

Eagle, ID (November 6, 2019) – Seven outstanding students beat out over 100 of their high-school and college peers in making the best case for sound money through an international, gold-backed scholarship competition......and the winners walked away with almost $10,000 in scholarship awards for their exceptional, thought-provoking essays.

Read More »

Read More »

Would an Uber ban in Geneva push other cities to treat drivers as employees?

It’s not the first time Uber has faced some bumps on the road in canton Geneva. But the latest move requiring the ride-hailing company to treat drivers as employees could spell big changes for the company. Will Uber call it quits or set a precedent for other cities?

Read More »

Read More »

The American Middle Class Isn’t Disappearing — But it’s Not All Good News

I'm not of the opinion that the American economy is doing amazingly well. However, I'm also not of the opinion that it is falling apart, or that the American middle class is disappearing before our eyes. Nor is there is no one, single, magic statistic we can point to and say "see, we're all worse off — or better off — now." Aggregate economic data is by its very nature lacking in nuance, moreover, difference measures of economic growth and...

Read More »

Read More »

Swiss government cuts drug prices by 100 million francs

Switzerland’s Federal Office of Public Health (FOPH) recently announced it had reduced the price Swiss healthcare providers and patients will pay for 257 drugs by 16.3%. These lower prices, which take affect on 1 December 2019, are expected to save CHF 100 million annually.

Read More »

Read More »