Found 1,867 search results for keyword: label

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »

Podcast: Passiv vs. aktiv: Was den DJE US-ETF besonders macht

Innovation im Finanzsektor? Geschieht jeden Tag!

Um als traditionsreicher Vermögensverwalter mit der Zeit zu gehen können, kommt es auf die Grundlagen an, weiß auch DJE. Der erste ETF aus dem Hause ist Ergebnis der fundamentalen Digitalisierung in der Datenerhebung, was nun in einer Top-Selektion des US-Aktienmarkts mündet.

Aber sind ETFs noch Innovation? Der aktive DJE US-ETF Xtrackers DJE US Equity Research UCITS ETF (ISIN: IE00050EGWG5)...

Read More »

Read More »

Ende des US-Exzeptionalismus? – DJE-plusNews August 2025 mit Mario Künzel

„Ist es vorbei mit der Einzigartigkeit der Amerikaner?“, fragt Mario Künzel, Referent für Investmentstrategien bei DJE, in der Augustausgabe der DJE plusNews. Denn: die Zukunft der USA ist noch immer nicht gewiss. Zwar habe die politische Unsicherheit abgenommen, aber gleichzeitig sind die Zollverhandlungen noch nicht abgeschlossen – gerade mit wichtigen Partnern wie China.

Dennoch bleiben die USA ein besonderer Player am Markt, da Wirtschafts-...

Read More »

Read More »

Titel – Marktausblick mit Stefan Breintner und Markus Koch 08/2025

Die Tech-Werte in den USA laufen sehr stark, doch nur wenige Aktien tragen die Indizes und damit die aktuelle Stimmung an den Märkten. Die befürchtete Rezession auf ganzer Breite? Ist ausgeblieben – ebenso wie eine hohe Inflation in den USA. Stattdessen könnte die Federal Reserve den Leitzins das erste Mal seit längerer Pause um 25 Basispunkte senken.

Welche Sektoren trotz der schwachen Marktbreite im aktuellen Umfeld interessant sind, warum...

Read More »

Read More »

The Lunatic Core of Radical Legal Egalitarianism

When the legal scholar Richard Posner labeled Critical Race Theory as having a “lunatic core,” he was echoing what Ludwig von Mises years before had written about polylogism. Unfortunately, CRT now dominates the nation‘s law school curriculum.

Read More »

Read More »

Bitpanda Launches in the UK with Access to 600+ Digital Assets

Bitpanda has officially launched in the UK, offering British investors access to more than 600 digital assets, the most comprehensive selection on the UK market.

Bitpanda has over 7 million users across Europe and holds multiple regulatory licenses outside the UK.

Its offering includes a wide range of digital assets, from well-known cryptocurrencies such as Bitcoin and Ethereum to emerging tokens and stablecoins.

Users also have access to selected...

Read More »

Read More »

Gezielt in die stärksten US-Aktien investieren – Der aktive US-ETF von DJE erklärt

In diesem Interview spricht Moderatorin Sabrina Löffler mit Kilian Stemberger, Analyst bei DJE Kapital AG, über den Xtrackers DJE US Equity Research UCITS ETF – einen aktiv gemanagten ETF, der gezielt in die 50 stärksten US-Aktien investiert.

Erfahren Sie:

➡ Was ETFs sind und wie sie funktionieren

➡ Der Unterschied zwischen passiven und aktiven ETFs

➡ Warum DJE erstmals Expertise in einem ETF-Produkt umsetzt

➡ Wie der kombinierte quantitative und...

Read More »

Read More »

The Low Beta Boom: Sidestepping The Dotcom Bust

Following the release of our article The High Beta Melt Up- Echoes of 1999, we received a few emails complaining that we left our readers hanging. They wanted to know how investors could have shifted their holdings from high beta and momentum stocks to sidestep massive losses when the dot-com bubble burst. In the first …

Read More »

Read More »

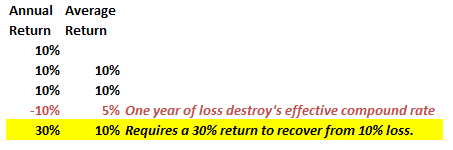

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

When markets decline—especially after long periods of sustained growth—the familiar advice resurfaces: "Be patient. Stay invested. Ride it out." The rationale? The market always goes up over time. But there's a critical flaw in this narrative. Your portfolio and a portfolio benchmark are entirely different things. And portfolio benchmarking, or the constant comparison of your …

Read More »

Read More »

Big Beautiful Reality – DJE-plusNews Juli 2025 mit Mario Künzel

Die Juli-Ausgabe der DJE plusNews mit Mario Künzel, Referent für Investmentstrategien bei DJE, widmet sich der „Big Beautiful Bill“ von US-Präsident Donald Trump, die erhebliche Steuererleichterungen für Bürger und Unternehmen bringen soll – aber dafür auch erhebliche Herausforderungen mit sich bringt würde.

Was das für die Märkte bedeuten und welche Auswirkungen zur „Big Beautiful Reality“ führen könnten, wird im Video anhand technischer und...

Read More »

Read More »

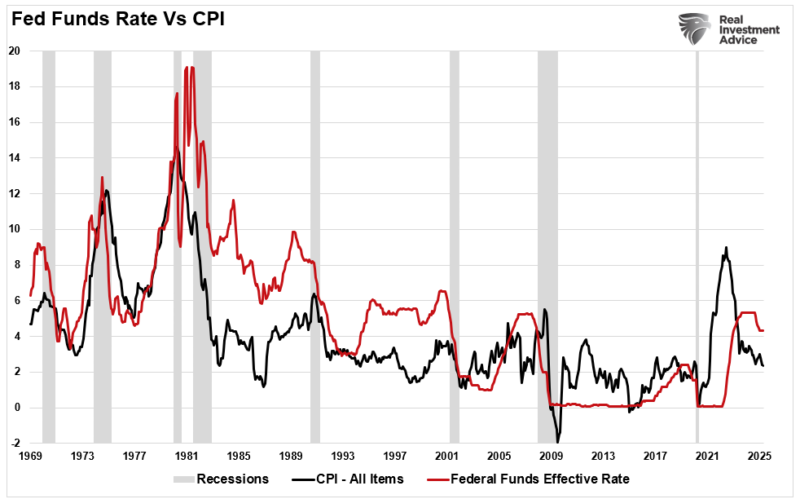

Might Lower Rates Be The Cure For Higher Prices?

The Fed is resisting interest rate cuts to help soften inflation to its 2% target. Supporting their policy is the belief that high interest rates lead to lower inflation. Most investors assume that the Fed is all-knowing and that its theories are logical. Are they? Might they be wrong, and lower interest rates are what … Continue...

Read More »

Read More »

Webkonferenz: Halbjahresbilanz mit Dr. Jens Ehrhardt und Markus Koch: “Spannende Zeiten”

Dr. Jens Ehrhardt zieht im Halbjahresfazit zusammen mit Börsenexperte Markus Koch Bilanz zur Wall Street und den Kapitalmärkten und warnt: „Es blinkt schon gelb.“ Trotz politischer Risiken wie Handelskonflikten und geopolitischen Spannungen blieben größere Rückschläge bisher aus. Zwar mahnen hohe Bewertungen und ein schwacher US-Dollar zur Vorsicht, doch Ehrhardt sieht auch Chancen. Besonders interessant könnten ausgewählte US-Nebenwerte sein, die...

Read More »

Read More »

Swiss group launches referendum against individual taxation

The introduction of individual taxation of spouses in Switzerland would create new inequalities, says an all-party group launching a referendum. +Get the most important news from Switzerland in your inbox The referendum was launched against the indirect counter-proposal to a popular initiative, which the group labels as deception. Individual taxation would not lead to greater …

Read More »

Read More »

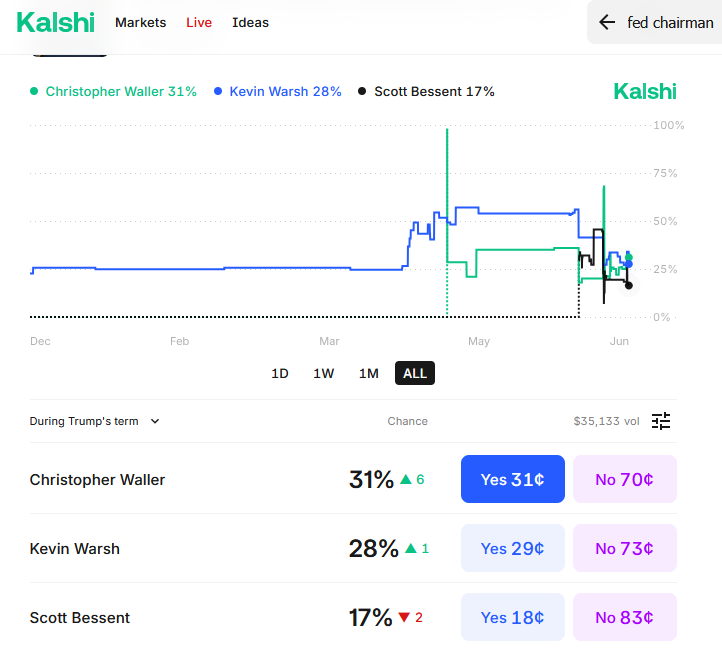

Shadow Fed Chair: Good Idea?

Donald Trump’s frustration with Chairman Powell increases by the day. Consequently, per The Wall Street Journal, expectations are that Trump will announce Powell's successor sooner than typical. Powell’s term expires May 2026. If Trump goes through with an early nomination, this "shadow Fed Chair" would espose views on the economy and monetary policy until Powell's retirement. Consequently, …

Read More »

Read More »

The Fed’s “Transitory” Mistake Is Affecting Its Outlook

In 2023 and 2024, the Fed was under intense public and media scrutiny for calling the post-pandemic surge in inflation “transitory.” Critics argued that the Fed's failure to anticipate the persistence and severity of rising prices undermined its credibility. Yet, with the benefit of hindsight and historical context, the Fed's position wasn't entirely misguided. Inflation …

Read More »

Read More »

Turkish Bank Garanti BBVA Kripto Partners with Wyden to Enhance Digital Asset Trading

Wyden, a Zurich-based provider of institutional digital asset trading infrastructure for regulated institutions, has formed a strategic partnership with Garanti BBVA Kripto, a subsidiary of Garanti BBVA, one of Turkey’s largest banks.

The collaboration aims to enhance Garanti BBVA Kripto’s digital asset trading services for both retail and corporate clients.

Through the partnership, Garanti BBVA Kripto will offer trading pairs in Turkish Lira and...

Read More »

Read More »

6-17-25 What’s the Difference Between Fixed Income and “Stable” Income?

What's the difference between fixed income and "stable" income?

Lance Roberts & Jonathan Penn break down the key differences between Dividend Stocks vs fixed income investments like bonds and annuities, and other strategies often labeled as stable income; how each performs in various market environments, the risks you may not see, and what every retiree or income-focused investor should consider. Lance and Jon also address the #1...

Read More »

Read More »

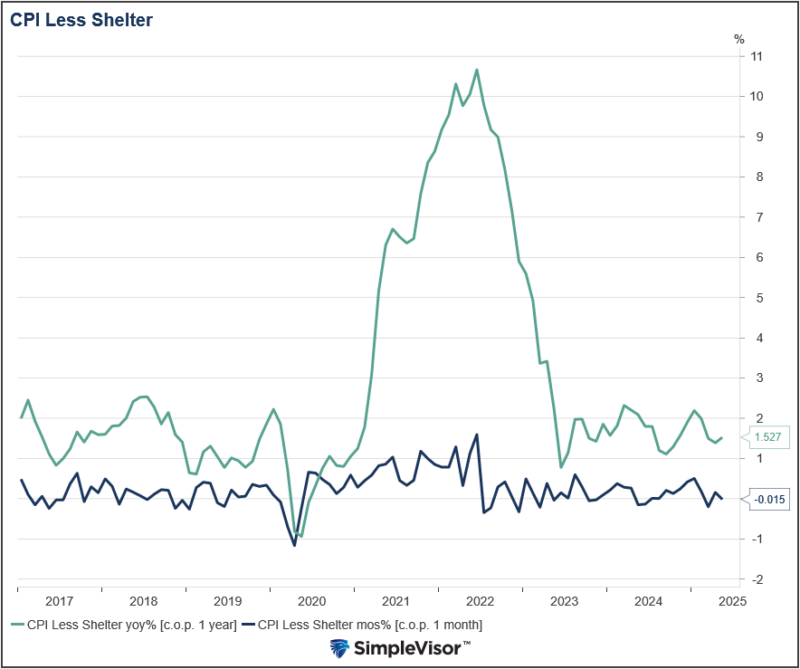

Inflation Remains Tame Despite Tariffs

The May CPI report released yesterday was considered the first inflation gauge to show how tariffs are impacting prices. We would like to see a few more months of inflation reports before claiming the coast is clear, but the May CPI is encouraging. For the fourth consecutive month, the CPI was below Wall Street estimates. … Continue...

Read More »

Read More »

What Keeps Us Safe?

On your computer monitor, your table lamp, or the label on your hair dryer, you will see the symbol "UL" with a circle around it. It stands for Underwriters Laboratories, a firm headquartered in Northbrook, Ill., and an unsung hero of the market economy.

Read More »

Read More »

Der Markt ist zurück: Marktausblick mit Stefan Breintner und Markus Koch 06/2025

Marketing-Anzeige

Stefan Breintner, Leiter Research bei DJE und Markus Koch, Wall-Street-Korrespondent und Börsenexperte blicken in ihrem bewährten monatlichen Marktanalyse-Format auf die Gemengelage. Nach einem eher schwierigen ersten Quartal endet das zweite mit positiveren Signalen.

Grund dafür ist der sogenannte „TACO-Trade“, positive Signale im US-Zollchaos und insgesamt positivere Konjunkturaussichten in Europa und den Emerging Markets....

Read More »

Read More »