What is Repo?

| Repo | Traditional / Securities Lending |

|

|---|---|---|

| What | Cash, Securities, other assets | Securities |

| Pledged | not pledged | pledged |

| Ownership | Lender (repo buyer) | Borrower (repo seller) |

| Risk | More risk-averse (lender ownership) |

Less risk-averse (lender has no ownership) |

| Reward | Interest paid by Buyer | Fee paid by borrower |

| Typical sellers/borrowers | Leveraged traders (bank desk, hedge funds) |

|

| Typical buyers/lenders | Risk-Averse investors (insurances, money market funds, recently central banks) |

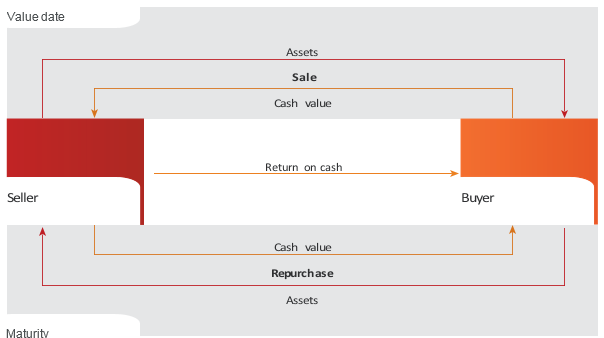

Repo can take the form of either ( legal and operational differences.)

- repurchase agreements or

- buy/sell-backs

Between the sale and the repurchase:

Default scenario:

|

|||||||||||||||||||||||||||||||||||||||||

Types: Classic Repo and Buy/Sell-BackRepo: Generic term for classic repo and buy/sell-back

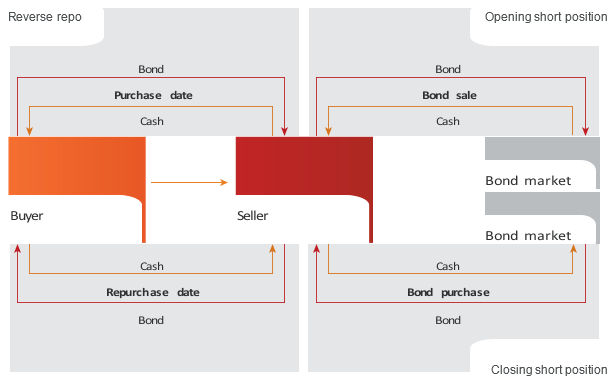

Although the term ‘repo’ is applied to the whole transaction, it is market convention to specifically describe the seller’s side of the transaction as the ‘repo’ and the buyer’s side as the ‘reverse repo’. Dealers talk about sellers ‘repo-ing out’ collateral and buyers ‘reversing in’ collateral. |

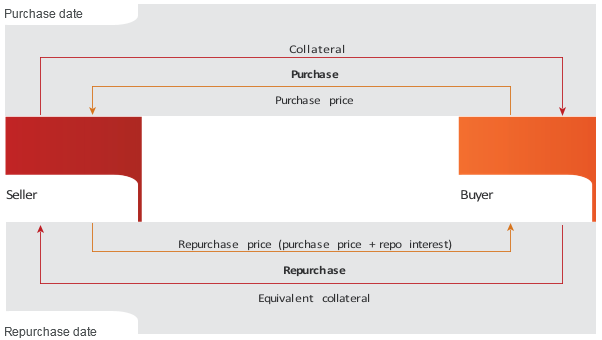

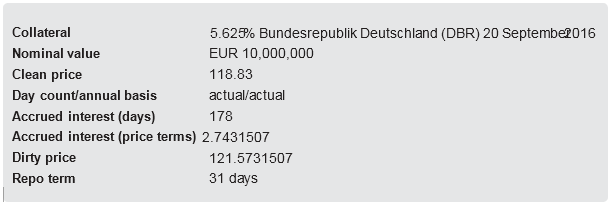

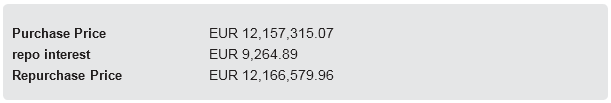

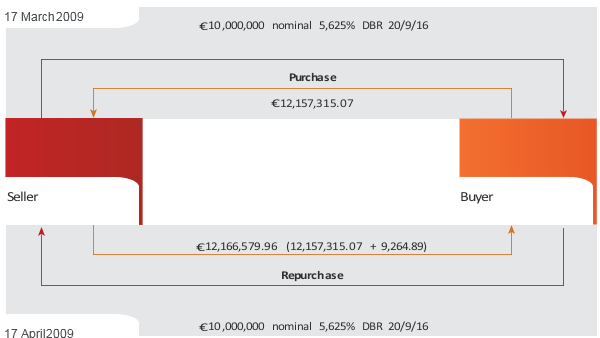

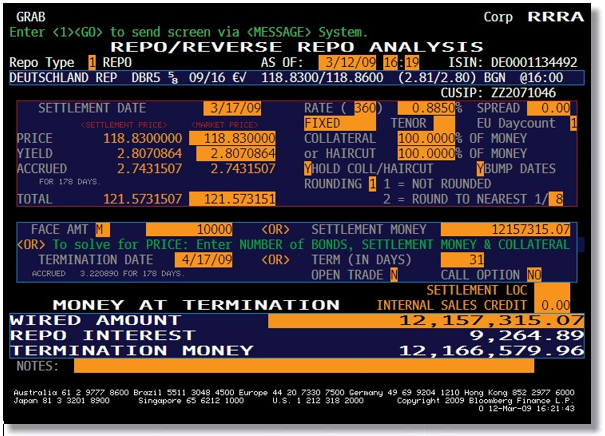

Comparing Repurchase Agreements and Buy/Sell-BacksThere is much confusion about the differences between repurchase agreements and buy/sell-backs. Comparisons are complicated by the fact that buy/sell-backs can now be documented (so that there are three types of repo: repurchase agreements, undocumented buy/sell-backs, and documented buy/sell-backs). Undocumented buy/sell-backs, which are the traditional form of the instrument, have a number of legal and operational drawbacks in comparison with repurchase agreements and documented buy/sell-backs. These differences are explained on page 25 – ‘Managing repo’. Examples of Repurchase Agreements and Buy/Sell-BacksRepurchase agreementIf the transaction is structured as a repurchase agreement, at a one-week repo rate of 0.885%, the cash flows would be: As there is no initial margin/haircut (see page 26 – ‘Initial margin’), the purchase price is simply the full cash market value of the bond: 5.625 x 178 10,000,000 + = 12,157,315.07 100 x 365 The repo’s interest payment is calculated as it would be for a deposit in the same currency (in the case of EUR, using a day count/annual basis convention of actual/360); 0.885 x 31 12,157,315.07 = 9,264.89 100 x 360 The Repurchase price is simply the purchase price plus the repo interest: 12,157,315.07 + 9,264.89 = 12,166,579.96 |

|

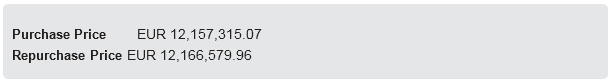

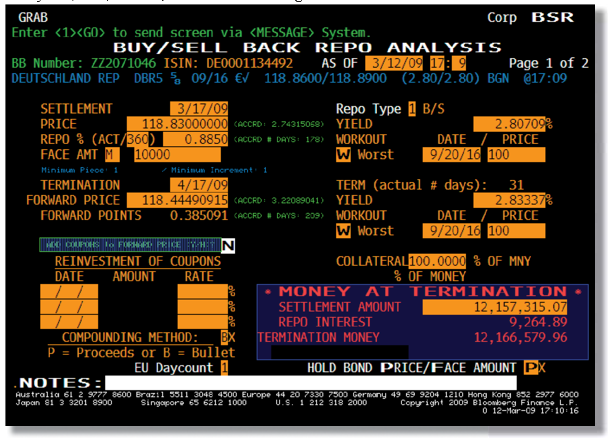

Buy/sell-backIf the transaction was structured as a buy/sell-back with equivalent terms to the previous repurchase agreement, the cash flows would be: There is no reference to repo interest, as there is none in a buy/sell-back. The return paid by the seller for use of the cash is the difference between the purchase price and repurchase price. The price of this buy/sell-back would traditionally have been quoted as a clean forward price, calculated by adjusting the repurchase price for the accrued interest on the collateral: Repurchase price – accrued interest at Repurchase date x 100 nominal value 5.625 x (178 + 31) 12,166,579.96 10,000,000 100 x 366 x 100 = 118.44490915 10,000,000 |

|

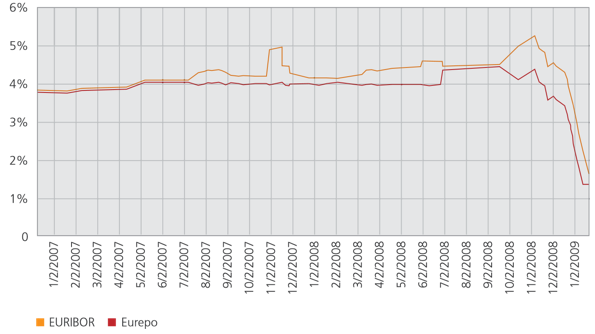

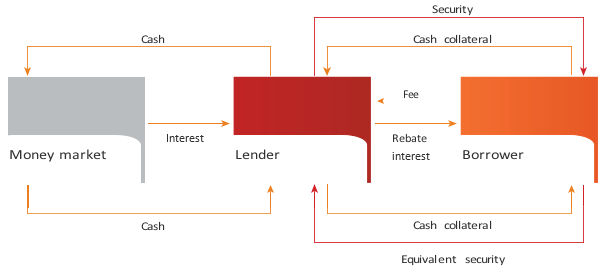

General Collateral Repo, Specials and Securities LendingGeneral collateral repo General Collateral (GC) repo is defined as a collateralised transaction driven by the need to borrow or lend cash. This means that the buyer does not insist on the seller providing a particular securities issue as collateral, but will accept any of a range of similar quality issues. In other words, the buyer has a ‘general’ requirement for collateral and the seller has some choice about precisely which securities to deliver. The bulk of repo is GC. As a means of borrowing or lending, GC repo is an alternative to unsecured money market instruments such as deposits and Commercial Paper (CP). The GC repo rate is therefore highly correlated with other money market rates. GC repo rates are most often compared with interbank deposit rates such as LIBOR and Fed funds. Given that repos are secured with collateral, the GC repo rate is normally below interbank deposit rates. The repo rates of euro-denominated repo are typically compared to the EONIA swap rate. Figure 6 compares Eurepo, EURIBOR and the EONIA swap rate, both for a term of one month[1]. [1] ) The EONIA swap rate is the fixed rate of a fixed-against-floating money market interest rate swap, where the floating rate is refixed daily at EONIA. EONIA is the Euro Overnight Interbank Average. This is calculated each business day in the Eurozone by averaging the overnight interbank deposit rates at which the banks in the EURIBOR panel have traded between midnight and 18:00 that day, with each rate weighted by the total volume of business done at that rate by the panel banks. Because it is the average price of overnight interbank deposits, EONIA is virtually a risk-free rate of return. An EONIA swap rate is largely the expected average of EONIA over the original term of the swap. The fact that EONIA swap rates are available for a range of terms, up to two years, allows comparison with term deposit and repo rates. The differential between EONIA swap rates and other rates largely represents credit and liquidity premiums (i.e. the compensation offered to lenders in return for taking credit and liquidity risks). Eurepo is an index of the GC repo rate for euro-denominated transactions. It is published daily for 10 terms, ranging between tom/next and 12 months, and is compiled on a similar basis to LIBOR and EURIBOR (i.e. an arithmetic average of rates taken from a middle range of quotes given at 11:00 by a panel of banks). For more details, go to www.eurepo.org. Similar GC repo indices are published by GovPX for USD repo (see www.govpx.com) and by the British Bankers Association (BBA) for GBP repo (see www.bba.org.uk). |

|

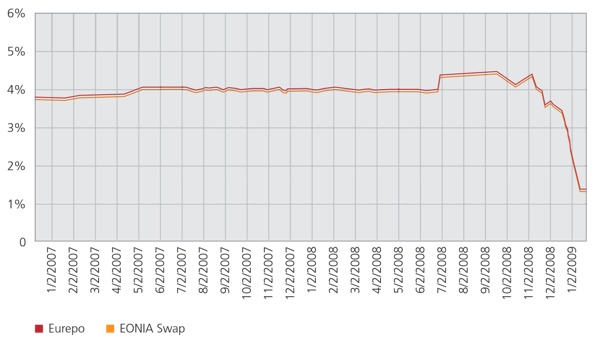

SpecialsOn occasion, buyers will seek a specific security as collateral in the repo market. Buyers will compete by offering cheaper cash than their competitors, so the repo rate for a security in demand will be forced below the GC repo rate. When this divergence of repo rates becomes apparent, the security concerned is said to have ‘gone on special’. The differential between the GC repo rate and the repo rate on a ‘special’ represents an opportunity cost to the buyer, as the buyer has had to sacrifice interest on its cash in order to acquire that security. It should be equivalent to the fee that the buyer would have to pay if it borrowed that same security in the securities lending market. If a security is subject to very intense demand, the borrowing fee may be large enough to force the repo rate on that security so far below the GC repo rate as to make it negative. This is not uncommon in equity repo and becomes more likely for all types of securities when interest rates in general are very low. Repo versus securities lendingSecurities lending is a financial activity comparable to repo and, in many cases, the two are substitutes for each other. In a securities lending transaction, one party gives legal title on a security to another party for a limited period of time, in exchange for legal ownership of a collateral asset. The first party is called the ‘lender’, even though the ‘lender’ is transferring legal title to the other party. Similarly, the other party is called the ‘borrower’, even though the ‘borrower’ is taking legal title to the borrowed security. The collateral assets in securities lending can either be other securities or cash (securities lending against cash collateral is operationally identical to a repo). The borrower pays a fee to the lender for the use of the loaned security. Securities lending against collateral in the form of other securities (non-cash collateral transaction) is illustrated in Figure 7. |

|

| However, if cash is given as collateral, the lender is obliged to reinvest it for the borrower and to ‘rebate’ most of the reinvestment return to the borrower. This is done by deducting the borrowing fee from the rebate interest earned. Securities lending against cash collateral is illustrated in Figure 8.A primary difference between repo and securities lending is that repo is generally motivated by the need to borrow and lend cash, while securities lending is driven by the need to borrow and lend securities. However, there is an overlap in function between securities lending and the ‘specials’ segment of the repo market.

Another key difference is that the repo market overwhelmingly uses bonds and other fixed-income instruments as collateral, whereas the core of the securities lending market is equities. Because the sale of equities transfers not only legal ownership, but also voting rights, it has become convention in the securities lending market for equities for loaned securities to be subject to a right of recall by the lender, in order to allow lenders to exercise their voting rights or other ownership options. In contrast, unless a right of substitution is agreed, an equity repo does not allow the seller to recall its securities during the term of the transaction. |

|

Why use repo?The usefulness of repo to cash borrowers (or securities sellers) and cash lenders (or securities buyers) stems from the fact that lenders who use the repo market to invest their cash receive collateral in exchange. This has the effect of reducing credit risk. If the borrower defaults, the lender can liquidate the collateral to recover most or all of its cash. The attraction of the repo market for lenders is enhanced by the fact that the reduced credit risk on lending through repo means that their loans are subject to lower regulatory capital requirements than unsecured lending, which improves the return on their cash. For further details see page 43 – ‘Credit risk and capital charges’. There is the added advantage that, if required, they can re-use collateral to replenish their cash balances at any time during the term of the repo, by repo-ing the collateral on to a third party. This means that repo does not significantly deplete the liquidity of lenders, as does lending in markets with unsecured and non-transferable instruments like deposits. Reduced credit risk and lower regulatory capital charges on repo mean that investors are willing to lend more cash at lower rates in the repo market than they are in markets in unsecured instruments like deposits and CP. Lower funding costs and higher leverage obviously make repo an attractive source of cash for institutions buying assets that can be used as collateral (e.g. securities). Repo is particularly attractive to institutions that are already highly leveraged (e.g. securities firms and hedge funds), who would find it expensive and/or difficult to borrow more funds in unsecured markets. Indeed, repo is the primary source of funding for such institutions. |

|

Basic Uses of RepoFrom the perspective of a seller (who is usually a securities dealer), there are two principal uses of repo:

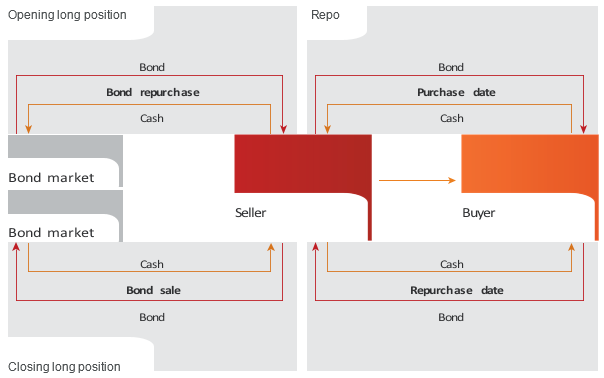

Figure 9 illustrates the use of a repo to fund a long position in an asset, in this case, a bond:

Figure 10 illustrates the use of repo (strictly speaking, the use of reverse repo) to cover a short position in a specific security:

|

|

Trading Strategies Financed or Covered by RepoGiven that repo is used to finance long positions in securities and to cover short positions, it is a key component of securities trading strategies. Many strategies are non-directional, in that their profit or loss depends, not on a general shift upwards or downwards in the yield curve (and the consequent opposite movements in bond prices), but on a relative widening or narrowing of the spread between the yields on two similar securities, or between a security and a derivative. Yield curve tradesIn yield curve trades (in which the yield curve is expected to steepen or flatten), a long position is taken in bonds in which the yield is expected to fall, and an off-setting short position in bonds from the same issuer, but with a different maturity, in which the yield is expected to rise: repo is used to finance the long position and a reverse repo used to cover the short position. |

|

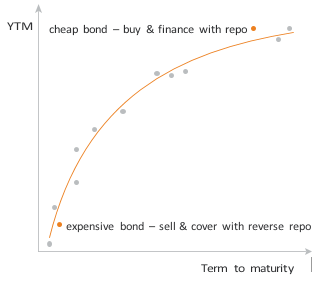

Relative Value TradesRelative value trades are similar to yield curve trades, but are put on, not because the slope of the yield curve is expected to change, but because two bonds from the same issuer, but with different maturities, are trading away from the yield curve (at yields higher or lower than bonds of comparable maturity) and are expected to move back into line. A long position is taken in the bond that is trading at a yield higher than comparables and is fi nanced with repo. As this bond has a higher yield, it will also have a lower price, and is said to be ‘cheap’ compared to the rest of the market. An offsetting short position is taken in the bond that is trading at a yield lower than comparables and is covered with reverse repo. As this bond has a lower yield, it will also have a higher price, and is said to be ‘expensive’, ‘rich’ or ‘dear’ compared to the rest of the market. |

|

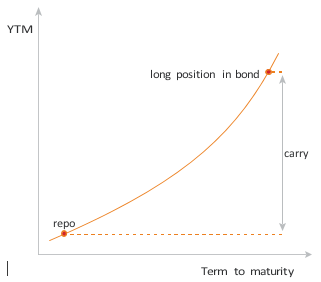

Carry TradesIn carry trades, repo will be used to provide short-term financing for reinvestment in longer-term bonds (not necessarily in the same currency), in expectation of little or no change in the slope of the yield curve. The dealer will earn the spread between the bond yield and repo rate, provided the yield curve does not fl atten too much. |