Evidence from simple tests supports perhaps some belief that crude oil tends to have strong and weak months of the year, Q4 is often the weakest quarter and Q1 and Q2 are the best.

In our seeking alpha article in October we suggested to short Brent oil and metals over the months October to December, especially after the sudden sharp rise of metals with QE3.

Silver had risen from 27$ in July to 35$ on October 5. Gold was up 250 dollars since April. Brent oil is trading still at February 2012 levels, despite a considerable slowing in emerging markets.

Mid-Term investors:

We see risks in the mid-term (at least 3 months) for emerging markets, but a very modest recovery in the United States; therefore we suggest to hedge metals and Brent Oil positions (BNO).

We recommend not to buy gold now and to hold long Yen (JYN), short euro (DRR), short silver (SLV) and short the New Zealand Dollar. (George Dorgan on Seeking Alpha).

We were challenged by a reader who thought that “oil rises always in winter.”

See also why buying gold in mid March is often a good deal.

Thanks to CXO Advisory we post a quick entry on seasonal effects on oil prices:

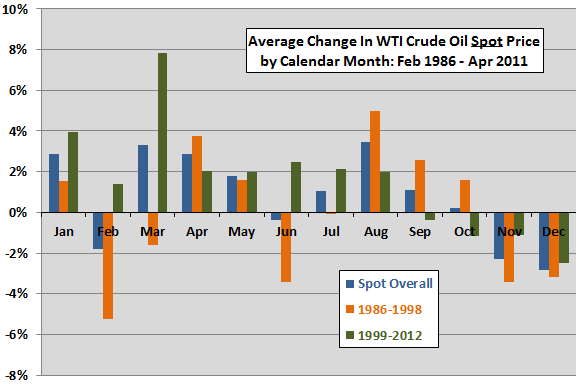

CXO advisory uses

(1) spot prices for West Texas Intermediate (WTI) Cushing, Oklahoma crude oil since 1986

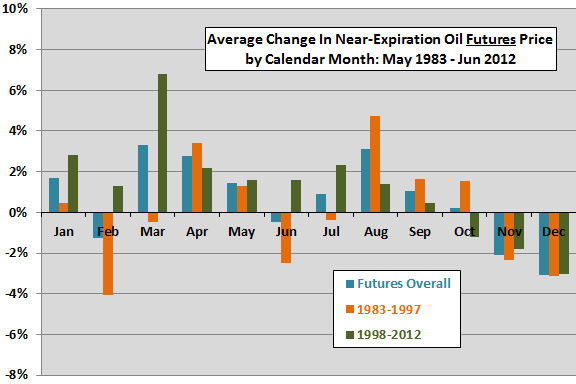

(2) nearest expiration futures prices for this same crude oil since April 1983 (29 years); and,

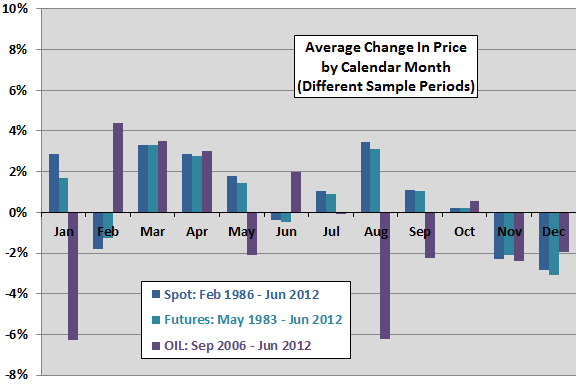

(3) and prices for the iPath S&P GSCI Crude Oil TR Index exchange-traded notes (OIL) since August 2006 (only about six years). (source CXO Advisors)

They found out that:

- Oil price tends to rise with some consistency during January, April, May and August.

- Oil price tends to fall with some consistency during November and December.

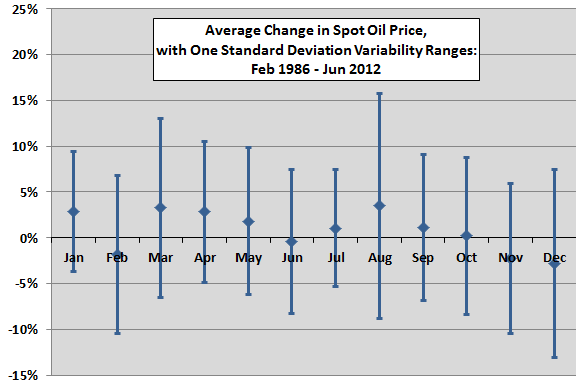

Then they focused on variability of prices:

The next chart shows average change in WTI crude oil spot price by calendar month over the available sample period, along with one standard deviation year-to-year variability ranges. Variability ranges are generally large compared to average monthly changes, such that the averages tend to be difficult to exploit. Variability by month is highest (lowest) for March, August and December (January and July), ranging from 6.4% to 12.3%.

They suggested that both price changes and variability of the next expiration futures were similar to spot prices .

The exchange-traded OIL, however, was influenced strongly by the boom and bust cycle in recent years. In two years out of six, OIL managed to increase even in December.

The final chart compares average monthly changes by calendar month for WTI crude oil spot price, WTI crude oil near-expiration futures price and OIL price over the respective available sample periods. As noted above, results for the two longer series are very similar. However, the very short OIL series deviates considerably from the other two series for some months, most notably January, February and August, emphasizing the large variabilities in the data.

They conclude:

In summary, evidence from simple tests supports perhaps some belief that crude oil tends to have strong and weak months of the year, but high year-to-year volatility by month inhibits exploitation.

Cautions regarding findings include:

- Sample periods for all three series (emphatically for OIL) are short for calendar-based analysis.

- Especially given the high variability in results, more detailed modeling is important in translating average results into portfolio-level outcomes.

- To the extent that distributions of monthly price changes are wild, the average and standard deviation statistics lose their predictive interpretations.

The full CXO advisors article is available here.