In recent posts Keynesians were criticized that hikes in the monetary base like Quantitative Easing (QE2) failed to lift the US economy, but it was the debt ceiling that helped to restore confidence in the US and that austerity can lead to GDP growth. Paul Krugman angrily replied that “even a huge rise in the monetary base would not be inflationary, and huge budget deficits would not send interest rates soaring. Krugman maintains that deflation is the great enemy of growth and “fiscal austerity would be contractionary, not expansionary.” In the following we will show that this time price deflation boosted growth in the US.

Investors used QE2 just to do the opposite to what the Fed intended, not the American economy was fostered but the “hot money” flew into emerging economies. The upturn in US investments at Q4/2009, Q1/2010, seriously slowed in Q4/2010 and in the first half of 2011. Keynesian will argue that rising government spending helped to pop up the increase in economy in 2009/2010 but contracting government spending made it worse in 2010/2011 (GDP details here).

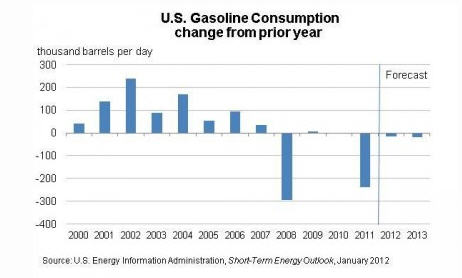

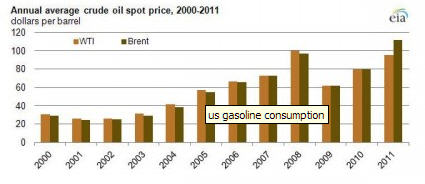

But most economic data proved that US recovery was actually stopped by the rise of gas prices and the perspective of a future hyper-inflation. Gas prices rose from August 2010 till May 2011 from 2.65 to a top of 3.91 and smashed consumer confidence with the result that gas consumption in the US decreased and GDP grew very modestly. Certainly this oil price rise was not only the failure of QE2 (or what markets created out of QE2), but also a result of the Libyan crisis. Emerging economies were forced to rapidly increase interest rates and create barriers against the hot money and rising inflation.

By Q3, 2011 everything changed: The potential crisis let the money flow back into the US, the Fed decided to replace Quantitative Easing by the Operation Twist, which essentially meant that the Fed was unable to help. Only after the deception about the lack of renewed money printing, the financial markets priced in the slowing oil demands which resulted in a renewed record-spread between Brent and US WTI oil and sharp decrease of the WTI crude price. The latter went down to 77$ per barrel in October. The high interest rates and the outflow of hot money cooled the economies of Emerging Markets significantly. Chinese and Brazilian PMIs were in contraction area at the end of 2011.

But then the unexpected happened: Great discounts led the US car industry expand first, durable goods consumption increased significantly in Q3. Similarly in Q4 discounts helped to increase retail sales and to sell the remaining inventories. Consumer sentiment was lifted again thanks to lower gas prices and better than weather than usually. GDP suddenly rose thanks to the stock piling needed after the sell-off. Selling higher quantities required a bigger work-force, but logically the productivity nearly contracted. The lower unemployment rate helped to increase consumer confidence from Lehman-crisis record-low levels in August 2011 to normal post-crisis levels. Finally the lower jobless numbers and higher consumer confidence boosted the ISM non-manufacturing index, that increased from 52.6 to 56.8 in February 2012. This again gives a hint of future growth in the PCE component of the GDP.

The evidence is clear: Price deflation helped to kickstart the US economy after a trough. And this strongly contradicts the Keynesian view that only inflation (and rises in the monetary base) can kickstart growth. Growth can be achieved without inflation and money printing, a strong argument for anti-Keynesians.

Will the US growth be sustained this time? The answer might be: Yes at least in 2012, because the Fed has learned from its failures, there won’t be any QE3 and a (commodity price) inflation will be avoided. The Fed’s QE2 money printing and the subsequent rate hikes by the EM central banks have successfully managed to suppress the economies of the Emerging Markets and the US has for this time won the fight for (cheap) resources.

Therefore commodity prices will only increase very in 2012, some people even insist that prices have topped out. Emerging Markets will not grow a lot stronger than industrialized countries as they did between 2005 and 2011. The shortages and the dip in the US economy expected by many investors will not happen in 2012. Thanks to cheaper commodity prices the US growth in 2012 will be sustained, growth in stock prices are expected to be stronger than the one in commodities.

One question should be asked: Might an increase of US short-term interest rates combined with a continued Operation Twist even further suppress commodity prices and therefore further boost US growth ?

Are you the author? See more for Next postTags: Deflation,Keynes,Keynesian,money printing,Oil & Commodities,PMI,QE2,QE3,Quantitative Easing,Swiss National Bank,U.S. Consumer Confidence,United States