Update December 2016:

Italians rejected the referendum that seeks to increase power of the prime minister and reduce power of the two chambers parliament. Prime minister Renzi has promised to resign.

This opens the door for new elections, in which the anti-euro parties Movimento 5 stelle (5 star movement) and Lega Nord (Northern League) may strengthen.

—————————————————————————————

Update December 2013:

Bear in mind that Italy has three options to become competitive again:

- either exit the euro zone and devalue the currency; more in this post.

- remain in the euro zone and devalue salaries.

- go for Japan-like decades-long slow growth with stagnating wages,

but also with falling inflation and (positive news!) falling bond yields, more e.g. here

————————————————————————————————————————————————————————————

Update February 2013:

We repost our original paper of July 2012, realizing that already on the political elections level, we were right.

We think that Italy, as opposed to Argentina in 2001 and Spain today, would survive a euro exit without big problems. Given the current public and political opinion in both Italy and Germany this scenario has a certain probability of happening in the next 2-3 years.

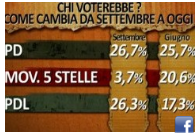

Prime minister Monti, who is not elected by the people but by the financial establishment, is supposed to govern only till 2013 and might even step down earlier. A June poll showed that the anti-euro movement “5 stelle” (5 star) would obtain 20.6% in elections and Berlusconi’s PDL 17.3%. The pro-Euro left-wing party Partito Democratic (PD) would get 25.7%. (Other voters undecided.) This would result into an anti-euro majority, given that Berlusconi’s PDL is tempted by an Italian euro exit.

Italy is effectively the country which is most opposed to the euro (source).

We wonder why, as opposed to Greece or Spain, an anti-euro majority can occur in one of the peripheral states, when the risks of a euro exit seem to be overwhelming. This research resulted in a long list of reasons why the Italian euro exit might happen in the next 2 or 3 years:

————————————————————————————————————————————————

Political and economic situation in Italy

1. The rise of the Five Star Movement that wants Italy to leave the Euro and possibly default on debt.

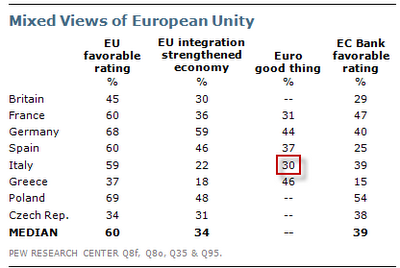

2. 44% of Italians view the euro negatively, only 30% favorably. That is the biggest negative spread in the Eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

3. Only a mere 50% of Italians would vote to keep the euro if given a chance. That is the lowest percentage in the Eurozone. Data from this November shows that 43% of Italians want to go back to the Lira.

4. Many politicians think that Italy’s primary surplus, which is now and historically not that bad, should get even better with an Italian euro exit, making the country’s labour more competitive. After the euro introduction Italy’s historical trade surplus with Germany has turned into a structural trade deficit. For example, German milk and milk products are exported to Italy via trucks through Switzerland and Austria whereas before Italy had its own strong production. A perverse effect of the euro!

5. The economic situation in Italy is worsening, consumers stop spending, but the hero of the English-speaking press Mario Monti is hoping on tax increases that will save his budget. We wonder what will happen to consumer spending then…

6. Thanks to reduced spending and the cheap euro in most of 2012, Italy’s trade balance has considerably improved. An even cheaper New Lira might push the trade balance into an even stronger surplus.

Lacking Competitiveness: European supply-side economists beat New/Post Keynesians

7. Italy, Spain, Portugal or Greece did not use the historically low interest rates between 2002 and 2007 to improve their economies via long-term factors like technology or better infrastructure between 2001 and 2008; the cheap money often flew into superfluous real-estate, overspending or was partially lost in bureaucratic or mafia-like channels. As opposed to the period between 2001 and 2008, when cheap money was easily available, funding for Italian and other peripheral companies has dried up now. The ECB OMT measure will not help a lot to improve monetary transmission.

8. Monti missed some necessary reforms: redundancies are still expensive for firms and the public employment quota high. Since salaries are downwards sticky, the only way to become competitive inside the euro zone is to wait for considerably higher wages in the Northern euro states and in the still much cheaper Eastern European countries. This process is very painful and can take many years or even decades. It might not even succeed because the richer Northern states can more easily replace labour by capital and the Eastern states attract more foreign investments thanks to cheap labour.

9. German economists and the German government are strongly influenced by supply-side theories. They look on long-term factors like competitiveness and are against short-term measures. For more details see here.

10. Supply-siders have also taken the lead in European institutions. It can be seen in the latest Memorandum of Understanding to bail out the Spanish banks:

“A shift to durable current account surpluses will be required to reduce external debt to a sustainable level.” (Par. II, point 3)

“In particular, these recommendations invite Spain to:

1) introduce a taxation system consistent with the fiscal consolidation efforts and more supportive to growth, 2) ensure less tax-induced bias towards indebtedness and home-ownership,

3) implement the labour market reforms,

4) take additional measures to increase the effectiveness of active labour market policies,

5) take additional measures to open up professional services, reduce delays in obtaining business licences, and eliminate barriers to doing business,

6) complete the electricity and gas interconnections with neighbouring countries, and address the electricity tariff deficit in a comprehensive way.” (Par. VI, point 31)

11. Finally major newspapers and mainstream economists accept that Robert Mundell’s basic economic principle of the “optimum currency area” will prevail and not the post Keynesian idea that printing money can heal economies even in the long-term, especially those that lack competitiveness. For further basic economic principles, which give reasons why the PIGS will not become competitive inside the eurozone, see here.

The euro kills the welfare state

12. If, on the contrary, the euro remains, then free-market forces will reduce the public-sector share and destroy the Southern European and French welfare states as Robert Mundell said:

“It puts monetary policy out of the reach of politicians,” he said. “[And] without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business.”

13. The euro removes the power from politicians to give election gifts to their people, such as before the election of the French president. Therefore, further reforms to increase competitiveness are at risk. More countries will become more hostile to the euro. The political dream of a common currency might destroy the European idea.

14. The German public has become very attentive to the huge risks implied in the ESM. It seems that now German consumers have decided to increase their savings, despite rising wages. Many of them think that the German state will need to finance the periphery forever, implying higher future taxes. Slow German growth or a recession might trigger German demands to stop the financing via the ESM and to exit the euro.

Italy’s costs in the euro zone are too high

15. Italy is too big to bail, due to the limited size of the ESM.

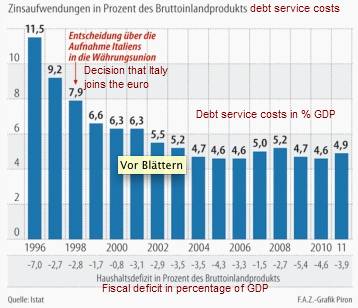

An April estimate of Italian government sources predicted that Italian debt servicing costs would rise to 5.4% next year and to 5.6% of GDP in 2014. By 2013 Italian 10 year yields have fallen to 4.56% from the high levels around 6% in the summer.

16. The currently low yields are driven by the recovery of the US economy and the positive Italian trade balance, achieved mostly with the reduction of consumer spending and imports. But continuing GDP reduction might increase Italian debt and will push yields upwards again. Lower salaries, low inflation or deflation might help to reduce Italian bond yields, but it increases debt levels.

Only higher inflation thanks to a new Lira will help to eliminate some Italian debt. The recent trend to domestic bond holders will help Italians to keep yields under control.

Germany and other northern states will not pay for cheaper PIIGS funding

17. Eurobonds will not come in our generation. Germany’s Merkel clearly stated that she will not allow this as long as she lives.

18. Even the German opposition does not want a direct ESM financing of banks. Only 17% of Germans want Eurobonds. Germans would accept a fiscal union only when German discipline dominates.

19. As opposed to Germany, who still feels responsible due to its history, Finland is especially resistant and wants collateral for further bailouts.

France or Italy will not accept a German fiscal big brother

20. France and Italy oppose a fiscal union, which would be under German or Brussels/German control. Spain and Portugal are rather like marionettes of the German, Finnish and ECB fiscal discipline, in the form of the fiscal compact or even more in the memorandum of understanding:

“According to the revised EDP recommendation, Spain is committed to correct the present excessive deficit situation by 2014. In particular, Spain should ensure the attainment of intermediate headline deficit targets of 6.3% of GDP for 2012, 4.5% of GDP for 2013 and 2.8% of GDP for 2014. Spanish authorities should present by end-July 2012 a multi-annual budgetary plan for 2013-14, which fully specifies the structural measures that are necessary to achieve the correction of the excessive deficit. Provisions of the Budgetary Stability Law regarding transparency and control of budget execution should be fully implemented. Spain is also requested to establish an independent fiscal institution to provide analysis, advice and monitor fiscal policy.” (Memorandum of Understanding, part VI, point 30)

As opposed to Italy, Spain and Portugal have no other chance because their risks are a lot bigger. An Italian exit could have a limited risks.

The risks of an Italian Euro exit are limited

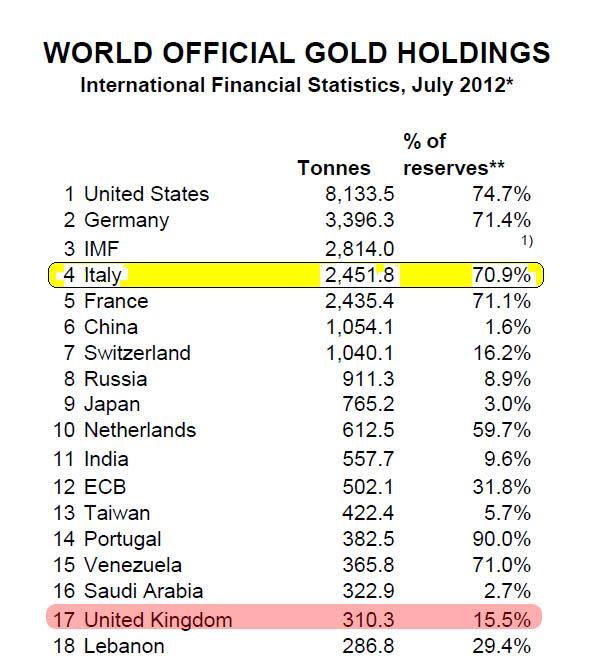

- Italy’s central bank has enough gold reserves that it could avoid hyperinflation if it left the euro.

- As opposed to Spain, Italy’s international investment position is only slightly negative, whereas Spain’s one is negative by 92% of GDP.

- Combined public and private debt is 260% of GDP, similar to Germany and much lower than France, Spain or the UK (UK total debt). With private wealth of €8.6 trillion, Italians are richer per capita than Germans (source).

- “Italy’s very high savings rate and private wealth mean that any interest rate shock would mostly be rotated back into the economy in higher payments to Italian bondholders. The macro-effects would even out.” (Telegraph). After this year’s LTRO and OMT programs, the principal holders of Italian government debt are Italian banks and privateers.

- Italy is first on the IMF’s long-term debt sustainability indicator at 4.1, ahead of Germany 4.6, France 7.9, the UK 13.3, Japan 14.3, and the US 17. An alternative approach for long-term debt, including implicit debt (via pension promises, etc.), shows an even better Italian result.

- A strong nominal interest rise (if it really happens) after the Italian euro exit would harm Italy’s mortgage borrowers a lot less than Spain’s, because the level of private indebtedness in Spain is higher than in Italy.

- The peripheral states with their 100 million people with lower per capita GDP are not relevant enough to trigger a collapse of major developing countries like China or India with 2 billion people or the United States with its 300 million inhabitants. Even the Asian Crisis and the Russian default in 1998 that affected about 2 billion people could not bring the US economy into a recession, on the contrary, cheap oil prices fuelled US consumer confidence. Six years after the financial crisis, US consumers are strong enough to absorb a crisis in the European periphery, especially when oil prices remain relatively cheap. Certainly, this does not mean strong growth; the US has still some years to go in de-leveraging, but some more years of balance sheet recession.

- The main risk is a shortfall in capital for peripheral banks, following the points made in risk 4, the risk will be limited, at least in Italy. The ESM will need to have a new temporary role for a short-time financing some Italian banks; in return Italy will promise not to default on its debt. Debt under Italian law should be transferred into New Lira at the 1999 Euro exchange rate, resulting in an implicit hair cut for foreign borrowers. The ESM will finally do something more useful than the long-term financing of peripheral economies by the German tax payer.

-

Wolfgang Münchau of the pro Eurobond establishment (FT and Euro Intelligence) was quick to respond to a potential Italian Euro exit in the German edition of Der Spiegel. His first argument was that German taxpayers must recapitalize the German banks.

The German banking exposure to Italy was only 36 bln. € even in 2010, a small figure compared to the risks Germany takes with the ESM. Since then, Deutsche Bank has hedged its exposure by 88%, and many more foreign banks have dumped Italian bonds.

-

As we all know, German banks managed to offload their “PIIGS risks” on the Target2 balance, on the Bundesbank, i.e. the German tax payer. Therefore, the risk of a recapitalization of German banks is now negligible from the German taxpayers’ view. After the 2012 LTRO operations, most Italian government bonds are now held by Italian banks or Italian individuals.

- If, according to Münchau, Italy went bankrupt, then Germany would need to accept billions of losses from the Target2 system. Target2 was previously just a technical settlement mechanism (source Whelan BoE) among euro member states. Thanks to the discussion, that Hans Werner Sinn started, Münchau and the common economic opinion have accepted, that when a country leaves the euro, the Target2 liabilities of the leaving member come due. In order to scare the German readers, Münchau points to the worst case, namely that Italy will not pay back its Target2 liabilities at all.We think that Italy wants to remain a member of the international community, even in the case of an Italian euro exit. Therefore, a more realistic approach would be to assume that Italy pays back at least the euro liabilities valued in the new Italian Lira. Based on Nomura’s Jens Nordvig’s full euro break-up scenario of 27% decrease for the New Lira, we estimate an 15-20% loss of the New Lira against the euro in the case of an Italian euro exit. As of July 2012, Italy has a 274 bln. € Target2 liability. If this is revalued in New Lira it would imply a loss of 40-50 bln. € for the German official sector, a mere 2% of German GDP.

Summary

We think that Italy, as opposed to Argentina in 2001 and Spain today, would survive a euro exit without big problems. Given the current public and political opinion in both Italy and Germany this scenario has a high probability of happen in the next 2-3 years. A new task for the ESM will be to support possible temporary fallouts on peripheral banks. After initial problems, the euro will appreciate because two of the weakest members, namely Greece and Italy, will have exited the common currency, the Italian and the European economies will recover quite quickly.

If Italy, however, does not leave the euro zone, both Italy and Germany run the risk of long-lasting balance sheet recession, in which both consumers and firms try to reduce debt and consume less, Germans in the fear of future German liabilities via the ESM, Italians in response to more and more austerity measures.

Hence an Italian Euro exit would really help the euro zone.

In the end the street will decide and not the establishment or the strange economists that contradict their own economic theories.

Read also:

Post Scriptum:

The main author of this blog speaks Italian and lived in Italy for a long time. Italians since the beginning have not been happy with the euro, many think that prices strongly increased due to the euro, but inflation-adjusted salaries remained the same. In Germany the anti-euro attitude was initially the same, but vanished with time when prices became relatively cheaper. In Italy the opposition against the euro never went away, after 12 years of the euro consumer prices are often higher than in Germany, but salaries are half or even less.

See more for

2 comments

DorganG

2013-11-03 at 11:51 (UTC 2) Link to this comment

dal sito:

http://vocidallestero.blogspot.it/2013/06/la-bce-scopre-che-il-problema-e-la.html

oramai basta andare su google, digitare “Italy euro exit”, e si trovano analisi come questa

https://snbchf.com/2013/02/talian-euro-exit/

che

sembra condensare in sé tre anni di goofynomics, orizzonte48,

vocidallagermania e vocidallestero, più il libro di Bagnai, etc. etc.

con una bella spiegazione del ciclo di Frenkel, e nel contempo fa un po’

di giustizia su presunti sondaggi pro o contro euro che darebbero gli

Italiani maggiormente favorevoli all’euro: qui invece si segnala come

sia proprio l’Italia il Paese europeo con la più alta percentuale di

cittadini che ritengono che l’euro sia il problema, i quali

rappresentano la maggioranza anche se di misura.

Damianat

2014-02-07 at 13:06 (UTC 2) Link to this comment

Interesting point of view