The German finance minister Wolfgang Schäuble has become the evil genius of the euro crisis. He has understood that the Cyprus crisis won’t lead to a bank-run and collapse of capital markets. We all know that the U.S. is now recovering. Hence he can continue the transfer union from South to North.

The transfer union from South to North

We take our own conclusion from the Cyprus 2013 tragedy and understand that the phrase “transfer union from Germany to the periphery”, often used by German critics in the euro crisis, does not have any substance despite a continuing “bail-out facade”:

- Germany is able to refinance itself with nearly zero percent interest but the periphery pays 5% or more for 10 year bonds. Still, as opposed to previously, the Italian 5% yield are mostly paid to local bond holders.

- The ECB and behind it the German Bundesbank, earns a 7% yield on its 2011 purchases or now better called “investment” in Italian bonds.

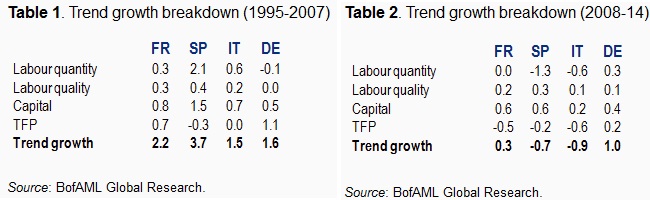

- German salaries are up by 2% after inflation, while in the periphery people get laid off; wages should decline according to European leaders.

- Brain-drain: Well-educated labour from Greece and other Southern countries comes to Germany. These people often work for salaries that do not correspond to their education.

- Italy and Spain now have (total) current account surpluses, which massively reduces the default risk for German and ECB bond holdings and helps to restore German (but not necessarily Italian or Spanish) consumer and business confidence.

- While the Italians and Spaniards have halved their deficits with Germany, bad news from the euro zone helps to depress the euro exchange rate. This results in a German competitive advantage in global trade and help for continuing German surpluses.

- The Italian government tries to get a hold on tax evasion while the French tax the rich and, implicitly they transfer the funds via current account deficits to the Germans.

- As the Cyprus case shows, not only the rich must bleed, but the poor do not only lose their jobs, but must also help paying back the accumulated current account deficits to Germany.

- Due to missing funds, the social welfare system in the weak countries is destroyed further and further.

- German home prices are rising, this makes many Germans richer every day, while the periphery gets poorer with falling prices.

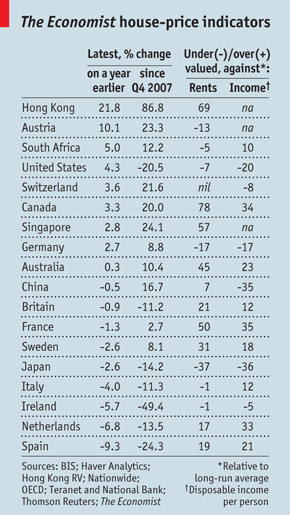

- The most important point is the following: Compared to Germany, strongly overvalued homes in Southern Europe, but also in France and in the Netherlands are poised for further retreat, because they are often bought with excessive debt.

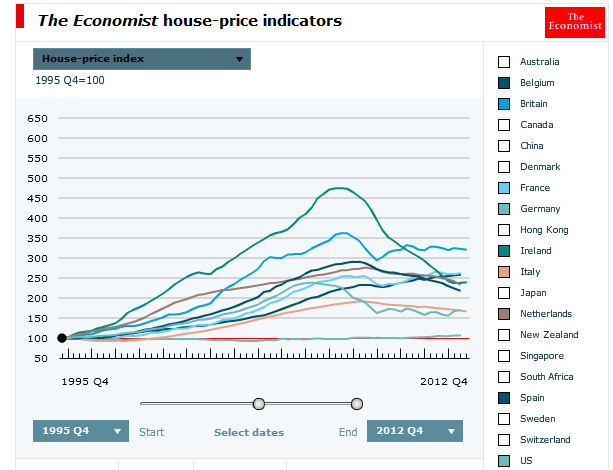

The 2012/Q4 house price values from bottom to top compared to 1995

According to the Economist, Germany’s home prices are just a bit higher than the ones in 1995, US prices stand at 175% of the 1995 level, Italy stands at 170%, while Spain leveled off to 225%, the Netherlands to 240%, France to 260%, Belgium to 270% and Britain even to 320%. Ireland has already come down to 230% from the 460% levels of 2007.

As the recent wealth survey by central banks show: median wealth of many countries in the periphery and of France are far higher when compared to Germany, mostly due to lower home prices and lower home ownership rates in Germany. This is also reflected in home price to rents and home price to income ratios:

Read more about the transfer union from North to South between the year 2000 and 2007.

The evil genius of the euro crisis

Wolfgang Schäuble, the German finance minister, has become the evil genius of the euro crisis. He has understood that for the first time Euro zone leaders have the possibility to avoid the moral hazard, from which Greece and some hedge funds during the Greek public sector involvement so greatly benefited. Even more, with Cyprus and the bleeding of some Russian oligarchs he has greatly secured Merkel’s victory in the upcoming German elections.

Some others call the ‘Cyprus project’ a “Brussels experiment”, an ECB measure to ensure the reforms path in the periphery and insists on adjustments and conditionality.

He knows that the Cyprus event will not lead to a bank-run and long-lasting tensions on capital markets, given that, as opposed to the period during the Greek crisis, the US is now recovering and a sustained recovery might even shrug off a euro zone breakup. But he grasped that the transfer union from North to South via current account imbalances until 2007 must be rolled back into continuing transfers from South to North.

Behind the “bail-out facade” that some called “transfer union from Germany to the South”, European leaders have effectively orchestrated a transfer union from South to North in the terms we have seen above.

Limitations of current account deficits visible in any fiscal adjustment plan and austerity via the fiscal compact will continue to depress the overvalued home prices and wealth in France and the Southern nations and prop up prices, salaries and wealth in Germany. The re-balancing of current account imbalances and the wealth transfer from South to North that started in 2010/2011 will have a long-lasting effect: Unfortunately it will end sooner or later in a German overheating.

The periphery must deflate now, even with a shrinking GDP and unemployment; this makes the euro and the policy of leaders very comparable to what countries did during the Great Depression.

Potential for overheating and inflation in Germany

Strikes have regularly erupted for two years in Germany, some recent official agreements foresee 5.6% salary hikes, a development that exercises upwards pressure on inflation, that currently is only tamed by very slow global growth.

Ready-to-use capital in German banks and – similar as in the 1970s- capital inflows, will further heathen the atmosphere, once the recovery really starts. Target2 imbalances might only diminish when some peripheral banks decide to pay back their LTRO loans, while current account surpluses with the US and Asia can further fuel the German boom that – similarly as in the 1970s – can be solved only with a stronger currency. It this currency is the euro -what it currently undoubtedly is – then with devastating effects on the less competitive European periphery.

We are sure that German inflation will touch 3% in a couple of years, while Italy and Spain will still exhibit low growth and relatively low price increases. Local and foreign investors will continue to pile into German real estate and (since Cyprus in German cash accounts) to secure their savings against the financial repression led by the Italian Draghi and the 65% GDP share of France, Southern members of the euro zone and, maybe even the Dutch that are fighting against their housing bust.

ECB interest rate will remain at far too low levels possibly for two decades, from 2001 to around 2020. After a decade of risk-taking in the European periphery, it will guarantee another cycle of excesses; this time the money will flow in German stocks and properties and in the German proxy with more international exposure and easier linguistic access called Switzerland, a country that tracked German economic development since the 1990s and where multinationals love to absorb high-qualified personnel from all over Europe resulting in Swiss current account surpluses of 12% of GDP and more.

Higher wages, however, means lower profits for entrepreneurs, the transfer from the rich to the middle-class has just started.

Thanks to the German competitiveness, far better than the slowly recovering United States, we judge that this real estate boom will last much longer than one decade – similar to the 20 year Norwegian and Australian booms. After the year 2020 and after more than one lost decade in Spain and Italy, the salary and current account re-adjustments among the euro zone members might be successful.

Then this German (and Swiss) housing bubble might bust along with supply-side shocks caused by ageing, far higher salaries in the developing world and the elimination of positive globalization effects that led to the emergence of these fatal imbalances before 2008.

2018: Who exits first, Germany or Italy?

From around 2016 or 2017 on, German inflation pressures might trigger a big debate about the introduction of a Northern Euro in a then relatively risk-friendly environment (as opposed to 2011). A successful introduction of this new currency – despite its quick overshooting of 50% against the (Southern) euro – would lead to a sharp reduction of German current account surpluses, but also to the successful defeat of inflation, the elimination of most risks of the real estate bubble and last but not least would make Jens Weidmann happy again.

The potential Italian prime minister of 2017, Beppe Grillo, already defied the idea uttered by many bankers and economists that the euro were “a hotel California”. This idea claims that a euro exit is impossible and that weak countries must in the good old gold standard manner, reduce salaries and, if this is not possible due to slow global growth, dismiss workers..

Given that Germany would leave the euro, Grillo could cancel the Italian referendum on the euro membership, foreseen for 2018, saying that, the (Southern) euro constitutes now an “optimum currency area”, ending his speech like always in a joke “We are now a weak member state in a currency union of weak countries because weakness makes us strong.”

See more for

1 comments

Jonathan

2013-10-07 at 02:50 (UTC 2) Link to this comment

Very good analysis, that reminds me the views of François Asselineau in France on the Eurozone.