In the following we present an history of the Swiss balance of payments (BoP) since 1993. We show the Q4/2013 PoB data on page2

and the update for the other quarters Q1 to Q3 of 2013 on page3. The page 4 finally gives a longer BoP history that goes into the 1980s.

It is very helpful to have read the explanation of the balance of payments model and the chapter on the balance of payments and central banks’ FX interventions.

Read also: The balance of payments 2014 that is based on the new IMF methodology.

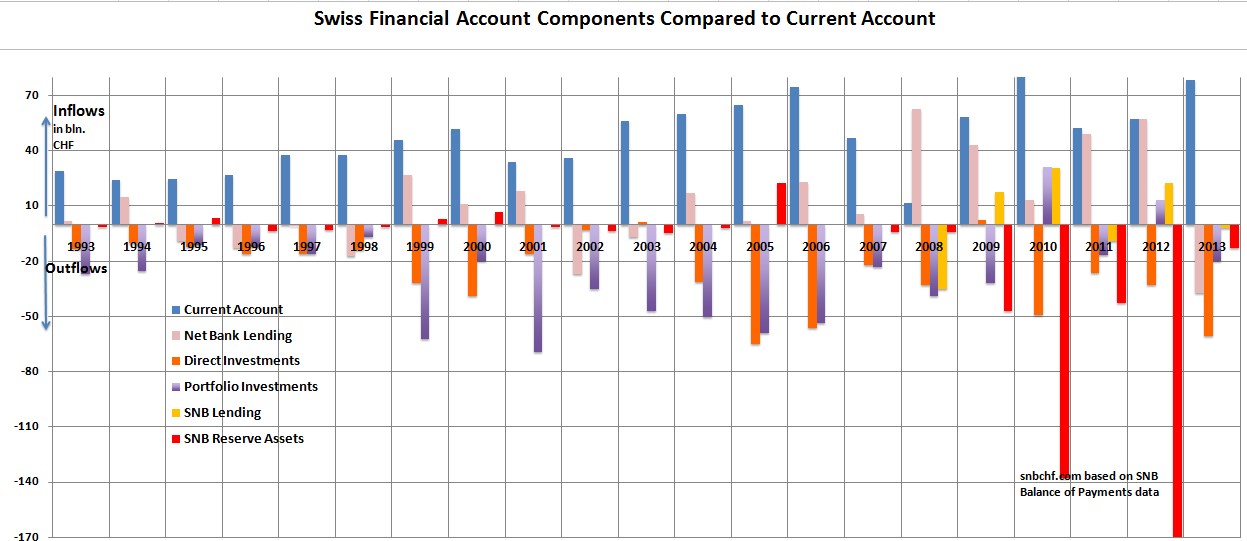

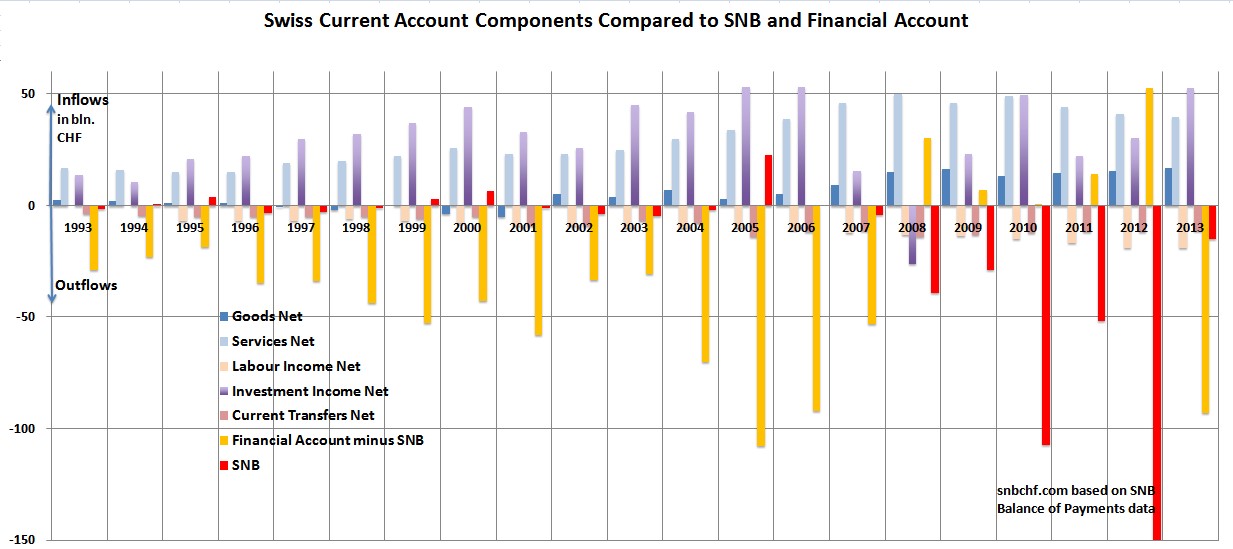

Swiss Current account compared to components of the financial account 1993-2013

The following graph shows the Swiss total current account compared to the components of the financial account (formerly called “capital account”), please click to enlarge.

Between 1999 and 2007 the Swiss saw more outflows in the financial account, in both portfolio and direct investments. This helped to offset the strong current account surplus. The high inflows of around 400 billion francs between 2009 and 2012 could be countered only with an increase of reserve assets. This number seems to be far worse than during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF).

Between 1999 and 2007 the Swiss saw more outflows in the financial account, in both portfolio and direct investments. This helped to offset the strong current account surplus. The high inflows of around 400 billion francs between 2009 and 2012 could be countered only with an increase of reserve assets. This number seems to be far worse than during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF).

source SNB

It becomes obvious that the two major “enemies” of the SNB are the inflows via persisting current account surpluses and positive net bank lending to Switzerland (or repayment of existing loans).

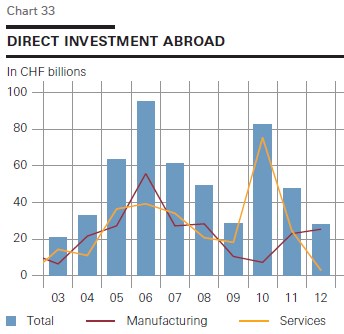

Direct Investments: Continuing direct investments of Swiss multinationals compared to lower foreign investments in Switzerland represent outflows. These outflows were helpful for the central bank, but after 2009 the difference between outflows and inflows was far smaller than in 2005 or 2006. The chart 33 from the SNB shows how Swiss multinationals extended their expansion world-wide, before and after the financial crisis.

From the official release

“In 2013, the receipts surplus from investment income surged by CHF 23 billion to CHF 53 billion.”This steep increase was due to the higher receipts from Swiss investment abroad”

same source SNB

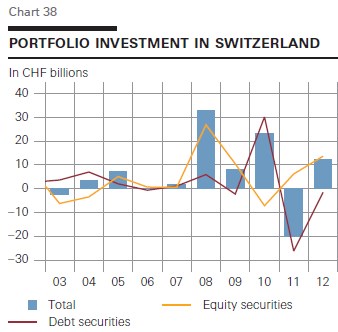

Portfolio Investments: As visible in the overview graph on top of the page, in 2010 and 2012 more foreigners bought Swiss stocks than the Swiss purchased foreign equities, foreigners want to participate in the success of the Swiss multinationals and their direct investments.

The chart 38 indicates that foreign investors buy preferably stocks, debt investments play a minor role. For foreign investors, Swiss stocks and their global exposure is a safe way of profiting from global growth. The carry trade, i.e. short-term funds in euro or other foreign currencies financed with “cheap” Swiss francs, does not play a role any more.

Other Investments and Net Bank Lending

Other Investments and Net Bank Lending

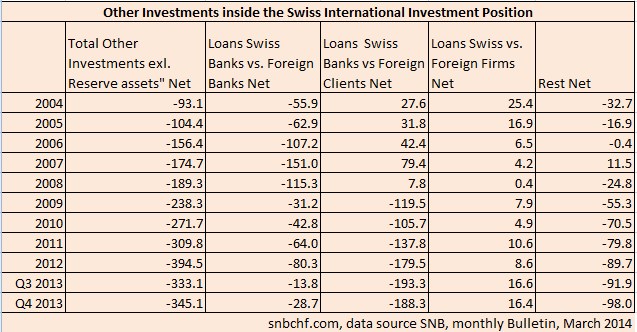

Between 2003 and 2012 the Swiss financial account component, “Other Investments”, that mostly contains loans or repayments of existing loans, indicated inflows into Switzerland, also visible in the overview on top.

But in 2013, a reversal is visible when hopes on a US recovery helped lending flows to reverse. It is initiated by the Swiss banks.

The following table from the net international investment position gives more details. The perspective is from the foreign sector, hence the total value of lending is negative and is getting smaller and smaller, “more and more negative.”

The main reason is that with the financial crisis rich foreign clients have become net lenders to Swiss banks, a movement that we also see in other offshore locations.

Before the crisis Swiss banks increased debt at foreign institutions in order to give loans to their foreign clients. This picture has reversed now. Since 2004 this net lending component has represented inflows into Switzerland, most interestingly even during the period of the weak franc until 2008. The major method were the so-called

There was no big Swiss bank lending to foreign countries, even if many European mortgages in were denominated in francs. Often Austrian and Eastern European banks accorded mortgages to their clients in Swiss franc. As visible here, Swiss banks were involved in rare cases.

We judge that the net positive lending to Switzerland could remain a danger for the central bank because it sustains the Swiss real estate boom, implies rising money supply and in the longer term inflation.

Swiss Financial account compared to components of the current account 1993-2013

The following chart shows the components of the Swiss current account compared to the total financial account, please click to enlarge.

As for the behavior of the Swiss franc, we suggest the following insights:

- As opposed to Japan today, Switzerland has still a trade surplus in goods and services. This constitutes a strong argument for an appreciating franc, while the yen should rather depreciate – what has effectively happened since October 2012.

- Labor income – which is only 25% of total current account surplus) represent an outflow and weakens the currency; but it is inverse proportional to the 100% of current account surplus.

- The investment income surplus may remain in foreign currency. This is valid especially for direct investments of Swiss multinationals. Whether some income from direct investments is changed into francs and CHF investments depends on short-term rate differentials (“carry trade”) and on the growth potentials abroad.

Net portfolio investments: Attractiveness of Swiss stocks compared to European stocks

We have seen above that in 2010 and 2012 foreigners bought far more Swiss equities than Swiss foreign stocks. The Asset Market Model stipulates that the Swiss franc can only weaken if euro zone stocks and peripheral bonds obtain a rising attractiveness among Swiss investors. Those are the ones that finally decide about the allocation of the Swiss current account surplus. In 2012, especially Spanish, French and Italian stocks seem to be at cheap valuations. The question, however, is if the currently very weak consumer spending in these countries will continue to harm company profits or not. For many Swiss investors, Swiss real estate and stocks offers lower risk and higher return.

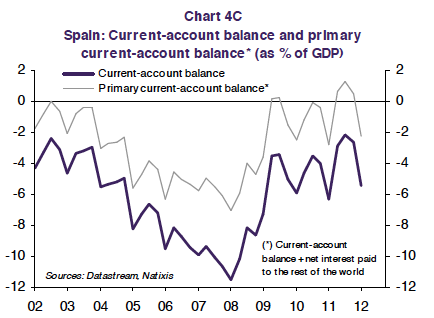

A trade surplus can be seen as a proxy for the combination of company profits in international trade and/or a public sector surplus (see more). The Spanish trade deficit was particularly high in 2007 with a spending rush based on the real-estate bubble, but interest rate differentials (the so-called carry trade) between the euro zone and Switzerland kept the franc weak.

We think that French, Italian or Spanish companies will appear more interesting to Swiss investors only if these countries are able to transform the trade deficit into a surplus, obtaining implicitly higher company profits and a smaller public deficit.

With ECB and Fed forward guidance, the argument for higher Euro zone short-term rates does not count for a couple of years.

References:

Swiss Balance of Payments Q4 and 2013 press release,

Swiss Balance of Payments 2012 press release

We show the Q4/2013 BoP data on page2.

See more for

2 comments

wiesenda

2013-08-19 at 03:48 (UTC 2) Link to this comment

The position “net bank lending” merits deeper inspection. I suspect it is an aggregate made up of several, possibly quite large, positive and negative terms whose importance is on top of that changing over time. Therefore it is difficult to draw conclusions from the aggregate value alone. For example, the idea that foreign bank clients are the source of positive net bank lending in the years after 2007 is possible albeit an outflow of deposits due to tax regularization may also be taking place.

Be that as it may, these flows surely have to be orders of magnitude smaller than the deleveraging going on in the Swiss banking sector? Were the two big banks not major conduits for exporting capital? Their shrinking exercise must be bringing capital home. The effect of this would be very similar to what has happened in Germany. Its current account surpluses post 2000 had been reinvested in the Euro periphery through the banking conduit (German banks lending to periphery banks).

When trust among banks evaporated post 2007 – they had realized that, oops, mortgage loans can go sour in the US (where they were exposed through securities), therefore also in Europe (where they were exposed through interbank loans) – the ECB stepped in as an intermediary for short term lending, later joined by various other facilities for longer-term lending.

The result of all this assisted de-leveraging and these bailouts was that the cumulative current account surpluses landed on the balance sheet of the Bundesbank as a TARGET2 credit. It is easier to think of this as a stock phenomenon (the transfer of a foreign loan portfolio from the banking system to the Bundesbank) than as a flow phenomenon.

I believe a similar thing is happening in Switzerland for slightly different reasons in a different setting – but basically it’s a central-bank-assisted deleveraging of the banking sector. Now that the money is parked at the SNB what do we do with it? Leave it in the custody account at the SNB? Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF? The latter by the way is the reason that Bali is full of Swiss supermarket checkout personnel as one English writer once remarked with a mixture of envy and admiration.

DorganG

2013-08-23 at 07:11 (UTC 2) Link to this comment

Sorry for the late response due to time constraints during the working week:

I added the details for net bank lending in the text. https://snbchf.com/wp-content/uploads/2013/07/Foreign-Clients-Lending-to-Swiss.jpg

This number shows the gross lending of foreign bank clients to Switzerland. Both gross lending and net lending of foreigners to Switzerland is increasing.

You are right saying that Swiss lending to US and EU has excessively decreased.

Thanks for impressive

“Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF?”