The dollar is always losing value. To measure the decline, people turn to the Consumer Price Index (CPI), or various alternative measures such as Shadow Stats or Billion Prices Project. They measure a basket of goods, and we can see how it changes every year.

However, companies are constantly cutting costs. If we see nominal—i.e. dollar—prices rising, it’s despite this relentless increase in efficiency.

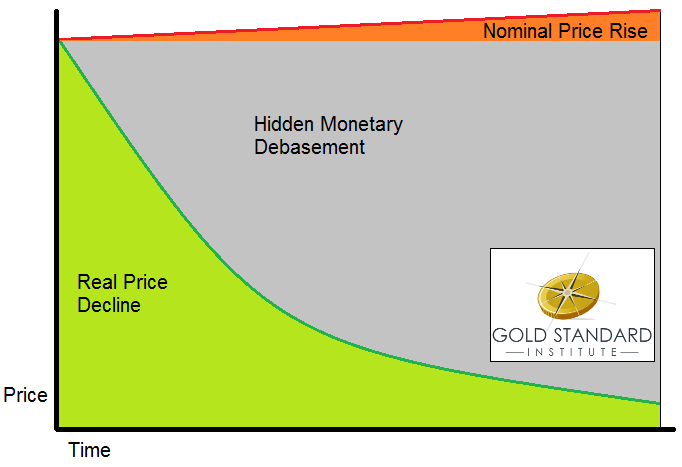

This graphic illustrates the disparity (I credit Tom Selgas for a brilliant visualization, which I recreated from memory).

CPI measures only the orange zone, the tip of the iceberg. Most people don’t see the gray zone, and that’s a result of the greatest sleight of hand ever.

We need an accurate way to measure monetary debasement. For example, in retirement planning it’s tempting to divide your net worth by the cost of consumer goods. This seems to show your purchasing power. For example, if you have $200,000 and the cost of groceries for a year is $20,000 then you can eat for ten years.

However, this approach is flawed. To see why, let’s briefly consider primitive times when there was no lending or banking. People had to set aside some of their income, to buy a durable good like salt or silver—hoarding. When they could no longer work, they sold a little bit every week to buy food—dishoarding. People accumulated wealth while working, and dissipated it in retirement.

Life got a lot better with the advent of lending, because interest enables people to live on the income generated by their savings. People no longer consumed their principal, worrying about outliving their savings.

Don’t think of capital assets as something to sell in order to eat. An old expression says, if you give a man a fish then he eats for a day, but if you teach a man to fish then he eats for a lifetime. Think of a productive asset like a fishery. It should produce for a lifetime. It should not be consumed as a mere fish.

Capital assets should be valued in terms of how many groceries they can buy, not by liquidation, but by production. Unfortunately, monetary policy is making this increasingly difficult. Interest rates have been falling for over three decades, and now there’s scant yield to be had anywhere. We are regressing to the dark ages of paying for retirement by dishoarding.

CPI understates monetary debasement, because companies are constantly becoming more efficient. Dividing wealth by CPI compounds the error, because asset prices are rising.

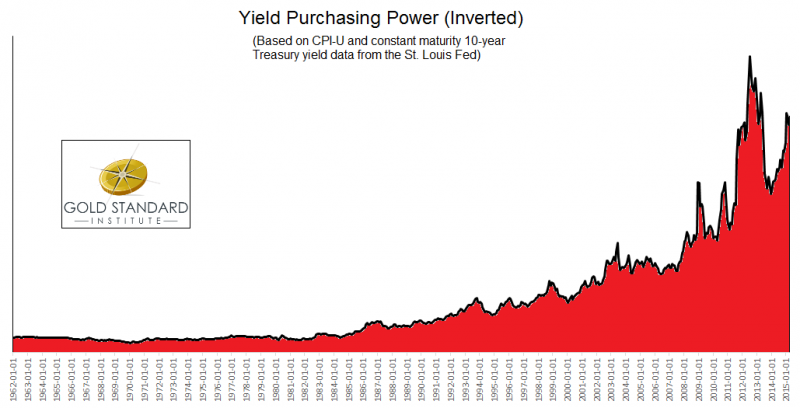

We need a different way of looking at monetary debasement. I propose Yield Purchasing Power (YPP). YPP is the yield on assets divided by the Consumer Price Index (or other index). The idea is to look at the productivity of assets to see what you can really afford.

Let me explain YPP with a simple example. If hamburgers sell for $5 and interest is 10%, then $50 of capital lets you eat one burger per year. Suppose the price of the burger doesn’t change, but the interest rate falls to 0.1%. You now need $5,000 in capital to earn that burger. Unfortunately, if you still only have $50, then you only get one burger every 100 years.

CPI doesn’t show this collapse in purchasing power, but YPP does.

Let’s take a look at YPP since 1962. The graph is inverted, to make the trend easier to see.

It’s interesting that the drop in purchasing power (rising in this inverted graph) begins around 1984, when the conventional view said inflation was tamed. CPI may have slowed down, but interest was falling too.

YPP shows us a staggering monetary devaluation—a classic parabola. The problem isn’t skyrocketing prices, but collapsing yields.

You need more and more assets to afford the same lifestyle. If your assets don’t keep up, then you have to liquidate your capital.

See more for

12 comments

Skip to comment form ↓

addison

2015-04-29 at 05:53 (UTC 2) Link to this comment

Great stuff Keith. Thanks. I guess ppl will have to make riskier and riskier investments to get a similar yield with capital as in year’s past. Where does one go today to get a solid yield with capital without risking too much? Perhaps we are just stuck buying near negative yield treasuries….or hoarding gold coins.

Philip

2015-04-29 at 23:38 (UTC 2) Link to this comment

The first diagram combined with YPP solves a conundrum that has existed in my mind for over a decade.

Simplicity personified and an invaluable new tool for monetary discussion. Brilliant Keith.

Keith Weiner

2015-04-30 at 17:10 (UTC 2) Link to this comment

Thanks for your comments.

Addison: We’re stuck. People can speculate for capital gains, but that’s not the same thing at all. Nor sustainable.

Lin

2015-05-19 at 09:41 (UTC 2) Link to this comment

Great article Keith, thanks.

Maybe the only way is to invest in emerging markets that still offer descent yield although the risk is definitely different.

Allesandro

2015-06-23 at 17:15 (UTC 2) Link to this comment

Keith,

I admire your writing and your skills of elucidation. Do you have a regular blog? If so, how does one subscribe?

Thanks.

Keith Weiner

2015-06-24 at 08:56 (UTC 2) Link to this comment

Thanks Allesandro.

My column, The Gold Standard, lives here. My company blog is http://monetary-metals.com. My personal blog is http://keithweinereconomics.com.

George Dorgan

2015-06-24 at 14:29 (UTC 2) Link to this comment

Maybe you have seen the author icons with Keith’s picture above. They contain links to his sites.

Rajesh Dhawan

2015-06-30 at 20:36 (UTC 2) Link to this comment

I like the way you explain things, Keith. The world is a screwed up place and it’s good to have someone like you show the real picture.

Thank you.

John McCallum

2015-07-07 at 16:42 (UTC 2) Link to this comment

Hi Keith,

Beautiful chart and wonderful thought.

is it possible to show it using Tbill rates as a proxy for CD rates?

Keith Weiner

2015-07-09 at 14:36 (UTC 2) Link to this comment

John,

Thanks for your comment.

Sure, one could just use that data series instead of CD rates.

David Michael Myers

2015-07-16 at 06:50 (UTC 2) Link to this comment

Wonderful work you are doing here. I admire, respect, and agree with almost everything that I have read so far.

I like you concept of YPP. How ever I have a “bone to pick” about it.

As Ludwig von Mises said [I paraphrase] all these little indices and rations that “mathematical economists” dream

up are worthless. I refer to your using CPI-U as the denominator in your formulation.

Not only is it invalid in the first place, the “gummint” cheats by changing the point of reference every so often

(to conceal the real debasement of the currency.)

I suggest that for the denominator of your formulation, you use instead, a standardized, weighted, “market-

basket of universally-common, every day items consumed by millions and millions of people every day.

My way of showing the loss in purchasing power is by comparing how the dollar-prices of some common,

everyday items have changed over the years. For example:

In 1913, prior to FDRoosevelt’s devaluation of the USDollar, either a $20 bill or a Double Eagle ($20 one-troy

-ounce gold piece) would buy 400 one-pound loaves of fresh bread @ 5 cents ($0.05) per loaf or 200 gal-

lons of regular (Ethyl) gasoline at 10 cents ($0.10) per gallon. However, a little over a century later, we find

that today things are much different.

That same (or equivalent) loaf of bread is priced at $2.50 (if you can find it at that low price.) The same gallon

of gasoline (87-octane regular) sells for about $3.00 per gallon (national average.)

Hence, a $20 bill will buy 8 loaves of bread or 6.67 gallons of gasoline. A troy ounce of silver is worth about

$1147 today [KITCO PM Fix] That will buy 458.8 loaves of bread or 382.3 gallons of gasoline.

I conclude that the YPP (when buying bread) is about 0.02 I obtained this by dividing 8 (loaves) by 400 (loaves).

YPP when buying gasoline is about 0.033 I obtained this by dividing 6.67 (gallons) by 200 (gallons).

I think that if one made up a “market basket” of commodities and applied this methodology, one would have an

“index” that would closely resemble your YPP.

*************************************************************************************************************************************

I have my own little campaign to establish rigorous definitions for the words “money” and “currency.” I my mind

they are two totally different things. And I think that the main reason the plundering politicians of the world have

been able to pull off their great theft of honest people’s productive efforts is that hardly anyone understands the

difference and the terrible consequences.

My definition of money: Money is a “meme” of using a physical commodity (or commodities) whose primary function

is to serve as a VERY-LONG-TERM STORE OF PURCHASING POWER and secondarily as the MEDIUM-OF-EXCHANGE

that is most widely-accepted across the face of the Earth. And since the history of mankind has shown us that an

overwhelming consensus of people, their families, tribes, clans, communities,nations, etc. throughout the entire world

obviously perceive PRECIOUS METALS as being as close to ideal money as earthly possible, I think that the term “money”

should apply EXCLUSIVELY to precious metals used as media-of-exchange in commerce.

My definition of currency: Currency is a “meme” of using any convenient object or concept as a MEDIUM-OF-EXCHANGE

in commerce. Currencies, by their very nature will lack the ESSENTIAL ELEMENT of “money”. Currencies are not and will not

be expected to serve as a very-long-term store of purchasing power. Throughout history, many different things have been

used as currency: cattle, bales of cotton, bales of tobacco, leather strips, cowrie shells, cigarettes, military scrip, company

scrip, US Federal Reserve Notes [fiat-currency], whiskey, IOUs, [even nowadays, some communities are creating their own

“local currencies” so as to abandon their country’s “legal tender” fiat-currency. Only when people realize their masters are

plundering and robbing them of their wealth, will the monetary madness end.

Alina

2015-08-08 at 08:04 (UTC 2) Link to this comment

To: David Michael Myers

“I have my own little campaign to establish rigorous definitions for the words “money” and “currency” – You are right 100% !

http://www.kdggold.com/en/content/zakon-greshema-eto-nelepaya-oshibka-ili-umyshlennaya-podmena-ponyatij/