I have been writing about consumption of capital, using the example of a farmer who sells off his farm to buy groceries. It’s a striking story, because people don’t normally act like this. Of course, there are self-destructive people in every society, but, not many. Most people know not to spend themselves into poverty.

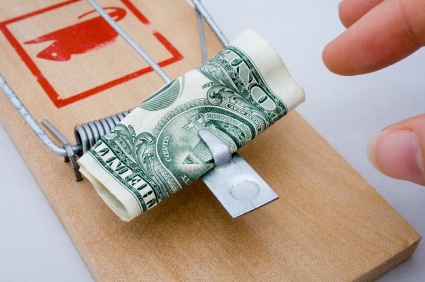

To make people hurt themselves, we need to add the essential element: a perverse incentive. Consider a parlor game called Shubik’s Dollar Auction. You auction off a dollar bill, but there’s one extra rule. The second highest bidder has to pay his bid, getting nothing in return. This game works best with a large crowd, so that several people bid before they think too much about it. Then the participants become ensnared. There is always an incentive to raise the bid by a penny. Would you rather pay $1.01 to buy a dollar, or lose $1.00 and get nothing? The same incentive works at $2.01, $3.01, and so on. There is no limit to how high the bidding will go, until someone gives up in disgust (and anger at whoever ran the game).

This game can make people overpay to win a dollar. How perverse is that?

It’s easy to see through this simple game, and many people will refuse to play. There’s only one way to push everyone into such a scheme: force. Let’s look at monetary policy in this light. When the Federal Reserve dictates interest near zero, everyone has to play under that rule. It causes some perverse outcomes.

Those with access to the Fed’s dirt-cheap credit can borrow to buy bonds, mortgages, or other assets. The result is rising assets and falling yields. With every increase in bond prices, there is falling yield purchasing power. This makes it impossible to live on the interest, forcing retirees to liquidate capital to buy groceries.

Let’s consider this from a different angle. Suppose you own a home. If you mortgage it, does that make you richer? Would you spend the borrowed funds like you would spend income? Of course not. What if someone else borrows money to buy the house from you, at a higher price than you originally paid? “Aha,” you say, “that’s different!”

Is it? At first, it may look like a capital gain. However, your gain is possible only because the next guy borrows more. Why is he doing that? With a lower interest rate, the same monthly payment covers a larger loan.

Suppose the rate keeps falling. One person after another buys the house, handing a profit to each seller. Each seller is given the incentive to spend some of his gain. However, nothing has been produced though this entire series of transactions. If nothing is produced, then what are these successive sellers consuming? They consume something that was previously produced. It’s otherwise known as capital. Endlessly rising home prices consumes capital.

This is a perverse incentive in action. Outside Shubik’s game, a dollar does not sell for $5. Outside central banking, capital is not destroyed en masse. While any fool can dissipate his inheritance and any farmer can sell his farm to fund his drug habit, farms are not destroyed. They are transferred intact, to more rational neighbors. Once back in responsible hands, they quickly return to productive use. A free market has no mechanism to cause all capital to be destroyed simultaneously.

The Fed does. We should call its game Shubik’s Wealth Effect.

See more for

7 comments

Skip to comment form ↓

Anonymous

2015-09-07 at 13:07 (UTC 2) Link to this comment

Hello Keith.

I do not understand how the successive sellers consume capital. Could you please develop a little bit?

Eric

George Dorgan

2015-09-11 at 09:32 (UTC 2) Link to this comment

Hi, the answer to your question is in Keith’s last post. The Fed and the Cotton Candy Machine.

Anonymous

2015-09-11 at 20:43 (UTC 2) Link to this comment

I will go through it. Thank you.

Anonymous

2015-09-11 at 21:21 (UTC 2) Link to this comment

I have read Keith’s last post, but I still fail to understand what he means when writing I”f nothing is produced, then what are these successive sellers consuming? They consume something that was previously produced. It’s otherwise known as capital. Endlessly rising home prices consumes capital”.

Whose capital is consumed?

George Dorgan

2015-09-11 at 22:07 (UTC 2) Link to this comment

Take a house where the construction costs were 50K and another 50K for the land. The real production value was hence 50K.

If speculation goes up to 1 Million, the difference of 900K. The subsequent owners consume now foreign (e.g. Chinese) goods and services based on their perceived wealth, but do not pay down the loan sufficiently.

By Austrian economic theory, the value of the house must fall again to its intrinsic value one day. Let’s say it is the initial 100K.

The crux is that the capital consumption gets only visible once this moment happens. Then future owners go bankrupt on their far too high loans, the speculators may have managed to sell the house in time. At that moment the total (here US) economy has seen a capital consumption of 900K.

Anonymous

2015-09-12 at 07:40 (UTC 2) Link to this comment

Thank you

tom kauser

2015-09-28 at 22:42 (UTC 2) Link to this comment

once upon a time the American Banking system was the laughingstocks of all other Counties banking systems. The American Banks had AUM that dwarfed both European and Japanese banks with the American media reinforcing said meme? Several years later the American banking system is flush with real cash thanks to Hank Paulson! The Fed (money center banking co-op) possesses trillions of interest producing assets under its control and all it took was 10 years of real or imaginary jawboning (mostly imaginary) of the possibility of a backing up of short term interest rates? Even today the Fed governors sold another round of speeches about a new series of possible rate increases for a free lunch and several thousand in speaking fees? Just throw the mortgage in the till and forget about it with so many free reserves who cares how long the mortgage payments stay current? I think there’s a sea monster in the water hazard Bruce…