The government has many ways of forcing us to use their paper dollar as money. The tax on capital gains on gold (I wrote about this here) is one bullet in their gun. The legal tender law—U.S. Code Title 31 §5103—is another. As with the tax, legal tender does not outright force anyone. It works by a subtler mechanism.

Under the law, the dollar is deemed to satisfy any debt. For example, a court may rule that Donald Sterling owes the National Basketball Association $2M. If he writes a check, or even hands over a briefcase full of hundred dollar bills, his obligation is settled. The meaning of the law is simple.

If the debtor offers—tender is an old word for offer—dollars then that legally discharges the debt. No court will force any debtor to pay with something else. The government has no need to threaten the creditor with jail. It’s simply that if he wants to be paid, he must accept payment in dollars. Take it or leave it.

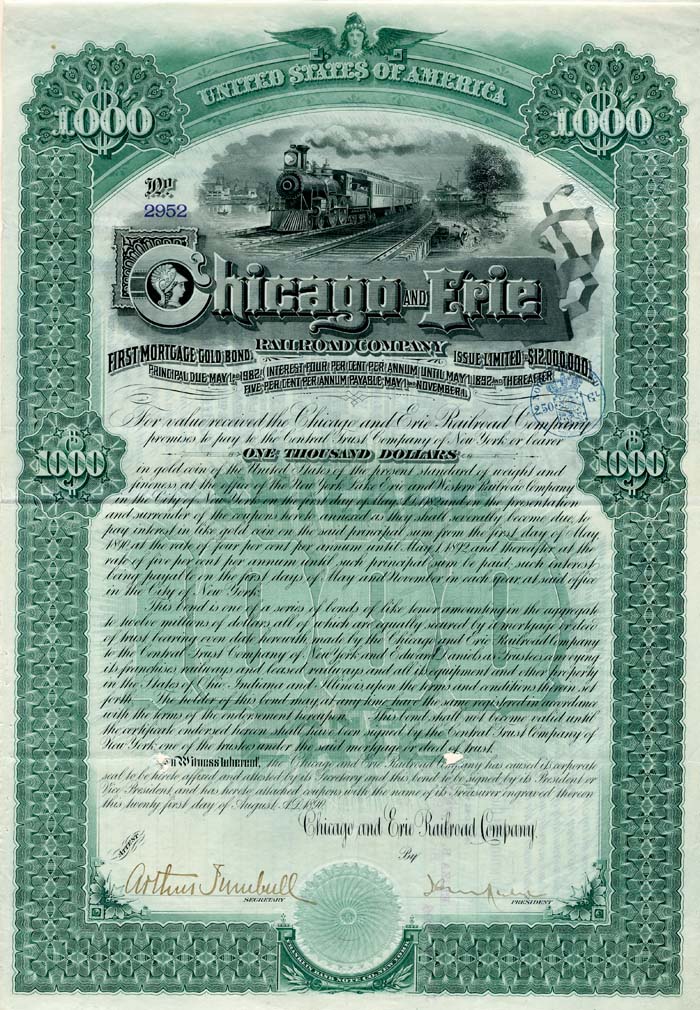

It was not always so. In 1890, John Pierpont Morgan helped the Chicago and Erie Railroad Company borrow $12M worth of gold—600,000oz—at 4 percent interest. This was an opportunity for savers to earn interest by lending their gold. The railroad was obligated to repay this debt in gold.

However, if you go to a branch of the JP Morgan Chase bank today, they will not lend you gold, nor will they accept a gold deposit. It’s not obvious why, so let’s work through an example.

Railroads were an exciting business in those days, connecting far-flung cities and civilizing the frontier. Perhaps the equivalent today is a company like Tesla Motors. Tesla recently sold $2B worth of bonds, to be repaid in dollars of course. Suppose that instead, the company sold 1.5M ounces of gold bonds. It will owe the bond investors the same gold back (ignoring interest to keep it simple).

Not quite. The government only recognizes debt by its dollar value, $2B. The legal tender law enables Tesla to offer this sum to the bondholders as payment in full. What happens if the gold price doubles by the bond maturity date? Tesla will prefer to pay in dollars.

If the gold price doubles, then a dollar of debt is worth half as much gold. Tesla gets off cheap, and only has to repay half the value of the gold it borrowed. Unfortunately, on the other side of the trade, the public investors lose half. They lent 1.5 million ounces and get back 750,000.

Those familiar with stock options may recognize that the legal tender law grants Tesla a free put option at the investors’ expense. Tesla has the right, but not the obligation, to make bondholders accept dollars. It will exercise the option if it’s favorable to the company to do so.

It’s a rotten deal for anyone who lends gold. In fact the legal tender law has killed the market for gold lending. There is essentially no lending of gold today.

If you can’t lend your gold at interest, there is only one thing left that you can do with it. You can lock it up in a safe. Gold gathers dust, unable to finance growth.

Meanwhile, Tesla buys equipment, pays rent, and hires workers. As it borrowed dollars, it pays dollars to its vendors, landlord, and employees. Dollars circulate because a business borrows them, pays them out, and the recipients spend them.

Often in assessing a bad law, we talk about its unintended consequences. The legal tender law certainly has a perverse outcome. However, it’s different from the typical bad law in one respect. The result—driving gold out of the credit market—is not unintended. This is the whole point. The law was intended to prevent gold from circulating, and it’s working as designed.

Gold owners simply hoard the metal. With lending turned into an act of financial suicide, there is nothing else they can do with it.

Gold will not circulate in the regime of legal tender law.

See more for