It’s pretty hard to convince the 1% of the benefits of the gold standard. One might think that the rich would want a free market in money, but they’re enjoying the fruits of the Federal Reserve’s labor too much right now. Richard Fisher, president of the Dallas Fed, underscored this. In New York recently, someone asked about the wealth effect—when a bull market stimulates spending. He said wryly, “the wealthy have been … very affected.”

Their consumption is certainly conspicuous. Bentley just announced the world’s most expensive SUV. Wilson Audio sells a pair of speakers that cost as much. At the MGM Grand in Las Vegas, Joël Robuchon serves a $425 16-course dinner.

The Fed can create dollars, but it should go without saying that it cannot create wealth. If the rich are getting richer, then their new riches aren’t coming from the Fed.

One view is that it’s transferred, from the poor and middle class to the rich. However, the poor don’t have much wealth to transfer. It’s more plausible that it comes from the middle class, except for one thing. The Fed has no mechanism for this.

The Fed is buying up bonds. A rising bond price gives free gains to bondholders. It also causes falling interest rates. Cheaper borrowing costs let Wall Street bid up stocks, real estate, and other assets. Assets are rising.

The rich own lots of assets, so they benefit from the Fed’s activities. However, the middle class owns assets too and benefit proportionally. It seems like both groups are getting richer, which brings us back to square one. The Fed cannot create wealth.

If wealth wasn’t created or transferred, then we need another theory. According to Sherlock Holmes, “When you have excluded the impossible, whatever remains, however improbable, must be the truth.”

The rich aren’t getting richer. They may feel richer because it’s easy to make money in an environment of rising asset prices. You buy something, wait for the price to go up, and sell it. Anyone can do it, though the rich have more money to invest.

Consider an example with SSO—an Exchange Traded Fund with 2X leverage to the S&P 500 Index. Suppose Mary started with $200,000 in February of last year, and she bought SSO at $90/share. At the end of the year, she sold it to George for $132/share. She did well, and her 200 grand turned into 293. She adds 20 grand to her capital base, or 10 percent. The remainder of $73,000, is pure income that she can use to buy a sports car. Mary now has a little Bimmer, with seats as white as … (aah, never mind).

source Zerohedge

Nobody wants to squander his life’s savings, but they’re happy to spend their income. George wouldn’t consume any of his 293 thousand. However he gave it to Mary to buy an asset, hoping it will rise further. Meanwhile, she spends 73 thousand—25 percent—of his former wealth.

Of course, the Fed didn’t manufacture the car. Nor did it make the companies in the index more valuable. It merely distorted stock prices. We rely on prices to signal us via profits and losses. We trust that earning a profit means that that we added value. It’s only natural to spend part of a profit. That’s what makes the Fed’s price distortion so dangerous. It fools us into consuming our capital.

Luke 15:13: “And not many days after the younger son gathered all together, and took his journey into a far country, and there wasted his substance with riotous living.”

source Zerohedge

The Fed is perverting the markets, making them into conversion machines that turn George’s wealth into Mary’s income. George won’t spend his savings. However, he puts it into Mary’s hands as a trading profit. Looking through the Fed’s green-colored glasses, she sees this as income.The rich aren’t getting richer. They—along with everyone else—are getting poorer, as a result of capital consumption. The parable of the Prodigal Son describes it perfectly.

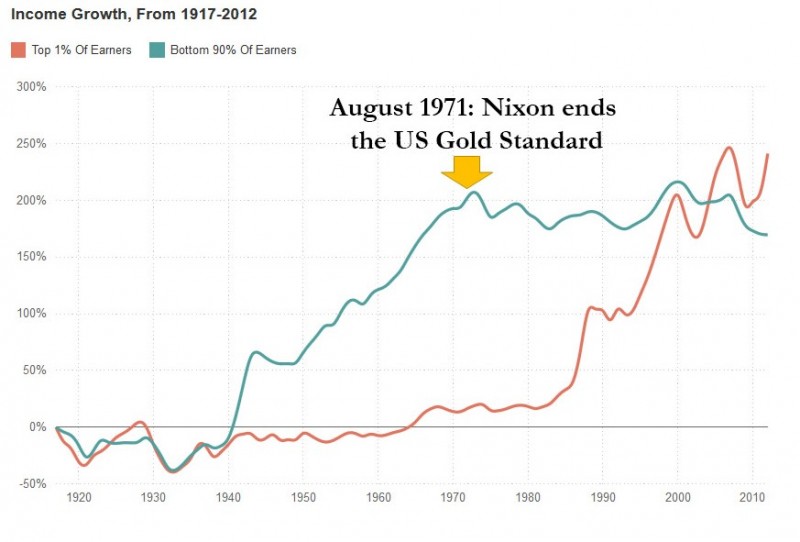

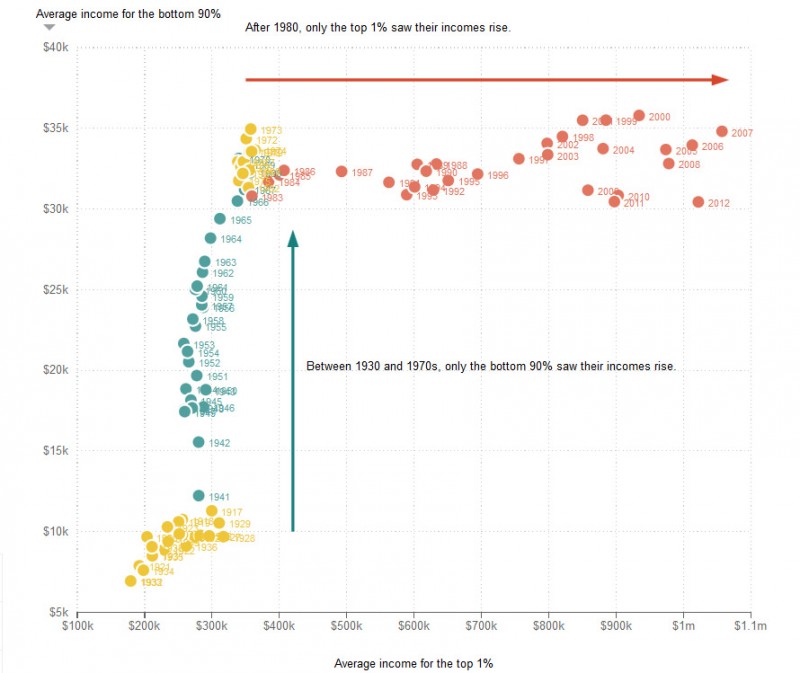

Between 1930 and 1970, however, during the times of the gold-standard and the gold-backed Bretton Woods System, income of the rest of the population increased.

It’s pretty hard to convince the 1% of the benefits of the gold standard, the top earners will need to renounce to their trading profits and their gains on asset price inflation.

See more for