Since March 2015, Keith Weiner of the gold standard institute, United States, contributes on snbchf.com. This post is another great insight for a simple fact that traders often forget.

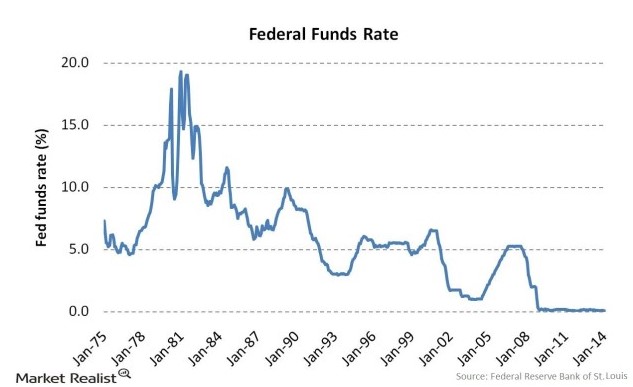

Everyone wants to know when the Fed will raise interest rates. The Federal Open Market Committee meeting last week only added to the speculation, with Fed watchers parsing every word of the press release. However the question should be, not when the Fed will raise interest rates, but if. Before our central planners can raise rates, they must deal with a problem of their own making.

source: Rock Bridge Investment

Let’s look at it, not from the perspective of the individual investor, nor even the commercial banks, but from the point of view of the Fed itself. The banking system now has large excess reserves. These bank assets are cash above what they are required to hold, which they choose to deposit at the Fed. It may seem counter-intuitive that, to the Fed, these reserves are a liability. One party’s asset is always another’s liability in our monetary system.

The Fed borrows to finance a portfolio of bonds (like any bank). Since the crisis of 2008, its appetite has been voracious. It has borrowed about $3 trillion more, largely the excess bank reserves. The Fed pays 0.25% interest for these funds, which are used to purchase bonds earning 2.5%. Right now, the Fed is making a tidy profit. On $3 trillion, 2.25% is about $68 billion a year (which it then pays to the Treasury, unlike a bank).

This all works so long as the cost of borrowing is low. However, the Fed’s low cost is the banks’ low incentive. The banks can pull out at any time, and they will – as soon as they find a better deal.

The Fed has used short-term borrowing to buy bonds that mature in ten years. Think of the Fed’s borrowing of the bank reserves like a balloon mortgage. The catch is that it must be renewed every day—at the banks’ sole discretion. The Fed has to keep it going until the principal on its bond portfolio is repaid in ten years.

The Fed risks a crisis.

This brings us back to the question of whether the Fed can raise rates. Though I criticized Marvin Goodfriend’s support of central planning, I thought he gave an excellent talk about the Fed’s dilemma. At the Shadow Open Market Committee (SOMC) meeting last month, he noted the growing pressure on the Fed to raise rates. We can’t have zero interest forever, but higher rates will destroy the Fed’s cash flow.

The Fed will be forced to pay a lot more to retain those three trillion dollars. Banks lend to one another at the Federal Funds Rate. The Fed has currently set this rate at 0.25%, but according to Goodfriend and the SOMC, it should be around 4%. If a bank can make that much by lending to other banks, it will not lend to the Fed at 0.25%. So upwards, the Fed’s interest expense must go. It could lose 1.5%, or $45 billion a year. Ouch.

There’s no good way to cover this shortfall. The Fed can try to borrow to pay for its losses, but that is unsustainable and self-defeating. That only digs the hole deeper, not to mention destroys credibility (presumably, credibility was one reason to raise rates).

Unfortunately it gets worse.

If the Fed Funds Rate goes to 4%, then the interest rate on 10-year bonds will go a lot higher than that. This will cause the market price of the bonds in the Fed’s portfolio to fall (a bond’s price moves opposite to its interest rate). Of course the Fed’s liabilities remain, so this portfolio will have a large negative net value.

On top of its cash flow problem, the Fed will have a solvency problem. No one knows what may happen if the Fed becomes bankrupt. The Fed isn’t going to want to find out the hard way. Maybe our wise central planners can find a way to change the rules to let them have their cake and eat it too—to stay solvent and raise interest rates.

I would not put my capital in harm’s way, to bet on a big rate hike.

Read also:

Mark Chandler: The Ultimate Carry Trade: Banks buy US Treasuries

See more for