We recently critized GDP growth that has become mostly an indicator of consumption and activity. We emphasized that strong GDP growth, in particular consumption-driven (hyper-) activity may lead to a depreciating currency, falling government bond prices and wealth in real terms.

In this post we will present the second part on Net National Savings Rate in % of gross national income (NNSR), our preferred alternative indicator to GDP. Please read first the introduction and the part about the production and investment-driven nations. This second part contains the consumption-driven economies, which are in Latin America, Africa and our Western societies – apart some few exceptions like Switzerland and Norway.

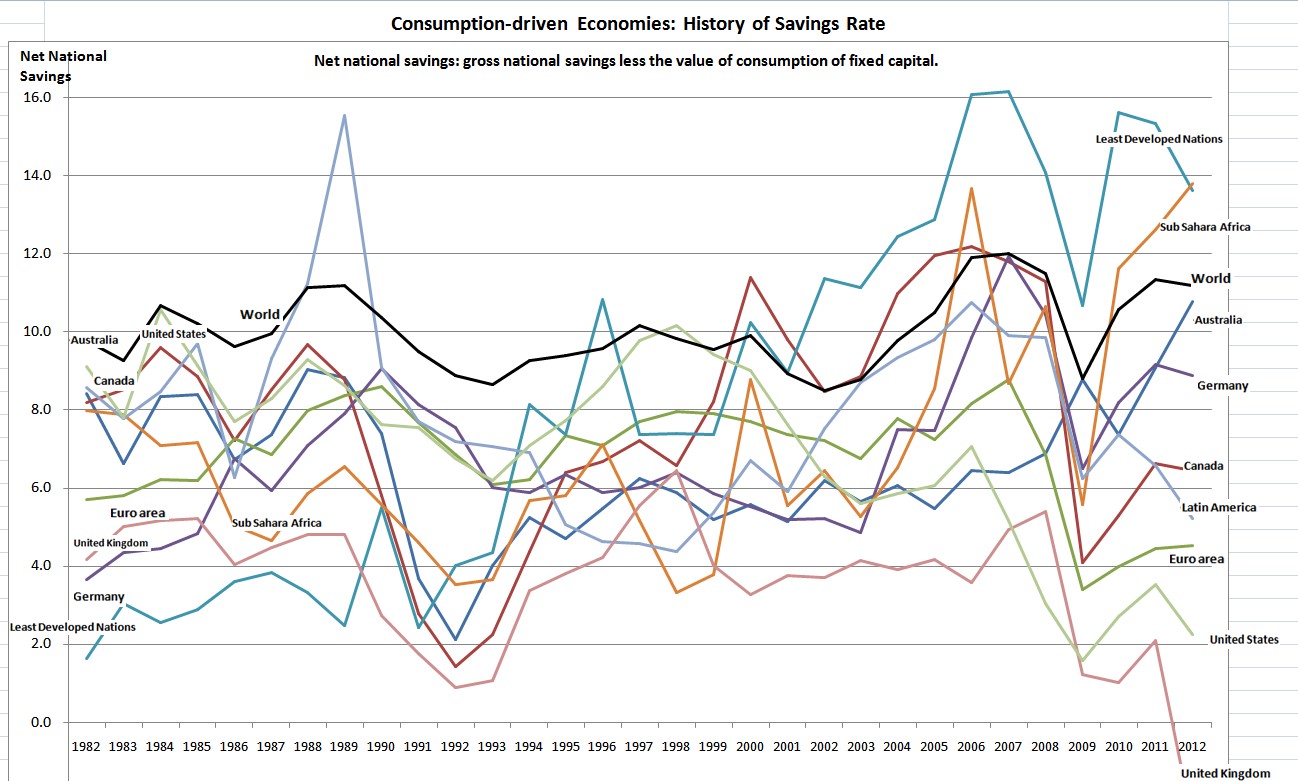

The mainstream still speaks about the savings glut. Sometimes even American businesses are considered to save too much. The net savings rate from the World Bank includes savings of households, of the government (like in state pensions) and the ones of the businesses minus depreciation. The rate for the whole world has remained mostly stable during the last three decades, fluctuating between values of 9% in 1993 and 12% in 2007.

In 2007, the massive difference between 2% savings in the U.S. and 12% in Germany and in the whole world let to the short-lived Great Recession period and low global interest rates and consequently low savings in 2009. In these consumer countries this phase is followed by the long-lasting Secular Stagnation. Other phases of low rates in post-recession periods are visible in 1992 and in 2002.

Please click to expand.

The so-called “least developed nations”,a UN classification, and Sub Saharan Africa have shown a great improvement. They were only consuming in the early 1980s and additionally they had to pay back high debt. Now those are slowly becoming a “production and investment-driven” nation.

The United States and Britain show heavily lower savings rate as opposed to previously: In the case of the U.S., net national savings have fallen from 10% in 1982 to 2% in 2012. The UK even exhibit negative net savings. This negative development is visible in the pure state of American and British infrastructure and in the low level of investments.

The “German story” is interesting. German net national savings fell from 16% in 1971 to 3% in 1981. Germany saw a wage price spiral in the early 1980s just some years later than the US started with it. Prevailing Keynesian policies enabled low savings rates combined with high fiscal expenditures. The winners of this game were wage earners, while entrepreneurs could not finance investments any more or did not obtain the needed cheap labor. Due to excessively high wages, Germany lost its status of major target of investments and of currency inflows it had until the 1970s.

Given that Germany had become a consumption-driven economy, Japan replaced it during the 1980s. Thanks to high savings in the early 1980s, even the U.S. was a target of investments what let to a strong dollar. After the Keynesian spending excesses after the German unification (net savings down from 9% to 6%), Germany decided that austerity and saving was a better, but a very slow way to success. Since salaries were excessively high in global comparison, German firms used the savings to expand globally, instead of investing in their home country.

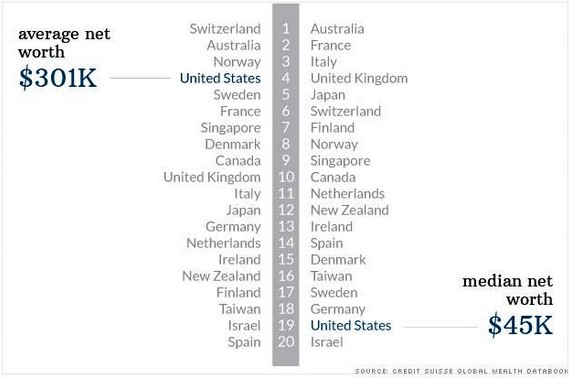

Since 1998, Australia and Canada increased their savings rate to over 10%. This was beneficial for their currencies, for employment and real wages, but – in particular – in the Canadian case negative for productivity (GDP in local currency/hours worked). No wonder for us: In our consumption-driven countries, GDP is negatively correlated to savings. Since real wages in Canada increased, productivity fell and median wealth moved upwards.

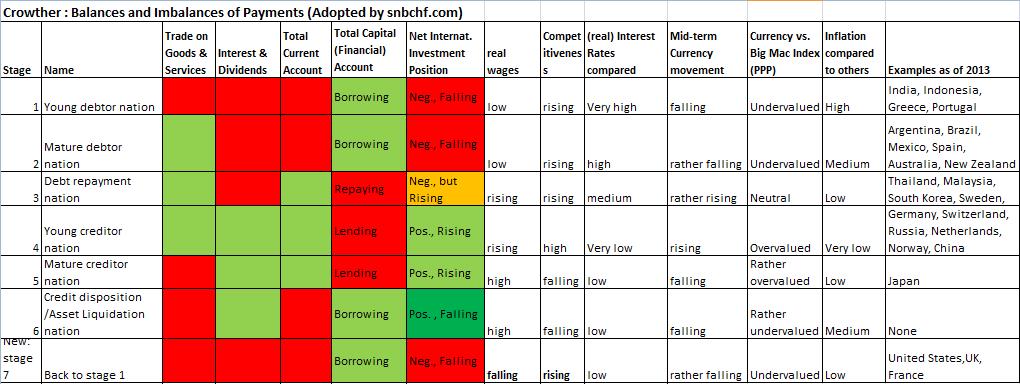

In Growther’s methology most of the above economies are young debtor nations – like Latin America or Africa, or mature debtor nations like Canada or Australia, countries that must pay back foreign debt. Or they are credit disposition nations that nearly arrive in stage 7, the moment when all components of the balance of payments are negative and consequently the currency must depreciate. Examples are the UK or the United States.

The only positive exception among these consumption-based economies is Germany that has become a mature creditor nation again.

Reference: