We extended and improved our existing post to contrarian investing. It was published on Seeking Alpha. We are pleased that it was awarded the Editor’s Pick.

- Gross Domestic Product(ion) is (or has become) a measurement of activity and consumption, but not of capital accumulation and production.

- In many cases, GDP growth is negatively correlated to saving. Higher savings (aka austerity) leads to lower GDP growth today, but to higher GDP in the future.

- In its worst case, GDP growth could be completely based on credit, eliminating the capital basis of a country (example Greece).

- FX rates are less driven by GDP but by savings and investments, in particular on the corporate side, by investors and micro-economic indicators.

- In addition to micro-economic indicators like price to cash flow or price to book ratio, the saving rate is the best macro-economic indicator of the investment style called “contrarian investing.”

Here the link to Seeking Alpha.

The post has three parts:

- FX rates and GDP growth

- The Misleading Concept called GDP

- Contrarian Investment and GDP

When we looked at the reasoning behind FX Rates’ movements, we discovered one important thing: the more a country saves and invests in comparison to spending, the stronger the currency. Savings typically happen in the local currency and strengthen it.Over a longer period, stronger consumption and GDP growth leads to a weaker currency. There are notably temporary or longer-lasting exceptions to this rule:

- A carry trade phase when the central bank hikes interest rates against wage and spending excesses. These phases, however, finish after a certain time with the collapse of the carry trade. Then the currency weakens again or in historic cases like Brazil, Mexico or Argentina it collapsed and caused hyperinflation. One other example is the USD long carry trade in 1997-2000 (dot com bubble). After the dot com overvaluation the dollar fell from €/$ 0.85 to 1.60 in 2007.

- Another exception is the competitive advantage of a country that combines initially low wages with moderate wage increases and investments that lead to higher production. Historic examples are Germany between 1950 and 1978, Japan between 1960 and 1990 and China since 1998. Those nations saw higher saving, current account surpluses and capital account inflows and strong investments for years. Consequently, the currency appreciated strongly together with stronger GDP.

- Strong immigration means more cheap labor and can lead to more savings and higher GDP growth at the same time (example Switzerland, the U.S. in their heydays). GDP per capita, however, struggles in this case.

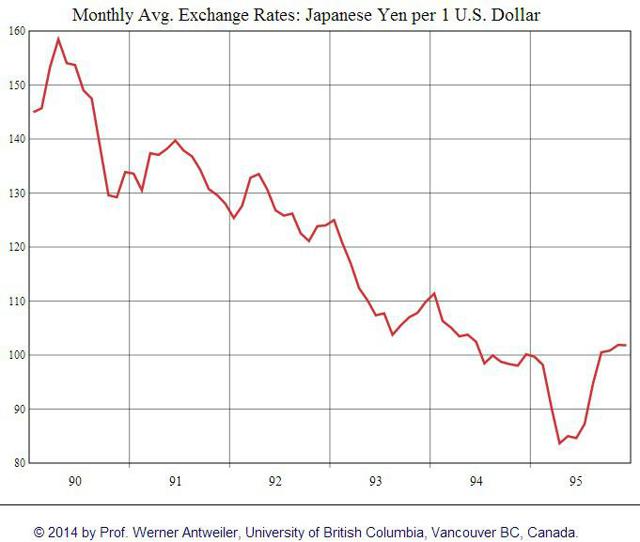

Despite the bust of the Japanese bubble in 1991 and weak GDP growth, the yen continued to perform strongly until 1995 to be weakened only with the dot.com carry trade in favor of the dollar.

Reasons for the strong yen were high savings, high current acount surpluses, low inflation and the focus on production, while Europeans and Americans saw a phase of GDP growth and strong consumption.

Reasons for the strong yen were high savings, high current acount surpluses, low inflation and the focus on production, while Europeans and Americans saw a phase of GDP growth and strong consumption.

Or as an economic text book of 2002 explains: Growth creates inflation and inflation weakens the dollar (when production is at maximum capacity).

To a certain extent, consumption influences industrial production, namely the fact that people mostly buy locally produced goods and nearly entirely locally executed services. However, especially for goods, this has changed a bit in the last 15 years. Higher consumption in Western countries without the corresponding production has made the Chinese rich.

Bawerk, a pseudonym writer based on the theories of the Austrian economist Eugen Böhm von Bawerk, stipulates that:

Gross Domestic Product (or Production) in advanced economies = Gross Domestic Consumption hence GDP is mostly consumption or consumption-driven activity.

Gross Domestic Consumption (GDC) is exercised today and not in the future, meaning it is not saved. Strong GDC growth is in certain cases equivalent to capital absorption. Movements of the saving rate, often incited by monetary expansion and easy credit, lead to boom and bust cycles.

- GDP is (or has become) a measurement of activity and consumption, but not of capital accumulation and production.

- In many cases, GDP is negatively correlated to saving. Higher saving (aka austerity) leads to lower GDP growth today, but higher GDP in the future. The former “sick man of Europe,” Germany, is the best example, because Germany saved when others were spending.

- In its worst case, GDP growth could be completely based on credit, eliminating the capital basis of a country (example Greece).

- Western countries saw rising housing investments based on more credit. These investments, however, do not lead to increased production, while the credit destroys the capital base.

- China, on the side, is building a strong future based on high saving, capital accumulation and high investments, even if the credit and housing investments part is increasing in parallel.

Some extracts from Bawerk:

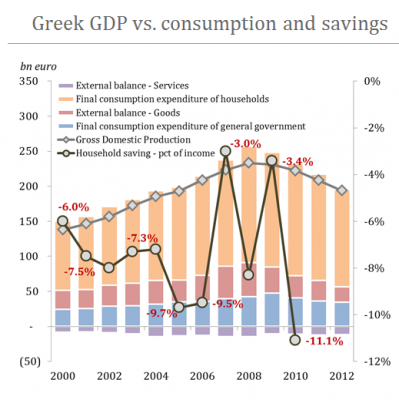

The Greeks ran a massive goods deficit with the rest of the world (and they still do). At the peak this amounted to a staggering sum of 48 billion euros.

At the time that meant almost 12 thousand euros per Greek worker, which corresponds roughly to what he made on a net basis that year. In other words, the Greek worker got 12 thousand euros from his employer which he spent on consumption and simultaneously consumed an additional 12 thousand through in-debting himself to foreigners.

According to the OECD saving rates in Greece, as a percent of disposable income, was deeply negative and has been for many years. In other words, the Greek society consumed far more than they themselves produced of value. This is not unique to the western world. On the contrary, most western countries have consumed more than they have produced for quite some time.

Knowing a thing or two about capital theory we would expect output in these economies to nosedive over the same period. Production comes out of capital accumulation and if society regresses through capital decumulation it follows logically that output must fall. However, if we look at consumption and GDP in Greece since 2000 we find a positive correlation.

And even more striking, the correlation between saving and GDP is negative! Everything we have ever learnt about personal finance, building a business or capital theory seems lopsided! According to the data it is the exact opposite! The more you consume and the less you save the more you grow your economy!

To make matters even more obscure, we can also find a positive correlation between government expenditure and output. If the government spends more money output increases and visa versa. No wonder the Europeans found austerity boring. Only an evil person (or an environmentalist) would advocate austerity when faced with such “proof.’

In order to answer this apparent conundrum we need to ask ourselves what GDP actually measures? In “Taking the Pulse on the Economy: Measuring GDP” by Landefeld et al. we learn that “the method (to calculate GDP) produces consistent estimates of the value of final sales to consumers…” in addition one has to add “government expenditures on goods and services.” This is what economists call final demand, or expenditure, approach. In other words, gross domestic production is derived primarily from household and government consumption. We say primarily, because statistical bureaus do adjust for net exports and government transfer payments. However, as a percent of the total these are relatively small.

The reader will immediately understand why we consistently call GDP for gross domestic consumption, or GDC. It does not measure production at all, but rather consumption.

Historically the so-called GDP concept were made out of the Keynesian worldview expressed in the infamous tautological equation Y = C + I + G + X where output Y equals consumption adjusted for net export.

Through a complete obfuscation of the terms and expression now used in our daily conversation about economics we often hear utter nonsense such as the US economy is driven by household consumption. In sheer ignorance one can even hear self-proclaimed experts, banksters and pundits state that 70 percent of the US economy is household consumption. The simple fact that we do not see this should be enough to discredit the whole notion of GDP and we recommend everyone to start calling it what it really is –gross domestic consumption, or GDC.

Only by doing so can we once again have a meaningful conversation about economics in general and austerity in particular. Yes, if you reduce consumption, then measured consumption as expressed by GDC will also fall. Conversely, if you lower your saving rate GDC will increase.

Our insights on FX rates and GDP interestingly coincided with this thinking of Austrian Economics. Therefore, we reckon that it is the economic theory that combines best the ideas of micro- and macroeconomics. We come to the contrarian part.

Which stock would you buy?

1) One is a company that builds more and more homes, gyms and facilities for its executives and employees and has nice marketing events serviced by its daughter company. Sales improved in particular thanks to sales to its own employees. (You might call this company Enron but also the Greek or US economy until 2007.)

2) Another one is a firm that increases its auto-financing capabilities, invests in new (output-enhancing) plants, profits on competitive wages and regularly increases revenue but has often weaker profits due to high financing costs of their investments. (Call this company China)?

Let’s look at the so-called “recovery” of the American and British economy since 2012/2013: Both are driven by lower savings incited by the feeling of being more wealthy, an illusion created by the Fed’s and BOE monetary expansion and the asset price inflation machine “quantitative easing.” This illusion pumps up home and stock prices with no relation to income. Additionally American companies improve their margins thanks to cost reduction programs that avoid investments. If some investments are done, then not in their country of origin but in China or other cheap labor places.

European austerity, however, leads to higher saving, but stronger GDC in the future and if wage deflation is high enough then even to more investments. Only logical that peripheral government bonds prices improve and yields fall.

Investments are still weak in Europe, in particular because labor is still expensive. We still need another 20% (labor cost) deflation in Southern Europe or alternatively 30-40% inflation in China. Unfortunately neither European nor Chinese leaders will not agree to that. Hence we will continue with the status quo: No investments in the West, massive, maybe sometimes excessive investments in China.

Since the Chinese are investing in the future, we remain bullish on China (NYSEARCA:YAO) or small caps that are hampered by high borrowing costs (NYSEARCA:HAO) and in the Keynesian eyes still insufficient Chinese consumption.

The following graph shows micro-economic insights on Italy.

Source: Seeking Alpha, Brett Eversole: An Incredible Opportunity… In Europe

Due to falling bonds yields and cheap valuations on southern European stocks, we also are bullish in particular on Italy (NYSEARCA:EWI). The index contains many banks that thanks to the LTROs were able to buy Italian government bonds at yields of 5% and higher. We are confident that thanks to the “euro, the new gold standard,” Italy has no chance to reproduce its history of high wage increases and inflation. Italians will finally go the right way:deflation and as already visible now, high current account surpluses.

We are less bullish on Spain (NYSEARCA:EWP), which recently experienced a Keynesian GDP growth injection with the government-financed cash-for-clunker method and consequently (temporarily?) higher stock prices.

For the real contrarian we even recommend Greek stocks (NYSEARCA:GREK) thanks to a strong increase of savings, a relatively strong capital base, low stock valuations and high unemployment, which has long-term potential for long-lasting pressure on wages and therefore rising company margins. The exodus of qualified workers is, however, a risk.

Conclusion:

In our view, the Austrian economic theory best integrates the macro- and microeconomic basis for investors. The best way for buying stocks or investing in foreign currency is to ignore GDP growth completely or to use it as counter criterion. An increase in the savings rate is a better predictor of future stock market or currency movements. In addition to micro-economic indicators like price to cash flow or price to book, the saving rate remains the best macro-economic indicator of the investment style called “contrarian investing.”

References:

Even mainstream economists prove that a concentration on property investments weakens export performance and productivity, namely:

VoxEU: Balazs, Kierzenkowski: Exports and property prices: Are they connected?

VoxEU: Charkraborty, Gioldstein, MacKinlay: Dark side of housing-price appreciation

Financial Times: Rising GDP not always a boon for equities

St. Louis Fed: Lessons from the Past Recession: The Faster They Grow the Deeper They Fall

Jay R. Ritter, University of Florida: Is Economic Growth Good for Investors

Further references:

Seeking Alpha, Brett Eversole: An Incredible Opportunity… In Europe

My discussion on Seeking Alpha with GDP-inspired so-called “contrarian” hedge fund manager Jake Honeycutt on “Italy: The New ‘Powder Keg’ Of Europe”

My subsequent article The New Widow-Maker Trade: Short Italian Government Bonds

See Bawerk’s full article on the rejection of GDP with further explanations, in particular with the relationship between GDC and money and the critique of monetary expansion and QE.

See more for

1 comments

nancyjohn2010

2014-12-14 at 18:14 (UTC 2) Link to this comment

Good things that you were able to put a lot of wonderful insights here about Forex trading. This are great introductions for some Forex traders to have an effective methods in their trading system

<a href=”http://forex-matter.blogspot.com/2011/06/forex-trading-platform.html”>Forex Trading software</a>