For recent updates that confirm our July 2013 findings, including the so-called “weather effect”, may jump to page 2 of this post.

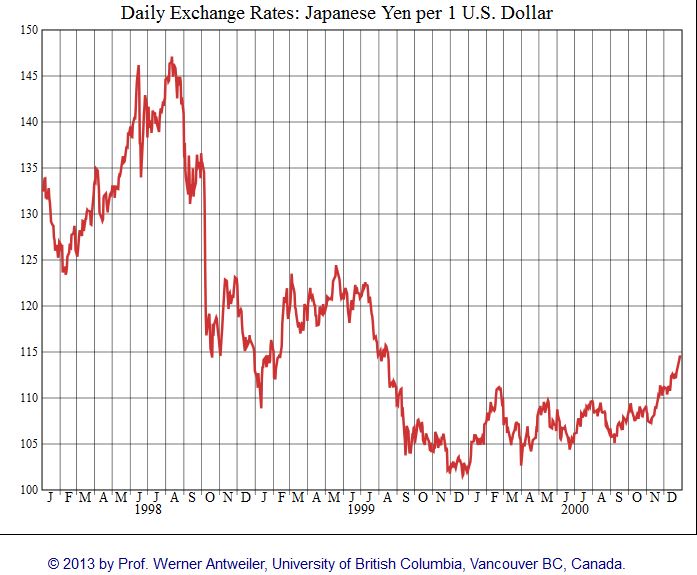

Whoever is betting on a quick and long lasting U.S. recovery after the deep financial crisis should look on Japan in 1998/1999.After the Asian financial crisis, the Japanese yen recovered from 147 yen per dollar to 115 in just 4 months. This at the height of the strong dollar period.

We often see over-enthusiam of FX markets helped by central banks. At the time US funds were moving into Japan, in the hope that Japan would recover. Everybody remembered Japan as the strong engine of the global economy until the early 1990s.

We have seen a completely analogous movement since the Fed decided to artificially sustain the U.S. housing market and the Japanese decided to devalue their currency. Investment flows are directed to the U.S., in 2012 China saw one year of FDI outflows. We see private equity funds and other investors betting on a recovery of the US housing market.

New York Times in 1999: At Last, It’s Time to Bet on Japan’s Recovery

By FLOYD NORRIS

Published: March 08, 1999The long national economic nightmare is finally ending in Japan. After a decade of denying reality, of bad policies being followed by worse changes, the Japanese economic pulse is starting to be heard.

That is not, to be sure, the opinion of most Japan-watchers, in or out of a country where every sign of an economic spring has proved false. Over the past seven years, Japan’s economy has grown just 5.5 percent, an average of less than 1 percent a year. It has been almost impossible for a seer to be too pessimistic.

”No one wants to stick their neck out and call the bottom,” says Ron Bevaqua, a senior economist with Merrill Lynch in Tokyo, who can list the positive things going on but nonetheless forecasts that this revival, like others before it, will sputter. He fears consumers will stop spending.

That pervasive pessimism has obscured positive developments that would provide encouragement anywhere else. At long last, the Government is doing everything it can to stimulate the economy with fiscal and monetary policy. Steps are being taken to recapitalize banks and alleviate the credit crunch. Japanese corporations are restructuring in ways that will make them more efficient. The number of new corporate bankruptcies has fallen sharply.

But because Japan has been down for so long, many doubt that announced reforms will be implemented and almost everyone is cautious. As retail sales rose in recent months, manufacturers hesitated to step up production. Now inventories are at a four-year low and production is starting to rise.The most obvious clue that change is at hand can be seen in the performance of small Japanese stocks. Most of them depend on the local economy and are of little interest to foreign investors. So in the years since the bubble burst, they have had almost nothing going for them. The Japanese index of over-the-counter stocks fell 85 percent from its 1990 peak to last October’s low. Now, however, it is up 50 percent from the low.

Big Japanese companies, more dependent on exports, have not done as well. Even with Friday’s 5 percent leap, the Nikkei 225 ended the week just 16 percent above its October low. It fell 67 percent from top to bottom.

It is still possible that consumers will be reluctant to continue spending, or that those in the Government who are appalled by the big budget deficits being posted will try to raise taxes, making the same error that so hurt the economy last year. It is not certain that Japan’s banks will succeed in putting their bad loans behind them, or that they will be willing to lend to businesses without the government guarantees now being used to stimulate lending.

In addition, notes Robert Barbera of Hoenig & Company, one of the few economists who expects Japan to grow this year, ”they have to prevent easy money at home from deteriorating into a collapsing yen, because the world needs them to generate a home-grown recovery, not an export-led expansion.”

But consider what will happen if the pessimists are wrong. Just as Japan’s falling yen and the retreat of Japanese banks helped cause the Asian collapse, the reversal of those trends could assure that tentative recoveries in South Korea and Thailand continue. A growing Japan would help to stem deflationary forces in the world, helping manufacturers and commodity producers.

Not everything will be better with a healthy Japan. Already, Japan’s big deficit financing is boosting long-term interest rates there and is one reason that long-term rates are rising in this country. The environment will not be quite as nice for consumers, who will see more inflation and higher mortgage costs. Japan will seem like a better place to invest money, making the United States seem less attractive and perhaps putting pressure on the dollar.

But, to say the least, all that would be worth it. Only months after many were worrying that a global recession, or worse, was at hand, there are signs that the sickest of the big economies is off the critical list and on the way to recovery. source New York Times

The Japanese Balance Sheet Recession Lasted one Decade more

Still the second lost Japanese decade was far better than the first one.

Will the U.S. repeat the false Japanese 1998/1999 Recovery?

In the Japanese 1998/1999 case, the strong yen phase lasted two years nearly until 2001.

It could imply another 2 years of a strong dollar now, two years until U.S. inflation becomes stronger and the euro zone and emerging markets recover.

Three points are critical preconditions to a longer-term continuation of a stronger dollar phase:

- Will the Americans go again for deficit spending? It does not seem so: Evidence from the NY Fed.

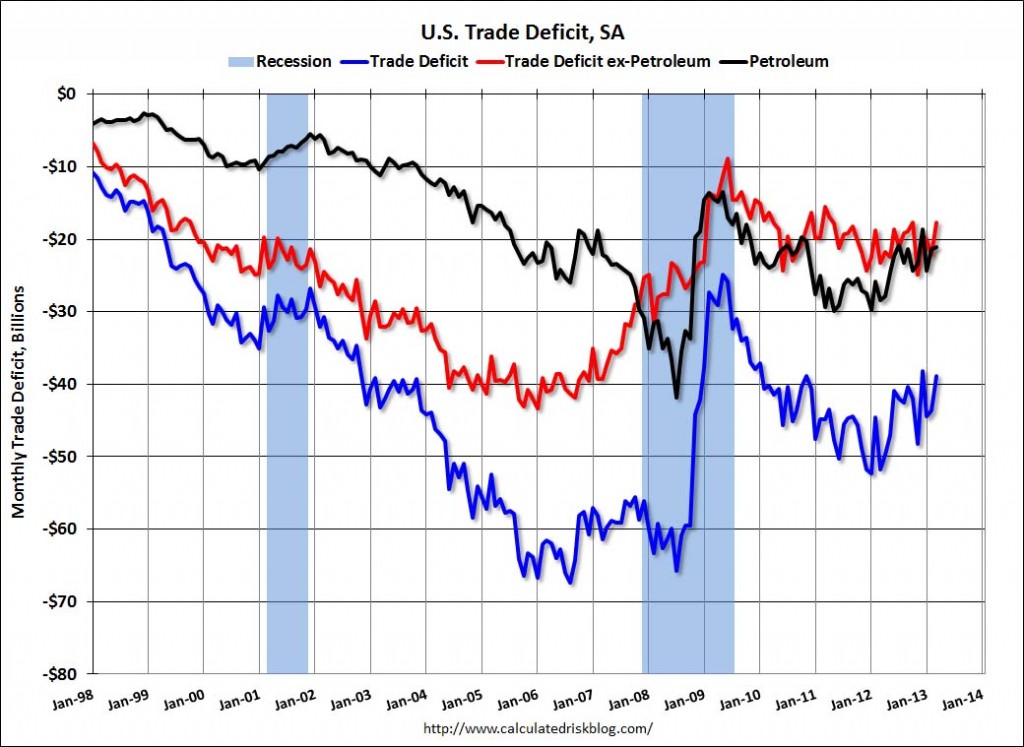

- Will the US trade and current account deficit finally improve? How long will relatively weak oil and gas prices sustain the US economy and the trade balance?

3. Who will consume during this recovery, if the emerging markets are slowing, Europe is in austerity and Americans do not like deficit spending any more?

Hedge fund managers, private equity managers?

It is easy to recover when funds are directed to the U.S. and the rest of the world is weak…. just for how long?