Along the double mandate of the federal reserve, monetarists can be divided into

- traditional monetarists that focus on a slow increase of money supply in order to avoid price inflation

- Market monetarists that want to target growth and income instead of inflation

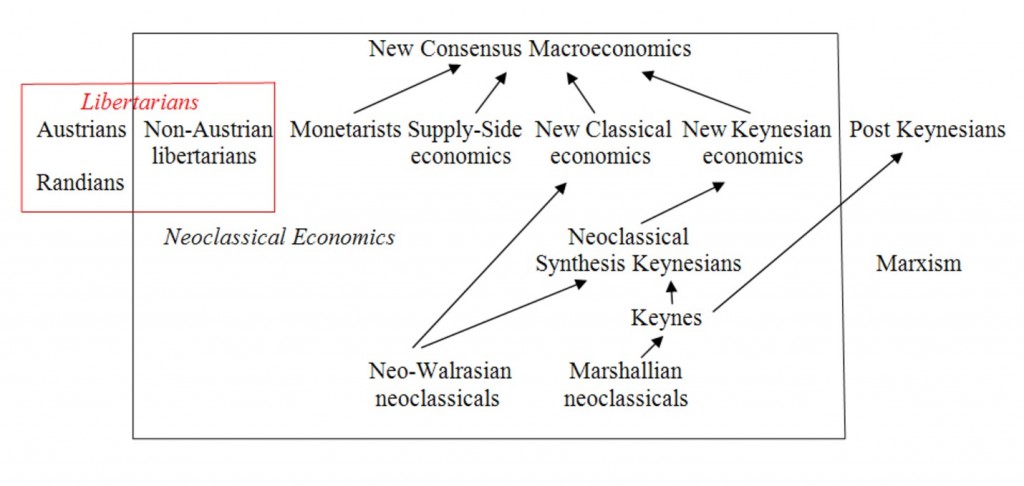

They are contained inside the “New Consensus Macroeconomics”, on the side that is close to the libertarian theories.

(Major source of this part)

Major economic schools (source) - Click to enlarge

The traditional monetarist theory

In his famous essay, “The role of monetary policy” in the American Economic, Friedman describes the monetarist business cycle, or better excesses of a sound business cycle, as follows:

- The end of the previous cycle, often from an inflationary period (sometimes a period of financial distress) followed by a sound recovery.

- Increase of money supply even if unemployment is already at a level below or near the natural rate of unemployment (NAIRU).

- Initial effect: “Much or most of the rise in income takes the form of an increase in output and employment rather than in prices”.

- The inflation phase: “The decline ex post in real wages, affects anticipations”.

- The overheating: “The rise in real wages will reverse the decline in unemployment” .. and slow GDP.

An economy possesses basic long-run (or even in the so-called “medium-run”, like Blanchard defines it) monetary neutrality if an exogenous increase of Z percent in its stock of money would ultimately be followed, after all adjustments have taken place, by a Z percent increase in the general price level, with no effects on real variables (e.g., consumption, output, relative prices of individual commodities).

While most economists believe that long-run neutrality is a feature of actual market economies, at least approximately, no other group of macro-economists emphasizes this proposition as strongly as do monetarists. Also, some would object that, in practice, actual central banks almost never conduct policy so as to involve exogenous changes in the money supply. This objection is correct factually but irrelevant: the crucial matter is whether the supply and demand choices of households and businesses reflect concern only for the underlying quantities of goods and services that are consumed and produced. If they do, then the economy will have the property of long run neutrality, and thus the above-described reaction to a hypothetical change in the money supply would occur. Other neutrality concepts, including the natural-rate hypothesis, are mentioned below.

Short-run monetary non-neutrality obtains, in an economy with long-run monetary neutrality, if the price adjustments to a change in money take place only gradually, so that there are temporary effects on real output (GDP) and employment. Most economists consider this property realistic, but an important school of macroeconomists, the so-called real business cycle proponents, denies it.

Volcker applied monetarist theory and rational expectations in his attack on inflation in the 1980s. With the reduction of money supply he managed to reduce inflation.

Market monetarists

Market monetarism advocate that central banks should target the level of nominal income instead of inflation, unemployment, or other measures of economic activity. This theory finds its application, especially in longer-lasting periods of economic shocks like after the sub-prime crisis.

In contrast to traditional monetarists, market monetarists do not think that monetary aggregates to be the best guide to intervention. Market monetarists also reject the neoclassical mainstream focus on interest rates as the primary instrument of monetary policy. They believe in the power of markets and reject fiscal policy as instrument.

Market monetarists prefer a nominal income target due to their twin beliefs that rational expectations are crucial to policy, and that markets react instantly to changes in their expectations about future policy, without the “long and variable lags” highlighted by Milton Friedman.

Their strategy is to target nominal GDP (NGDP) growth in the United States and other aligned powers, restoring it to pre-crisis trend levels. The idea comes from Irving Fisher’s “compensated dollar plan” in the 1930s.

The school is not Keynesian. They are inspired by interwar economists Ralph Hawtrey and Sweden’s Gustav Cassel, as well as monetarist guru Milton Friedman. “Anybody who has studied the Great Depression should find recent European events surreal. Day-by-day history repeats itself. It is tragic,” said Lars Christensen from Danske Bank, author of a book on Friedman.

“It is possible that a dramatic shift toward monetary stimulus could rescue the euro,” said Scott Sumner, a professor at Bentley University and the group’s eminence grise. Instead, EU authorities are repeating the errors of the Slump by obsessing over inflation when (forward-looking) deflation is already the greater threat.

“I used to think people were stupid back in the 1930s. Remember Hawtrey’s famous “Crying fire, fire, in Noah’s flood”? I used to wonder how people could have failed to see the real problem. I thought that progress in macroeconomic analysis made similar policy errors unlikely today. I couldn’t have been more wrong. We’re just as stupid,” he said.

Did monetary expansion cause the euro crisis?

In line with Friedman’s traditional view, we argue that inflation and monetary expansion, explicitly QE2, was a main reason for the euro crisis.

Further reading

The Market Monetarist: Money matter, markets matter by Lars Christensen

A test of market monetarism: Measuring the effect of fiscal policy compared with monetary effects

How to implement NGDP targeting

The Money Illusion: What is market monetarism?

See more for