Category Archive: 3) Swiss Banks

Changes to the UBS Board of Directors

Zurich, 10 January 2020 – The Board of Directors of UBS Group AG announced today that it will nominate Nathalie Rachou and Mark Hughes for election to the Board at the Annual General Meeting on 29 April, 2020. David Sidwell and Isabelle Romy will not stand for re-election. David Sidwell will have completed a twelve year term of office and Isabelle Romy has decided to step down after eight years on the UBS Board.

Read More »

Read More »

The S&P’s Biggest Bear Capitulates

First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank's Aleksanda Kocic), and now the market's QE4-driven meltup has forced Wall Street's biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS' head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end...

Read More »

Read More »

Credit Suisse Ex-Employee Says “Striking Tall Blonde” Spy Followed Her In Manhattan And Long Island

When Colleen Graham heard a story of investigators looking into Credit Suisse for spying on its recently departed head of wealth management, something sounded familiar. She had recalled, years prior, when she was working on a JV between the bank and Palantir Technologies, a "striking tall blonde" had followed her in Manhattan after she refused to sign off on how revenue from the JV would be booked.

Read More »

Read More »

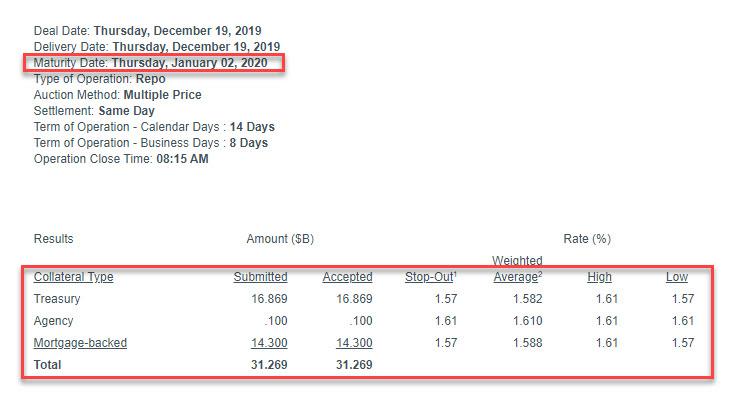

Repo Crisis Fades Away: For The First Time, A “Turn” Repo Is Not Oversubscribed

It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck. Today's Term Repo saw $26.25BN in security submissions ($15.75BN in TSYs, $10.5BN in MBS), below the $35BN in total availability. This was the first "turn" repo that was not fully subscribed (on Monday, there was $54.25BN in demand for $50BN in repos maturing on Jan 17).

Read More »

Read More »

Rosenblatt Goes Full Bear On Apple With $150 Target As China iPhone Sales Slump

Rosenblatt Securities analyst Jun Zhang maintained a sell rating on Apple with a price target of $150 per share, citing a decline in iPhone sales in China is leading to a wave of production cuts by the company. "Based on our recent channel checks, we believe Apple's total iPhone sales in China were down ~-30% y/y in November," said Zhang in a note to clients on Tuesday.

Read More »

Read More »

China No Longer Needs US Parts In Its Phones

China was once very dependent on US chips for its phones. The latest Chinese phones have no US parts. The Wall Street Journal reports Huawei Manages to Make Smartphones Without American Chips. American tech companies are getting the go-ahead to resume business with Chinese smartphone giant Huawei Technologies Co., but it may be too late: It is now building smartphones without U.S. chips.

Read More »

Read More »

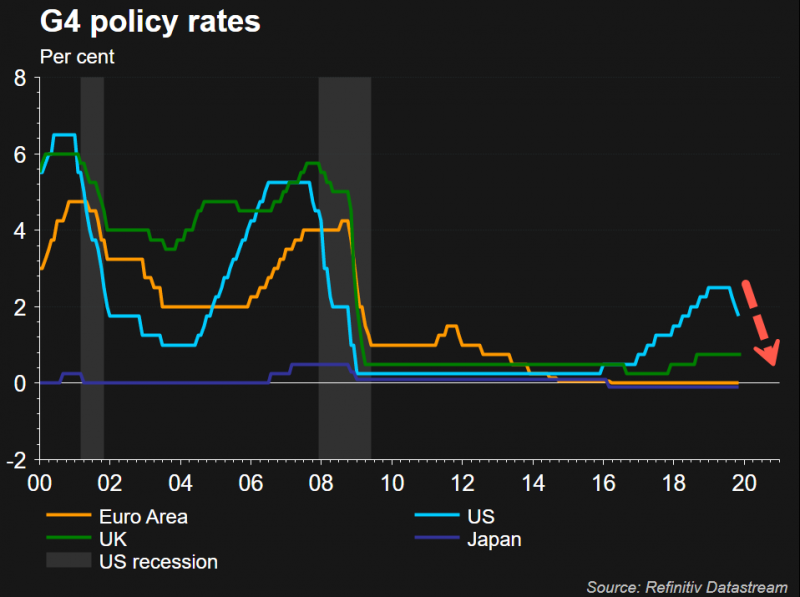

UBS Has No Choice In Passing Negative Rate Pain To Customers

There's been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump's support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%.

Read More »

Read More »

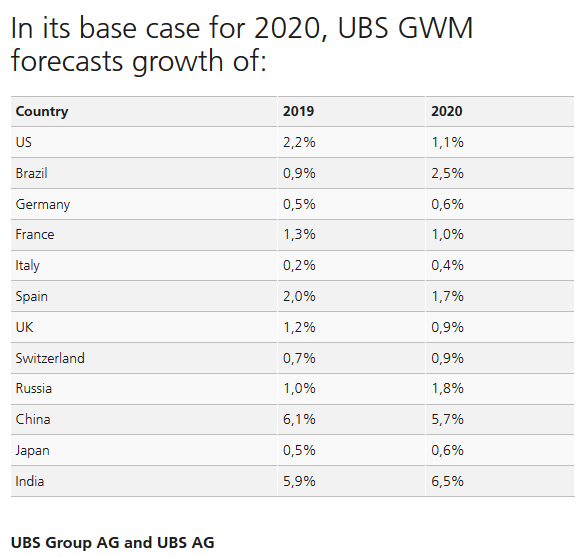

UBS unveils Year Ahead outlook for 2020 and a ‘decade of transformation’

Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook.

Read More »

Read More »

World’s Ultra-Rich Preparing For Market Crash, UBS Warns

A synchronized global slowdown, with no end in sight, has spooked some of the wealthiest investors around the world, according to a new survey from UBS Wealth Management, seen by Bloomberg. UBS polled wealthy investors, who are preparing for a significant stock market correction by the end of next year.

Read More »

Read More »

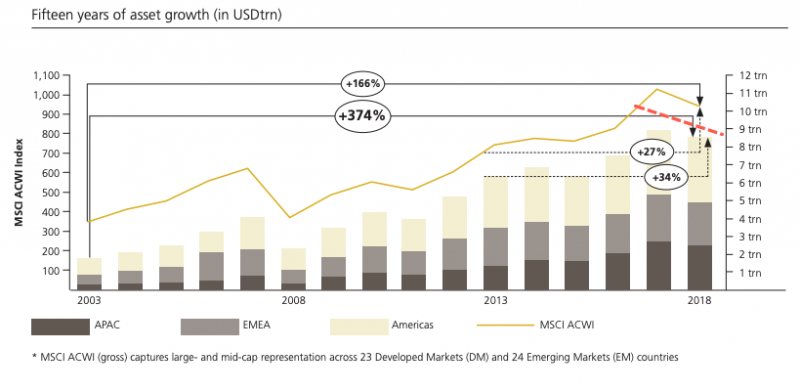

Billionaire Boom “Has Now Undergone A Natural Correction”

Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen. These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report.

Read More »

Read More »

UBS Global Real Estate Bubble Index 2018

The UBS Global Real Estate Bubble Index 2018 report is produced by UBS Global Wealth Management's Chief Investment Office and analyzes residential property prices in 20 developed market financial centers around the world. Hong Kong faces the greatest risk of a housing bubble, followed in descending order by Munich, Toronto, Vancouver, Amsterdam, and London.

Read More »

Read More »

Results of the Annual General Meeting 2018 of UBS Group AG

UBS shareholders approved all the Board of Directors’ proposals at today’s Annual General Meeting in Basel. Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Jeremy Anderson and Fred Hu as new members of the Board. They approved the payment of an ordinary dividend of CHF 0.65 per share, an increase compared with the previous year.

Read More »

Read More »

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »