Category Archive: 3) Swiss Banks

Credit-default swaps: the case for the defence

Vultures, rats and maggots are often the focus of disgust, less because of anything for which they can be blamed, and more because of the conditions with which they are associated. Death, disease and squalor carry a stigma that is hard to shake.

Read More »

Read More »

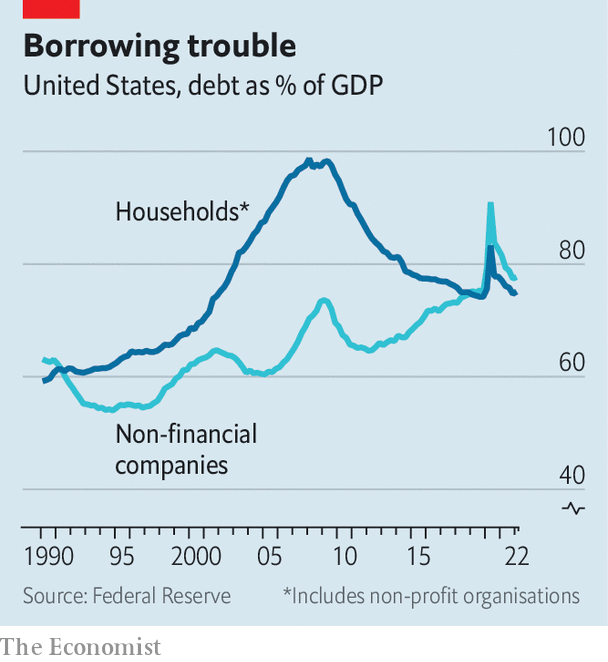

As interest rates climb and the economy cools, can companies pay their debts?

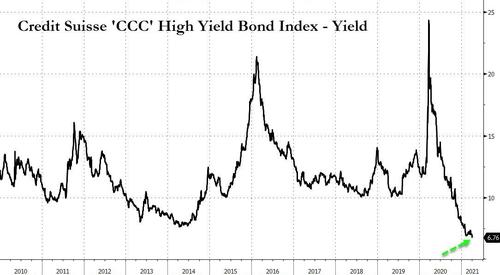

Welcome to the American corporate-debt market of 2022. Often the only risky bonds that are being issued are the legacy debts of a now ancient-seeming time—when interest rates were low and a recession was unthinkable. Elsewhere, the high-yield market has almost ground to a halt.

Read More »

Read More »

UBS celebrates 50 years in Singapore, as a window to the world, connecting people and ideas

UBS is celebrating 50 successful years in Singapore with the official opening of its largest Asia Pacific office at 9 Penang Road.

Read More »

Read More »

UBS celebrates its first Female Founder Award winner as part of the Future of Finance Challenge

For the first time since starting the Future of Finance Challenge in 2015, UBS has presented a Female Founder Award as part of its Future of Finance Challenge. Around one-third of the overall entries qualified for this award.Kimberley Abbott of Vested Impact won the Female Founder Award.

Read More »

Read More »

UBS launches collective philanthropy initiative to help clients address critical global issues

New York, NY,October7, 2021 – Harnessing the power of collective philanthropy, UBS today announced the launch of UBS Collectives (“Collectives”), an innovative social-impact initiative that connects UBS’s philanthropic clients on issues that matter most to them.

Read More »

Read More »

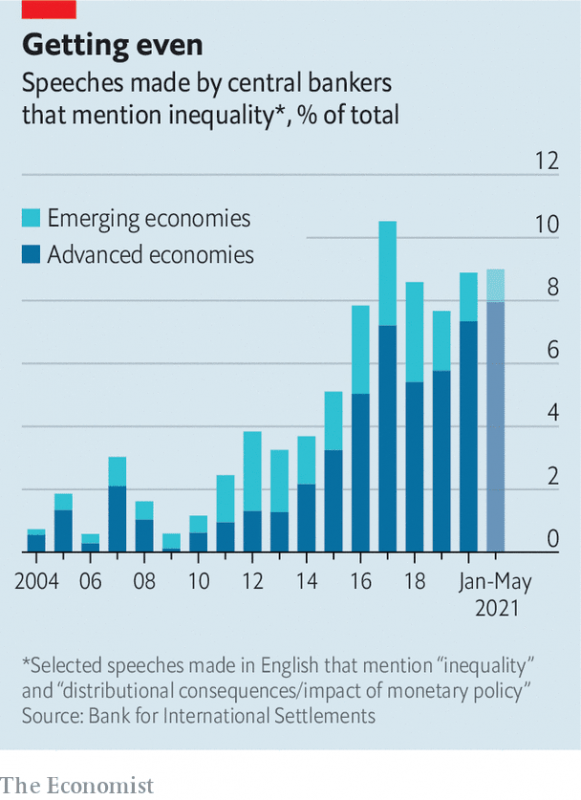

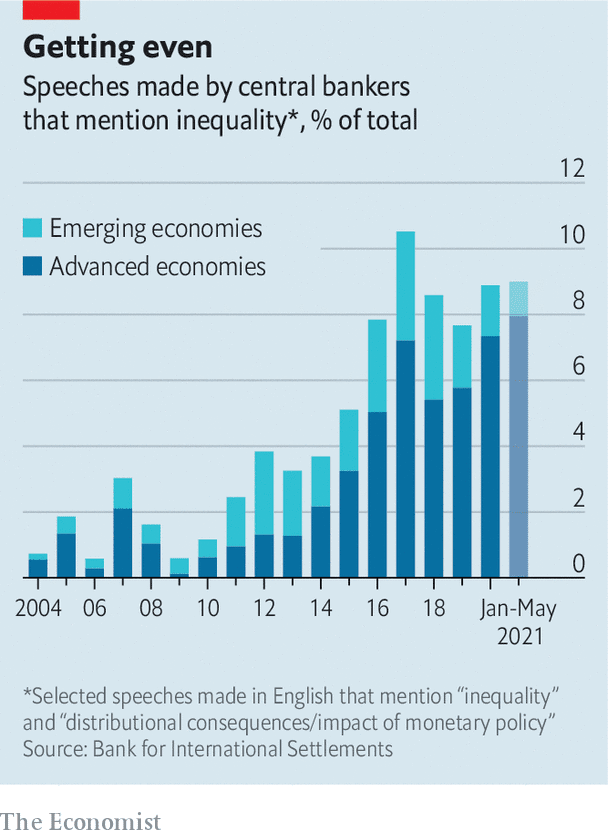

The Pandemic has Widened the Wealth gap. Should Central Banks be Blamed?

Jul 10th 2021THE GLOBAL financial crisis of 2007-09 was socially divisive as well as economically destructive. It inspired a resentful backlash, exemplified by America’s Tea Party. That crisis at least had the tact to spread financial pain across the rich as well as the poor, however.

Read More »

Read More »

West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill.

Read More »

Read More »

UBS International Pension Gap Index: Swiss pensions – an international comparison

Pension schemes are as diverse as the cultures of the countries whose working population they insure. Nevertheless, they all aim to guarantee a certain level of income in retirement. The UBS International Pension Gap Index, first released in 2017, analyses the sustainability and adequacy of the pension promises across 24 jurisdictions.

Read More »

Read More »

UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn't just for rank-and-file minimum wage jobs.UBS has now said that, amidst historic competition and a "retention crisis" in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted.

Read More »

Read More »

Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn't yet known as the bank weighs whether it should cover some client losses associated with the "low risk" trade-finance funds that collapsed earlier this year.

Read More »

Read More »

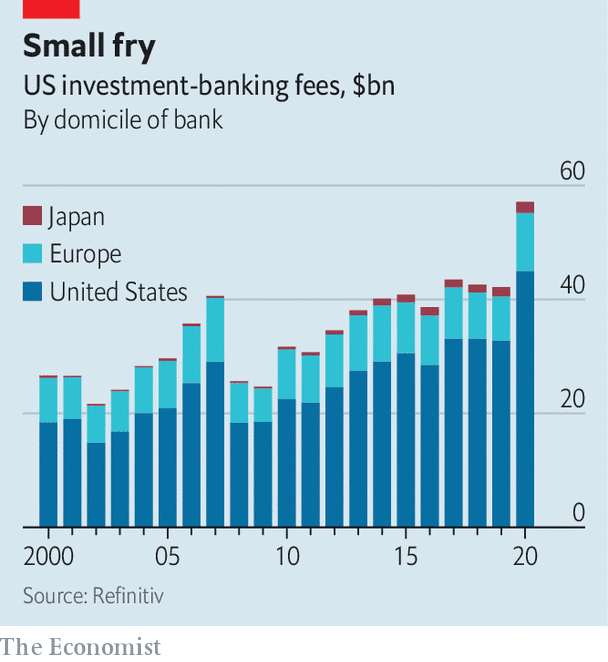

Why foreign banks’ forays on Wall Street have gone wrong—again

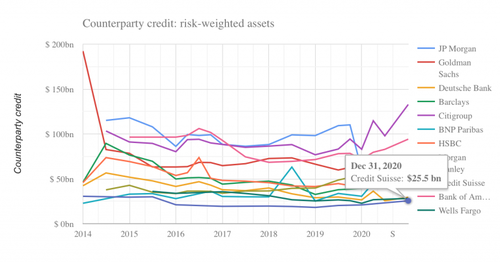

May 8th 2021THE IMPLOSION of Archegos Capital, a New York-based investment firm, in April splashed egg on many faces. Banks that had lent it vast sums to bet on volatile stocks have revealed over $10bn in related losses in recent weeks. America’s leading investment banks, barring Morgan Stanley, were largely absent from the big casualties, though. Instead the grim league table featured foreign champions. Most notable, because of its huge loss of...

Read More »

Read More »

The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the...

Read More »

Read More »

Credit Suisse’s Archegos Exposure Was Reportedly Over $20 Billion

Just minutes after the SEC is reportedly "exploring how to increase transparency for the types of derivative bets that sank Archegos," The Wall Street Journal reports that Credit Suisse Group AG had somehow allowed a massive exposure to investments related to Archegos Capital Management or more than $20 billion.

Read More »

Read More »

Credit Suisse Slashes Bonuses After $4.7 Billion Archegos Disaster

While all of the banks playing "pass the hot potato" with Archegos Capital's now-dismantled equity book are undoubtedly still assessing the damage they incurred (or at least will report to shareholders), it looks like no one had it worse than Credit Suisse. The banking giant has now slashed its bonus pool by "hundreds of millions of dollars" according to FT, after the firm lost $4.7 billion in the Archegos implosion.

Read More »

Read More »

“They’re Just Chasing” – The Fed Has Put Distressed Investors Out Of Business… Again

"People aren’t investing, they’re just chasing." That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don't justify the high risks anymore.

Read More »

Read More »

Results of the Annual General Meeting 2021 of UBS Group AG

Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Claudia Böckstiegel and Patrick Firmenich as new members of the Board. Shareholders approved a dividend distribution of USD 0.37 (gross) in cash per share. They also approved the new share buyback program 2021–2024.

Read More »

Read More »

Can Credit Suisse Avoid Becoming The ‘Deutsche Bank’ Of Switzerland?

“And the future is certain, give us time to work it out…”Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player.

Read More »

Read More »

Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of "stealth" prime broker deleveraging, as tens of millions of shares were yet to be accounted for.

Read More »

Read More »

Another Wirecard? Invoices Backing Greensill-Issued Bonds Never Existed, Administrator Finds

As the collapse of Greensill Capital threatens to ensnare former PM David Cameron in a humiliating public probe, the Financial Times on Thursday reported some disturbing new details that appear to suggest Greensill wasn't merely reckless, but potentially guilty of a Wirecard-style fraud.

Read More »

Read More »

Credit Suisse Claws Back Bonuses, ‘Restructures’ Asset-Management Unit As Greensill Scapegoating Continues

Credit Suisse is still reeling from the collapse of Greensill Capital, a firm which it championed by helping to sell its financial products (created by ensconcing trade invoices in a complex securities wrapper).

Read More »

Read More »