Category Archive: 3) Swiss Markets and News

Swiss rents 40 percent too high, according to bank’s calculation

According to the bank Raiffeisen, if rents had followed the path prescribed in the Swiss Code of Obligations, they would be much lower. Their figures show that changes in interest rates have not flowed through to renters. If rents had fallen in step with mortgage interest rates they would be 40% lower than they are currently.

Read More »

Read More »

Proposal to remove Swiss home-owner tax rejected

In Switzerland, those who own the home they live in must add imputed rent to their income when calculating their income tax. This means owner-occupiers are taxed for living in their own homes, an odd concept for some who are new to Switzerland.

Read More »

Read More »

Bank drops plan to loosen Swiss mortgage restrictions

The bank Raiffeisen has dropped its attempt to reduce minimum deposit requirements for home loans, according to RTS. Last autumn, it unveiled plans to reduce loan deposit requirements. However, last week, the bank announced that FINMA, Switzerland’s financial regulator, was opposed to the idea.

Read More »

Read More »

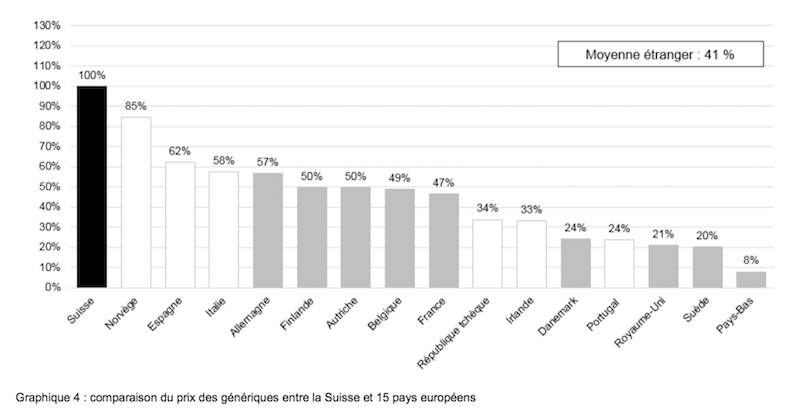

Swiss drug prices more than double european average – “Mr Price” takes aim

Switzerland’s public price watchdog chief, Stefan Meierhans, also know as “Mr Price”, has taken aim at high Swiss drug prices. A report published last week shows prices of generic drugs are nearly 2.4 times more expensive in Switzerland compared to the average price across 15 european countries.

Read More »

Read More »

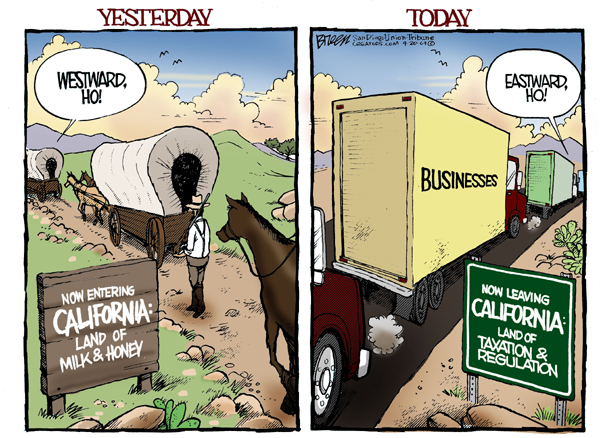

California, Nestle and Decentralization

Nestle USA has announced that it will move its headquarters from Glendale, California, to Rosslyn, Virginia, taking with it about 1200 jobs. The once Golden State has lost some 1690 businesses since 2008 and a net outflow of a million of mostly middle-class people from the state from 2004 to 2013 due to its onerous tax rates, the oppressive regulatory burden, and the genuine kookiness which pervades among its ruling elites.*

Read More »

Read More »

Uncertainty and concern follow voter rejection of Switzerland’s company tax reform

Speaking to Tribune de Genève, Serge Dal Busco, Geneva’s minister of finance, voiced his concerns about last Sunday’s rejection of Switzerland’s planned company tax reform. At the same time he remains optimistic about the chances of a new federal corporate tax reform project.

Read More »

Read More »

Swiss analysis: Switzerland’s gender pay gap – what the detail reveals

In 2014, the average gross annual salary for a full-time male worker in Switzerland was CHF 81,000, CHF 10,000 or 12.5% higher than that of an average woman. But what does this high level difference mean? Inspired by the Swedish statistician Hans Rosling, who passed away recently, I decided to dig deeper to see what was behind this top line pay difference.

Read More »

Read More »

Swiss unemployment rises. French-speaking cantons worst affected.

The unemployment rate across Switzerland climbed by 0.2% to 3.7% in January, and regional differences were clear. Across French and Italian-speaking cantons the rate averaged 5%, while across the German-speaking cantons it was 3.1%.

Read More »

Read More »

Swiss Might Drop Daylight Savings

Switzerland could drop daylight savings. Currently, Switzerland’s Federal Council sees no reason to abandon it, however if Switzerland’s neighbours did it would follow, mainly for economic reasons said the Federal council. National councilor Yvette Estermann (UDC/SVP), who is fiercely opposed to daylight saving, took the opportunity to point out the negative health consequences of changing the time every six months.

Read More »

Read More »

A recent purchase shows how hard it is to trust product packaging

Volkswagen shocked the world when it was revealed it was cheating on emissions tests on a grand scale. Now some television makers may be gaming the energy efficiency ratings of some of their televisions, according to the Economist.

Read More »

Read More »

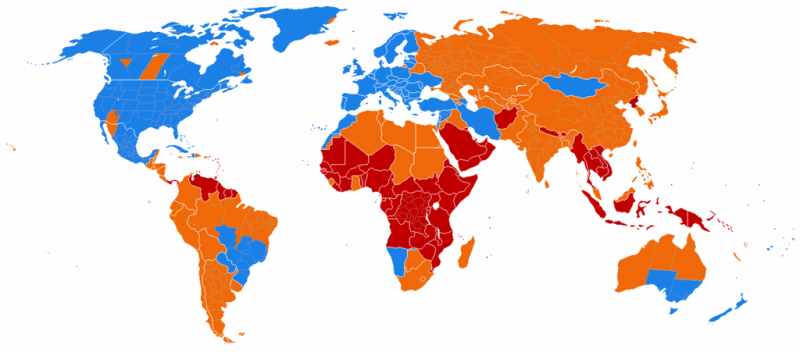

Switzerland: Chocolate, Watches, And Jihad

Swiss authorities are currently investigating 480 suspected jihadists in the country. "Radical imams always preached in the An-Nur Mosque... Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad." — Saïda Keller-Messahli, president of Forum for a Progressive Islam.

Read More »

Read More »

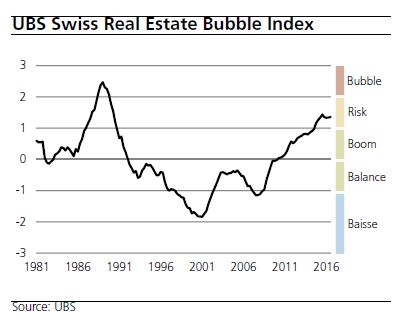

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016. The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks. The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

Read More »

Read More »

Swiss fact: 96 percent of Swiss workers earn 3,000 francs or more a month

A report published by the Swiss Federal Office of statistics, shows that only 4.3% of full-time workers earn less than CHF 3,000 per month. The monthly figure is net of social security deductions, but includes one twelfth of the 13th bonus month typically paid in Switzerland.

Read More »

Read More »

More than 3,000 state beneficiaries in Geneva admit not declaring assets or other income

Last October, Geneva state councillor Mauro Poggia, had his department send out close to 91,000 letters to those receiving social benefits, asking them to contact the authorities if they had failed to declare any assets or income. Laurent Paoliello, a spokesperson from the DEAS, said they received 3,200 letters back. So far, we haven’t been through all the letters, he said.

Read More »

Read More »

Those over 25 may pay more for Swiss health insurance

The Swiss States Council commission on public health endorsed a plan that could lead to higher health insurance premiums for those over 25. Swiss health insurance providers are required to pay into a communal pot to spread risk between insurance companies.

Read More »

Read More »

Immigration to Switzerland slows for third year in a row

ZURICH (Reuters) - Net immigration to Switzerland slowed for a third consecutive year in 2016, potentially easing concerns over immigration that have strained Switzerland's ties with the surrounding European Union. Around 143,100 immigrants arrived in Switzerland in 2016, down nearly 5 percent from the previous year, while around 78,000 foreigners left, an increase of 5.6 percent.

Read More »

Read More »

Swiss fact: work days lost to strikes in Switzerland close to one ninth of neighbouring countries

Across the ten years to 2008, Switzerland lost an average of 3 working days per 1,000 workers to strikes a year. This compares to 32 days in Austria, 33 days in France, and 55 days in Italy. Germany was close behind Switzerland with 4 days. The combined average for Switzerland’s neighbours: Austria, Germany, France and Italy, was 26 days. Switzerland’s 3 day average was one ninth or 11% of this.

Read More »

Read More »

Changes to health insurance zones could lead to steep premium rises for some

In Switzerland, how much you pay for compulsory health insurance depends on where you live. Premiums vary hugely by canton. For 2016, average monthly adult premiums in Basel City are CHF 545.60, Switzerland’s most expensive, compared to CHF 326.70, in lowest-cost Appenzell-Innerhoden. The difference between the two cantons is 40%.

Read More »

Read More »

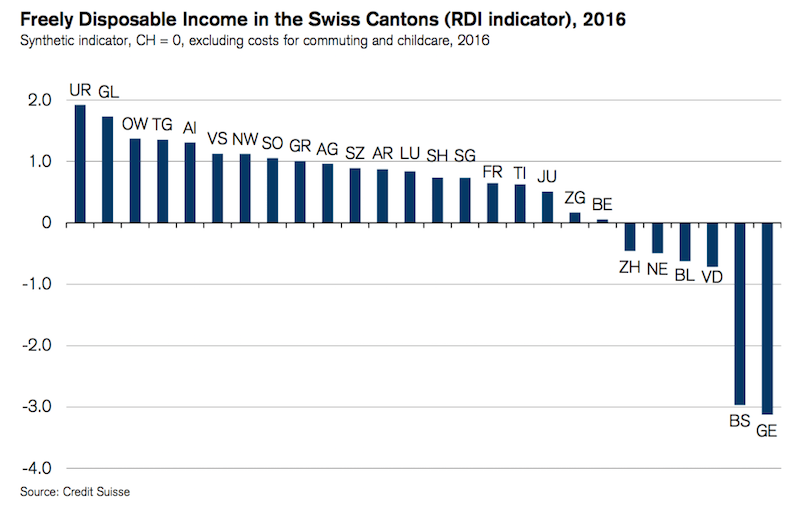

Switzerland’s costliest cantons for tax, housing, health, commuting, and childcare

This week the bank Credit Suisse published its cantonal cost of living report. Its ranking considers a typical household’s biggest expenses: tax, housing, commuting, basic health insurance and childcare. It takes income and deducts all of these costs to arrive at a measure of disposable income.

Read More »

Read More »

Swiss fact: Switzerland has one of the world’s lowest home ownership rates

In Romania, 96.1% of the population owns the home they live in. In Switzerland the percentage is 37.4%. Home ownership rates vary significantly across the country. The lowest rates are found in the canton of Basel-City (16.0%) and Geneva (18.3%). Relative to these two cities, home ownership abounds in Valais (57.2%), the highest. Vaud (31.4%), Zurich (28.5%), Bern (39.9%), and Luzern (34.8%) are all in between.

Read More »

Read More »