Category Archive: 3.) Investec

Outlook for the South African economy

There’s been a “renewed confidence” in the market since Ramaphosa’s election as ANC President, with a “huge ramp up in SA economy plays” – #InvestecWealth In its latest Global Investment View for Q1 2018, #InvestecWealth & Investment experts discuss the South African market’s positive reaction to current political events. In this video, Paul Deuchar, Head …

Read More »

Read More »

Global investment icebergs to look out for in 2018

From transition risk to investor complacency, #InvestecWealth experts highlight the risks on their radar for Q1 2018. Following the release of the Global Investment View for the first quarter of 2018, Investec Wealth & Investment experts, Paul Deuchar and Alexandra Nortier, outline the major risks on the horizon, including the normalisation of interest rates, the …

Read More »

Read More »

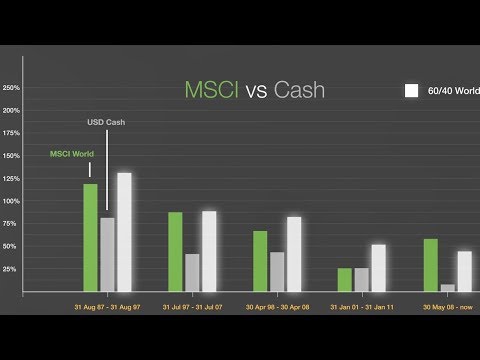

Investing in turbulent times

“What would’ve happened if you invested at the peak of the last five market crashes?” asks #InvestecWealth study. An Investec Wealth & Investment study explored whether it’s better to invest or sit on cash in turbulent times. Investec tested how a portfolio of 60% equities and 40% bonds would’ve performed over a ten-year period following …

Read More »

Read More »

Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the Italian-speaking canton of Ticino (71%). The lowest rate was in the Lake Geneva region (41%).

Read More »

Read More »

Income inequality in Switzerland remains stable after redistribution

Income inequality in Switzerland has remained stable according to a report published by Switzerland’s Federal Statistical Office. A key measure of inequality involves dividing the income share of the top 20% by that of the bottom 20%, a measure known as S80/S20. 1 is complete equality.

Read More »

Read More »

New poll on vote to axe Swiss broadcast fee suggests rejection

A poll run by the media group Tamedia shows a clear majority in favour of rejecting the initiative, dubbed “No Billag”, which aims to end Switzerland’s broadcasting fee. This poll follows one done in December 2017, which showed a majority in favour of the initiative.

Read More »

Read More »

Cameron van der Burgh: The Man behind the Medals

When multi Olympic medalist Cameron van der Burgh approached #Investec for sponsorship he was only 21 years old. Over almost a decade Cameron has broken two world records and become a South African swimming icon. This is a look at the man behind the medals. More on Out of the Ordinary #InvestecSponsorships http://bit.ly/2BolmxR

Read More »

Read More »

Budget busting burgers – Swiss franc still the most overvalued

The Economist has just published its January 2018 Big Mac index, a light-hearted measure of whether currencies are under or overvalued. The underlying assumption is that a Big Mac is the same whether bought in Kiev or Chur, so any price difference must be due to the exchange rate.

Read More »

Read More »

Swiss fact: health insurance premiums cover only 37percent of Swiss healthcare costs

Figures published in 2017 show that only 37% of Swiss healthcare costs were covered by basic compulsory health insurance premiums. The remaining cost was covered by the government (20%), accident and social insurance (10%), private complementary health insurance (7%), charity (1%) and out-of-pocket spending by individuals (26%).

Read More »

Read More »

Swiss fact: nearly 50 percent of Swiss GDP comes from 4 cantons

Switzerland is made up of 26 cantons – technically six are half cantons1 – each with its own distinct taxes, education system, hospitals and government. Land area varies significantly, from 37 sq/km Basel-Stadt to 7,105 sq/km Graubünden.

Read More »

Read More »

Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany.

Read More »

Read More »

The number of people on welfare continues to rise in Switzerland

In 2016, around 273,000 people, 3.3% of the population, received welfare in Switzerland. The number (not the rate) was 2.9% higher than the year before and 15.7% higher than 5 years earlier when the rate was 3.0%. Rates of those receiving government aid varied significantly by canton, ranging from 0.8% in Appenzell Innerrhoden to 7.4% in Neuchâtel.

Read More »

Read More »

Switzerland has more job vacancies than jobseekers

Speaking to Tages-Anzeiger, Cornel Müller, director of marketing at x28, Switzerland’s largest job search aggregator, said there was a large jump in the number of jobs available in Switzerland compared to one year ago.

Read More »

Read More »

Investec Vision 2018: What is Vision?

Investec Wealth & Investment’s Head of Research, John Haynes, describes the purpose of Vision. To watch the full video, please visit: http://bit.ly/2qrNoZd To hear the views of our research team at a Vision 2018 event near you, please visit: http://bit.ly/2lUFeCL

Read More »

Read More »

Swiss tourism – sharp rises and falls from some countries over the summer

The number of visitors to Switzerland rose 6% this summer, but this headline figure hides some steep rises and falls. From May to October 2017, 11 million people holidayed in Switzerland, 644,000 more than the over same period in 2016.

Read More »

Read More »

Private Equity Pulse Insight

The 3 reasons why 40% of M&A deals fail and whether this will rise and fall. For more info: http://bit.ly/2z40Xgp

Read More »

Read More »

The economic implications of the South African political landscape

Political commentator Justice Malala talks to John Haynes and Paul McKeaveney about the potential impact on the economy post the ANC elective conference. The panel believes that if the outcome of the ANC elective conference is viewed positively by the market, South Africa’s economic recovery will be swift. Justice Malala comments that if the result …

Read More »

Read More »

Investec Business Cash Solutions

Investec’s Business Cash Solutions, specialises in managing surplus cash for SME’s, maximising returns through a range of flexible cash deposit products. We like to work with our clients to understand their business’s unique cash flow requirement and then customise a solution to ensure that both the appropriate access to funds are available, as well as …

Read More »

Read More »

European commercial property market rallying

While Europe is bouncing back, Brexit is casting a shadow on the UK’s commercial property market, says Investec UK’s CIO. In an interview at the recent #InvestecWealth Forum in Johannesburg, Chris Hills, Chief Investment Officer, Investec Wealth & Investment UK, said that the European commercial property market is recovering thanks to stimulus from the European …

Read More »

Read More »

Leading growth investor reveals his favourite emerging markets.

Sunil Thakor, MD, Sands Capital, on why China and India are ripe for investment. Talking at the recent #InvestecWealth Forum, Thakor gave examples of the unexpected industries he has found fantastic growth opportunities in. India rising “One of our favourite parts of the world is India,” says Thakor. The country’s attractive young demographic profile and …

Read More »

Read More »