Category Archive: 2) Swiss and European Macro

Deutschland vor dem Wirtschafts-Kollaps? – Punkt.PRERADOVIC mit Heiner Flassbeck

Noch reden alle über den Virus und den Lockdown – doch jetzt wird auch die Diskussion um Geld, Wirtschaft und Hilfen losgehen. Muss Deutschland solidarisch mit den anderen EU-Ländern wie Italien sein? Auf jeden Fall, sagt Top-Ökonom Heiner Flassbeck. Deutschland profitiert wie kein anderes Land von der Gemeinschaft. Die Schuldendebatte findet der ehemalige Chefökonom bei …

Read More »

Read More »

Yanis Varoufakis: Coronavirus economic fallout could heap more misery onto Greece

“I very much fear that Greece will have the largest number of people who go hungry as a result of the economic dimension of this pandemic,” Yanis Varoufakis tells Euronews… READ MORE : https://www.euronews.com/2020/04/23/yanis-varoufakis-coronavirus-economic-fallout-could-heap-more-misery-onto-greece What are the top stories today? Click to watch: https://www.youtube.com/playlist?list=PLSyY1udCyYqBeDOz400FlseNGNqReKkFd euronews: the...

Read More »

Read More »

ÖL-PANIK! Jetzt Gazprom, Shell & Co. kaufen?

► Folge mir bei Instagram: https://www.instagram.com/erichsenlars ► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ Öl-Aktien sind derzeit massiv unter Druck an der Börse und das völlig zurecht. Zum ersten Mal in der Geschichte der Börse sind bei einem Rohstoff die Notierungen in den negativen Bereich gerutscht. Das hat …

Read More »

Read More »

Lagebeurteilung am Aktienmarkt: Bärenmarkt-Rallye, stabile Seitenlage oder mehr?

Nach einem schnellen und dramatischen Einbruch zeigten sich die Aktienmärkte seit Mitte März erholt. War das nur die Ruhe vor dem Sturm einer zweiten Verkaufswelle? Immerhin zeugen die dramatisch gesunkenen Ölpreise von einer aktuell schlimmen wirtschaftlichen Verfassung. Oder sind die Märke bereit, in die Zukunft zu schauen, die gemäß konjunktureller Frühindikatoren eine allmähliche Erholung der …

Read More »

Read More »

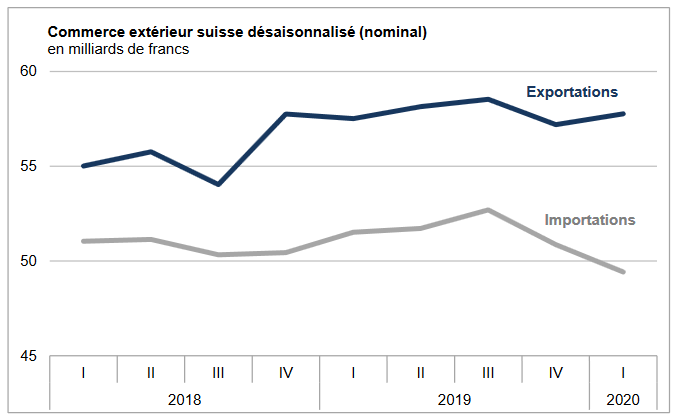

Swiss Trade Balance Q1 2020 : chemistry-pharma keeps exports in black numbers

The boom in chemicals and pharmaceuticals enabled Swiss exports to increase in March as well as in the first quarter of 2020 (+ 2.2% respectively + 1.0%). Despite the global economic situation linked to the “Covid-19”, the performance of this sector offset the decline suffered by most of the other groups. As in the previous quarter, seasonally adjusted imports fell (- 2.8%). The trade balance for the first three months of 2020 ends with a surplus...

Read More »

Read More »

Yanis Varoufakis un messaggio agli attivisti italiani “Organizzarsi per una battaglia per l’Europa”

Commento di Yanis Varoufakis alle conseguenze delle decisioni del’ incontro dell’Eurogruppo il 9 di Aprile e strategie per Diem25 Italia per combattere la battaglia per l’Europa che si sta combattendo sul campo di battaglia Italiano

Read More »

Read More »

Roger Waters and Yanis Varoufakis: Another Now #2 | DiEM25 TV

Donate ? https://i.diem25.org/donations/to/events Join us! ? https://diem25.org/join Roger Waters of Pink Floyd fame is here tonight, with host Yanis Varoufakis for some ranting and raving 😉 The coronavirus crisis is revealing that the powers that be of the European Union have learned nothing from the Eurocrisis. They are currently betraying the interests of the majority …

Read More »

Read More »

Ray Dalio: “Depression und neue Weltordnung”

► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ ► TIPP 2: Spare monatlich in die besten Aktien der Welt. https://www.rendite-spezialisten.de/video/zd-erichsen-yt/. Ganz einfach mit dem Zukunfts-Depot der Rendite-Spezialisten (Ich bin dort Chefredakteur). Bist Du beim nächsten Depot-Kauf dabei? Jetzt anmelden und Gratis-Monat sichern: https://www.rendite-spezialisten.de/erichsen/ Ray Dalio...

Read More »

Read More »

422 CORONA Donald Trump Hans-Werner Sinn gegen Christian Felber Tilo Jung gg KenFM MARKUS KRALL NS4F

Quelle https://NextS4F.de Greta Thunberg Fridays for Future Markus Krall Christian Felber Parents for Future Gemeinwohl-Ökonomie GWÖ Prof. Niko Paech Postwachstumsökonomie DIE WISSENSCHAFTLICHE TAGESSCHAU HEUTE Andreas Michalsen Next Scientists for Future Scientists for Future Max Otte hans-georg maaßen sahra wagenknecht WerteUnion Rainer Mausfeld hans-werner sinn ulrike herrmann Weltrat der Weisen Atlas Initiative Dr. med. Rüdiger Dahlke …...

Read More »

Read More »

Yanis Varoufakis feat. Roger Waters in “Another Now”, Monday, April 20 at 20:00 CEST | DiEM25 TV

“Another Now” is back on Monday night with Yanis Varoufakis and the brilliant Roger Waters. Don’t miss an incredible hour of “ranting and raving” with one of the founding members of Pink Floyd LIVE on DiEM25 TV. Register ? https://i.diem25.org/en/events/630

Read More »

Read More »

Yanis Varoufakis: “L’Europa sta per vivere una depressione massiccia che abbiamo il dovere di …

Yanis Varoufakis: “L’Europa deve imparare dagli errori del passato e cominciare a mettere in atto politiche di sostegno all’Italia e all’Unione europea. In base ai risultati dell’eurogruppo temo che questo non sia stato fatto. L’Europa sta per vivere una depressione massiccia che abbiamo il dovere di evitare”. Sulle misure prese dall’Europa: “Non sono 500 miliardi, …

Read More »

Read More »

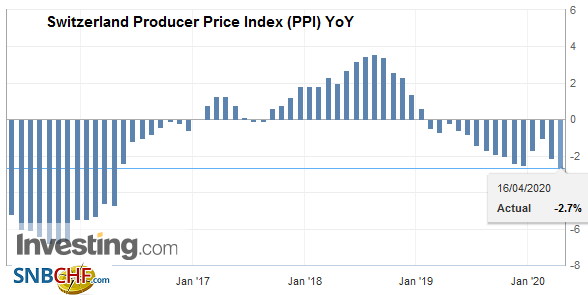

Swiss Producer and Import Price Index in March 2020: -2.7 percent YoY, -0.3 percent MoM

16.04.2020 - The Producer and Import Price Index fell in March 2020 by 0.3% compared with the previous month, reaching 99.4 points (December 2015 = 100). This decline is due in particular to lower prices for petroleum products. Compared with March 2019, the price level of the whole range of domestic and imported products fell by 2.7%.

Read More »

Read More »

Das Ende des Euro?

► Abonniere meinen Kanal: https://www.youtube.com/erichsengeld?sub_confirmation=1 ► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ Steht der Euro vor dem Aus? Sein Vermögen überwiegend in Euro zu lagern, ist eine schlechte Idee, soviel wissen wir schon. Die Lage um den Euro, seine Kaufkraft, sein Wert wird in Zukunft eher noch …

Read More »

Read More »

A reality check on China’s return to work

The recent recovery in industrial activity seems to have stalled, probably because of the collapse in external demand and high levels of vigilance inside China. Since the large-scale coronavirus infection was contained, the Chinese government has been trying hard to get the economy back on track. The end of the lockdown in Wuhan after two in a half months is an important milestone in that respect.

Read More »

Read More »

Johann Hari and Yanis Varoufakis: Another Now #1 | DiEM25 TV

Donate ? https://i.diem25.org/donations/to/events Join us! ? https://diem25.org/join The coronavirus crisis is revealing that the powers that be of the European Union have learned nothing from the Eurocrisis. They are currently betraying the interests of the majority of Europeans in the same way that they have done so in 2010 — by failing to mobilize existing …

Read More »

Read More »

Gold: Jetzt noch kaufen?

► Höre Dir auch meinen Podcast an! Du findest ihn bei • Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ • iTunes: https://itunes.apple.com/de/podcast/erichsen-geld-gold-der-podcast-für-die-erfolgreiche/id1455853622 • Spotify: https://open.spotify.com/show/1a7eKRMaWXm8VazZH2uVAf ► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ Der...

Read More »

Read More »

Central banks to the rescue

While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

Read More »

Read More »

Talking To My Daughter – A Brief History of Capitalism // Yanis Varoufakis // Book 1 of 2020

Whilst some parents read their children fairy tales, Varoufakis writes his daughter a story about capitalism and the economy. He provides a fantastic overview which is accessible due to his distilled explanations and creative use of allusions. Varoufakis provides historical contextualisation to explain why geography and climate dictated which countries had stronger economies and how …

Read More »

Read More »

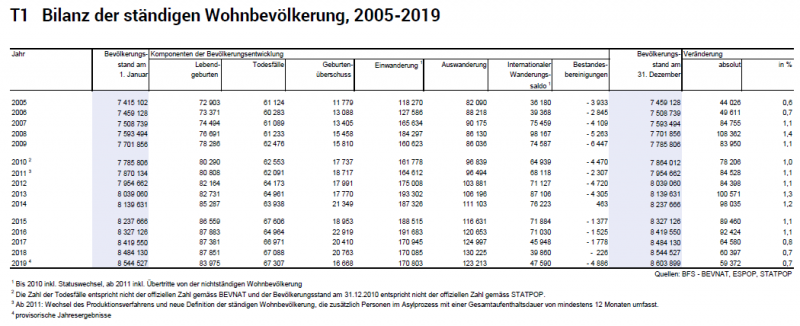

Switzerland’s population continued to increase and age in 2019

09.04.2020 - At the end of 2019, Switzerland had a population of 8 603 900, i.e. 59 400 persons (+0.7%) more than in 2018. Since 2017, the population has grown more slowly than in previous years. Zurich recorded the greatest increase while Appenzell Innerrhoden, Neuchâtel, Nidwalden and Ticino saw their population decline.

Read More »

Read More »