Category Archive: 2) Swiss and European Macro

African Monetary Sovereignty: Heiner Flassbeck & Cedric Mbeng Mezui

International conference: ““The quest for economic and Monetary Sovereignty in 21st Century Africa: lessons to be learnt and ways forward” (6 to 9 November, City of Culture, Tunis). Evening keynote 11/08/2019: – Heiner Flassbeck: Monetary Sovereignty and why it is difficult to achieve – Cedric Mbeng Mezui: Domestic resources mobilization and industrialization For more information: …

Read More »

Read More »

Yanis Varoufakis – The Lib Dems have abandoned Liberalism

Yanis Varoufakis has nothing but contempt for the party who enabled austerity. Catch the full interview here: https://novara.media/varoufakis2

Read More »

Read More »

Jetzt noch deutsche Aktien kaufen?

► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ ► TIPP 2: Spare monatlich in die besten Aktien der Welt. https://www.rendite-spezialisten.de/video/zd-erichsen-yt/. Ganz einfach mit dem Zukunfts-Depot der Rendite-Spezialisten (Ich bin dort Chefredakteur). Bist Du beim nächsten Depot-Kauf dabei? Jetzt anmelden und Gratis-Monat sichern: https://www.rendite-spezialisten.de/erichsen/ Mit Blick auf...

Read More »

Read More »

Ist das schon die Jahresend-Rallye?

Trotz der vielen Rezessionsanzeichen sind die Aktienmärkte in bester Laune. Tatsächlich scheint sich die Dunkelheit des transpazifischen bzw. transatlantischen Handelsstreits aufzuhellen. Zwar ist US-Präsident Trump für jede böse Überraschung gut, doch die Börse bezahlt bereits eine fundamental bessere Zukunft. Daneben bilden sich die politischen Risiken zurück und setzt die internationale Geldpolitik ihre Freizügigkeit nach kurzer …...

Read More »

Read More »

Rettet Christine Lagarde den Euro?

► Kennst Du schon meinen Podcast? Hier findest Du ihn bei • Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ • iTunes: https://itunes.apple.com/de/podcast/erichsen-geld-gold-der-podcast-für-die-erfolgreiche/id1455853622 • Spotify: https://open.spotify.com/show/1a7eKRMaWXm8VazZH2uVAf Rettet Christine Lagarde den Euro? Das klingt ein klein wenig provokant, aber sie ist unsere neue...

Read More »

Read More »

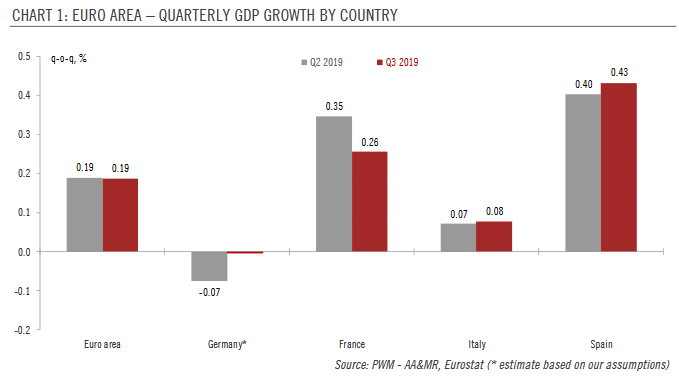

Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November.

Read More »

Read More »

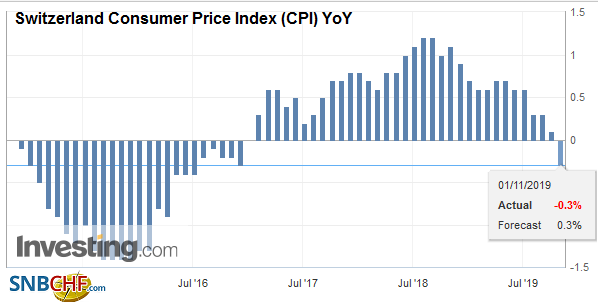

Swiss Consumer Price Index in October 2019: -0.3 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in October 2019 compared with the previous month, reaching 101.8 points (December 2015 = 100). Inflation was –0.3% compared with the same month of the previous year.

Read More »

Read More »

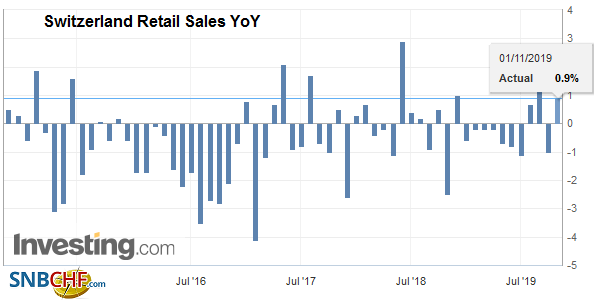

Swiss Retail Sales, September 2019: +0.6 percent Nominal and +0.9 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 0.6% in nominal terms in September 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. Real turnover adjusted for sales days and holidays rose in the retail sector by 0.9% in September 2019 compared with the previous year.

Read More »

Read More »

Konjunkturdelle- oder beule?

Weltweit trübt sich die Konjunktur ein. Wie heftig es in Europa und Deutschland wird, hängt nicht nur von den üblichen Verdächtigen Handelskrieg und Brexit ab, die die Politik sehr gerne als alleinig Schuldige brandmarkt. Auch eine noch großzügigere Geldpolitik unter der neuen EZB-Präsidentin Christine Lagarde bringt nicht den gewünschten konjunkturellen Erfolg. Eine eigenständige sinnvolle Wirtschaftspolitik …

Read More »

Read More »

Pictet — The Entrepreneurs

Innovation and sustainability were high on the agenda at the annual Pictet Entrepreneur’s Summit. These two themes were thoroughly dissected by a stellar panel of international thinkers and doers who spoke about the challenges and opportunities available to entrepreneurs. Experts included ex-Managing Director of Google UK and fintech founder Dan Cobley, the man who turned Patagonia into a multi-billion dollar business, Michael Crooke, and author...

Read More »

Read More »

Pictet — The Entrepreneurs

Innovation and sustainability were high on the agenda at the annual Pictet Entrepreneur’s Summit. These two themes were thoroughly dissected by a stellar panel of international thinkers and doers who spoke about the challenges and opportunities available to entrepreneurs. Experts included ex-Managing Director of Google UK and fintech founder Dan Cobley, the man who turned …

Read More »

Read More »

11 Peter Bofinger The Monetary Policy of the ECB since 1999

The Euro at 20 – Macroeconomic Challenges PLENARY SESSION II: MACROECONOMIC POLICIES IN A MONETARY UNION Chair: Torsten Niechoj, Rhine-Waal University of Applied Sciences Fiscal policies in a monetary union (Gennaro Zezza, University of Cassino) The Monetary Policy of the ECB since1999: Failure or Success (Peter Bofinger, Würzburg University) Three blindspots in Euroarea Macrofinance: a …

Read More »

Read More »

13 Plenary 2 Discussion – Zezza – Bofinger – Gabor

The Euro at 20 – Macroeconomic Challenges PLENARY SESSION II: MACROECONOMIC POLICIES IN A MONETARY UNION Chair: Torsten Niechoj, Rhine-Waal University of Applied Sciences Fiscal policies in a monetary union (Gennaro Zezza, University of Cassino) The Monetary Policy of the ECB since1999: Failure or Success (Peter Bofinger, Würzburg University) Three blindspots in Euroarea Macrofinance: a …

Read More »

Read More »

Ray Dalio: Es kommt kein Crash!

►TIPP 1: Folge mir bei Instagram: https://www.instagram.com/erichsenlars ► TIPP 2: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ Ray Dalio, die Hedgefonds-Legende sagt, es kommt kein Crash. Das ist einerseits interessant weil Ray Dalio zu den 100 reichsten Menschen auf diesem Planeten gehört und das andererseits interessant weil er ein beinahe …

Read More »

Read More »

Jakob Augstein im Gespräch mit Marcel Fratzscher

„Aufschwung Ost“ reloaded – wie kommt der Osten endlich auf die Beine? Am 9. November feiert Deutschland 30 Jahre Mauerfall, doch die Deutsche Einheit scheint ferner denn je. Viele Ostdeutsche fühlen sich als Bürger zweiter Klasse, und die AfD feiert im Osten einen Wahlerfolg nach dem nächsten. Für Marcel Fratzscher, Präsident des Deutschen Instituts für …

Read More »

Read More »

Pictet Perspectives – Value Stocks start to make a comeback ?

Markets have reached new highs, but looking beneath the surface reveals a more complex picture. Over the last 18 months, investors have ploughed into companies with a growth style bias at the sake of value, pushing the valuation differential between the two styles to an extreme. At this point, it does not require a dramatic rotation to narrow that valuation differential and we are now starting to see renewed investor interest in value-style stocks.

Read More »

Read More »

Pictet Perspectives – Value Stocks start to make a comeback ?

Markets have reached new highs, but looking beneath the surface reveals a more complex picture. Over the last 18 months, investors have ploughed into companies with a growth style bias at the sake of value, pushing the valuation differential between the two styles to an extreme. At this point, it does not require a dramatic …

Read More »

Read More »

Tesla & Wirecard: Hohe Gewinne mit fallenden Aktien!

► TIPP 1: Sichere Dir meine Tipps zu Gold, Aktien, ETFs – 100% gratis: http://lars-erichsen.de/ ► TIPP 2: Spare monatlich in die besten Aktien der Welt. https://www.rendite-spezialisten.de/video/zd-erichsen-yt/. Ganz einfach mit dem Zukunfts-Depot der Rendite-Spezialisten (Ich bin dort Chefredakteur). Bist Du beim nächsten Depot-Kauf dabei? Jetzt anmelden und Gratis-Monat sichern: https://www.rendite-spezialisten.de/erichsen/ Mit Tesla und...

Read More »

Read More »

A New Financial Order | Aaron Meets Yanis Varoufakis

Yanis Varoufakis is a Greek economist, academic and politician. A former member of Syriza, he served as Minister of Finance from January to July 2015 under Prime Minister Alexis Tsipras. He has been Secretary-General of MeRA25, a left-wing political party, since he founded it in 2018, he regained a parliamentary seat in July 2019. At …

Read More »

Read More »