Category Archive: 2) Swiss and European Macro

Hans Werner Sinn BESTER VORTRAG Euro Desaster Europas Neugründung 12 20161

Hans-Werner Sinn BESTER VORTRAG – Flüchtlingewelle, Eurodesaster | Europas Neugründung 2017 der schwarze Juni Europa am Abgrund ▻ Mehr von . Prof. Dr. Dr. h.c. mult. Hans-Werner Sinn sprach auf Einladung von Prof. Dr. Gunther Schnabl am 20. Juni 2017 an der Universität in Leipzig im Rahmen der Leipziger Wirtschaftspolitischen. Hans-Werner Sinn BESTER VORTRAG – …

Read More »

Read More »

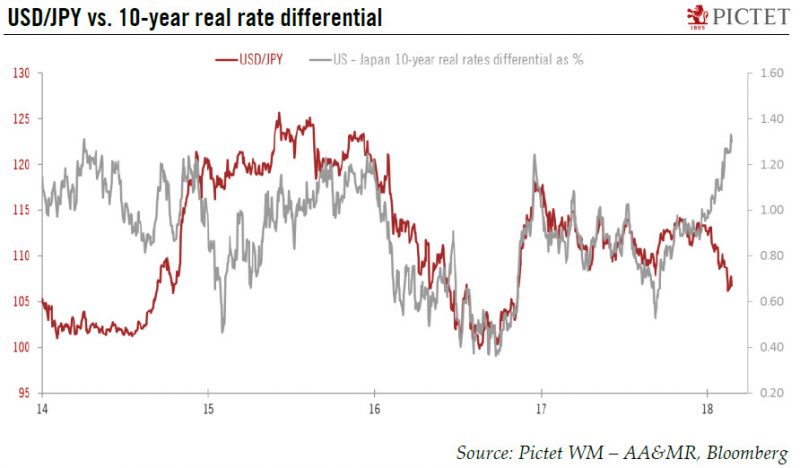

Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Read More »

Read More »

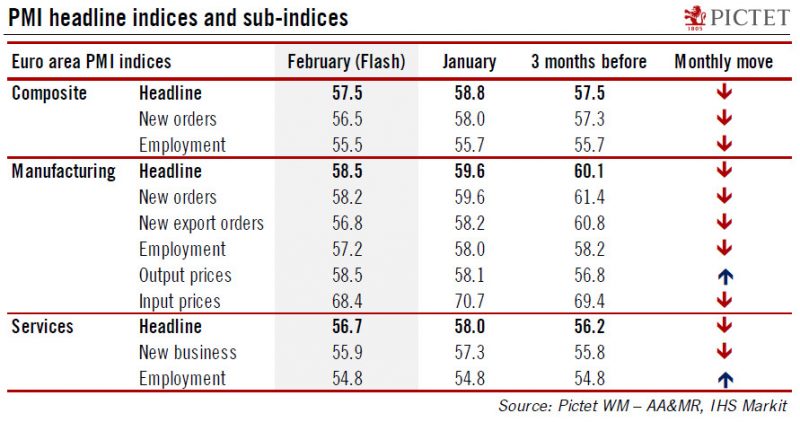

Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in new orders and output slowed...

Read More »

Read More »

Vortrag Heiner Flassbeck (24.11.2017, Haus der EU Wien)

Destabilisierung der Demokratie durch falsche Wirtschaftspolitik. Im Rahmen der Tagung “Demokratie in Gefahr. Neue Techniken der Macht” (24.-25.11.2017). Gefördert vom Zukunftsfonds der Republik Österreich und der Kulturabteilung der Stadt Wien, Wissenschafts- und Forschungsförderung. Video: Nicole Duchkowitsch, Stefan Tesarik und Fabian Traxler (TGM Wien).

Read More »

Read More »

Sollte jeder Bitcoin haben?

► TIPP: Sichere Dir mein E-Book „Bitcoins: Digitales Gold oder Luftblase?“, sowie wöchentlich meine Tipps zu Bitcoin & Co. – 100% gratis: http://www.lars-erichsen.de/bitcoins Sollte man Bitcoin als strategischen Teil der Vermögensanlage betrachten? Diese Frage kann man durchaus kontrovers diskutieren. Heute möchte ich euch erklären, warum ich Bitcoin, Bitcoin-Gold, Bitcoin-Cash und Ethereum weiterhin halte. Los geht´s! …

Read More »

Read More »

Yanis Varoufakis: Trumps Wirtschaftspolitik, BREXIT, die deutsche Politik (SPD) & die Lage der EU

In diesem exklusiven Interview mit Yanis Varoufakis, Gründer der Bewegung Demokratie in Europa 2025 und ehemaliger Finanzminister Griechenlands, sprechen wir über die Wirtschaftspolitik der Trump-Regierung und über deren Auswirkungen in den USA und im Ausland. Darüber hinaus diskutieren wir über den BREXIT und über Lösungen, die zum Wohle der Briten und der Europäer angestrebt werden …

Read More »

Read More »

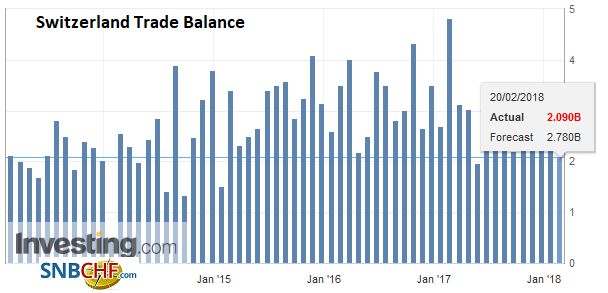

Swiss Trade Balance January 2018: Imports Cross the 17 Billion Franc Mark

Although exports fell in January 2018 from the December peak, their trend remains upward. Imports, for their part, began the year with fanfare to sign a record result. In both traffic directions, chemicals and pharmaceuticals made rain and shine.

Read More »

Read More »

Zeigt Inflation wieder ihre hässliche Fratze?

Die Happy Hour an den Kapitalmärkten scheint vorbei zu sein, dafür aber die Stimmungsverschlechterung nah. Denn die Inflation – so die Angst – werde wieder sprießen wie das Unkraut im Frühling. Und steigt die Teuerung, dann steigen auch die Zinsen. Schließlich wollen die Anleger einen Inflationsausgleich haben. Und nach vielen Jahren des geduldeten Wildwuchses werden …

Read More »

Read More »

Jetzt raus aus deutschen Aktien?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Aktien – 100% gratis: http://lars-erichsen.de/ Jetzt deutsche Aktien verkaufen? Das zumindest meint Ray Dalio, Gründer von Bridgewater Capital, dem größten Hedgefond der Welt. Wie diese Nachricht zu interpretieren ist und was ich davon halte, sage ich euch in diesem Video. ——– ➤ Mein YouTube-Kanal zum Thema Trading: …

Read More »

Read More »

Yanis Varoufakis on Trumponomics, BREXIT, German Politics & the state of the EU

In this exclusive interview with Yanis Varoufakis we talk about the economic and political situation in the United States, Britain, Germany, Spain and Greece. FOLLOW US ONLINE: Facebook: https://www.facebook.com/acTVism/ Website: http://www.actvism.org/ Twitter: https://twitter.com/acTVismMunich YouTube: https://www.youtube.com/acTVismMunich/ Citations to the links/videos/graphics exhibited in this video can be found here:...

Read More »

Read More »

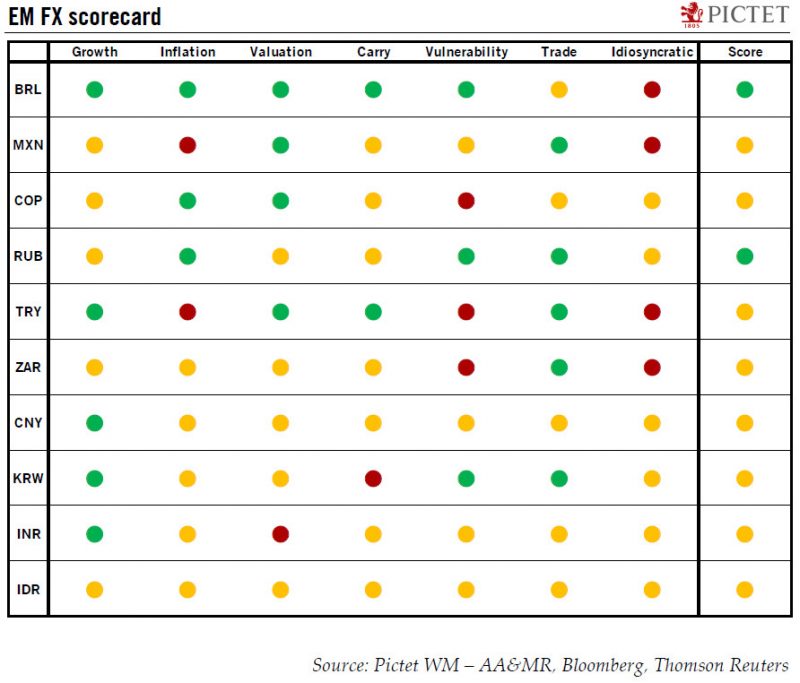

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

Prof Heiner Flassbeck und Dirk Müller im ORF zu Gast

Solch eine Kombination von Gästen möchte man einmal beim deutschen Fernsehen erleben. Die Sendung ist zwar relativ (25.01.2015 ) alt, aber die Erkenntnisse und Erklärungen rund um die Wirtschaft innerhalb der EU gelten nach wie vor. Meine Empfehlung dazu: Heiner Flassbeck ➡️ https://makroskop.eu/ Dirk Müller ➡️ https://www.cashkurs.com/ Quelle: ORF ➡️ http://tvthek.orf.at/ Die Sendung wurde inzwischen …

Read More »

Read More »

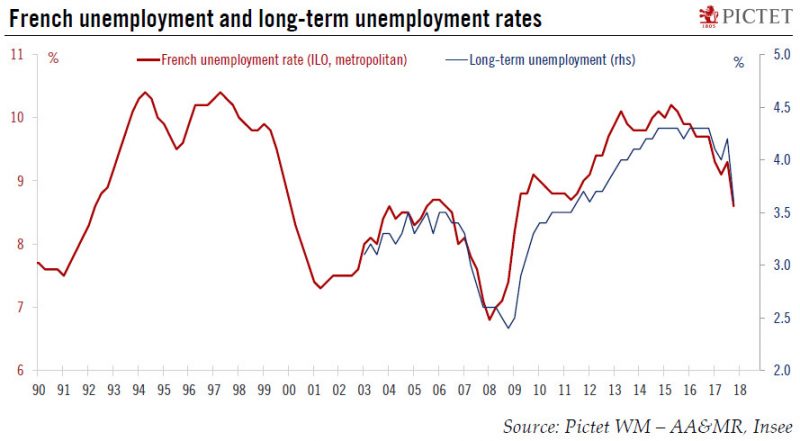

Europe chart of the week – French unemployment

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009.

Read More »

Read More »

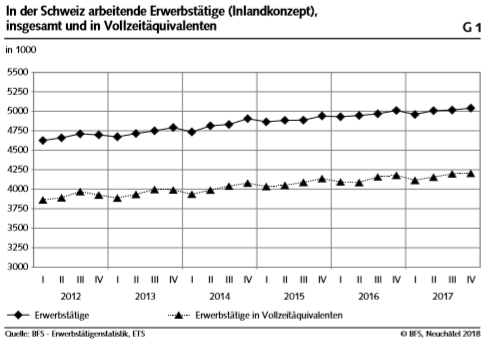

Swiss Labour Force Survey in 4th quarter 2017: 0.6 percent increase in number of employed persons; unemployment rate based on ILO definition at 4.5 percent

The number of employed persons in Switzerland rose by 0.6% between the 4th quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 4.6% to 4.5%. The EU's unemployment rate decreased from 8.3% to 7.4%. These are some of the results of the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office (FSO).

Read More »

Read More »

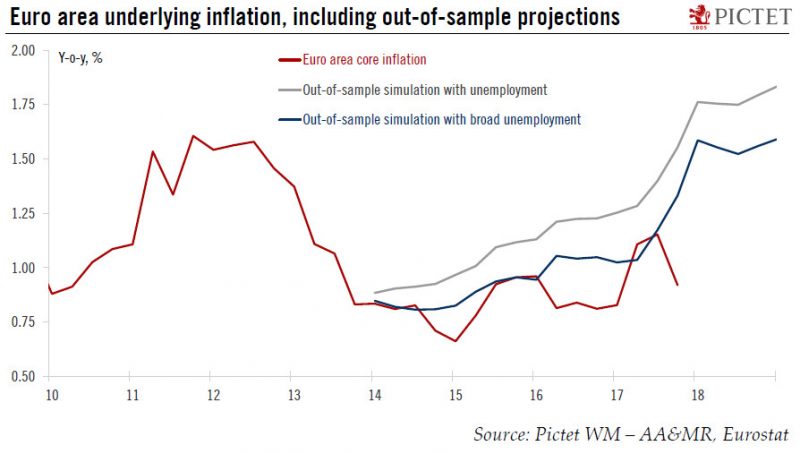

Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré last year, who described the...

Read More »

Read More »

Die Aktien-Favoriten der Deutschen

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Die am häufigsten gesuchten Werte bei deutschen Privatanlegern heißen momentan: Daimler, Volkswagen, Deutsche Bank und Steinhoff. Wir schauen uns die Aktien mal etwas genauer an – sowohl den Chart, als auch was die Analysten sagen. Los geht´s! ——– …

Read More »

Read More »

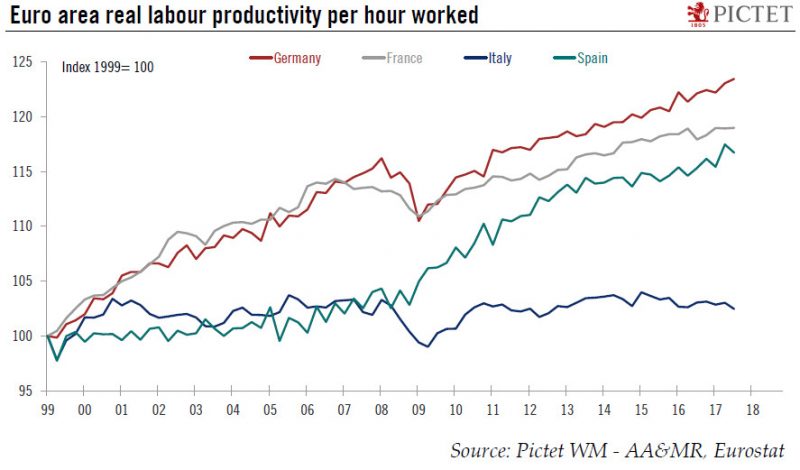

Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural...

Read More »

Read More »

Swiss Producer and Import Price Index in January 2018: +1.8 YoY, +0.3 MoM

Neuchâtel, 13 February 2018 (FSO) - The Producer and Import Price Index rose in January 2018 by 0.3% compared with the previous month, reaching 102.2 points (December 2015=100). The rise is due in particular to higher prices for petroleum products, electricity and gas as well as metals and metal products. Compared with January 2017, the price level of the whole range of domestic and imported products rose by 1.8%. These are some of the findings...

Read More »

Read More »

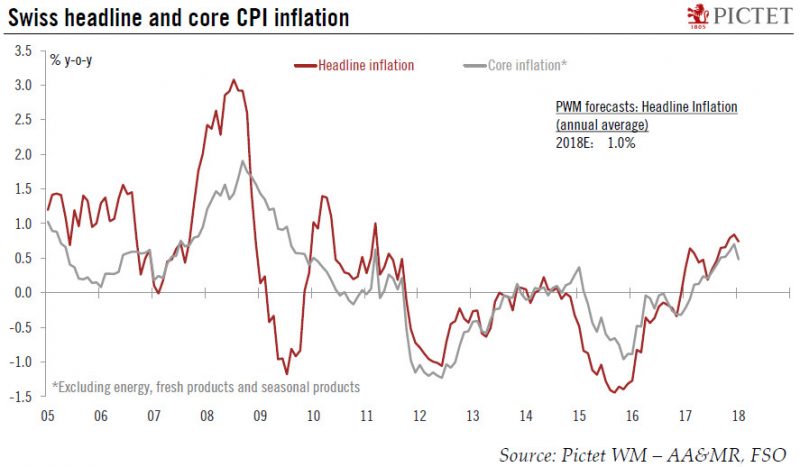

Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October 2017.

Read More »

Read More »

Keine Angst vor dem Crash!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Die Märkte sind nun endlich ein klein wenig zurückgekommen. Ist das Ganze nun ein Crash? Vielleicht für diejenigen, die den Markt noch nicht lange verfolgen. Ob nun Crash oder riesige Korrektur: Wenn diese Marktbewegung kommt, ist sie das …

Read More »

Read More »