Category Archive: 1.) SNB Press Releases

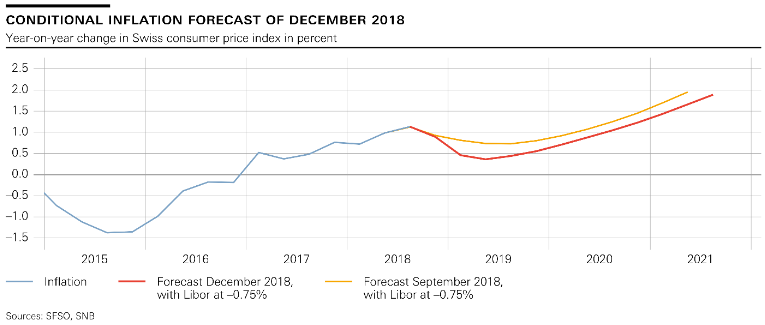

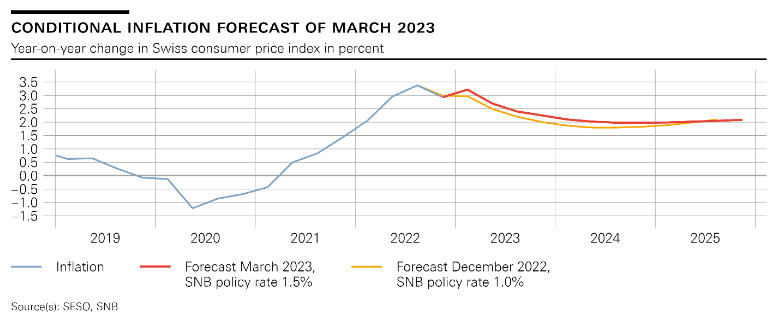

Monetary Policy Assessment of 13 December 2018

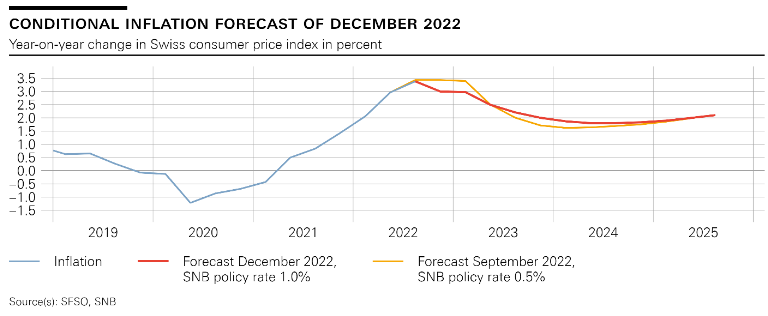

The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

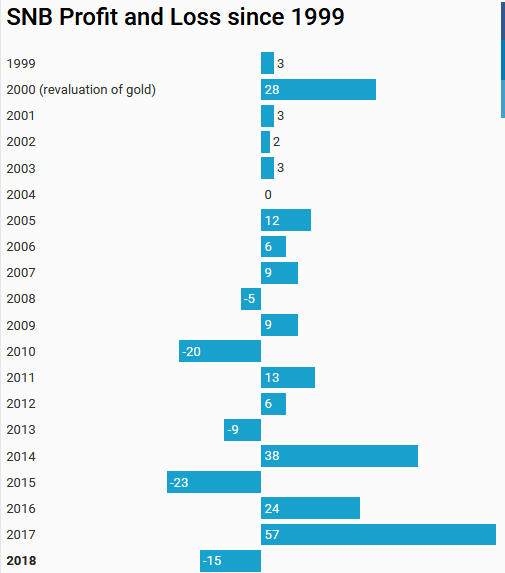

SNB reports a loss of CHF 7.8 billion for third quarter of 2018

The Swiss National Bank (SNB) reports a loss of CHF 7.8 billion for the first three quarters of 2018. A valuation loss of CHF 3.7 billion was recorded on gold holdings. The loss on foreign currency positions amounted to CHF 5.3 billion. The profit on Swiss franc positions was CHF 1.5 billion.

Read More »

Read More »

SNB appoints new delegate for regional economic relations for Central Switzerland

With effect from 1 October 2018, Gregor Bäurle will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Central Switzerland region. He succeeds Walter Näf, who is taking on a new position, representing the SNB in the Swiss delegation to the OECD in Paris as of 1 January 2019.

Read More »

Read More »

Third Karl Brunner Distinguished Lecture, 20.09.2018

Third Karl Brunner Distinguished Lecture, 20.09.2018

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich

05:15 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank

15:50 Lecture by Otmar Issing, Former Member of the Board, European Central Bank

Read More »

Read More »

Third Karl Brunner Distinguished Lecture, 20.09.2018

Third Karl Brunner Distinguished Lecture, 20.09.2018 00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich 05:15 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank 15:50 Lecture by Otmar Issing, Former Member of the Board, European Central Bank

Read More »

Read More »

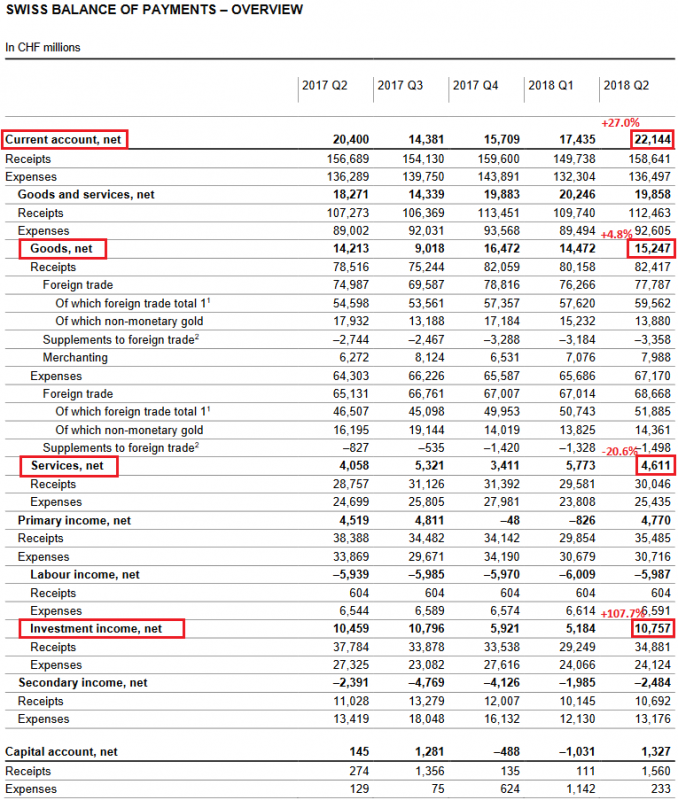

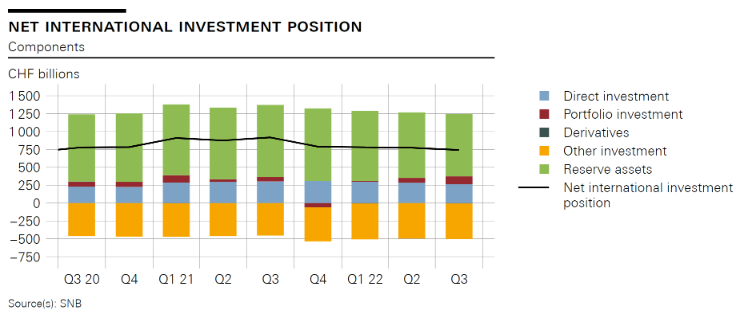

Swiss Balance of Payments and International Investment Position: Q2 2018

Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF, Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn., Services Balance: Minus 20.6% to 4.6 bn., Investment Income: Plus 107.7% to 10.7 bn. CHF.

Read More »

Read More »

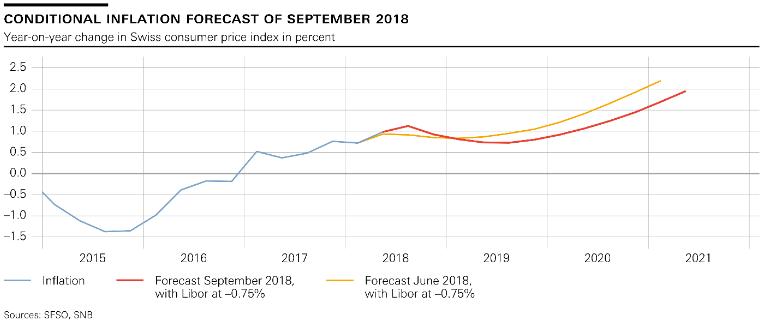

Monetary Policy Assessment of 20 September 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

SNB banknote app updated for new 200-franc note

The Swiss National Bank’s ‘Swiss Banknotes’ app is designed to help the public familiarise themselves with the new banknotes. The popular app, which has been downloaded some 100,000 times, now also showcases the new 200-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

Die neue 200-Franken-Note: Präsentation – Le nouveau billet de 200 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 200-Franken-Note am 15. August 2018 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. - Ce film donne quelques impressions de la présentation du nouveau billet de 200 francs qui a eu lieu le 15 août 2018. Fritz Zurbrügg, vice-président de la...

Read More »

Read More »

Die neue 200-Franken-Note: Präsentation – Le nouveau billet de 200 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 200-Franken-Note am 15. August 2018 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. – Ce film donne quelques impressions de la présentation du nouveau billet de 200 francs qui a eu lieu le …

Read More »

Read More »

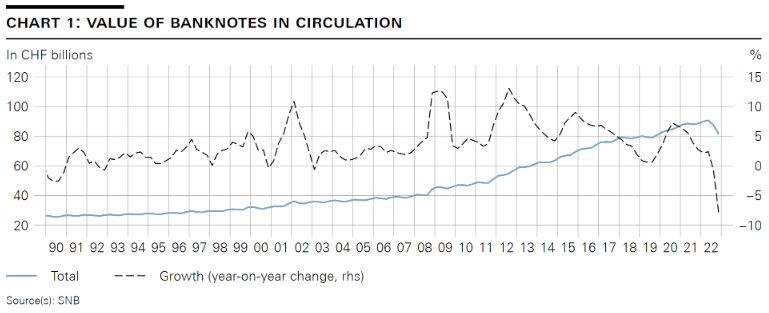

Swiss National Bank releases new 200-franc note

Fourth banknote in latest series showcases Switzerland’s scientific expertise. The Swiss National Bank (SNB) will begin issuing the new 200-franc note on 22 August 2018. Following the 50, 20 and 10-franc notes, this is the fourth of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice.

Read More »

Read More »

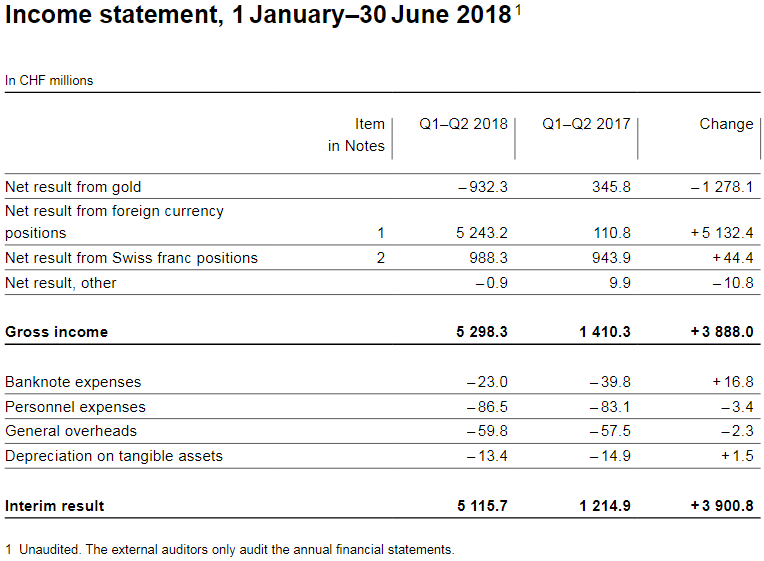

SNB reports a profit of CHF 5.1 billion for the first half of 2018

The Swiss National Bank (SNB) reports a profit of CHF 5.1 billion for the first half of 2018. A valuation loss of CHF 0.9 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.2 billion. The profit on Swiss franc positions was CHF 1.0 billion.

Read More »

Read More »

Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 21.06.2018

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

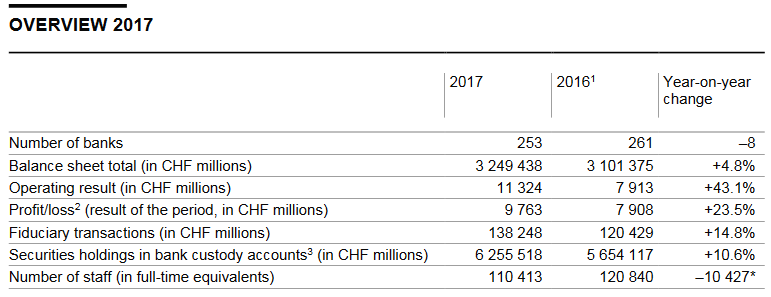

Banks in Switzerland 2017, Results from the Swiss National Bank’s data collection

Summary of the 2017 banking year. Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion.

Read More »

Read More »

Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct.

Read More »

Read More »

SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments.

Read More »

Read More »

Results of the 2017 survey on payment methods

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behaviour and the use of cash by house holds in Switzerland, and to ascertain the underlying motives for this behaviour.

Read More »

Read More »

Panel Discussion, 8th High-Level Conference on the International Monetary System, 08.05.2018

0:00:00 Challenges for Monetary Policy from Global Financial Cycles

Panel participants:

Tobias Adrian (IMF), Agustín Carstens (Bank for International Settlements), Philip Lane (Central Bank of Ireland), Mario Marcel (Central Bank of Chile), Jerome Powell (Federal Reserve), Hélène Rey (London Business School)

This panel is part of the 8th High-Level Conference on the International Monetary System (jointly organized by the International Monetary...

Read More »

Read More »