Category Archive: 1.) SNB, George Dorgan’s opinion

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

The sight deposits at the SNB increased by 5.2 billion francs compared to the previous week.

Read More »

Read More »

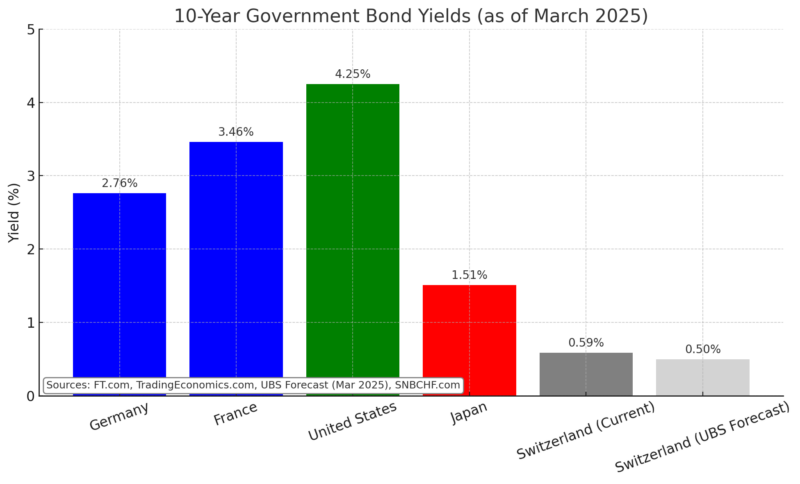

SNB Monetary Assessment March 2025

Swiss National Bank (SNB) Policy Update Policy Rate Cut: SNB lowered its policy rate from 0.50% to 0.25% due to low inflationary pressure and rising downside risks. 2025 Outlook: The policy rate is expected to remain at 0.25% for the rest of the year.

Read More »

Read More »

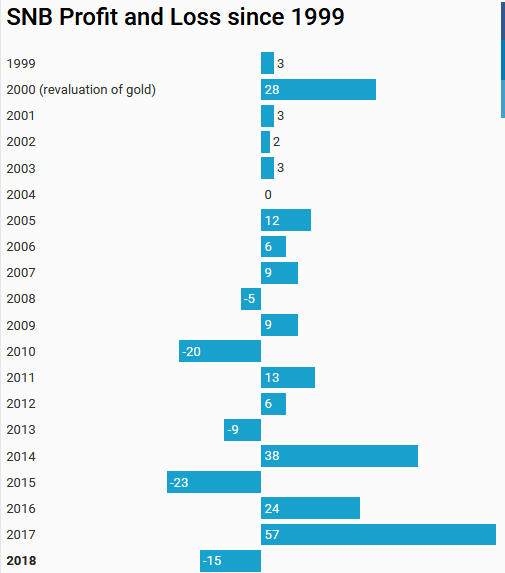

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »

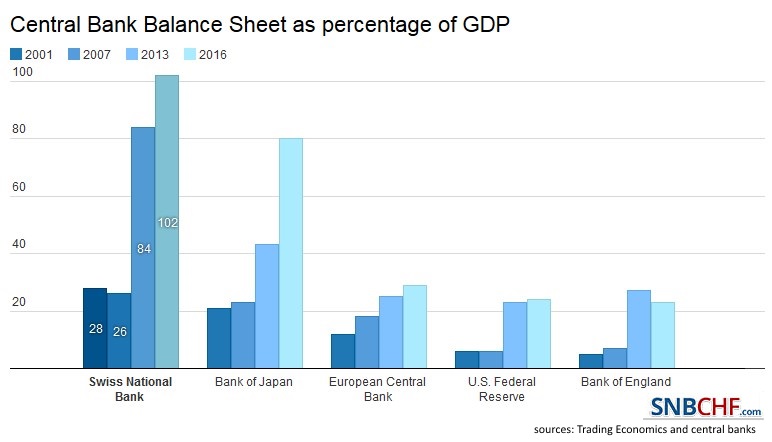

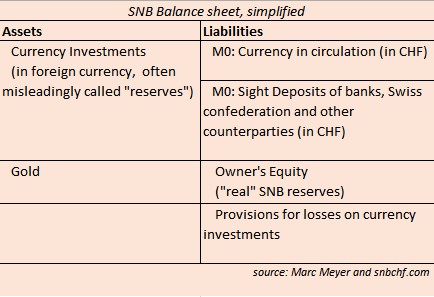

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

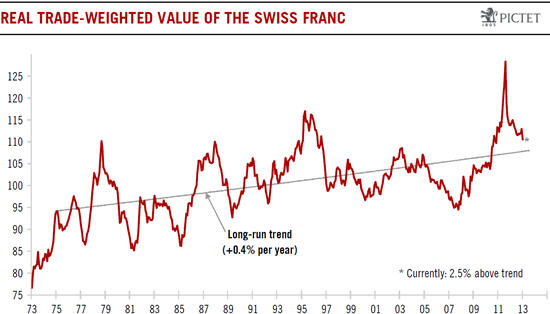

Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger.

Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved.

Read More »

Read More »

SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

SNB intervenes for 6.3 bil francs in the week ending last Friday. Once again a record high since January 2015. The SNB raised the intervention level to 1.0850. Apparently conversion of GBP->CHF flows into GBP-> EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K last week.

Read More »

Read More »

Purchasing Power Parity, REER: Swiss Franc Overvalued?

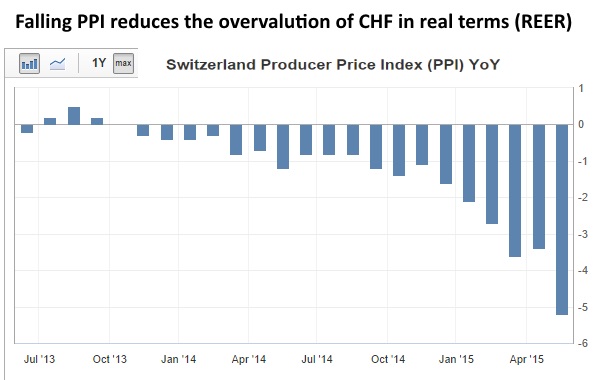

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

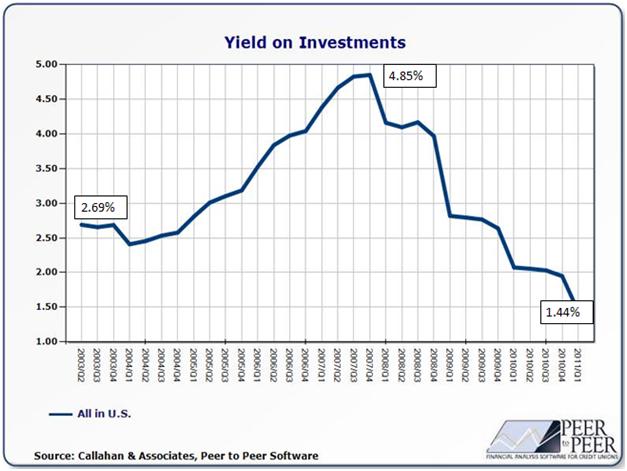

SNB Increased Equities Share to 20 percent, A High Risk Game for a Conservative Investor

A share of 20% equities is too much for a conservative investor.

- She increases the CHF debt with continuing interventions at a pace of 10% per year.

- yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive.

Read More »

Read More »

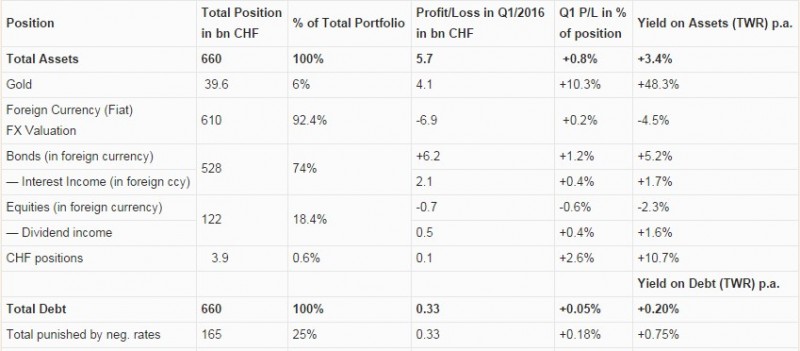

Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

SNB Results Q1 2016: Two thirds of SNB profit comes from Gold. Deflation helps with higher bonds prices and profit on negative interest rates.

Read More »

Read More »

April 2016: SNB running suicide again?

Speculative position: Speculators are even longer CHF (against USD): +9410x 125K contracts.

Sight Deposits: SNB intervenes for 6.4 bln. CHF in only three weeks. Sight deposits (aka debt) are rising by nearly 1% per month, this is 10% per year. The SNB can never achieve such a yield on investment, her yield is between 1 and 2 percent. Is the bank running suicide again?

Read More »

Read More »

March 2016: Highest SNB Interventions since January 2015

Speculative position: Strong shift to CHF long: +4967x 125K contracts after the Fed reduced their expectations of rate hikes for this year. …………Sight Deposits: SNB intervenes for 6.1 bln. CHF during the month of March. This is the higest level since January 2016. ……….FX: EUR/CHF steady slightly over 1.09. As I expected last week, the EUR/CHF …

Read More »

Read More »

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July.

Read More »

Read More »

Monetary assessment meeting Swiss National Bank

Monetary assessment meeting Swiss National Bank: My real-time tweets contain the main important points of the SNB meeting from the view of investors or FX traders.

Read More »

Read More »

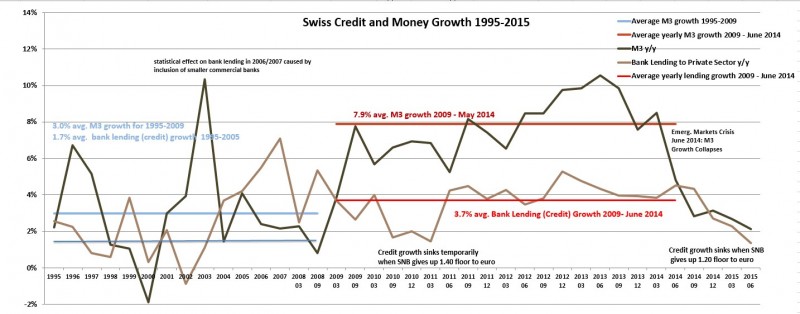

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

Will the SNB be able to survive an upturn in inflation: We focus on income and yields for foreign exchange position and gold and find out if the SNB makes enough income to survive a franc appreciation.

Read More »

Read More »

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »