Category Archive: 1) SNB and CHF

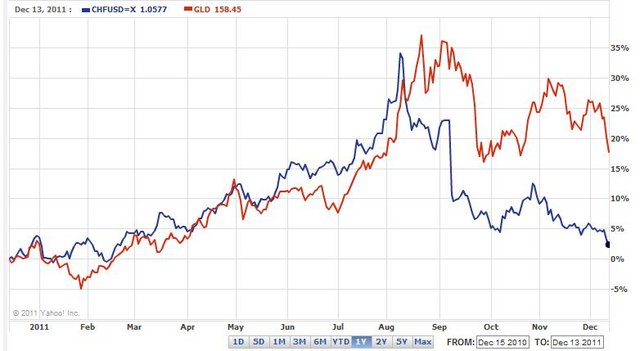

EUR/CHF, Market betting on Floor Hike, December 2011

Four Trades For 2012: #2 Sell The Swiss Franc I bought EUR/CHF shortly after the 1.20 peg was introduced and have held it ever since. My only regret has not been trading the range more aggressively. At this point everyone has an opinion of the SNB so I won’t try to convince the bears. Personally, … Continue reading »

Read More »

Read More »

SNB: Lift EUR/CHF floor or not ?

Many participants in the FX markets seem to be sure that the SNB will lift the EUR/CHF flow to 1.25 Here the pros and the cons:

Read More »

Read More »

EUR/CHF Markets Betting on Floor Hike: October 2011

October 2011 Looks Like Market Exercising The Free EUR Put The SNB Bought For It EUR/CHF has been under pressure for the the last two weeks despite Herculean efforts by the EU/IMF to bailout the euro zone. It looks as if the market is taking up the SNB on its offer the buy unlimited … Continue reading »

Read More »

Read More »

Expectations: Jedi monetary policy

On Tuesday, the Swiss National Bank (SNB) adopted a bold policy of pledging to sell Swiss Francs in an unlimited amount to ensure that the exchange rate viz-a-viz the euro is at least 1.2 Swiss Francs per euro. The exchange rate promptly jumped over 8 percent to a bit more than 1.2 Swiss Francs per euro. The SNB can clearly weaken its currency in this way, so long as its commitment is unwavering.

Read More »

Read More »

Exchange-rate targets: Francly wrong

WHEN the going gets tough, the tough buy Swiss francs. That was true in the 1970s, when the Swiss were forced to impose negative interest rates on foreign depositors. And it has been true in recent years, with Switzerland's currency rising by 43% against the euro between the start of 2010 and mid-August this year.

Read More »

Read More »

Currency interventions: Francs for nothing

CENTRAL banks have historically been regarded as the guardians of a currency's value, but occasionally they want to drive their exchange rates down. Rarely have they acted as aggressively as the Swiss National Bank (SNB) did on September 6th.

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): May 2011

May 2011 ForexLive Asian Market Open: Analysis With Fries Just brilliant Jamie Australian GDP this morning and the market is now gearing itself for a poor number after yesterday’s data and weekend comments from the Treasurer. China is selling rallies in AUD/USD and Middle East Sovereigns are buying big dips; sounds like a recipe for medium … Continue reading »

Read More »

Read More »

Swiss Franc at record highs (May 2011)

May. 27th 2011 Extracts from the history of the Swiss franc (May 2011) This month, the Swiss Franc touched a record high against not one, but two currencies: the US dollar and the Euro. Having risen by more than 30% against the former and 20% against the latter, the franc might just be the world’s … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): April 2011

Quick Look At The Order Board EUR/USD: At least two sizeable barriers at 1.4550; light stops immediately above 1.4555; decent-sized offers near 1.4600 AUD/USD: Decent-sized bids from option players 1.0610/20 USD/JPY: Solid bids 82.00, 81.80, 81.50. Offers still solid 83.10, 83.30 and somewhat larger near 83.50. EUR/GBP: Heavy stops above .8950 EUR/CHF: Moderate buying interest near …

Read More »

Read More »

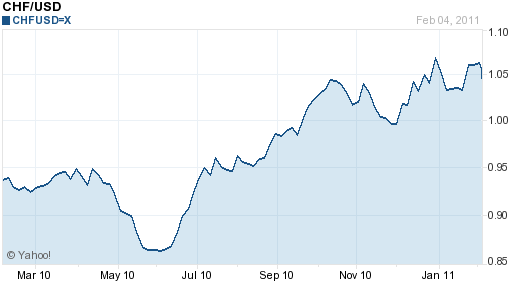

Has the Swiss Franc Reached its Limit? (February 2011)

Feb. 6th 2011 Extracts from the history of the Swiss franc (February 2011) The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and …

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): January 2011

ForexLive Asian Market Open: Risk Aversion To The Fore Fears of an escalation of the troubles in Egypt and a possible spread throughout the region have led to some risk aversion in early interbank trade. EUR/JPY is trading at 111.40 after closing at 111.75 on Friday night, USD/JPY is trading just below 82.00, and EUR/CHF … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): December 2010

Hildebrand Unable To Unload ‘Burden’ Of Record Franc As GDP Seen Slowing Bloomberg article. EUR/CHF down at 1.2595 from early 1.2635. Just reading UBS forex strategists say they are bearish the cross, focusing on 1.2439 ahead of 1.2283. They see resistance at 1.2714. They also forecast a fall in USD/CHF. See break through support at … Continue reading...

Read More »

Read More »