Category Archive: 1) SNB and CHF

The IMF Assessment for Switzerland and our Critique

In the 2014 assessment for Switzerland by the International Monetary Fund several sentences caught our eyes; we will contrast them with our recent critique. The most important one was that for the IMF is only "moderately overvalued", this would have no negative effect for exporters.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

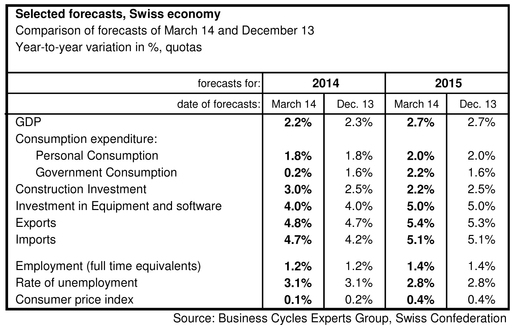

SECO expects 2.2% Swiss growth, further CHF strength ahead, understand why

The Swiss government see Swiss GDP growth at 2.2% in 2014 and 2.7% in 2015. Our estimate sees a divergence in the GDP components; we expects a lower trade surplus and higher spending. in both cases CHF should rise.

Read More »

Read More »

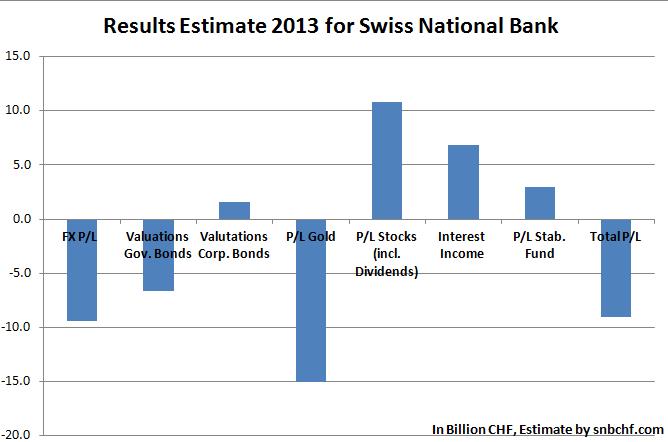

2013 SNB’s Valuation Gains 14 billion CHF on Stocks, but Losses of 35 bln. on Gold, FX and Bonds

The Swiss National Bank (SNB) is reporting a loss of CHF 9.1 billion for the year 2013 (2012: profit of CHF 6.0 billion). Valuation losses on gold holdings amounting to some CHF 15.2 billion contrast with a profit of CHF 3.1 billion on foreign currency positions and a net result of CHF 3.4 billion from …

Read More »

Read More »

SNB Q1/2014 Results: 1.7% annualized Yield on Seigniorage, 2% annualized Loss on FX Rate Change

The main task of a central bank occupied with QEE (quantitative easing or exchange intervention) is to obtain higher gains on seigniorage than it loses with its "ever appreciating" currency. Otherwise its equity capital would be absorbed.

Read More »

Read More »

15 Billion SNB Losses on Gold in 2013, But 40 Billion SNB Profit on Gold between 2000 and 2012

For anybody complaining about gold that caused the big loss of the Swiss National Bank. Since 2000, the total SNB profit was 32.1 bln. CHF, of which 24.6 billion came from gold.

Read More »

Read More »

George Dorgan bei den Jungfreisinnigen Zürich, Teil 1: CHF und Schweizer Wirtschaft

Am 7. Februar hat George Dorgan eine Präsentation bei den Jungfreisinnigen Zürich gehalten. Themen waren die weitere Entwicklung des Frankens, die Schweizer Wirtschaft, die SNB und die Auswirkungen der Gold- und Masseneinwanderungsinitiativen.

Read More »

Read More »

George Dorgan at Swiss Young Liberals: Slides

On Friday the 7th of February at 19.00, George Dorgan is presenting his outlook on the Swiss Franc. He explains if and when the Swiss National Bank is able to generate profits again. Moreover he discusses the influence of the two referendums “Save Our Swiss Gold” and “Against Mass Immigration” on the Swiss Franc and …

Read More »

Read More »

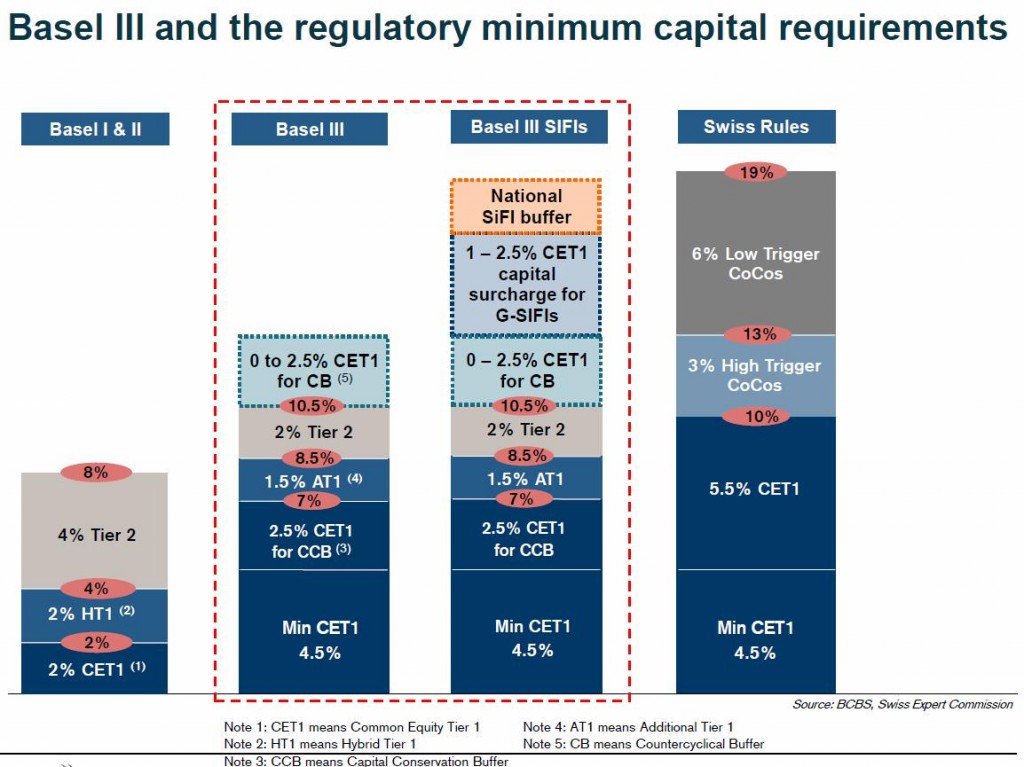

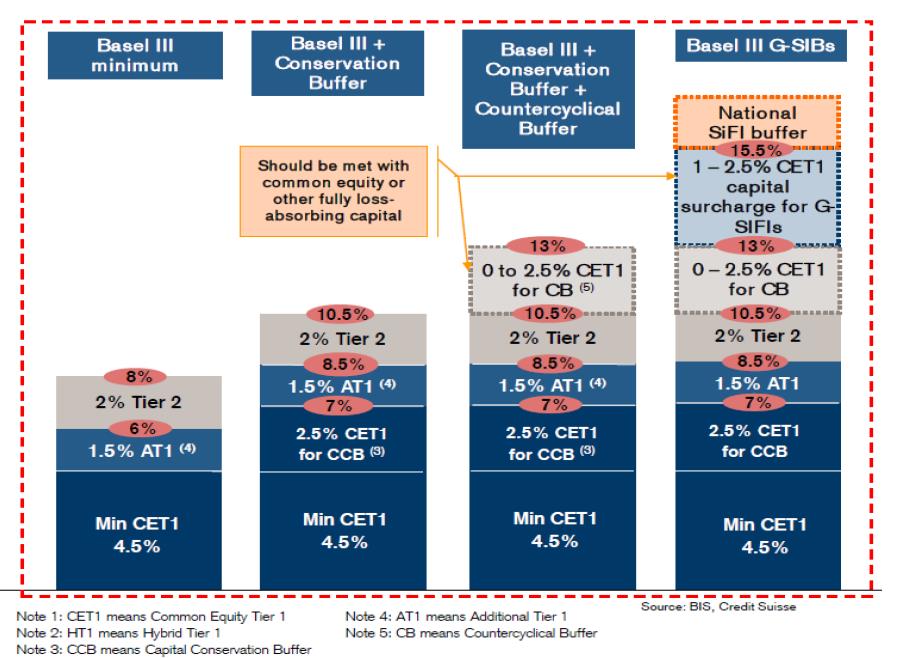

SNB Increases Weight of Countercyclical Capital Buffer for Banks

The SNB requires banks to raise the weight of the counter-cyclical capital buffers” (CCB) by holding extra capital worth 1 per cent of the risk-weighted assets in their mortgage portfolios.

Read More »

Read More »

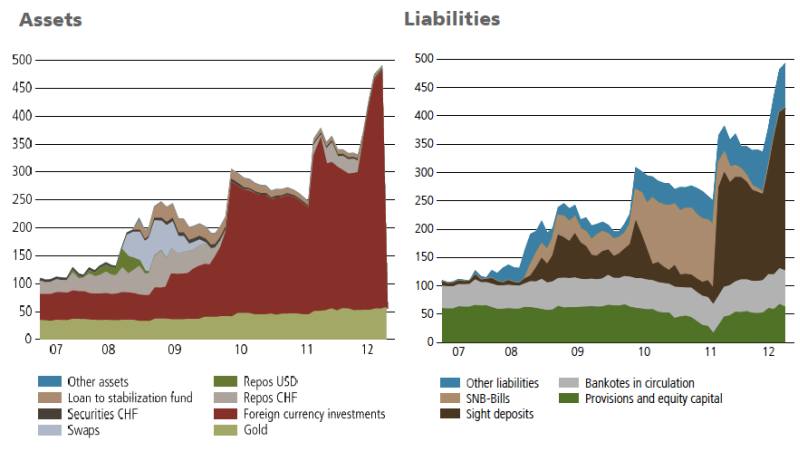

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

Swiss National Bank Monetary Policy Mandate – 2007 version vs. today

The mandate of the Swiss National Bank is concentrated on price stability, i.e. less than 2% inflation and to avoid deflation.

Read More »

Read More »

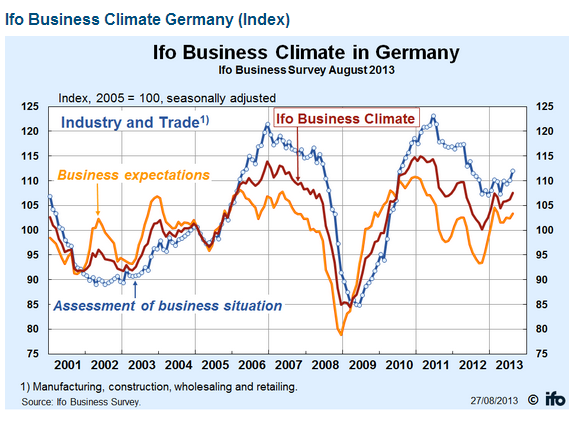

ECB rate cut creates complex situation for SNB

Says Thomas Jordan.

Need to wait to assess impact of ECB rate cut

Wasn’t totally surprised by the cut

Interest rates will remain low in Switzerland

Low rates may lead to property bubble risk which SNB will respond to if necessary

SNB monitoring property market which is already in difficult situation

I did wonder about the lack of movement in EUR/CHF yesterday considering that nearly every other euro pair took a hit. It’s either become the...

Read More »

Read More »

Weekly Newspaper on Swiss National Bank and Swiss Franc

Feel free to click into the other categories “politics”, “business”, #chf, #snb in order to see more articles.

Read More »

Read More »