Category Archive: 1) SNB and CHF

Marc Meyer

The best posts by Marc Meyer, the biggest and most influential enemy of the Swiss National Bank. He regularly published in German on InsideParadeplatz.ch

Read More »

Read More »

Is the Swiss Franc Really so Expensive or is Swiss Consumption anemic?

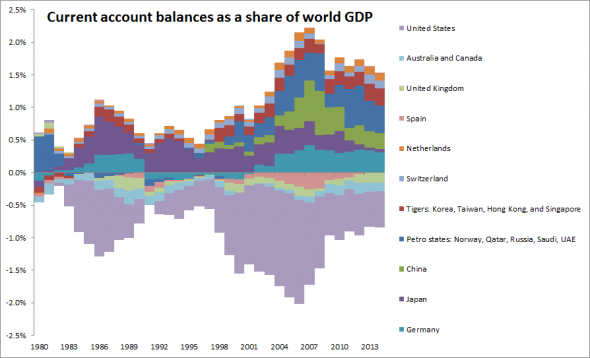

One of the most predictable consequences of the Swiss National Bank’s decision to stop suppressing the exchange rate between the franc and the euro was the whinging of Swiss exporters. That doesn’t mean the policy change was an error. If anything, it may help rebalance the Swiss economy away from its excessive dependence on exports towards greater levels of domestic consumption.

Read More »

Read More »

Werden Bund und Kantone die Nationalbank rekapitalisieren?

Marc Meyer speaks out against the view of Barry Eichengreen and Beatrice Weder di Mauro that published an article in Project Syndicate. The two professors were of the opinion that the SNB could print without limit. Meyer does not agree.

Read More »

Read More »

Colin Lloyd on the end of the EUR CHF peg

Colin Llyod gives a detailed explanation of the end of the EUR/CHF peg on Seeking Alpha. Most extracts come from George Dorgan, on snbchf.com

Read More »

Read More »

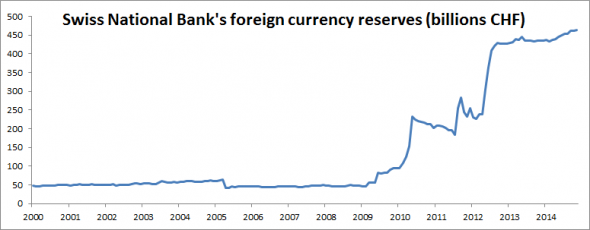

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »

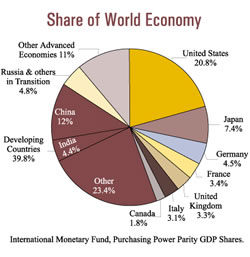

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

Switzerland’s currency: Shaken, not stirred

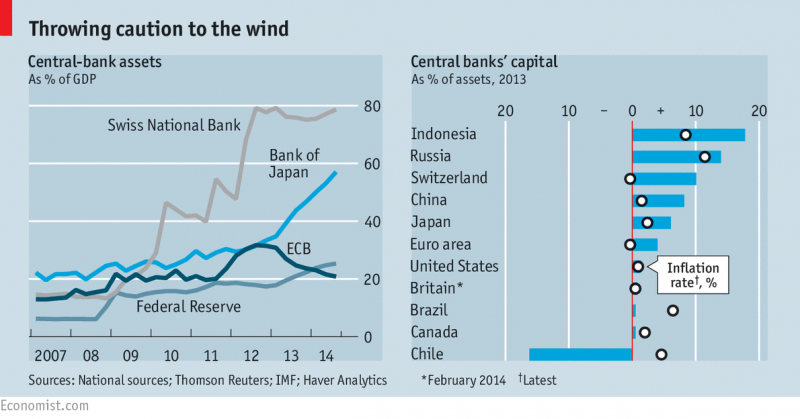

SWISS voters used to hold their central bank in high esteem: one survey in 2013 found the Swiss National Bank (SNB) to be their most respected national institution. That may change after its shock decision on January 15th to abandon the Swiss franc’s cap against the euro. The franc instantly shot up by 30%, provoking howls of anguish from Swiss firms.

Read More »

Read More »

Free exchange: Broke but never bust

CONTEMPORARY central banking is a strongbox of oddities. Deposits, which normally pay interest, can now incur a charge. Investments in government debt, which normally offer a return, give a negative yield. Faced with this weirdness central banks are trying to respect some cardinal rules of finance, with the Swiss National Bank (SNB) and the European Central Bank (ECB) taking steps to protect themselves from losses and ensure that their...

Read More »

Read More »

Foreign exchange: Swiss miss

WHEN the Swiss National Bank (SNB) intervened to weaken its currency in 2011, analysts called the subsequent abrupt drop in the franc’s value a “20-standard-deviation move”. Assuming the franc’s ups and downs follow a normal distribution, such a big shift should not have occurred again for many squillions of years.

Read More »

Read More »

Switzerland’s monetary policy: The three big misconceptions about the Swiss franc

ON THURSDAY January 15th Switzerland’s central bank, the Swiss National Bank (SNB), removed the cap on its currency, which it had imposed over three years ago and reaffirmed only three days before its repeal. The doffing of the cap surprised and upset the foreign-exchange markets, hobbling several currency brokers, including Alpari (which happens to sponsor the London football team I support).

Read More »

Read More »

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

Risk and the finance sector: Swiss miss

INVESTORS checking out the Everest Capital website will find that the hedge fund offers strategies that are diversified across themes, countries and sectors. So they wouldn't have expected losses from any one bet to be that significant. But over the weekend, it was revealed that last week's surge in the Swiss franc had virtually wiped out the group's main fund, Everest Global Capital.

Read More »

Read More »

The Economist explains: Why the Swiss unpegged the franc

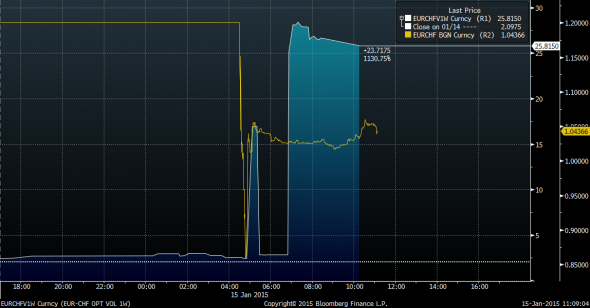

IN THE world of central banking, slow and predictable decisions are the aim. So on January 15th, when the Swiss National Bank (SNB) suddenly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro, there was panic. The franc soared. On Wednesday one euro was worth 1.2 Swiss francs; at one point on Thursday its value had fallen to just 0.85 francs.

Read More »

Read More »

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

Nationalbank-Chef Thomas Jordan hat die Aufhebung des Euro-Mindestkurses bekannt gegeben – SRF Börse

Nach dem Entscheid spielten die Finanzmärkte verrückt. «Die Exporte werden ohne Mindestkurs im laufenden Jahr stagnieren», erwartet Claude Maurer, Ökonom bei der Credit Suisse. SMI: -8.7 Prozent. Weblinks: http://www.snb.ch/de/ http://www.six-swiss-exchange.com/ https://www.credit-suisse.com/de/de.html http://www.dievolkswirtschaft.ch/editions/200903/Maurer.html

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »