Category Archive: 1) SNB and CHF

EUR/CHF Price Forecast: Attempting a bearish breakout from a Triangle pattern

EUR/CHF is trying to break out of a Triangle pattern.

If it succeeds it will probably lead to further downside towards the price objective for the pattern.

EUR/CHF is attempting to break out of a Triangle pattern it has formed over the last three months (see chart below).

EUR/CHF Daily Chart

A bearish close on Tuesday will indicate a decisive breakout has happened and suggest the start of a likely strong decline.

The market activity prior to...

Read More »

Read More »

USD/CHF edges higher above 0.8700 amid renewed US Dollar demand

USD/CHF gains ground to near 0.8730 in Friday’s early European session.

The Fed cut interest rates by a quarter point at the November meeting on Thursday.

The safe-haven flows could underpin the Swiss Franc.

The USD/CHF pair drifts higher to around 0.8730 during the early European session on Friday. The renewed Greenback demand provides some support to the pair. Traders brace for the advanced US Michigan Consumer Sentiment data for November...

Read More »

Read More »

USD/CHF Price Prediction: Potential Bull Flag pattern forming

USD/CHF might be developing a Bull Flag continuation pattern.

This suggests there will be an extension of the uptrend to upside targets higher.

USD/CHF – which looked as if it might be reversing trend and starting a new short-term downtrend at the start of the week – suddenly turned on a dime and spiked higher on Wednesday.

The pair rallied to a higher high, giving the established uptrend a shot in the arm. USD/CHF has since peaked and started...

Read More »

Read More »

Forex Today: Markets remain on edge on US election day

Here is what you need to know on Tuesday, November 5:

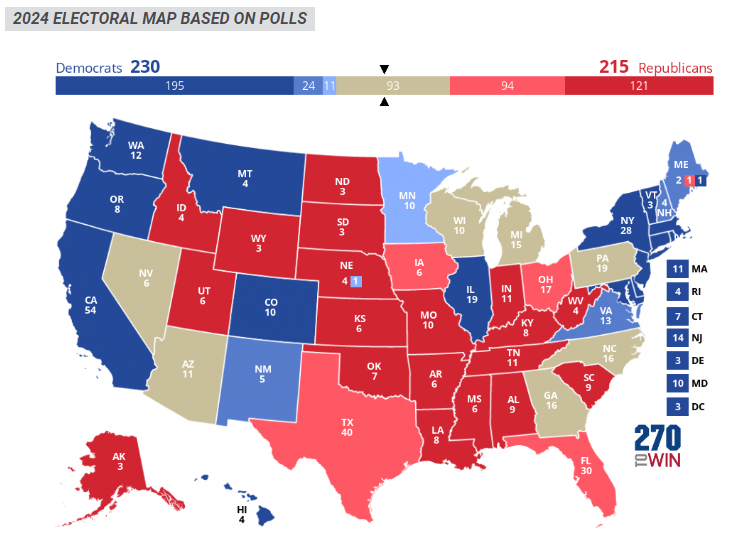

Financial markets remain on edge as the US presidential election takes center stage, with latest polls pointing to a tight race. On Tuesday, the US economic calendar will feature Goods Trade Balance data for September and the ISM Services PMI report for October. Later in the day, the US Treasury will hold a 10-year note auction.

US Dollar PRICE This week

The table below shows the...

Read More »

Read More »

USD/CHF remains below 0.8650, market caution emerges ahead of US presidential election

USD/CHF remains steady due to market caution amid increased uncertainty surrounding the US election results.

Improved US Treasury yields could have provided support for the US Dollar.

The continued slowdown in Swiss inflation has increased the likelihood of a bumper SNB rate cut in December.

USD/CHF holds ground after registering losses in the previous session, trading around 0.8640 during the Asian hours on Tuesday. The US Dollar (USD) remains...

Read More »

Read More »

USD/CHF dips toward 0.8650 as the US Dollar weakens amid lower Treasury yields

USD/CHF depreciates as the US Dollar loses ground amid lower Treasury yields.

The recent poll indicated that Kamala Harris and Donald Trump are locked in a close contest across seven battleground states.

The 10-year Swiss bond yield falls toward 0.38% due to rising expectations of more aggressive rate cuts by the SNB.

USD/CHF retraces its recent gains from the previous session, trading around 0.8650 during the European session on Monday. The US...

Read More »

Read More »

Gold price edges higher amid US presidential election uncertainty

Gold price drifts higher in Monday’s early European session.

Safe-haven demand amid US presidential election uncertainties, persistent Middle Eastern tensions, might lift the Gold price.

Traders brace for the US election outcome on Tuesday ahead of the Fed rate decision.

The Gold price (XAU/USD) trades in positive territory on Monday. The US presidential election risks and the ongoing Middle East geopolitical tensions are likely to underpin the...

Read More »

Read More »

USD/CHF slides to test 0.8645 support with US inflation data on tap

The US Dollar depreciates for the second consecutive day and approaches support at 0.8645.

The focus today is on the US PCE Prices Index but the highlight of the week is Friday's NFP report.

A break of 0.8645 would confirm a double top at 0.8700.

The US Dollar is on the back foot on Thursday, with investors bracing for the release of October’s PCE Prices Index data. The USD/CHF is testing the support area at 0.8645 after being rejected at the...

Read More »

Read More »

USD/CHF Price Prediction: Gaps higher at open, uptrend remains intact

USD/CHF has opened a Runaway Gap higher at the open, suggesting the uptrend will continue.

Volume is low, reducing the chances that the gap represents a point of exhaustion.

USD/CHF opened a gap higher at the open on Monday (see chart below) and then promptly fell back down. It has since closed the gap.

Despite the speed of the decline following the gap higher, the short and medium term trend is still probably bullish, which given the old...

Read More »

Read More »

Gold price remains on the defensive below $2,748-2,750 hurdle amid positive risk tone

Gold price attracts some dip-buying on Monday and draws support from a combination of factors.

Middle East tensions, US election jitters and a modest USD pullback seem to benefit the XAU/USD.

Bets for smaller Fed rate cuts and rising US bond yields might cap the upside for the precious metal.

Gold price (XAU/USD) struggles to capitalize on its intraday bounce and remains below the $2,748-2,750 supply zone through the early part of the European...

Read More »

Read More »

USD/CHF hovers around 0.8650, upside likelihood appears possible as the US election looms

USD/CHF may appreciate further due to fading odds of bumper rate cuts by the Fed in 2024.

The US Dollar receives support from market caution ahead of the US presidential election.

The recent lower Swiss inflation rate increased the dovish sentiment surrounding the SNB.

USD/CHF remains steady after registering losses in the previous session, maintaining its position above 0.8650 during Asian trading hours on Friday. This level is near its...

Read More »

Read More »

US Dollar rallies on Wednesday with US yields surging higher

The US Dollar rolls through markets and strengthens against most major G20 currencies.

US equities are falling further while markets calibrate the new normal for the Fed interest-rate outlook.

The US Dollar index adds even more gains to its October rally and trades in a crucial technical area.

The US Dollar (USD) speeds up its rally this Wednesday just ahead of the US Opening Bell, fueled by uncertainty ahead of the US presidential election and...

Read More »

Read More »

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

USD/CHF may regain its ground as US Treasury yields continue to surge.

CME FedWatch Tool suggests an 86.9% chance of the Fed’s 25-basis-point rate cut in November, with expecting no bumper cut.

The Swiss Franc faces challenges as lower inflation reinforces the likelihood of another rate cut by the SNB in December.

USD/CHF offers its gains from the previous session, trading around 0.8650 during the early European hours on Tuesday. This downside of...

Read More »

Read More »

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

USD/CHF drops to near 0.8630 even though the US Dollar resumes its upside journey.

The SNB is expected to cut interest rates again in December.

Investors expect the Fed to reduce interest rates gradually.

The USD/CHF pair drops to near 0.8630 from the two-month high of 0.8370 in Monday’s North American session. The Swiss Franc pair corrects even though the US Dollar (USD) rebounds after a mild sell-off on Friday, suggesting sheer strength in the...

Read More »

Read More »

USD/CHF Price Prediction: Consolidates within short-term uptrend

USD/CHF is trading in a mini-range after pulling back from new highs.

This is probably a pause before the pair goes to new highs.

USD/CHF is consolidating within its short-term uptrend in what is likely to be a temporary pull back before the market goes higher again.

The pair is probably in a short-term uptrend now given the rising sequence of peaks and troughs since it broke out of the range-bound consolidation in August and September. ...

Read More »

Read More »

USD/CHF trades around 0.8630, recovers recent losses due to less-dovish Fed

USD/CHF edges higher as robust US labor and inflation data have diminished the likelihood of bumper rate cuts by the Fed.

Atlanta Fed President Raphael Bostic expects just one more interest rate cut of 25 basis points this year.

The Swiss Franc strengthened as lower inflation in September reduced the need for the SNB to implement substantial rate cuts.

USD/CHF retraces its recent losses registered in the previous session, trading around 0.8630...

Read More »

Read More »

USD/CHF Price Prediction: Pull back unfolding after higher high

USD/CHF is correcting back after peaking as it extends its uptrend. The pair will probably resume its bullish bias after the pull back has completed. USD/CHF is pulling back within its short-term uptrend after peaking at 0.8642 on Monday.

Read More »

Read More »

Gold price retraces as China’s stimulus disappoints amid buoyant US Dollar

Gold slips as China’s stimulus efforts fail to ease deflationary pressures. Minneapolis Fed President Kashkari’s comments on modest rate cuts and a strong labor market further support the Greenback. Geopolitical tensions, including Israel’s response to Hezbollah and Iran, continue to influence Bullion prices, with traders eyeing US economic data later this week.

Read More »

Read More »

USD/CHF Price Prediction: Now probably in a short and medium term bull trend

USD/CHF continues rising and might have established a medium-term uptrend. It is likely to continue higher although it is potentially overbought and a downside gap risks closing.

Read More »

Read More »

USD/CHF strengthens above 0.8550 ahead of FOMC Minutes

USD/CHF gains ground to near 0.8575 in Wednesday’s early European session.

Reduced bets of a jumbo Fed rate cut in November support the USD ahead of the FOMC Minutes.

The escalating Middle East geopolitical tensions might cap the pair’s upside.

The USD/CHF pair trades on a stronger note to around 0.8575 during the early European session on Wednesday. The firmer US Dollar (USD) amid diminishing odds for more aggressive rate cuts by the Federal...

Read More »

Read More »