Category Archive: 1) SNB and CHF

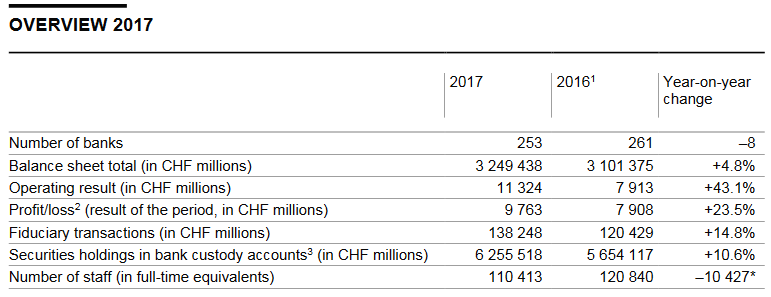

Banks in Switzerland 2017, Results from the Swiss National Bank’s data collection

Summary of the 2017 banking year. Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion.

Read More »

Read More »

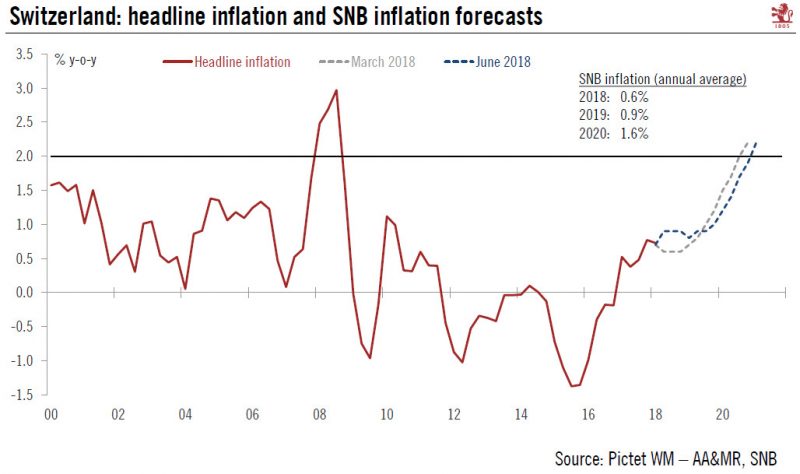

Buying more time

At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

Swiss residential property risks growing in buy to let, according to Swiss National Bank

On 21 June 2018, the Swiss National Bank (SNB) announced its decision on interest rates, which it left unchanged. Switzerland’s economy has been sailing into the headwinds of a strong currency since the SNB scrapped its exchange rate cap in January 2015 and the Swiss franc briefly went beyond parity with the euro.

Read More »

Read More »

SNB Monetary Assessment June 2018, Introduction

I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary. Situation on the financial markets Let me start with the developments on the financial markets.

Read More »

Read More »

Introductory remarks by Fritz Zurbrügg

In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will talk about the big banks, before going on, in the second part, to outline our current assessment of the situation at domestically focused banks.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I would also like to briefly touch on the rejection of the sovereign money initiative by the people and the cantons as well as a publication marking the tenth anniversary of the SNB’s educational programme, Iconomix.

Read More »

Read More »

Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct.

Read More »

Read More »

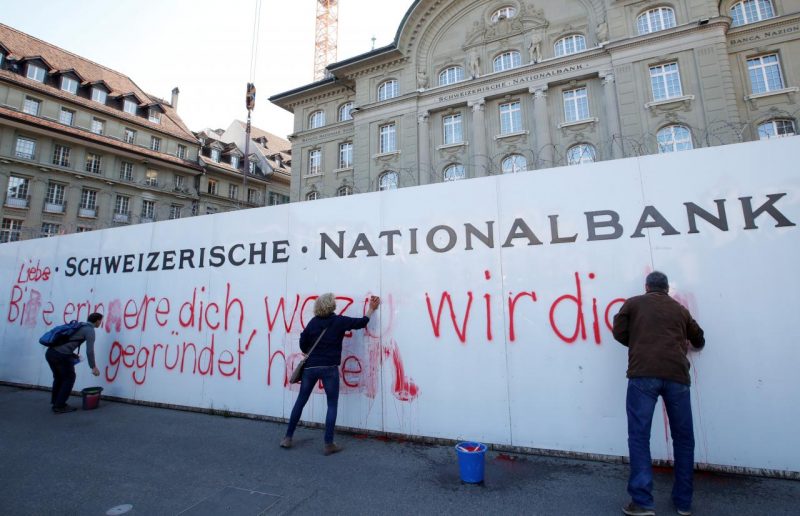

Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘.

Read More »

Read More »

SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments.

Read More »

Read More »

Nach Vollgeld-Schlacht: Wir Schweizer dürfen nie mehr zum Spielball ausländischer Ideologen werden

Wer sich intensiv mit der fachlichen Materie „Vollgeld-Initiative“ auseinandergesetzt hat, kann aufatmen. Wäre diese Initiative angenommen worden, hätte deren Umsetzung unser Land in ein wirtschaftliches und politisches Chaos gestürzt.

Read More »

Read More »

‘Much too early’ to lift interest rates, says SNB chairman

The continued volatility surrounding the Italian elections and the threat of global trade wars make it far too early for the Swiss National Bank (SNB) to consider raising rock bottom interest rates, says chairman Thomas Jordan.

Read More »

Read More »

Vollgeld – Eine umfassende Analyse

Am 10. Juni stimmen wir in der Schweiz auf nationaler Ebene über die Vollgeld-Initiative ab. Diese widmet sich einer der wohl komplexesten und zugleich wesentlichsten Thematiken unserer Gesellschaft: unserem Finanzsystem. Die Idee des Vollgeldes geht weit über die Initiative in der Schweiz hinaus und ist heute in erster Linie Bestandteil der «Modern Monetary Theory». Ihren Ursprung lässt sich in das 19. Jahrhundert zurückverfolgen. Auf der Webseite...

Read More »

Read More »

Bricht die Italien-Krise der SNB das Genick?

Am 7. April 2017, dem Tag der Generalversammlung der Schweizerischen Nationalbank, war die Welt der Notenbank noch in Ordnung. Der Euro notierte bei 1.20 zum Franken, und SNB-Chef Thomas Jordan konnte einen Jahresgewinn für das vergangene Geschäftsjahr von 54 Milliarden Franken vorweisen.

Read More »

Read More »

Results of the 2017 survey on payment methods

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behaviour and the use of cash by house holds in Switzerland, and to ascertain the underlying motives for this behaviour.

Read More »

Read More »

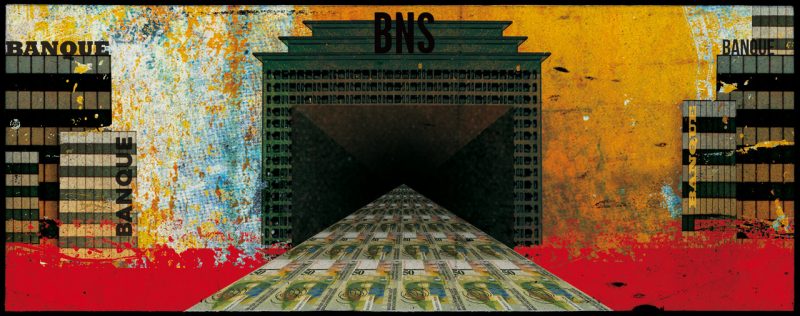

Le bilan de la BNS, Une arme de destruction massive

Chers amis lecteurs, voici le drame de la Suisse. Il s’appelle « Politique monétaire non conventionnelle« . Une arme de destruction massive que personne n’ose approcher, ni même aborder! Elle consiste en l’art de se faire un bilan sans bases réelles et avec en contreparties de l’endettement!

Read More »

Read More »

Switzerland’s vote to change its monetary system – sensible or silly?

Sometimes Swiss voters are presented with questions that only specialists are equipped to answer. The vote on 10 June 2018 to change their monetary system appears to be one of these. On the surface it appears simple. Upon closer inspection it contains much complexity and uncertainty, compounded by a widespread misunderstanding of how the financial system works – banks do not act simply as intermediaries, lending out the deposits that savers place...

Read More »

Read More »

“Vollgeld – Was spricht dagegen? (Sovereign Money—What are the Problems?),” RABE, 2018

Die Vollgeld-Initiative will die Schweizer Geldpolitik komplett umkrempeln. Künftig soll nur noch die Nationalbank Geld herstellen dürfen, sowohl Banknoten und Münzen als auch das elektronische Geld. Die Schweizer Geschäftsbanken wie die UBS oder die CS, die heute 90% des elektronischen Geldes herstellen, soll das künftig verboten sein.

Read More »

Read More »

Will the SNB raise interest rates?

The Swiss National Bank (SNB) could be moving forward in their process of raising interest rates according to current reports with the previous Q4 2019 hike predicted to become reality in Q3. This minor shift in expectations is positive for the Swiss Franc and gives the market some news to be targetting and assessing in deciding the value of the CHF.

Read More »

Read More »

BNS, Initiative Monnaie Pleine veut lui donner les pleins pouvoirs

L’initiative «Monnaie pleine», qui sera soumise au peuple le 10 juin prochain, entend radicalement transformer le système bancaire suisse. Si elle est acceptée, la BNS obtiendrait les pleins pouvoirs. Décryptage des risques et des enjeux. L’initiative «Monnaie pleine», sur laquelle le peuple sera appelé à se prononcer le 10 juin prochain, demande que seule la Banque nationale suisse (BNS) puisse émettre de la monnaie.

Read More »

Read More »

La question de Monnaie pleine induit-elle le votant en erreur?

Le peuple suisse doit, le 10 juin 2018, répondre à cette question: Acceptez-vous l’initiative populaire « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la Banque nationale ! (Initiative Monnaie pleine). Le oui à la question sous-entend que ce concept monétaire garantit la monnaie suisse et les avoirs bancaires d’une part, et d’autre part que l’ensemble des avoirs bancaires relèvent de la banque centrale.

Read More »

Read More »