Category Archive: 1.) Forex Live Based CHF SNB

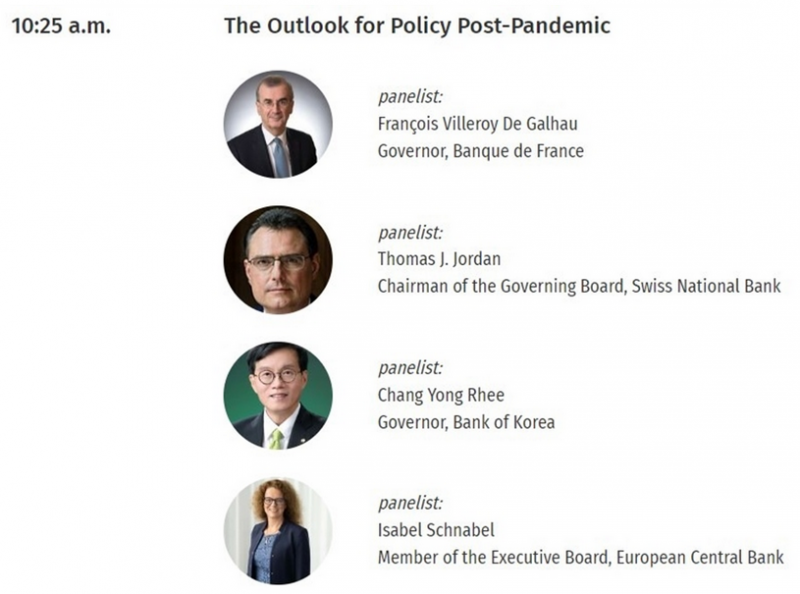

Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »

Martin Schlegel appointed to SNB

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose.

Read More »

Read More »

SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Vulnerabilities have increased and Swiss real estate market. Swiss apartments overvalued by 10% to 35%. SNB continues to monitor developments in real estate market. It is not roll of monetary policy to curb risk to financial system. The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304.

Read More »

Read More »

SNB introduces possibility of repo rate transactions being indexed to policy rate

This will be added to the SNB's monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory.

Read More »

Read More »

SNB says successfully tested use of digital currency to settle transactions with top investment banks

The latest trial could see the introduction of central bank digital currency move a step closer in Switzerland. The SNB says that they integrated the digital currencies into payment systems and used them in simulated transactions involving UBS, Credit Suisse, Goldman Sachs, and Citigroup.

Read More »

Read More »

SNB sets up refinancing facility and deactivates counter-cyclical buffer

There is no upper limit for virus fund. Drawdowns can be made at any time. Says interest rates to correspond to the SNB policy rate (-0.50%). Will be available from tomorrow.

Read More »

Read More »

Scotia says evidence points to Swiss National Bank intervening in CHF

FX strategist at Scotiabank cites the relative stability of EUR/CHF (above and around 1.06) in the past two weeks while turmoil in markets elsewhere.

Read More »

Read More »

SNB’s Jordan: Franc exchange rate is important in relation to Swiss monetary conditions

Negative rates are a necessity. Negative rates have side effects, SNB trying to minimise those side effects. Balance of risks is tilted to the downside. SNB conducts independent monetary policy, does not follow the ECB. But needs to take international environment into account.

Read More »

Read More »

SNB’s Jordan: Swiss franc remains highly valued

Foreign exchange market remains fragile. Negative rates, readiness for intervention still necessary. Danger of a worsening international situation remains large. Imbalances in Swiss real estate market still persist.

Read More »

Read More »

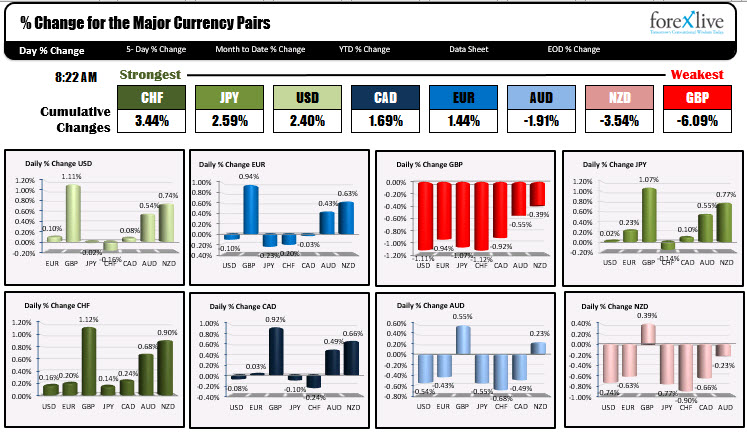

The CHF is the strongest, while the GBP is the weakest as NA traders enter for the day

Well...maybe some NA tradersThe US has a partial holiday with the bond market closed but the US stock markets open. Canada is off for Thanksgiving. So North American traders entering for the day, may be a little stretch today. However, the forex market is open. The CHF is the strongest as some of the euphoria from the events of last week (Brexit hope and China/US) fade and there is a flight into the safety of the CHF (and JPY).

Read More »

Read More »

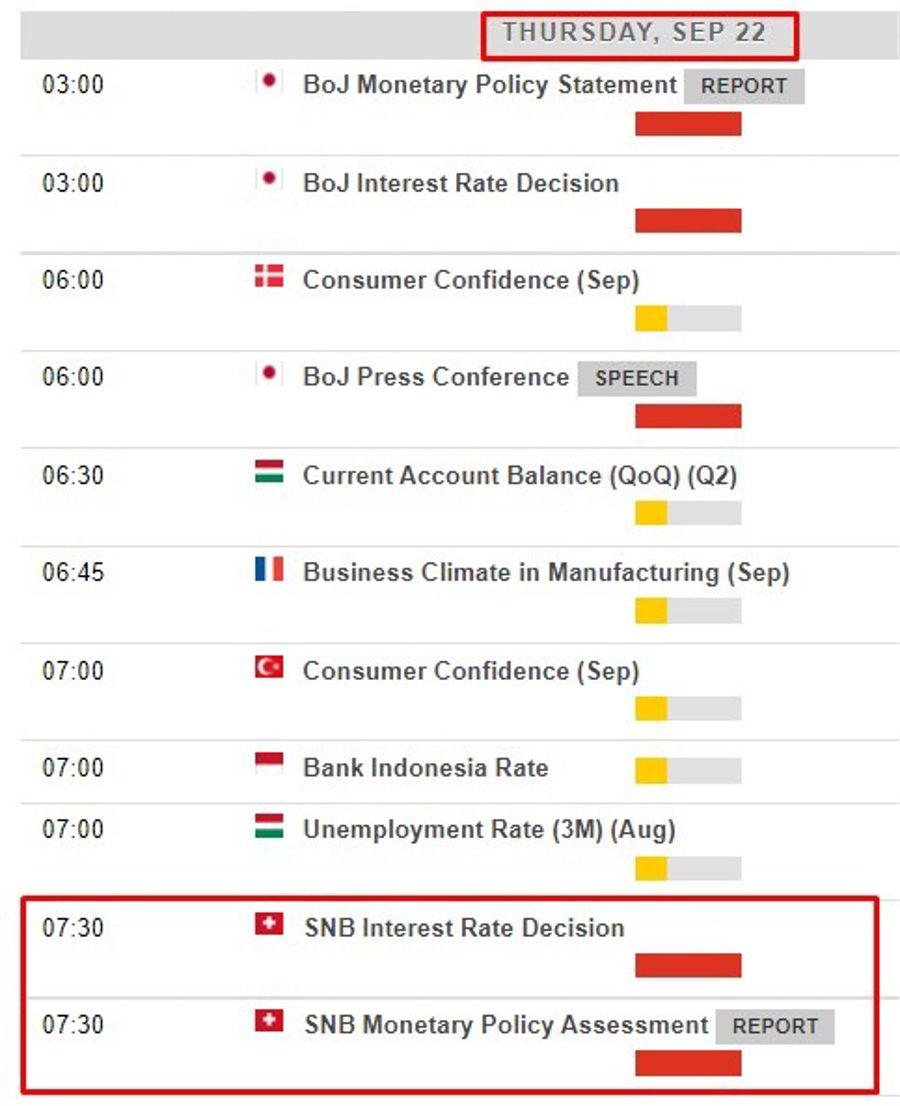

SNB leaves policy rate unchanged at -0.75 percent

SNB announces its latest monetary policy decision - 19 September 2019. Sight deposits rate unchanged at -0.75%Willing to intervene and will remain active in FX market as necessaryExpansionary monetary policy continues to be necessary.

Read More »

Read More »

Morgan Stanley forecasts a surprise 25 basis point cut from the SNB

The Swiss National Bank needs to respond to the strong currency and lower rates from the ECB, according to Morgan Stanley. The consensus for Thursday's meeting is no change from -0.75% but Morgan Stanley and UBS are two firms that are forecasting a surprise 25 bps cut.

Read More »

Read More »

CHF is ‘not strong in real terms’ – no need for SNB intervention

A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19.In brief, Stan Chart argue the franc is not strong in real termsadjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spotno need for SNB to intervene to try to weaken ittherefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near...

Read More »

Read More »

Uptick in site deposits puts the spotlight on SNB intervention in the franc

Has the SNB started to intervene. The weekly site deposit data from the Swiss National Bank showed a small uptick but with some perspective, it's a notable turn. Bloomberg highlights the bump and what looks like a bid to keep EUR/CHF above 1.10.

Read More »

Read More »