Category Archive: Recommended

AstroPay as a Payment Method for Online Gambling in Australia: Is It Worth?

Year in and year out, online gambling continues to increase in popularity in Australia. With the industry’s growth, there has been a surge in the number of payment methods available to players. With the many payment options available, AstroPay stands out as one of Australia’s most secure and reliable online gambling options. What is AstroPay? …

Read More »

Read More »

Zillow CEO: If You Can, Sell Your U.S. Home Now

Via CNBC Against the backdrop of increasing home prices and the prospect of much higher mortgage rates, it’s a “great time” to sell, Spencer Rascoff, CEO of online real estate marketplace Zillow, told CNBC on Thursday. That is, if you can find a place to buy, he added. “As mortgage rates inevitably come from …

Read More »

Read More »

Adam Smith Institute: Could Deflation Be Salvation?

Imagine wages and factor prices are stable. Hence deflation means productivity growth: Higher quantities bought for a lower price. Low inflation or even deflation is the Swiss success story for decades and the success story for the United States recently. The Pigou effect seems to be saving the US economy, just as it did in …

Read More »

Read More »

Jim Rogers: EU Should Address Real Problem: Their Excessive Spending Habits

Switzerland's banking secrecy is under threat. EU finance ministers have agreed to put pressure. Jim Rogers EU leaders should address the real problems - like their own unchecked spending habits. Video

Read More »

Read More »

Fast Fact: Germany paid 5% Interest and Had 0.5% Average Growth between 1996 and 2002

Most recently the Bundesbank critised the ECB decision to reduce Italian yields contained in the OMT program. To put things into perspective: Germany paid 5% interest for 10 years government bonds between 1996 and 2002. This at average inflation-adjusted GDP growth rates of 0.5%. But there was no ECB that was buying German bonds …

Read More »

Read More »

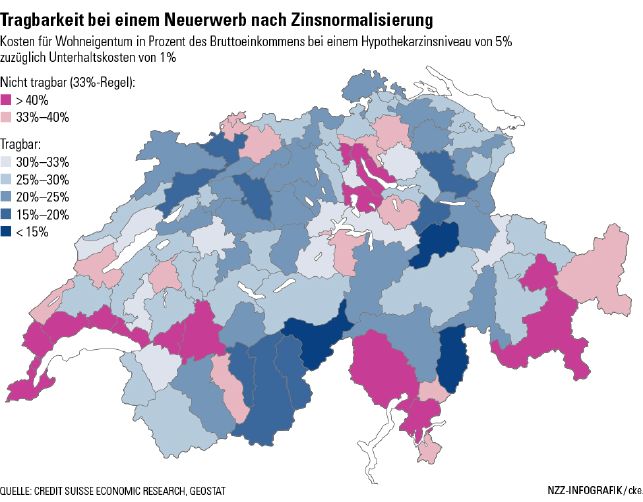

Credit Suisse Study: Swiss Real Estate Market Needs Higher Rates

A new study by Credit Suisse claims that the SNB needs to hike interest rates in order to avoid excessive risk taking in real estate markets; in particular around the centers of Geneva and Zurich, but also in the Southern Swiss cantons with lower income, but high real estate prices.

Read More »

Read More »

Paul Krugman in 1990s: Long Live the French Franc!

Krugman in the 1990s: "France represents the most extreme case of “eurosclerosis”: of “ludicrously overregulated” labor markets and overprotected jobs. These issues and the unsuited German monetary policies to create the euro were the source of France’s troubles." View Craig Willy's...

Read More »

Read More »

Will the SNB Start Financial Repression too?

Most recent Swiss inflation data show that several items have risen by 1% in one month. Former ECB member Lorenzo Bini Smaghi claims that a currency war would lead to financial repression even by central banks that predominantly concentrate on price stability - like the SNB.

Read More »

Read More »

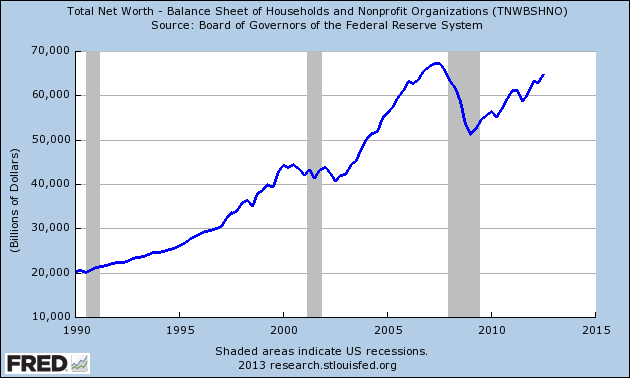

Recreating the Asset Bubble: The Fed’s Plan for Economic Recovery

The Fed's plan is recreate an asset bubble, so that economic actors have enough time to forget about the latest one and adjust their rational expectations about low future growth to the upside. Read the Circle...

Read More »

Read More »

Will Switzerland finally get hit by eurozone woes?

Switzerland and Japan are currently the leaders in currency manipulation, now even in front of the Fed and far ahead of the leader until 2009, China. Hear the interview with Guardian's Ambrose Evans-Pritchard on World Radio Switzerland.

Read More »

Read More »

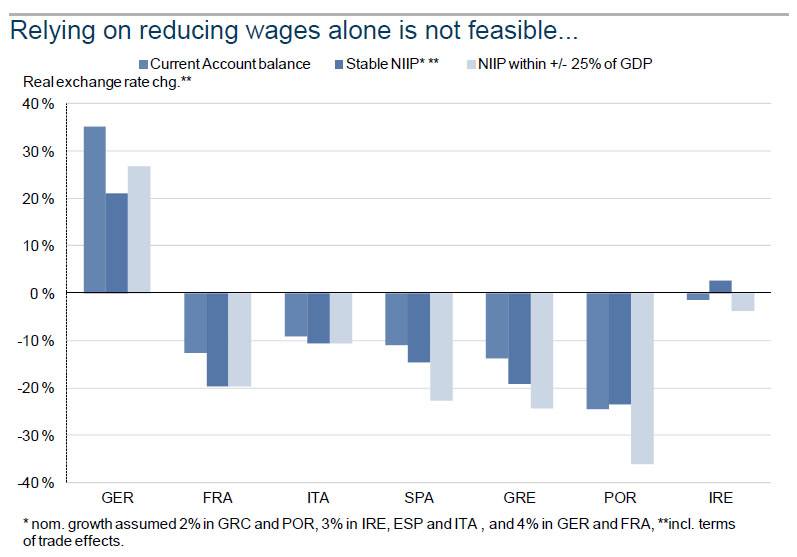

Goldman Sachs: Reducing Wages in Periphery Is Not Enough

The must-read Goldman analysis on Zerohedge: it is not enough to reduce wages in Greece or Spain. These countries will see lost decade(s). Completely in-line with our analysis that

Read More »

Read More »

The Rise and Fall of Keynesian Economics

John Cassidy's remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

Keynesians led the world to two of its most unfortunate experiences, the 1970s stagflation and to the...

Read More »

Read More »

About the Impossibilities of the Common-Currency-Recession-Austerity Cycle

Charles Wyplosz, Professor of International Economics, Graduate Institute, Geneva repeats our arguments in "Who says No to Austerity, Says Yes to the Northern Euro" about the impossibility of getting out of the common currency - recession - austerity - cycle. Similar as we do, he proposes a public...

Read More »

Read More »

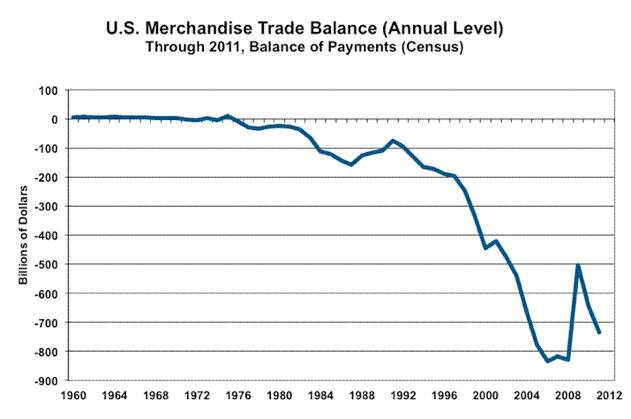

Can the United States Be Really More than Just the Global Consumer?

The ISM PMI under 50 shows that the United States are in contraction as for industrial production. The dollar is simply too strong. The Americans consume, but the US trade deficit gets bigger. The Chinese, Japanese, Germans and some global US firms take the profits on it. Today a worth-reading propaganda...

Read More »

Read More »

Five facts you need to know about China’s currency manipulation

Five facts you need to know about China’s currency manipulation Ezra Klein. Washington Post

Read More »

Read More »

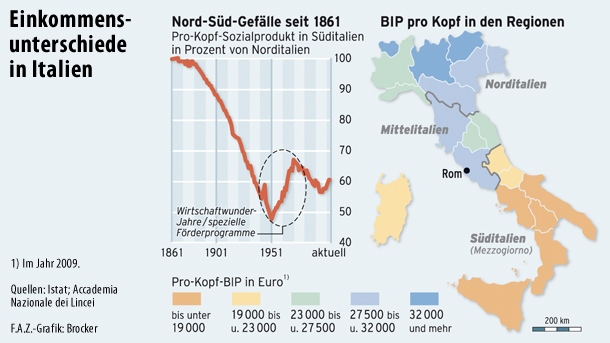

Wie eine Währungsunion Italiens Süden verarmen ließ

Wie eine Währungsunion Italiens Süden verarmen ließ

Vor 150 Jahren wurde in ganz Italien die Lira eingeführt. Der reiche Norden blieb reich. Der Süden stürzte ab.

mehr in der FAZ

Read More »

Read More »

Switzerland, the Paradise of Insider Trading and Intransparency

Switzerland is well known as the country, where even central bankers were allowed to do insider trading. Instead the whistle blowers get problems with the courts. Some new cases of insider trading include UBS, General Electric and Valiant, see the article on

Read More »

Read More »

May Japan face a weak yen and high bond yields?

Like often in global economic downturns, the demand for Japanese cars and electronics has fallen in Q3, especially due to European purchasers. Additionally fueled by a row with China, the current account has become negative. Is Japan doomed because the yen will fall and bond yields will rise?

Read More »

Read More »

Poll: Austrian politicians miss economic skills or are simply liars

For the Austrian public, the Greek crisis shows that 21% of politicians and so-called experts do not have the required economic skills, 60% say that these elites were simply lying

Details on ORF. Latest

Read More »

Read More »

SNB Losses in October and November: 8.4 Billion Francs, 1.5% of GDP

According to the SNB balance sheet and the SNB data delivery to the IMF, the central bank lost 8.4 billion francs of equity in the months of October and November, the equivalent of 1.5% of Swiss GDP. Details SNBCHF.COM

Read More »

Read More »