Category Archive: 9a.) Real Investment Advice

4-7-25 The Market Crash – Hope In The Fear

Are markets close to a short-term bottom? The response to the unexpected magnitude of tariffs creates pain and anxiety, as markets reprice valuations and trade negotiations begin. Some markets suspend short-selling; US markets are over-sold; bonds are doing well; the Fed is expected to cut rates five times. Lance discusses markets' hope and fear (charts); lessons investors can learn from the Coog's vs Duke (Lance's wife is not amused). Wall Street...

Read More »

Read More »

The Market Crash – Hope In The Fear

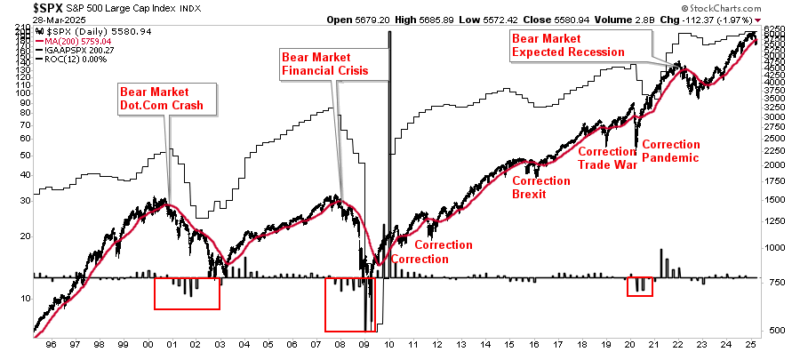

Last week, we noted that "nothing good happens below the 200-DMA," and the tariff-induced market crash this past week confirmed that statement. However, we also noted that over the last 30 years, previous failures at the 200-DMA have also often been buying opportunities. That is unless some "event" of magnitude creates a massive shift in analysts' estimates. …

Read More »

Read More »

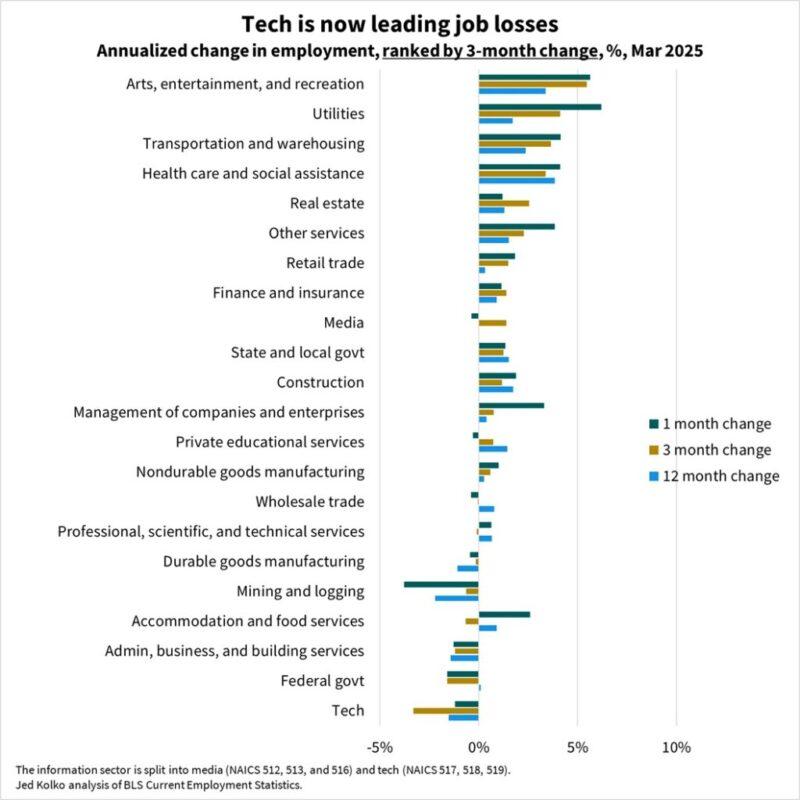

Stagflation Or Just Stag?

While stagflation fears grip the market and make headlines, the bond market appears more concerned about 'stag than ‘flation. Stagflation describes sluggish economic activity or a recession coupled with higher prices and rising unemployment. The 'stag' refers to a stagnant economy, while the 'flation' is inflation. Please read our article, Stagflation Panic: A Misdiagnosed Media Spin, …

Read More »

Read More »

The “Liberation Day” Tariffs Crash The Market

Inside This Week's Bull Bear Report The "Liberation Day" Crash Last week, we noted that it would not be uncommon for the market to retest recent lows. That is what happened on Monday morning before rallying sharply off that level. However, that rally was short-lived as President Trump's "Liberation Day" on Wednesday afternoon liberated the …

Read More »

Read More »

The Stock Market Warning Of A Recession?

A Wall Street axiom states that the stock markets lead the economy by about six months. While not a perfect predictor, the stock market reacts to investor expectations about future corporate earnings, economic activity, interest rates, and inflation. When sentiment shifts due to anticipated weakness in any of these areas, equity prices often decline, reflecting …

Read More »

Read More »

Fair Trade Isn’t Equal Trade: Trump Breaks Key Economics Rule

Heading into April 2nd, investors were under the impression that Trump's goal was to set tariff rates that allow for fair trade with other nations. Trade impediments like tariffs, taxes, VATs, currency manipulation, and other methods that don't allow for fair trade would be offset with tariffs. More simply, Trump would level the playing field. …

Read More »

Read More »

4-3-25 Markets’ Tariff Tizzy

President Donald Trump's tariff terrors were revealed Wednesday afternoon, and markets were not enthused. At all. The worse than expected tariff rates are the highest ever. Trade policy is still uncertain, however, as the tariffs are seen as a negotiating tactic, and subject to revision. But this makes it difficult for companies to re-calculate forward looking estimates of earnings. And as the ripple effects of higher expenses are felt in the...

Read More »

Read More »

The Definitive Guide to Estate Planning for Wealth Protection and Legacy

Estate planning is one of the most important yet often overlooked aspects of financial management. Without a comprehensive plan in place, your wealth and assets may not be distributed as intended, leading to unnecessary tax burdens, family disputes, or legal complications. Proper estate planning ensures that your legacy is protected, your family is financially secure, …

Read More »

Read More »

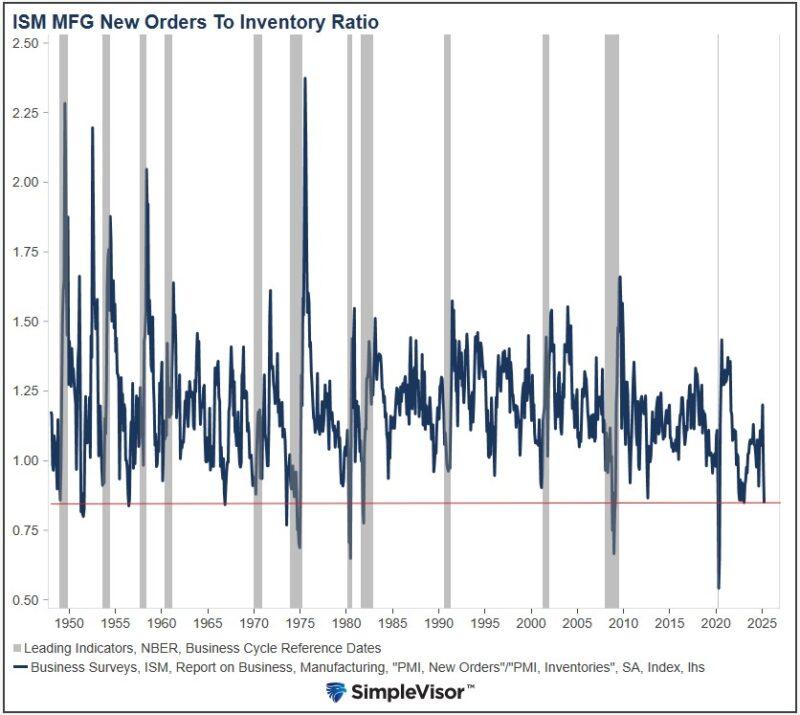

The Tariff Impact In One Graph

Over the past few weeks, we have discussed the sharp jump in the trade deficit due to a surge of imports trying to front-run potential tariffs. Thus far, the impact of front-running tariffs on economic data has only been significant in consumer and corporate surveys and the aforementioned trade deficit. That was until Tuesday. The …

Read More »

Read More »

4-2-25 Liberation Day – What Does It Mean for You?

Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make Liberation Day look like a success? If that were the case, he might promise the worst regarding tariffs and underdeliver. In other words, the tariffs announced on Liberation Day may not be...

Read More »

Read More »

Trumps Puzzle

We are big fans of Sunday crossword puzzles, which tend to be bigger and more challenging than the weekday format. Adding to their allure, most Sunday puzzles have a clever theme, typically three or four clues whose answers stretch across the puzzle. Solving the theme often makes a complex puzzle a little easier. Like a … Continue reading »

Read More »

Read More »

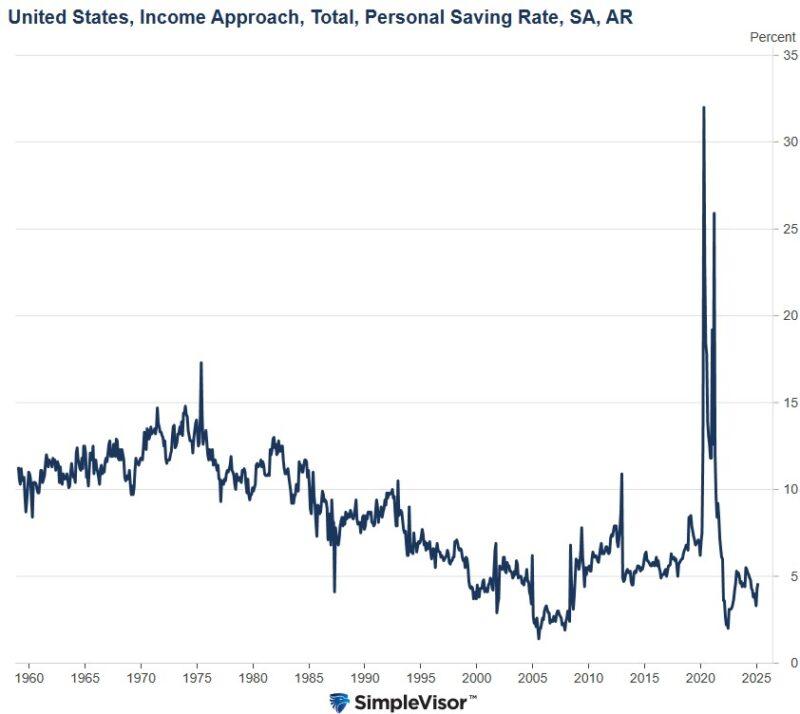

Personal Savings: An Unpolitical Sentiment Gauge

Yesterday's Commentary discussed the vast divergence in the economic sentiment of Democrats versus Republicans. In the piece, we wrote: "Democrats think today’s economic outlook is worse than during the peak of Covid and the financial crisis of 2008. Sentiment is tricky to convert into an economic forecast. Sometimes, sentiment is bad, but consumers continue to …

Read More »

Read More »

Understanding Market Trends: The Power of Buyers and Sellers

Understanding market trends: More buyers drive prices up, more sellers bring them down. Learn how futures impact gold prices! 📈💰 #MarketInsights

Watch the entire show here: https://cstu.io/25b2ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

4-1-25 Failure At The 200-DMA – Correction Continues

Investors must remember that we're coming off two years of exceptional market returns, and that market corrections must be viewed in their proper context...and expected. Lance discusses the positive and negative impact of Mag-7 stocks on markets due to their weighting; meanwhile, the First Quarter has ended with institutional buyers acting in the final minutes of Monday's trading day, boosting stocks to a less than 1% gain at the close. Markets...

Read More »

Read More »

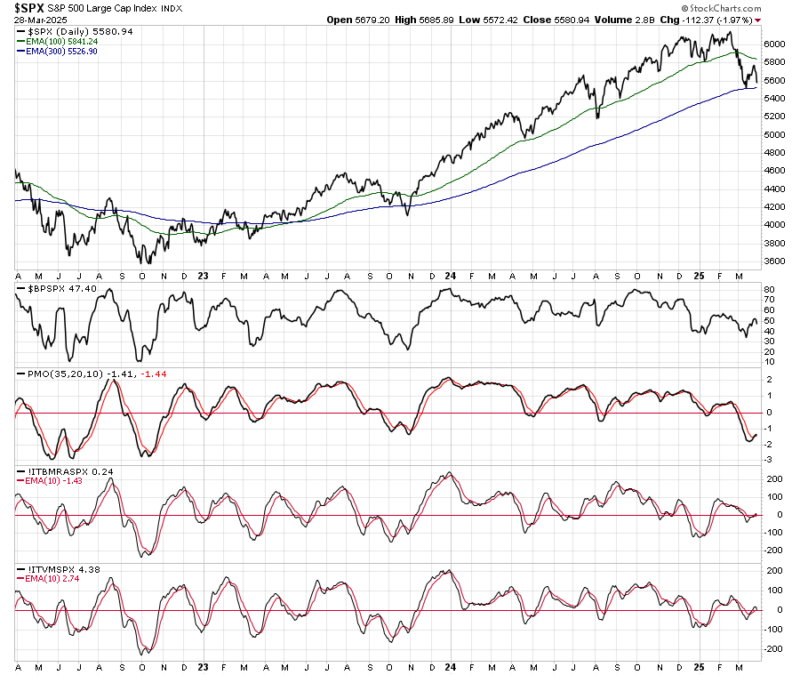

Failure At The 200-DMA

In last week's post, "Is the correction over?" we wrote about the potential for a rally back to the 200-DMA. However, the failure of that test increased short-term concerns. As we noted in that post, there were early indications of buyers returning to the market. To wit: "The chart below has four subpanels. The first … Continue reading...

Read More »

Read More »

Liberation Day: A Bullish Scenario

Stocks are hitting the skids as April 2nd, or Liberation Day, quickly approaches. Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make …

Read More »

Read More »

Mastering Buy Low, Sell High: Essential Tips for Investors

Learn to take profits and buy declines! Investing tip: Sell high and buy low. Don't miss the buy signal for Bitcoin at 80,000! 💰📈 #Investing101

Watch the entire show here: https://cstu.io/6f035d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

3-29-25 Savvy Social Security Planning

Much has been reported and speculated about the recently passed Social Security Fairness Act. In this episode of Candid Coffee, Richard Rosso and Danny Ratliff discuss what the repeal of WEP and GPO mean for you; understanding Social Security Spousal Benefits and survivor benefits; and rethinking retirement planning with an income boost from Social Security. They take a clear-eyed look at the Social Security Fairness Act, Windfall Elimination...

Read More »

Read More »

3-31-25 Sellable Rally Or “Buy The Dip”?

There are no discernable signs of economic stress...yet, bu tconsumers are concerned about wages and job security. The question begging to be asked: When is the Fed going to step in (Fed purview: Employment and price stability...AND by extension, consumer confidence). How will markets react to Liberation Day (4/2)? Corporate buy backs will resume 3rd week of April. Markets pulled back on Friday (mimicking four similar pull backs last year.) Make no...

Read More »

Read More »

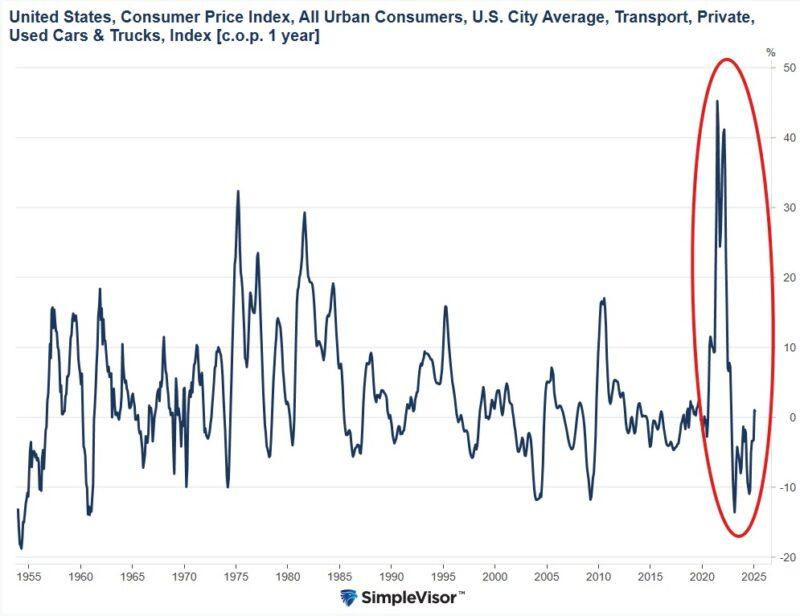

Are Used Car Prices Set To Soar Again?

It wasn’t that long ago that used car prices were soaring as the production of new cars was crimped due to Covid-related supply line shortages. Since then, used car prices have stabilized as the supply lines have healed. However, like many goods, prices haven't retreated to pre-pandemic levels. As we wrote in yesterday's Commentary, the …

Read More »

Read More »