Category Archive: 9a.) Real Investment Advice

Understanding Inflation: The Role of Supply and Demand in the Economy

Supply and demand drive inflation, but slowing economic growth is the solution. An interesting conundrum! #EconomyTalks #Inflation #SupplyDemand

Watch the entire show here: https://cstu.io/dd3cf6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Quick Market Rotations: Favorable Shifts Happen Fast!

Ever wonder why certain markets suddenly surge? ? Rotations happen fast in the financial world! ? Stay on top of your portfolio and risk management! #FinanceTips #MarketInsights ??

Watch the entire show here: https://cstu.io/d9c943

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-7-25 Taking the No-buy Challenge

TIring of overconsumption and desirous of paying off debt, more and more Americans are participating in the "no buy 2025" trend to reduce spending. Rich and Jonathan discuss strategies for improving household budgets, Money Saving Tips and Frugal Living Hacks, with Financial Discipline Strategies and Spending Freeze Guidance, plus tax traps to avoid as a result of the Social Security Fairness Act, and the challenges from inherited IRA's....

Read More »

Read More »

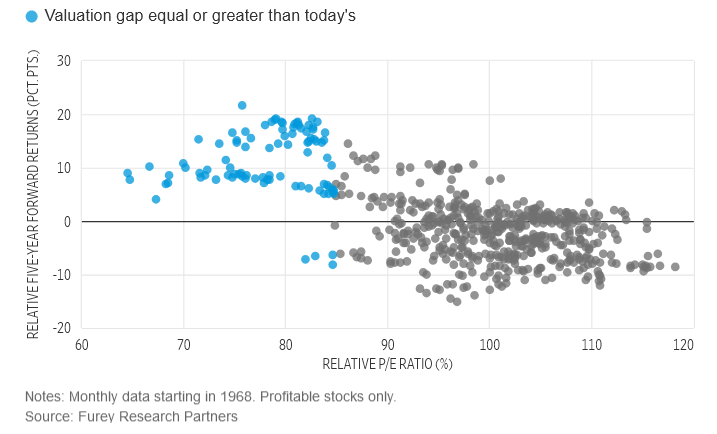

Small Cap Stocks Are Offering Outsized Returns

The Wall Street Journal published an interesting article For Small Cap Stocks, Look Past The Trump Trade. It is worth sharing the article's premise and the potential pitfalls in the analysis as quite a few articles seem to be popping up recently touting small-cap stocks. Let's start with the scatter plot below, courtesy of Fuery …

Read More »

Read More »

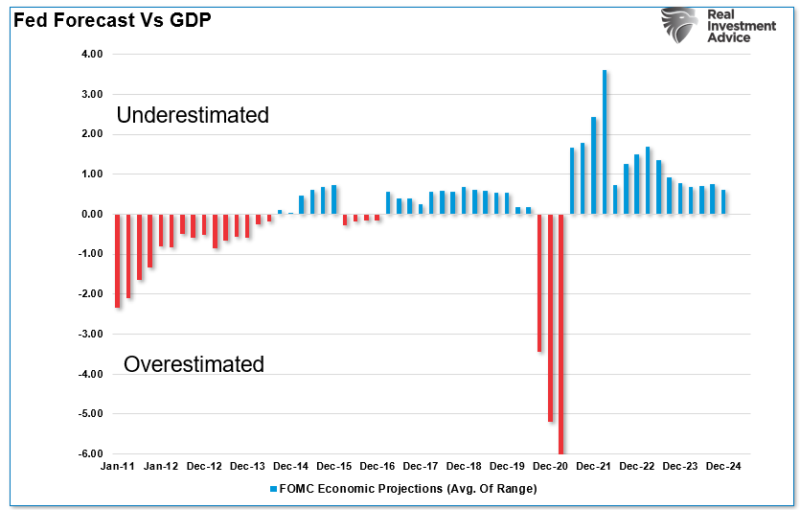

Forecasting Error Puts Fed On Wrong Side Again

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously …

Read More »

Read More »

Avoid Emotional Trading: Key to Better Long-Term Returns

Emotional trading leads to mistakes & selling bottoms. Turn off, let the market digest. Don't follow the herd. Timing is key. #StockMarketTips

Watch the entire show here: https://cstu.io/9193b9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-6-25 Where Money Comes From

Markets remain in a bullish trend for the moment, despite disappointing economic news in the Trade Deficit and the ISM Services Index. Improving relative strength is also providing lift for the market. Technically, everything is fine despite disappointing news from AMD, Google, and others. Money flows continue to creep upward with continued buying. Lance and Michael spend the remaining segments of the show discussing money, currencies, and concepts...

Read More »

Read More »

The Role of Annuities in a Retirement Income Plan

Planning for retirement involves building a diverse and stable income strategy that ensures financial security throughout your golden years. Among the tools available, annuities in retirement planning offer a unique advantage: the ability to create a reliable, guaranteed income stream. However, understanding their types, benefits, and potential drawbacks is essential to determining whether they fit …

Read More »

Read More »

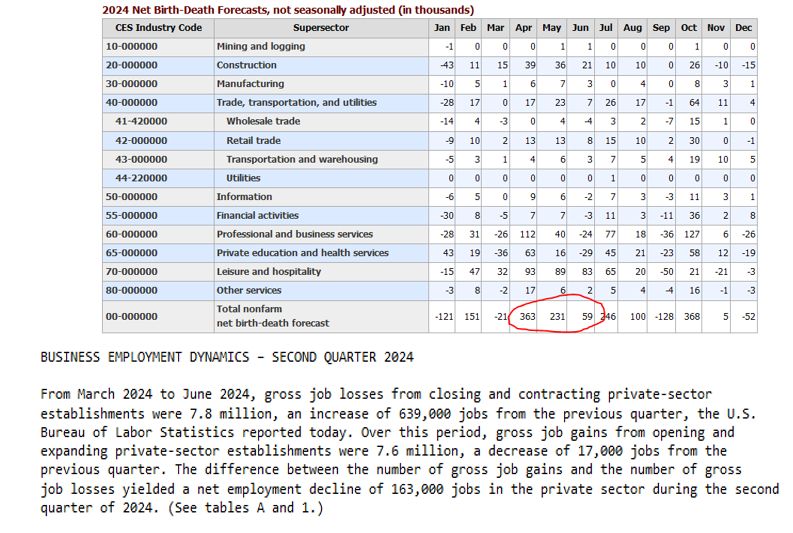

The Birth Death Adjustment: Trade With Caution

When formulating its monthly employment data, the BLS includes an adjustment for the net number of new jobs coming from new businesses and those lost by companies that have shut down. This adjustment is logical, as neither new nor closing firms are included in their surveys. While the so-called birth death adjustment is rational, the …

Read More »

Read More »

Master Discipline: Respecting Stop Loss Levels in Trading

Stay disciplined with your stop loss levels! Don't fall into the trap of constantly waiting for the price to go back up before selling. Approach trading with a different mindset. ? #TradingTips #Discipline

Watch the entire show here: https://cstu.io/354a00

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

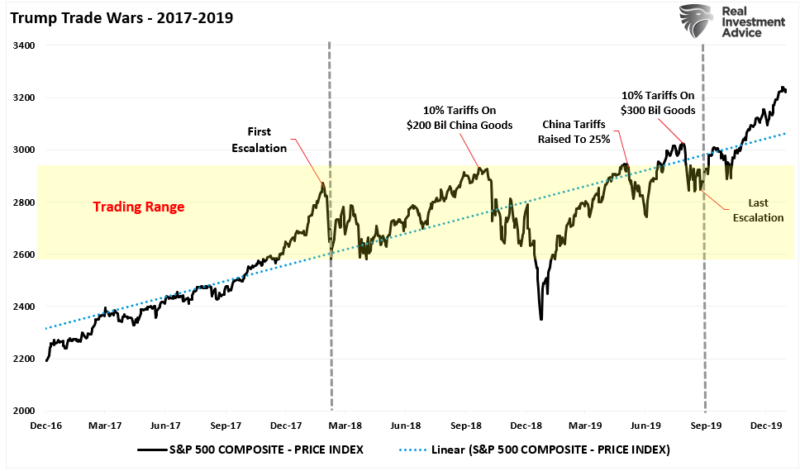

2-5-25 What the Bond Market is Telling Us About Trump 2.0

Markets are recovering from tariff troubles on Monday; a brief history of Trump's past trade wars & results; Google's earnings miss & correction; earnings have been okay, but epectations are slipping. The China Trade War retaliation begins; it's all about posturing. Markets rally from Monday; if you're worried about the volatility, there's too much risk in your portfolio. Lance razzes Danny "Bulldog" Ratliff about his absenteeism...

Read More »

Read More »

DOGE Deficit Reductions

The newly formed Department of Government Efficiency (DOGE), headed up by Elon Musk, is tasked with reducing government waste and increasing efficiency and productivity. The big question bond investors are keying on is how effectively DOGE can reduce the deficit. Tracking DOGE savings is now easy. As we share below, the US Debt Clock shows …

Read More »

Read More »

Where Does Money Come From?

All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does money come from? Furthermore, knowing who does and doesn't print money and the incentives and disincentives that change the money supply are critical to inflation forecasting. …

Read More »

Read More »

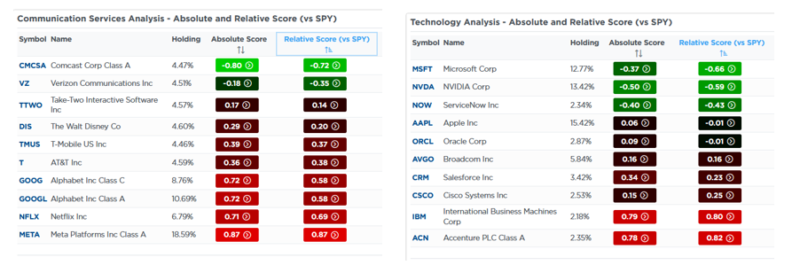

Stay Balanced and Monitor Market Trends for Optimal Investment Performance

Don't let fear of a bear market hold you back! Stay informed with Simple Visor's tools to analyze the market trends. ? #InvestingTips #MarketAnalysis

Watch the entire show here: https://cstu.io/d4f84b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

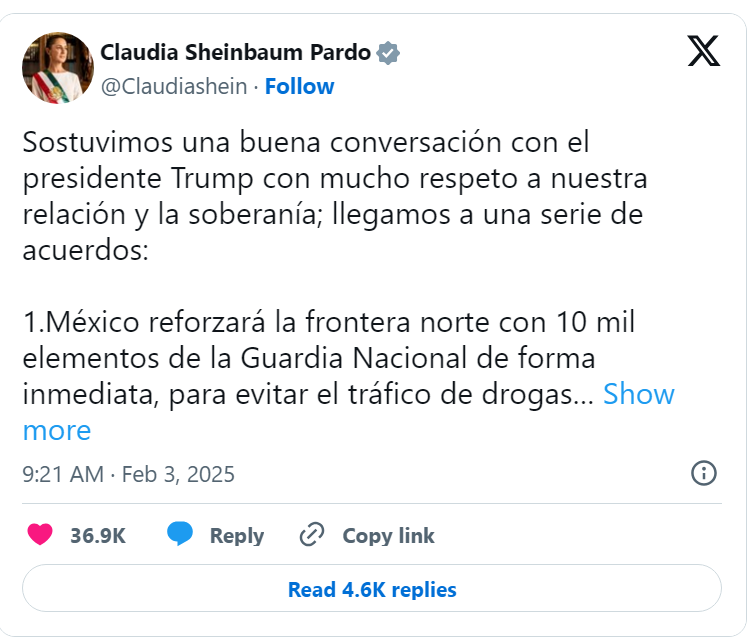

2-4-25 Trade War Over!

Well that was fast.

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. The announcement of tariffs set the market on its heels Monday morning as media writers quickly pushed narratives about the potential impacts. However, as suggested on the “Real Investment Show” before the market opened on Monday, the best thing to do would be “nothing.” We stated the market’s opening would...

Read More »

Read More »

Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined …

Read More »

Read More »

New Tariffs Torpedo Global Markets

Investors woke up Monday morning to a sea of red. On Friday, after the markets had closed for the weekend, President Trump announced a new series of tariffs levied against Mexico, Canada, and China. Moreover, he threatened that those tariffs could increase and that new tariffs would be announced for the Euro-region. Cryptocurrencies, technology, and …

Read More »

Read More »

Is This the Start of a Market Correction? Traders Watch Key Support Levels

Watch how the markets respond to support levels. Holding them = no big deal. Breaking them = potential for a larger corrective cycle. ? #MarketAnalysis

Watch the entire show here: https://cstu.io/242abd

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Tariffs Affect Corporate Profitability and Consumer Prices

Consumer reactions to tariffs impact companies' profitability. Watch how prices may increase due to tariffs affecting both earnings and consumer wallets. #EconomicImpact

Watch the entire show here: https://cstu.io/19c7dc

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Impact of Trade Tariffs and Border Policies

Colombia and Panama react differently to tariffs. Leaders need to understand the impact. #TradeWars #Tariffs #Leadership

Watch the entire show here: https://cstu.io/90d4ff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »