Category Archive: 9a.) Real Investment Advice

How CFOs Manufacture Earnings and the Impact on Wall Street Estimates

Are company revenues telling the whole story? CFOs admit to manufacturing earnings to meet Wall Street estimates. Dive deeper into the economy with us! ? #EarningsManipulation #WallStreetInsights

Watch the entire show here: https://cstu.io/1a8cc6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Back To Back 20 Percent Gains: What’s Next?

While 20% gains in the S&P 500 are not uncommon, as circled below, back-to-back 20% gains have only occurred three times since 1950. The most recent back to back 20%+ gain was 2023 and 2024. Accordingly, given the rare performance of the last two years, lets look back and see what history teaches us. The … Continue reading...

Read More »

Read More »

Understanding Taxable vs. Non-Taxable Benefits: Key Insights from a Financial Advisor

? Understanding the tax implications of benefits can be tricky! Remember, it all depends on how it's paid for. Stay informed! ? #taxes #benefits

Watch the entire show here: https://cstu.io/fd173c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Mastering Stop Loss Strategies to Avoid Mistakes and Protect Investments

Stop losses can be frustrating for investors! Giving a little room below the moving average may help avoid getting tripped out too soon. ?? #InvestingTips

Watch the entire show here: https://cstu.io/27058f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Scenarios For 2025

Over the past couple of weeks and into the next few weeks, you will likely be inundated with economic forecasts and stock market scenarios for 2025.

Read More »

Read More »

The Overlap Trap: Risks of Having Multiple Financial Advisors

Diversification myth debunked! Having multiple advisors doesn't mean you're diversified. It could lead to overlap risk and concentrated positions. ? #InvestingTips #RiskManagement

Watch the entire show here: https://cstu.io/fa2fb9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Complete Guide to Investment Strategies for Building Wealth

Building wealth through investing requires a clear understanding of foundational principles and a disciplined approach to asset allocation. Whether you’re new to investing or looking to refine your strategy, this guide explores key investment strategies for wealth creation, offering insights on diversification, risk tolerance, and how to build a portfolio that aligns with your goals. …

Read More »

Read More »

Google’s New Quantum Chip is Out of This World

AI machine learning receives most of the publicity concerning today’s technological advancements, but the potential in quantum computing is just as exciting, if not more so. There’s a fundamental difference between quantum computing and AI. Artificial intelligence utilizes classical binary computing, where information is processed in bits, which can either be in an on or …

Read More »

Read More »

How Government Spending Affects Corporate Profitability and Market Risks

Government spending impacts economics & markets. With overbought markets & high speculation, there's a higher risk ahead. Stay informed! ?? #Economics #MarketInsights

Watch the entire show here: https://cstu.io/aaf1b6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Impact of Supply and Demand on Housing Prices

? Housing market insights! Supply and demand are key. Now it's easier to buy or sell a house with affordable loans available. #housingmarket #realestate ??

Watch the entire show here: https://cstu.io/c91c52

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

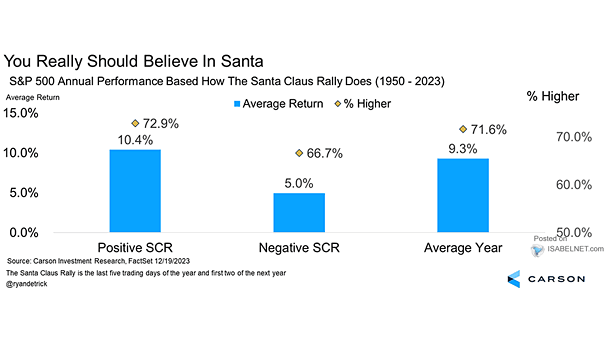

Is Optimism Too Optimistic For 2025?

Inside This Week's Bull Bear Report Last Chance For Early Bird Registration Get your tickets for the 2025 Economic and Investing Summit before prices increase on January 1st. Seating is very limited. Did Santa Get Stuck In The Chimney? Last week, we discussed that the selloff heading into Christmas was the setup for the beginning …

Read More »

Read More »

How to Achieve Multiple Years of Gains in Just One Year

Turning 4% into 14% - that's the power of smart investing! ?? #Investing #FinancialGoals #StockMarket

Watch the entire show here: https://cstu.io/f5609a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Affordable Care Act & The Inflation Of Healthcare

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. …

Read More »

Read More »

2024 in Review

2024 was an unbelievable year for the S&P 500 up 28% YTD. The index constituents' average and median returns are 15.7% and 11.8%, respectively. Altogether, this year’s index returns dwarf the long-term average S&P 500 return of 7.9% since 1928. The Finviz heatmap pictured below shows the 2024 returns of the stocks in the index. … Continue...

Read More »

Read More »

Understanding the Impact of Inflation on Your Retirement Savings

Planning for retirement is a lifelong process, but inflation can pose significant challenges to even the best-laid plans. Inflation slowly reduces the purchasing power of your savings, which can leave retirees struggling to afford the lifestyle they envisioned. Understanding the inflation impact on retirement and taking proactive steps to protect your retirement savings is critical …

Read More »

Read More »

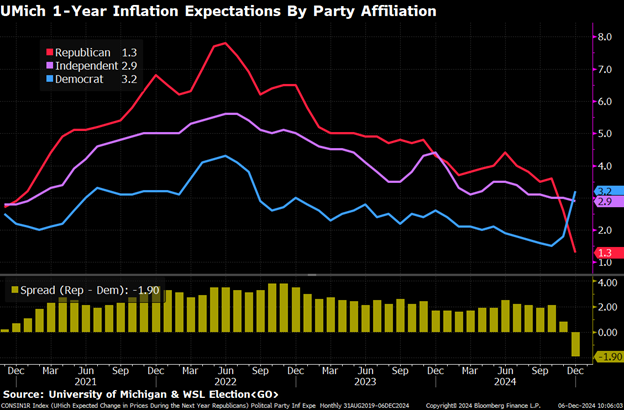

Inflation Forecasts Can Reflect Political Bias

The Fed uses many inflation gauges to develop its forecasts. An important one that Powell has flagged many times is inflation expectations. However, there is a weakness in using inflation expectations as an input to the Fed’s forecasts. Inflation expectations are collected from two primary sources: markets and surveys. Both traders and individuals have political …

Read More »

Read More »

Psychological Optimism and High Expectations for Next Year

? High expectations for next year driven by 'animal spirits' - everyone's optimistic due to America first policies. Exciting times ahead! ??? #EconomicOutlook

Watch the entire show here: https://cstu.io/21033b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Our Christmas Wish To You

We want to take this opportunity to wish you, your family, and your loved ones a very merry and joyful Christmas. We also want to say “Thank You” for all of your support, loyal readership, and the friends we have made through sharing ideas over the last year. While it may be deemed “politically incorrect” these days to say such …

Read More »

Read More »

Our Christmas Wish To You

We want to take this opportunity to wish you, your family, and your loved ones a very merry and joyful Christmas. We also want to say “Thank You” for all of your support, loyal readership, and the friends we have made through sharing ideas over the last year. While it may be deemed “politically incorrect” these days to say such …

Read More »

Read More »

The Widow’s Penalty: Understanding Single Tax Rates

Single tax rates may increase tax liability & impact retirement savings. Planning ahead is key! ? #FinancialPlanning #TaxTips #Retirement

Watch the entire show here: https://cstu.io/444875

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »