Category Archive: 9a.) Real Investment Advice

5-20-25 Are the Markets Too Complacent?

Are investors dangerously ignoring risk? Despite signs of slowing economic growth, elevated valuations, and geopolitical uncertainty, markets continue to trend higher with remarkably low volatility. Lance Roberts & Jonathan Penn address whether or not markets too complacent, remembering wedding anniversaries, and whether the ratings agencies are to be believed: Why even rate Treasuries at all?

A look at bad headlines (If it bleeds, it leads),...

Read More »

Read More »

USA Versus JNJ

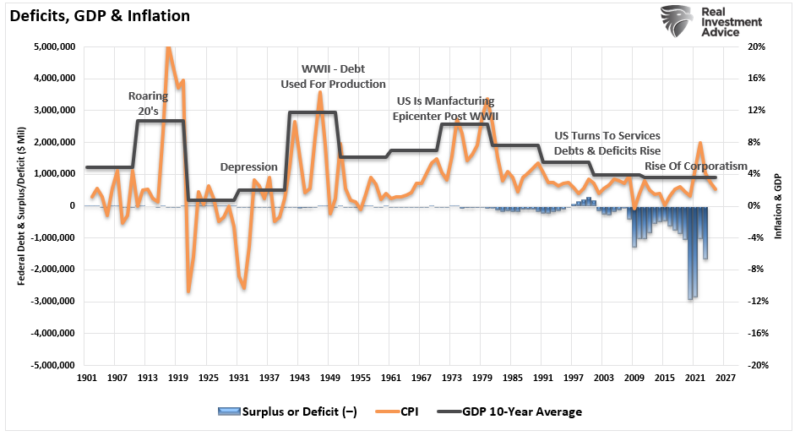

Over the last fourteen years, as we share below, the US government credit rating has slipped from AAA to AA. Moody's was the first to cut the USA from AAA to AA in 2011. Fitch followed in 2023, and Moody's did the same last weekend. Now that the USA government is fully rated AA by … Continue reading »

Read More »

Read More »

How to Achieve Financial Independence and Retire Early (FIRE)

The FIRE movement—short for Financial Independence, Retire Early—has gained popularity among those who want more control over their time and financial future. Unlike traditional retirement models, FIRE encourages aggressive saving and disciplined financial planning to reach financial independence far earlier than the typical retirement age. Whether you dream of leaving the 9-to-5 grind in your …

Read More »

Read More »

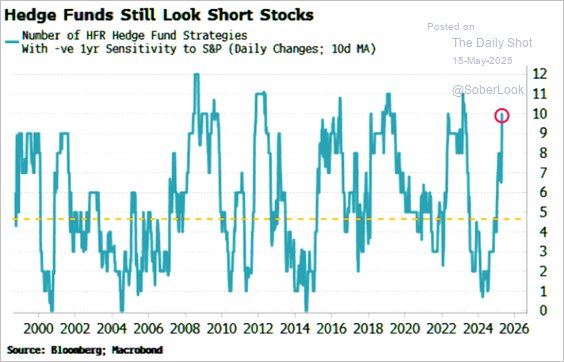

The TLT Short Trade Is Crowded

Short positions in TLT, the popular 20-year US Treasury Bond ETF, have spiked to over 130 million shares, up from 107 million last month. TLT has 541 million shares outstanding. Consequently, the short interest has risen from 20% to 24% of the float. Furthermore, TLT's days to cover ratio (short position/average trading volume) is nearly …

Read More »

Read More »

Moody’s Debt Downgrade – Does It Matter?

This morning, markets are reacting to Moody's rating downgrade of U.S. debt. For those promoting egregious amounts of "bear porn," this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and …

Read More »

Read More »

Recession Probabilities Decline

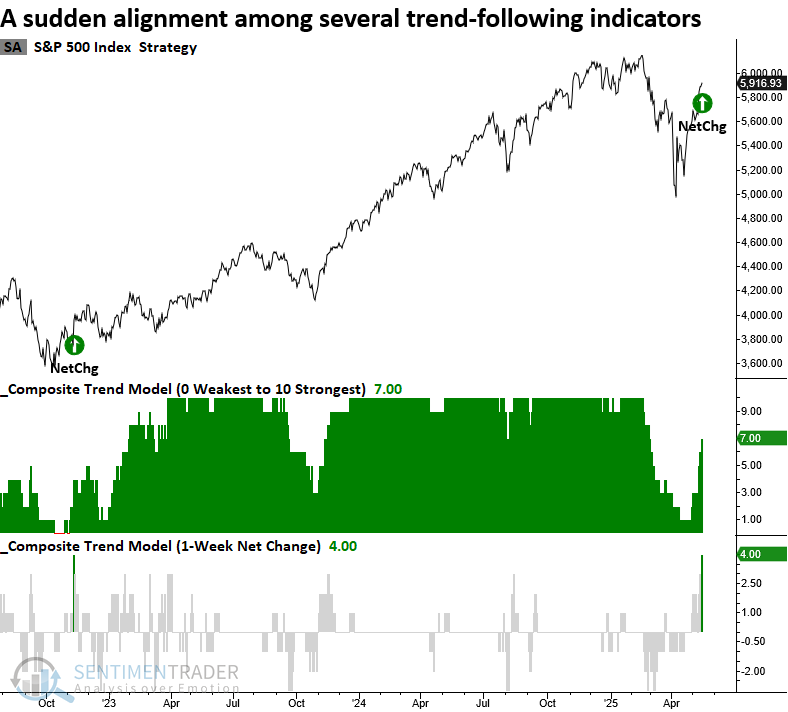

Inside This Week's Bull Bear Report The "Can't Stop, Won't Stop" Rally Last week, we discussed how the rally had repaired much of the previous damage following "Liberation Day." However, we also made competing cases for the bulls and bears on the market's next move. "It is always difficult to say whether this is a 'bear market' rally while you are in the midst of it.

Read More »

Read More »

5-16-25 You Are Much More Economically Sensitive (when you’re an investor)

Investors have a "spidey-sense" of what's going on in the world around them, noticing things like restaurant occupancies and the number of freight trucks on the highway.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

5-16-25 “Tax-Free Social Security: Dream or Deception?”

What if your Social Security benefits were no longer taxed?

A new bill in Congress could make that happen — but is it real policy or just political posturing?

Richard Rosso unpacks the proposal to eliminate federal income tax on Social Security, what it could mean for retirees, and the fiscal reality behind the promise.

🧾 What’s in the proposed legislation

💸 How it could impact retirement income

⚖️ The budget math Congress doesn’t want to talk...

Read More »

Read More »

Bank Regulators Will Help The Treasury

Per an article in the Financial Times titled US Poised To Dial Back Rules Imposed In Wake of 2008 Crisis, US bank regulators are preparing to reduce bank capital requirements. Of particular interest to the bond market is the supplementary leverage ratio, better known as SLR.

Read More »

Read More »

Corporate Stock Buybacks – Do They Affect Markets?

Fisher Investments recently wrote an interesting article asking whether corporate stock buybacks affect markets. Here is their conclusion: "Yes and no? Stocks move on supply and demand. Stock buybacks, where a company buys and takes shares off the market, theoretically reduce supply.

Read More »

Read More »

5-15-25 If You Don’t Raise Cash You Can’t Buy the Dip

Now is not the time to be greedy. Markets operate in cycles, and in post-election years tend to have a decent rally in May and June; July tends to be weak, strong August, weak September, followed by October, November, & December rallies. These will offer opportunities to buy into dips. If you don't have cash at the ready, to cannot take advantage of those opportunities.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w...

Read More »

Read More »

5-15-25 What’s Up with Yields Now?

Are rising yields a warning sign, or are they reflecting renewed economic strength?

Lance Roberts & Michael Lebowitz dive into the latest movements in bond yields and what they signal for markets, the Fed, and your portfolio.

Lance and Mike analyze the shape of the yield curve, interest rate forecasts, and what it all means for investors in 2025:

* Why the 10-year Treasury yield is making headlines

* Is the inverted yield curve still...

Read More »

Read More »

The Best Investment Strategies for a High-Inflation Environment

Rising inflation can chip away at the value of your money and investments, making it one of the most persistent threats to long-term wealth. As prices increase and purchasing power declines, investors must be proactive in adjusting their strategies to protect their portfolios.

Read More »

Read More »

Homebuyers Are Paying More For Less

Below our Market Trading Update, we share analysis from the Atlanta Fed showing that housing affordability has been at its worst in the last twenty years. This is unsurprising given that potential homebuyers face the highest mortgage rates in 20+ years.

Read More »

Read More »

5-14-25 The Equity Chase is On

As markets climb higher, investors are rushing back into stocks. But is the chase for equity returns grounded in fundamentals—or just FOMO? Lance Roberts & Danny Ratliff dive into the sudden surge in equity markets and the renewed appetite for risk. Is this rally sustainable—or are investors simply chasing performance at the top? What’s fueling the stock market rally in 2025, how is sentiment shifting, and why chasing returns in bull markets...

Read More »

Read More »

The Wealth Effect Is Not Always Virtuous

In 2010, following the financial crisis and market meltdown in 2008 and early 2009, Fed Chairman Ben Bernanke made a notable speech explaining the virtues of the wealth effect. To wit: Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

Read More »

Read More »

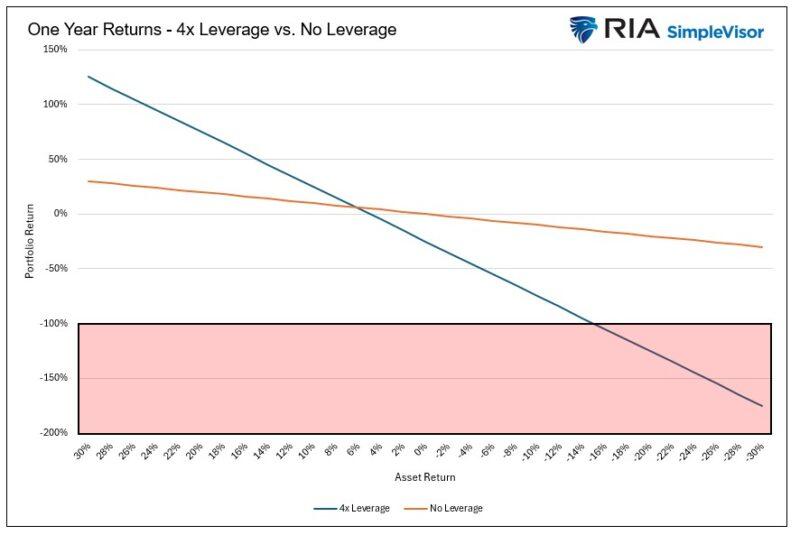

Leverage For Retirement Plans: Is The Risk Appropriate?

Bloomberg recently published, This 30-Year Old's Startup Is Bringing Leverage To 401K Savers. Their article details Basic Capital, a new startup providing institutional investment strategies to individual 401K and IRA savers.

Read More »

Read More »

5-13-25 Align Your Investing Goals with Your True Risk Persona

Typically, the more some investors handle their money, it's like a bar of soap: the smaller it gets. If you're going to take money off the table, align your approach with who you are as an investor.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

5-13-25 Is Tariff-driven Volatility Over?

Tariffs rattled markets. Then… silence. Are we in the clear—or is another shock coming? Lance Roberts and Jonathan Penn tackle the question: Is Tariff Volatility Over? The reversal of tariffs is only a 90-day reprieve; markets are very over bought, and after Monday's rally are due for some pullback (sooner or later); be patient and bide your time before jumping into the fray. Lance and Jonathan discuss why contrarian investing is smart. Preview of...

Read More »

Read More »

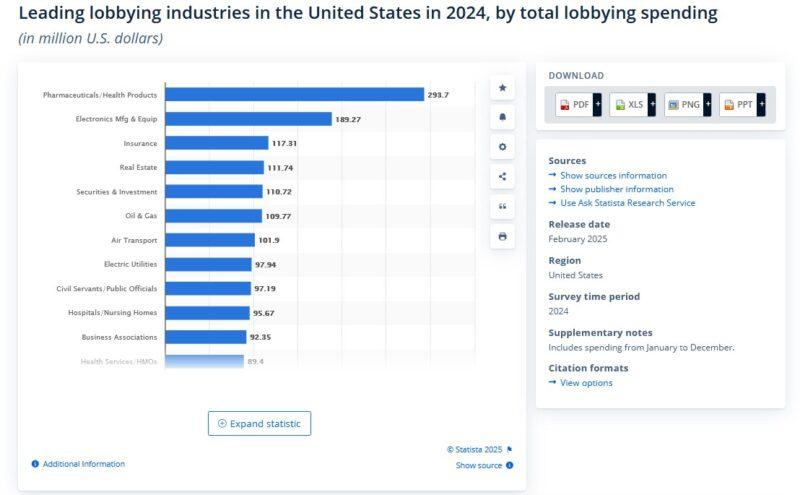

Executive Order On Drug Prices Rattles Healthcare Sector

Despite the weekend's positive news on China trade negotiations and the associated jump in most stock prices, the healthcare sector was hit hard. The culprit is an executive order aimed at reducing U.S. prescription drug prices. Donald Trump plans to implement a "Most Favored Nation" (MFN) policy.

Read More »

Read More »