Category Archive: 9a.) Real Investment Advice

Does AI Capex Spending Lead To Positive Outcomes?

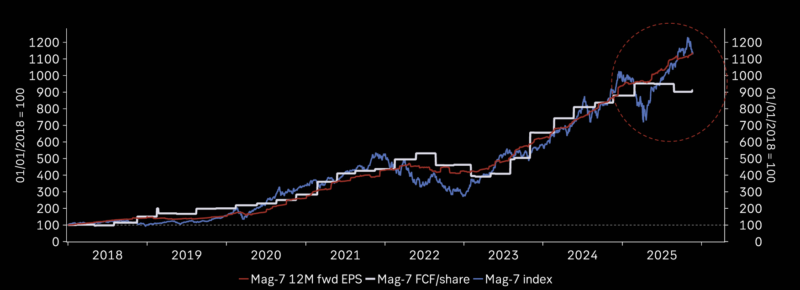

As someone who views corporate finance through a pragmatic lens, I’ve been closely watching the current surge in capital expenditures (capex) tied to artificial intelligence (AI). The question I’m addressing here is this: when a company spends massive amounts of free cash flow and takes on increasing debt, in this case for AI CapEx, does …

Read More »

Read More »

A Third Of US Debt Matures In 2026

We received the following question from a client: "I was at a conference where they showed that roughly a third of the currently existing US Government debt is set to mature in the next few years. How can we pay it back?" A third of the approximately $30 trillion in US Treasury debt equates to … Continue reading »

Read More »

Read More »

12-11-25 The Fed’s Surprising ‘Dovish Cut’ Explained

➢ Listen daily on Apple Podcasts: The Fed delivered a far more dovish cut than markets expected.

In this short video, Michael Lebowitz and I discuss why Powell’s tone shifted, what he revealed about jobs and inflation, and why this matters for markets now.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-11-25 Bifurcated Fed Cuts Rates: What’s Next?

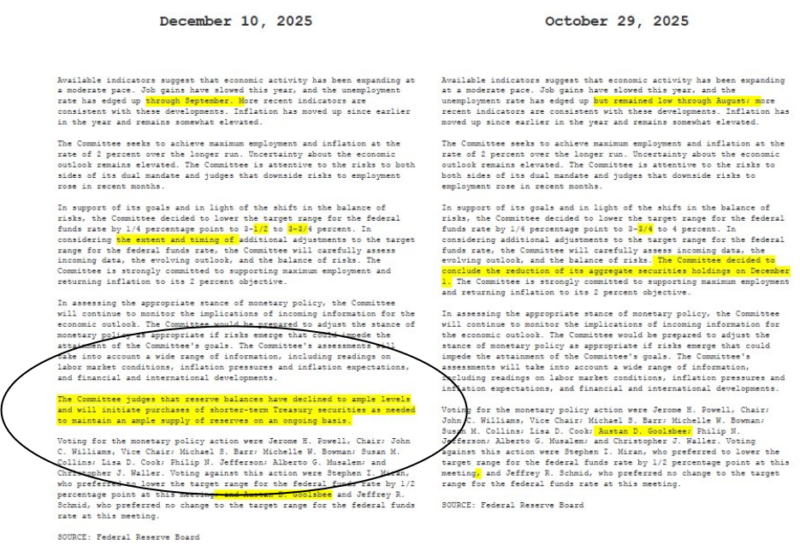

The Federal Reserve cut rates by a quarter point Wednesday, but the real story is the division behind the decision. For the first time since 2021, three Fed governors dissented--an uncommon break in policy unity that raises new questions about inflation progress, economic risk, and the path of monetary policy into 2026.

Lance Roberts & Michael Lebowitz explain why the Fed cut now, what the dissent signals, and how a split vote may affect...

Read More »

Read More »

Hawkish Or Less Dovish? QE Or Not QE?

There is a growing divergence of views among FOMC members. Some remain dovish, favoring more rate cuts. Their argument is based on a belief that inflation will continue to move toward the 2% target and that the weakening labor market benefits from lower interest rates. On the other side of the aisle are hawkish views. … Continue reading...

Read More »

Read More »

12-10-25 2026: A Tale of Two Markets—Bull Then Bear?

Next year may unfold as a tale of two markets: strength early fueled by liquidity and momentum, followed by potential weakness as valuations and credit risks emerge.

In this short video, Lance Roberts explains why a balanced approach with defensives, cash, and flexibility is the smartest way to navigate 2026.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-10-25 Market Sloppiness, Bitcoin Signals & Fed Week: Live Q&A

It’s Fed Day, and today’s Live Q&A covers what investors should expect as markets position around the announcement, why volatility may pick up afterward, and how this week’s action shapes the potential for a Santa Claus Rally. We also discuss whether the Fed has stepped back from its inflation mandate, what that means for long bonds, and how Treasury supply-and-demand dynamics factor into portfolio risk.

Lance Roberts & Danny Ratliff...

Read More »

Read More »

Affordability Crisis: Michael Green Challenges The Poverty Line

Michael Green, Chief Strategist and Portfolio Manager at Simplify Asset Management, wrote a provocative Substack essay, Part 1: My Life Is A Lie, that is sparking a debate among economists and raising awareness of the affordability crisis. It's not just the wonky economists debating the merits of his article; The Washington Post, CNN (News Central), …

Read More »

Read More »

Hassett To Replace Powell: Betting Markets Are Confident

Based on comments from President Trump and the odds on the Kalshi betting site, shown below, Kevin Hassett is the likely nominee to replace Jerome Powell when his term as Fed Chair ends in May. While still half a year away, the market is beginning to price in what a Hassett leadership might mean for … Continue reading »

Read More »

Read More »

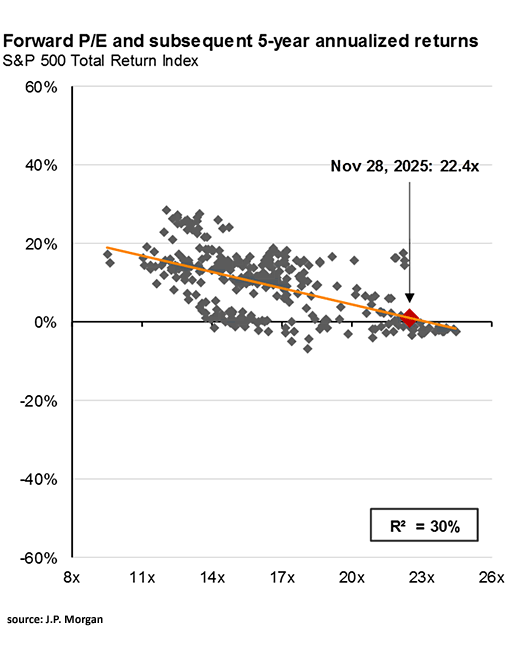

12-9-25 Bear Case for 2026: Valuations, Mean Reversion & Credit Stress

Markets are dangerously overextended and priced for perfection going into 2026.

In this short video, I explain why elevated valuations, mean reversion, and rising credit stress could make 2026 far riskier than investors expect.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-9-25 Dealing with Debt & Smart Money Moves

Debt can reshape a family, fracture relationships, and derail financial goals — especially when fraud or addiction is involved. Lance Roberts & Jonathan Penn address the importance of protecting your credit and financial future, and share four “good enough” financial moves to simplify money management without sacrificing results...strategies to cut through the noise and help you stay on track with less time, less stress, and fewer decisions....

Read More »

Read More »

Is Japan In A Death Spiral?: A Contrarian Take

A day doesn't seem to go by without a market pundit asserting that Japan is in a monetary and fiscal death spiral. It's easy to come to such a conclusion given: Based on those stats and others, it's easy to see why many think it's only a matter of time before Japan's economic system collapses. … Continue reading »

Read More »

Read More »

12-8-25 Bull Case for 2026: Liquidity, Fed Cuts & Market Support

Despite all the loud, extreme narratives, the market outlook for next year is neither all-bull nor all-bear.

In this short video, I outline the bull case for 2026, where rising liquidity, Fed cuts, and expanding consumer credit tilt the outlook toward a stronger 2026.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-8-25 Bullish Case or Bearish Backdrop? The Real Market Setup for 2026

Lance Roberts looks at both sides of the Market Cycle—the bullish liquidity-driven momentum and the bearish fundamental weaknesses. With support and resistance levels tightening around the S&P 500, and the Fed meeting, economic data, and major earnings directly ahead, investors must prepare for a market that could swing in either direction in 2026.

0:00 - INTRO

0:18 - Markets Set up for Santa Claus Rally

5:30 - Expect Sloppy Trading This Week...

Read More »

Read More »

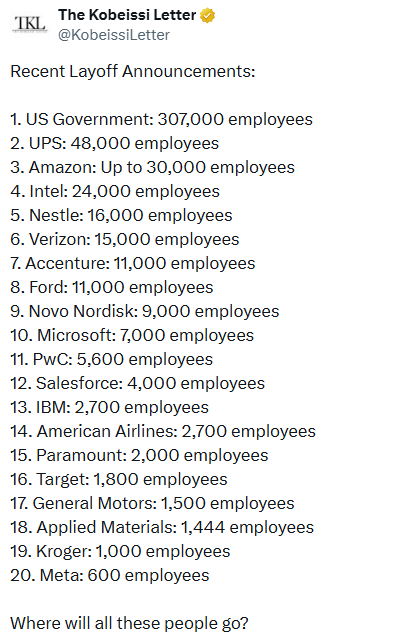

1 Million Layoffs

U.S. employers have announced over 1 million layoffs this year, the highest annual total since the pandemic-era collapse in 2020. November alone saw more than 71,000 layoffs announced, keeping pressure on sectors from technology to telecoms even as the equity market pushes higher. The post below, courtesy @KobeissiLetter, details some of this year's announcements. …

Read More »

Read More »

The DPI Link To Margin Debt

A recent article by Simon White, via Bloomberg, discussed the rising cost of margin debt for investors. While his analysis below compares the cost of debt to GDP, we will also consider a more critical comparison to disposable personal income (DPI). Here is Simon's point. "Yet, where history does raise a red flag is if … Continue reading...

Read More »

Read More »

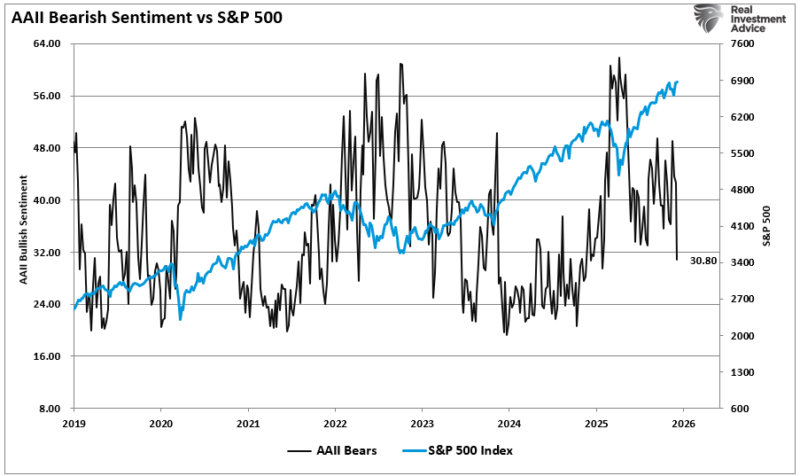

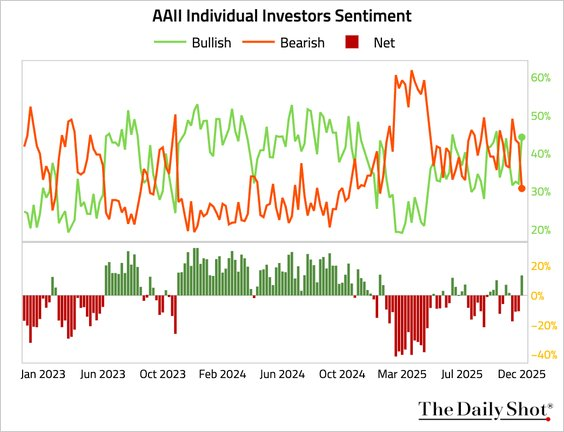

Bullish Case Or Bearish Backdrop

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

12-5-25 Why Fed Cuts Could Make the Dollar Stronger, Not Weaker

Fed rate cuts aren’t inherently bearish for the dollar $DXY. By supporting economic growth and boosting $SPY / $QQQ, they attract foreign capital that strengthens the currency.

In this short video, MIchael Lebowitz and I discuss why easing supports growth, pulls in foreign capital, and ultimately contradicts the constant dollar-debasement narrative.

📺Full episode: -iyGgj0

Catch me daily on The Real Investment Show:...

Read More »

Read More »

Jobs Data From Alternative Sources May Drive Fed’s Next Move

With the federal government shutdown delaying critical economic reports, the official jobs data remains incomplete. Last week, the Bureau of Labor Statistics (BLS) released the September jobs report. However, the October report, originally expected earlier this month, remains in limbo, potentially permanently. The reason is due to the shutdown, as the BLS was unable to …

Read More »

Read More »

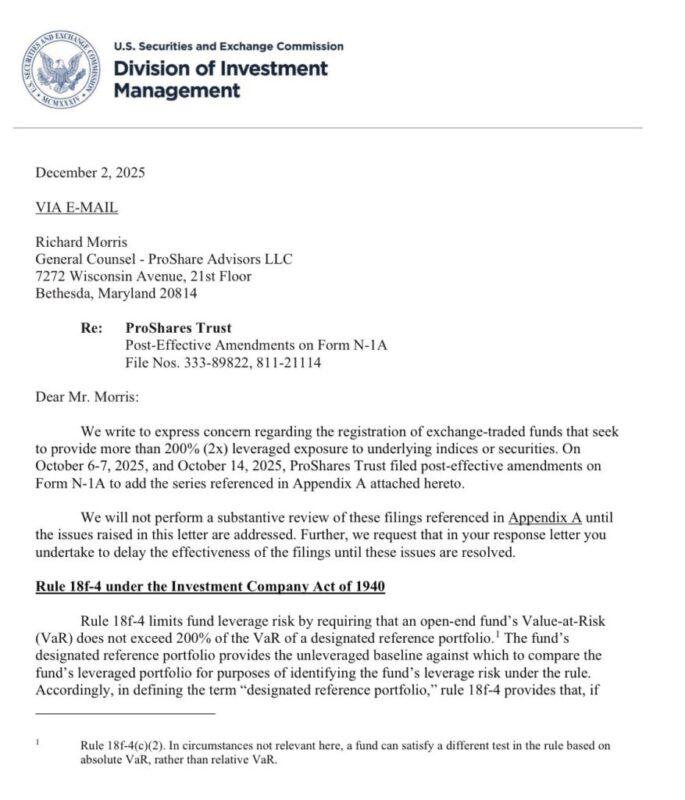

5x Leverage Is Too Much Says The SEC

Wall Street’s financial engineers thought they had found yet another way to turn financial markets into casinos. The gimmick this time is with 3x, 4x, and even 5x leveraged ETFs tied to individual stocks and cryptocurrencies. The SEC just ruled against these new proposals, apparently drawing the line at 2x leverage as the rules state. …

Read More »

Read More »