Category Archive: 9a.) Real Investment Advice

1-6-26 Financial Nihilism vs. Financial Planning

More investors—especially Millennials and Gen Z—are treating markets like a casino. Not because they’re reckless, but because the traditional path to financial security feels broken.

Lance Roberts & Jonathan Penn break down Financial Nihilism vs. Financial Planning: why speculative behavior is rising, and what still works when confidence in long-term investing erodes. Options trading, crypto, meme assets, and betting apps offer fast outcomes...

Read More »

Read More »

Tax-Efficient Investing Strategies

Tax‑Efficient Investing: Keep More of What You Earn Growing wealth is only part of the story. Keeping it, especially after taxes, is where strategy makes the biggest difference. For high-net-worth investors, tax drag can be a persistent leak in performance, especially when taxable income and capital gains stack up inside the wrong accounts. Tax-efficient investing …

Read More »

Read More »

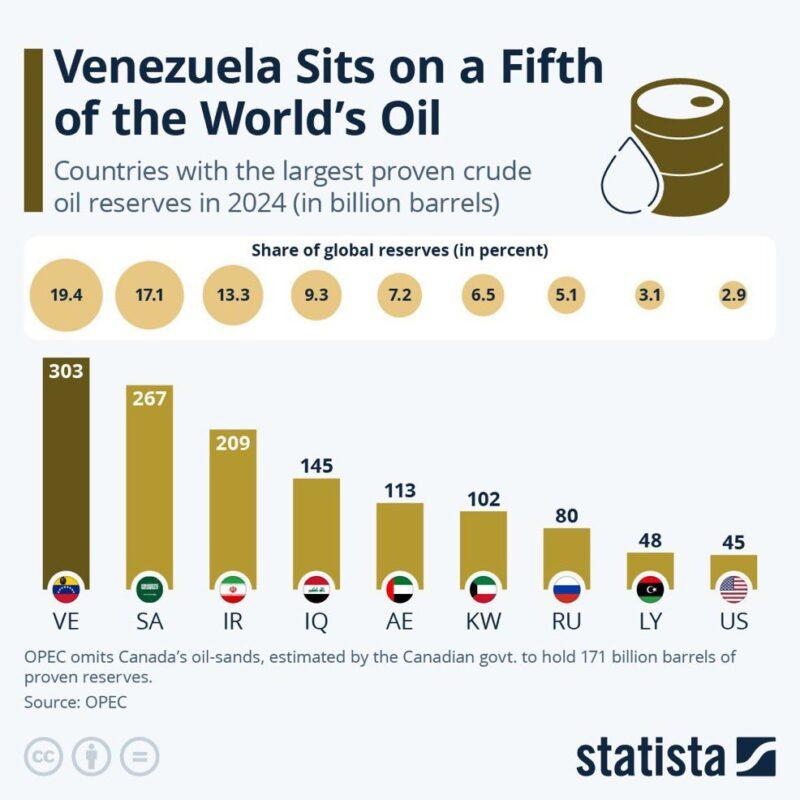

Venezuela Leads Energy Stocks Out Of The Gate In 2026

Venezuela holds 20% of the world's proven oil reserves. Not only are they the largest, but as shown in the Statista graphic below, they hold approximately seven times that of the United States. Despite its large reserves, Venezuela has fallen well short of its ability to supply the world. US sanctions and the significant deterioration …

Read More »

Read More »

1-5-26 Don’t Just Bet on Upside — Prepare for Any Outcome

The outlook for 2026 hinges on how valuations and economic growth play out.

In this Short video, I cover multiple $SPX year-end scenarios and explain why managing ranges matters more than betting on a single target.

📺Full episode: -Z7mJI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-5-26 2026 Market Outlook: Bullish Momentum, Valuation Risks, and What Comes Next

Markets closed 2025 with strong gains, but the path forward into 2026 is far more nuanced than headline optimism suggests.

Lance Roberts reviews what drove 2025’s market performance, why the Santa Claus Rally failed, and how shifting inflation trends, Federal Reserve policy expectations, and valuation levels are shaping market outlooks for 2026.How can investors navigate the New Year with realistic expectations, disciplined risk management, and...

Read More »

Read More »

Precious Metals Aren’t Predicting Economic Collapse

In 2025, the prices of precious metals rose sharply, with silver prices recently surging past $80 per ounce. Of course, when precious metals rise, there is always the same group of commentators (mostly paid newsletter writers and physical metal dealers) to declare that a financial breakdown is underway. Articles like those published on ZeroHedge by …

Read More »

Read More »

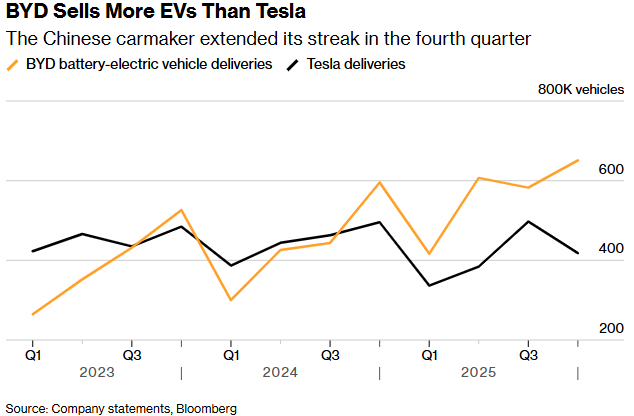

Tesla EV Deliveries Continue to Lag Global Rivals

Tesla EV deliveries totaled 1.64 million vehicles in 2025, leaving the company behind China’s BYD, which delivered more than 2.2 million EVs for the year. The result marks a second consecutive annual decline in Tesla EV deliveries, reinforcing the growing pressure on the company’s core automotive business. Fourth-quarter deliveries fell sharply year over year, underscoring …

Read More »

Read More »

Market Outlook For 2026

🔎 At a Glance 💬 Don't Miss Our Upcoming "Live & In Person" Summit Our 2026 Summit is a limited-seating event, so secure your tickets now before they sell out. Topics Include: I look forward to seeing you there. 🏛️ Market Brief - Strong Year-End Returns Lead to Bullish Market Outlooks Let's start this week … Continue reading...

Read More »

Read More »

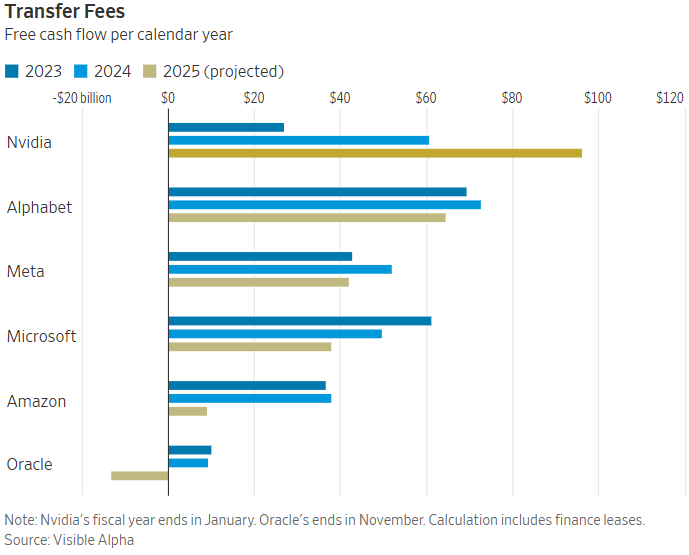

Nvidia’s Cash Strategy Reflects Regulatory Landscape

Nvidia’s explosive growth has created a new challenge: how to deploy an unprecedented amount of cash in a world where scale itself has become a regulatory constraint. The chart below, from The Wall Street Journal, illustrates Nvidia’s massive free cash flow growth. However, traditional uses of its cash, such as large acquisitions, are increasingly difficult …

Read More »

Read More »

Market Volatility Strategies For Investors

Navigating Market Volatility: Strategies for Confident Investing Market volatility has a way of feeling personal. One week your investment portfolio looks steady; the next it’s down, headlines are loud, and every conversation sounds like a prediction. That emotional whiplash is normal. Panic selling is what turns temporary price volatility into permanent damage. For high-net-worth families …

Read More »

Read More »

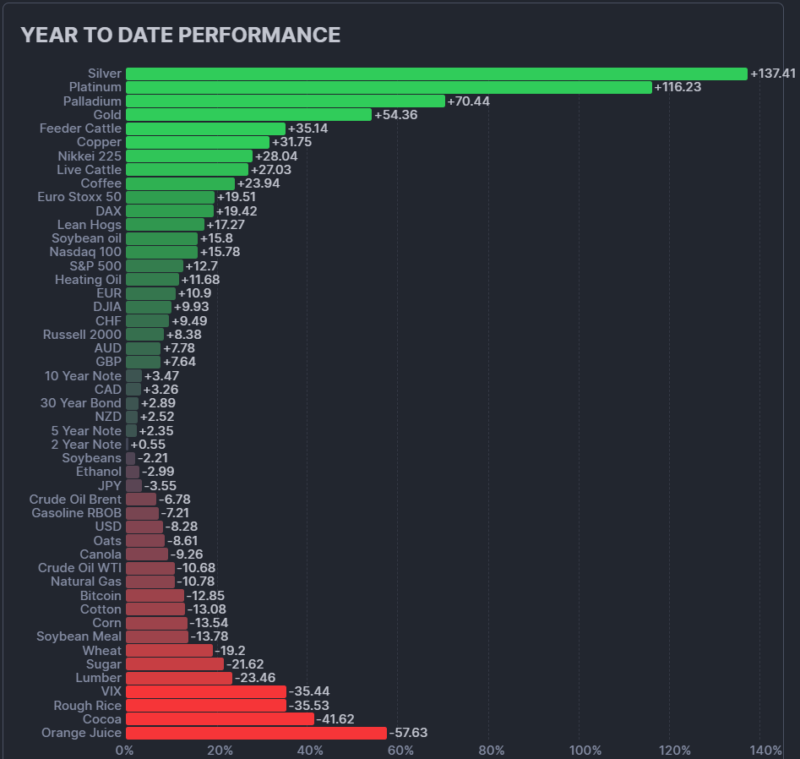

YTD Returns Highlight a Narrow Market

YTD returns across major U.S. asset classes continue to reflect a highly concentrated market. The Finviz chart below does a nice job illustrating YTD returns across a wide array of futures contracts. Large-caps dominate YTD equity returns, while small- and mid-cap stocks lag amid tighter financial conditions and slower earnings growth. Outside of equities, YTD …

Read More »

Read More »

12-30-25 What People Get Wrong About Inflation & Prices ️

Prices aren’t meant to fall in a healthy economy. Inflation is necessary for growth and rising wages, which is why the Fed targets 2%. In this short video, Tom Zizka and I discuss why falling prices usually signal recession—not relief—and once prices reset higher, they rarely return to old lows. If you like this video, please ❤️like and 🔁share!

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

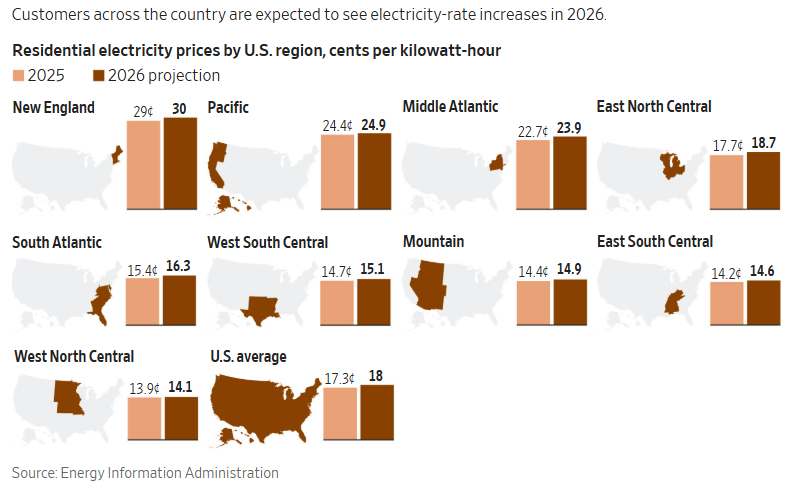

Electricity Prices Could Become a Structural Inflation Problem

Most Americans are paying higher electricity prices, and the pressure is unlikely to ease anytime soon. According to the Wall Street Journal, electricity prices have risen meaningfully across much of the country since 2022, and the drivers extend well beyond the frequently cited surge in data-center demand. While electricity prices had historically tracked inflation, that …

Read More »

Read More »

Financial Planning For Retirement In Your 50s

Financial Planning in Your 50s: Building a Secure Retirement Your 50s can feel like a financial crossroads. Earnings are often strong, responsibilities are real, and time starts acting a little less patient. College may be on the horizon (or underway). Aging parents might need support. Work is busy, life is full, and retirement is no …

Read More »

Read More »

12-29-25 The Hidden Logic Behind Dollar Weakness

The U.S. doesn’t want a permanently strong dollar because it would choke the global economy and destabilize trade.

In this short video, Brent Johnson and I discuss why the U.S. has historically managed the dollar to stay range-bound and how dollar strength or weakness shapes global liquidity and growth.

📺Full interview: -SDg

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

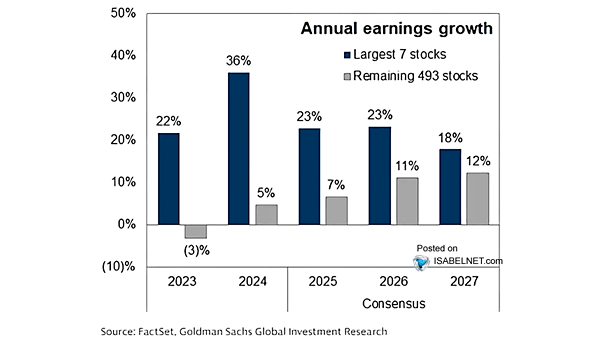

The Market Risk In 2026 If Growth Projections Fail

There is a rising market risk in 2026 that is largely overlooked as we wrap up this year. As discussed in the "Fed's Soft Landing Narrative," optimism about 2026 is running high. Currently, investors are pricing in strong economic growth, robust earnings, and a smooth path of disinflation. Notably, Wall Street estimates suggest a significant …

Read More »

Read More »

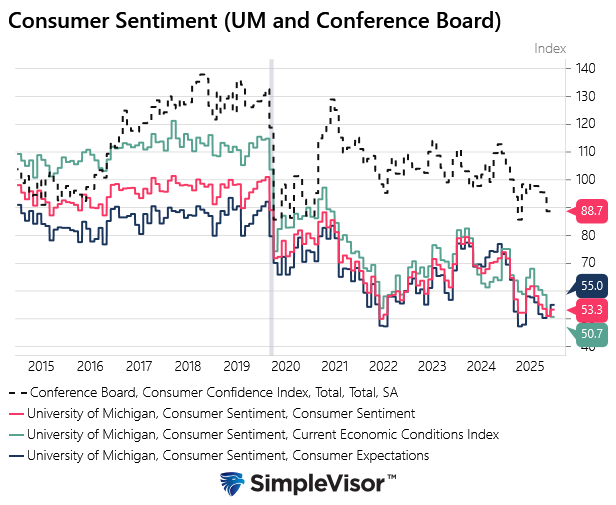

The Consumption Conundrum

GDP, released on Tuesday, showed that the economy grew by a larger-than-expected 4.3%. Powering the strong economic growth was personal consumption, which rose by 3.5%. Consumers are spending!. What's unusual about that statement is that consumer sentiment remains historically weak. Typically, there is a strong correlation between personal consumption and consumer sentiment. As we share …

Read More »

Read More »

12-27-29 The Fed Is Pricing Growth Without Jobs — And That’s the Risk

Markets are pricing in strong growth and big earnings gains next year, but the labor and inflation data point to a slowing economy.

In this short video, Joseph Wang and I discuss why the Fed is relying on productivity rather than job growth to drive the economy—and why that assumption is the key risk to watch in 2026.

📺Full interview:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

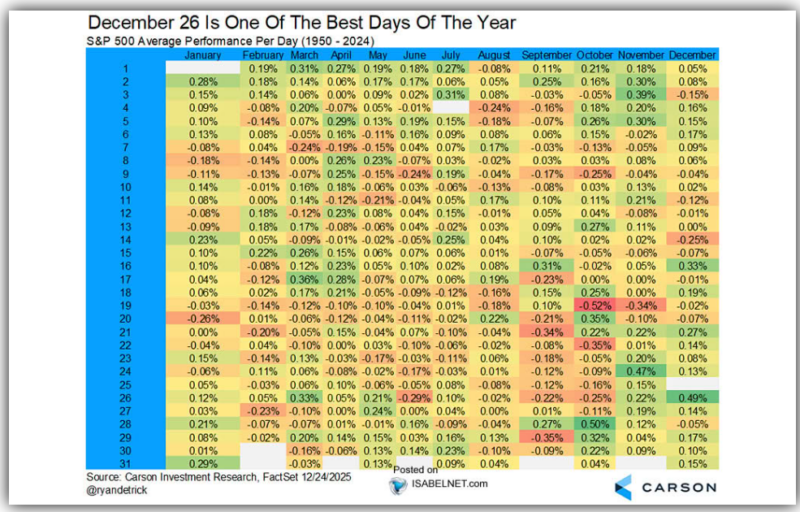

The Santa Claus Rally Begins

🔎 At a Glance 💬 Editor Note I am traveling this weekend for the Christmas holidays with the family. Therefore, I don't have access to all of my usual data and analysis. However, I did not want to miss the opportunity to send you at least a short note. The following Market Brief and Technical … Continue reading »

Read More »

Read More »

12-26-25 Buying Gold Doesn’t Mean You’ve Left the Dollar

Gold $GLD is rallying and everyone’s calling the end of the dollar $DXY — but that story misses a critical detail.

In this short video, Brent Johnson and I discuss why buying gold or commodities like #crudeoil doesn’t mean you’ve escaped the dollar, and what really keeps the dollar in control.

If you like this video, please ❤️like and 🔁retweet

📺Full interview: -SDg

Read More »

Read More »