Category Archive: 9a) Buy and Hold

8-1-25 Don’t Let the Point Spread Fool You

The financial media started in early with headlines about "sweeping" new tariffs and markets tumbling 485-points...only, consider, with the Dow at 43,832, that's only about 1%. So don't let yourself be swayed by sensationalistic headlines.

Hosted by RIA Advisors Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

Zahlen alle Zölle? Alle zahlen Zölle. #welthandel

Zahlen alle Zölle? Alle zahlen Zölle. 📉 #welthandel

Marktgeflüster Podcast #158: KRÄSH incoming? Sell-Trigger von Goldman & BofA aktiv?

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände...

Read More »

Read More »

Zukunft Gold – Das neue Finanzsystem der Welt | Handelswährung | Gold Vaults | Schulden | T-Bills

Die Welt bereitet sich auf ein neues #Finanzsystem vor. Das alte System - wir spüren das alle - gerät aus den Fugen. immer mehr #Schulden in USA und bei uns. Gold, Aktien und Bitcoin erreichen Höchststände. Handelskriege, #Zollstreit und #Kriege lösen einander ab. Die Puzzle-Steine fallen jetzt an ihre Stellen und ich habe ein Modell gefunden, das alles beschreibt. Nichts geschieht zufällig.

-

✘ Werbung:

Mein Buch Politik für Wähler ►...

Read More »

Read More »

8-1-25 Herd Mentality Could Be Costing You Big

Why do investors so often buy high and sell low? Jonathan Penn & Matt Doyle expose the dangers of herd mentality in the stock market, how FOMO (fear of missing out) drives bad decisions, and what behavioral finance teaches us about avoiding costly investing mistakes. Learn how to recognize crowd behavior—and how to protect your portfolio from emotional traps. Jon & Matt also cover market response to new tariffs, and whether markets will...

Read More »

Read More »

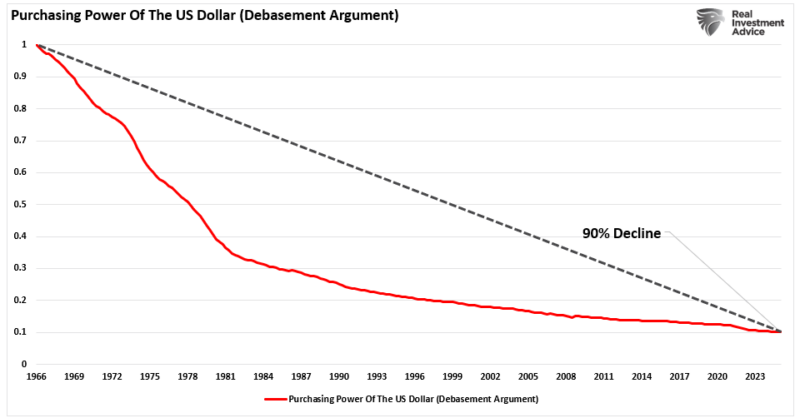

Debasement: What It Is And Isn’t.

Over the past year, financial headlines continue to flood investors with doomsday predictions about the U.S. dollar. Whether it's social media influencers waving "dollar collapse" charts or YouTube personalities warning about debasement, the noise has become deafening. The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs.

Read More »

Read More »

GDP Is Meh: The Bullish And Bearish Headlines Are Misleading

The BEA reported that real GDP grew by 3.0% in the second quarter. Such is almost a percent better than the longer run trend growth rate, and is a cause for optimism for some. However, first quarter GDP was -0.5%, well below trend growth, and worthy of pessimism. The problem with being optimistic about the second quarter or pessimistic about the first quarter is that the threat of tariffs and actual tariffs abnormally impacted the data.

Read More »

Read More »

7-31-25 How High Interest Rates Impact the Housing Market

He housing market is like a pyramid: Younger buyers purchase homes from the generation ahead of them so those buyers can move up. Higher rates are making those houses unaffordable and the pyramid ceases to work.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA.

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

7-31-25 The Fed Holds Firm

The Federal Reserve holds interest rates steady in its latest policy meeting, signaling a firm stance amid inflation concerns, and despite unchecked market bullishness. Lance Roberts & Michael Lebowitz break down what the Fed's decision means for investors, the economy, and your portfolio. AI datacenter buildouts are showing up in economic data...but, the 3% GDP print has a more dire undertone: Strip out the build outs, and the economy is...

Read More »

Read More »

Dissent In The Fed Ranks

December 2024 marked the second-to-last time there was a dissent by an FOMC voting member. The dissent, at the time, was a sole vote by Jefferey Schmid against cutting rates. The last dissent was yesterday. While the Fed voted to maintain the Fed Funds rate at 4.25-4.50%, Michelle Bowman and Christopher Wallace cast dissenting votes in favor of reducing rates.

Read More »

Read More »

Steuererklärung im Studium? Und man kann nachreichen! #steuern

Steuererklärung im Studium? Und man kann nachreichen! 💡 #steuern

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

4 % Zinsen bei der Deutschen Bank?

Und das, obwohl uns das viel Geld kostet: Die Deutsche Bank bietet 4 % Zinsen für Festgeld für sechs Monate. Das klingt erst mal stark. Warum empfehlen wir diesen Deal nicht? Schließlich könnten wir, wenn wir da einen Affiliate-Link für dieses Festgeld bekommen, eine Menge Geld damit verdienen.

Deswegen: Wir sind Teil der gemeinnützigen Finanzstiftung und arbeiten somit 100 % unabhängig und empfehlen immer nur etwas, von dem wir auch zu 100 %...

Read More »

Read More »

Home Office oder Pendeln? #steuern

Home Office oder Pendeln? 💼 #steuern

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

Trump diktiert, Europa zahlt: Der wahre Deal hinter seiner Zollpolitik

Trump, Zölle & Europa: Wer hat hier wirklich die Macht?

Ursula von der Leyen reist überraschend nach Schottland und plötzlich fließen hunderte Milliarden aus Europa in die USA.

Was steckt dahinter? Und warum ordnen sich plötzlich selbst die größten Industrienationen den Vorgaben von Donald Trump unter?

Gerald analysiert die aktuellen Entwicklungen rund um Strafzölle, Energieabkommen und milliardenschwere Investitionen und zeigt, was das für...

Read More »

Read More »

Zuseherfrage zur Informationsbeschaffung und Wissensaneignung

Ein Zuseher fragt mich, wie ich mich informiere und wie ich Fakten und Zusammenhänge finde, die zu meinen Videos führen. Es geht um Kanäle und Medien aus deren Inhalte ich meine YouTube-Beiträge erzeuge und die Art und Weise, wie ich sie finde.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch...

Read More »

Read More »

Eure krassesten Vertragsklauseln | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_EjdW1OR8OOQ

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_EjdW1OR8OOQ

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_EjdW1OR8OOQ

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_EjdW1OR8OOQ

Justtrade* ►...

Read More »

Read More »

7-30-25 How to Effectively Hedge Against Inflation

IIt's a mega-earnings report day, and a Fed Meeting day, to boot; the notion among some investors that 20% returns are normal is scary. The Fed is expected to hold steady on interest rates, but there is dissention in the ranks of Fed Governors. Inflation erodes your purchasing power—are you prepared? Lance Roberts & Danny Ratliff break down smart strategies to hedge against inflation and protect your wealth. Lance and Danny commiserate on kids...

Read More »

Read More »

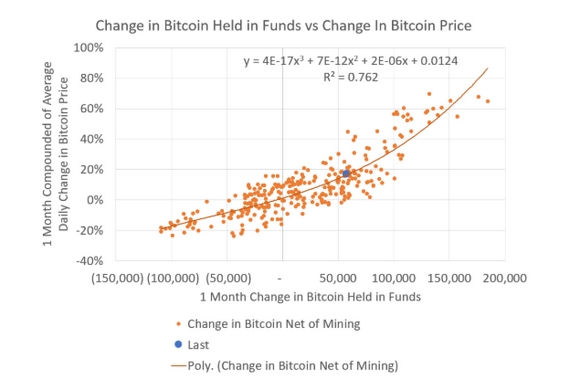

A Ponzi Scheme: The Graph Driving MicroStrategy And Others

The graph below, from Michael Green (@profplum99), is the best way to show the logic that drives a Ponzi scheme in Bitcoin. The Ponzi scheme graph illustrates that there is a robust correlation between changes in the amount of Bitcoin held in funds (ETFs) and the price change. Simply, as new capital is used to …

Read More »

Read More »

The High Beta Melt Up: Echoes Of 1999

In our recent article, "The Magnificent Seven Are Mediocre," we pondered whether the stock market is entering a melt-up phase, where investors driven by extreme speculative behavior and hopes for exponential returns favor volatile stocks with high betas. To be clear, we do not know whether we are in a melt-up phase. The market could …

Read More »

Read More »

Die bestbezahltesten Minijobs! Kennst du noch mehr? #minijob

Die bestbezahltesten Minijobs! 💸 Kennst du noch mehr? #minijob

🎥 Bestbezahlte Minijobs: 556€ (steuerfrei) mit diesen Nebenjobs!: ?si=RChf7mBy2fw8eCch

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »