Category Archive: 9a) Buy and Hold

Nvidia Deals: Round Tripping Or Vendor Financing?

“Nvidia takes a $1 billion stake in Nokia” reads a recent CNBC headline. As part of the agreement, Nokia commits to purchasing Nvidia’s AI chips and computer platforms. Additionally, the companies will collaborate to develop 6G cellular technology. Deals like this are becoming more common in the AI industry. Some view Nvidia’s recent investment in …

Read More »

Read More »

Tariffs Are On The Docket: Will SCOTUS Upset The Market?

The Supreme Court (SCOTUS) will begin hearing arguments challenging President Trump’s use of tariffs. Given the market volatility that tariffs have generated over the last six months, the SCOTUS case could prove to be yet another market-moving event. The tariff challengers argue that the administration overstepped its bounds under the 1977 International Emergency Economic Powers …

Read More »

Read More »

Wofür geben Deutsche ihr Geld aus? #konsum

Wofür geben Deutsche ihr Geld aus? 💶 #konsum

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

11-10-25 The Rocket Market: AI, Risk, and What Comes Next

Markets have rocketed higher for six straight months — but how long can it last?

Hedgefund Telemetry founder, Tom Thornton joins Lance Roberts to unpack the forces driving this “Rocket of a Stock Market.” From AI euphoria and sector rotation to passive indexing risks and the Fed’s impact on valuations, we dig into what’s really happening under the surface.

#StockMarketAnalysis #AIBubble #InvestorSentiment #MarketVolatility #TomThornton

Read More »

Read More »

¿Cómo Emprender en Familia? Tips para Lograrlo con Éxito – Alexandra González & Fernando González

👉 https://realmentor.net/rd 👈 ENTRA AQUÍ y descubre el SISTEMA de PADRE RICO que te enseña a construir activos, crear ingresos que no dependan de tu tiempo y acelerar tu libertad financiera con Fernando González-Ganoza, mentor hispano y representante oficial de Robert Kiyosaki por casi tres décadas.

En este nuevo episodio, Fernando González conversa con su hija Alexandra González sobre uno de los temas más poderosos (y más complicados) del mundo...

Read More »

Read More »

11-4-25 Reality Check For AI Hype Starts Now

AI stocks are finally facing reality after months of run-ups. Stocks like $PLTR and $META crushed earnings but aren’t being rewarded, as investors are finally questioning their sky-high valuations.

In today’s video, I explain why the AI boom faces its first true test—and why managing risk now matters more than ever.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Debatte um den digitalen Euro 🇪🇺 #ezb

Debatte um den digitalen Euro 🇪🇺 #ezb

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Buch: Der Digitale Euro – Dominik Kettner | Die größte Enteignung der Geschichte

Der #DigitaleEuro steht vor der Tür. Mit ihm kommt eine Verordnung der EU, die viele politische Ansinnen an die neue digitale #Zentralbankwährung knüpft. Verfolgbarkeit aller Transaktionen durch die #e-ID, Festlegung von Höchstgrenzen für Besitz und Transaktionen. Dazu Möglichkeit der Sanktionierung von Individuen und Gruppierungen. Die neue Währung wird alles enthalten, was den Bürger transparent machen wird. Freiheit ade!

-

✘ Werbung:

Mein Buch...

Read More »

Read More »

Dem Markt geflüstert: Amundi MSCI World 2x #hebel

Dem Markt geflüstert: Amundi MSCI World 2x 🌍 #hebel

Das gesamte Video findest du auf unserem Youtube-Kanal: 🎥 NEU! MSCI World 2x Hebel ETF: Warum eigentlich nicht?

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum...

Read More »

Read More »

11-4-25 Smart or Risky? How Investors Are Adapting to Today’s Markets

In this episode, we explore how today’s investors are adapting to volatility, inflation, and complexity across markets.

Lance Roberts & Jon Penn explore Structured Notes: These complex instruments promise tailored returns, but they come with tax pitfalls and credit risks investors must understand before buying. We’ll break down how structured notes work—and why they may belong inside an IRA rather than a taxable account.

The Return of...

Read More »

Read More »

Amazon And OpenAI: Yet Another Massive Investment In AI

Yesterday morning, OpenAI announced a massive $38 billion strategic partnership with Amazon Web Services (AWS). This deal highlights OpenAI's diversification strategy amid explosive growth and capacity demands for training advanced models like ChatGPT. Before the deal, OpenAI relied 100% on Microsoft for its cloud infrastructure. In addition to diversifying its cloud servers, the deal may …

Read More »

Read More »

11-24-25 Solana vs Bitcoin: The New Treasury Strategy

Is Solana the next evolution of Bitcoin’s corporate playbook? Lance Roberts and DeFi Development Corp. CFA, Parket White, explore how digital assets like Solana, stablecoins, and tokenized treasuries are reshaping balance sheet strategy for companies and investors alike.

💡 From Bitcoin to Solana, learn how digital asset treasuries are changing the rules of modern finance.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO...

Read More »

Read More »

🧀 Parmesan kaufen = reich sein?

🧀 Parmesan kaufen = reich sein?

🎤 Wir haben euch gefragt, was ihr mit 1 Mio Euro machen würdet.

Parmesan, Wohnung oder Uhr? Wie würdet ihr die Million investieren?

#️⃣ #straßenumfrage #geldanlage #millionär

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle...

Read More »

Read More »

10€ sind nichts mehr wert

Fast 10 € für Würstel mit Brot und Wasser. 🌭💸

Ganz ehrlich: 10 € sind heute nichts mehr wert.

Und was macht die Masse?

👉 Jammern. Meckern. Schuld beim Staat suchen.

Falsch. ❌

Wenn du nicht willst, dass dein Geld jeden Tag weniger wert ist, musst du dir überlegen, wie du finanziell frei wirst.

Die Preise steigen sowieso.

Die Frage ist nur: Bist du der, der zahlt oder der, der profitiert?

#investmentpunk

#inflation...

Read More »

Read More »

The Rules of Money the Rich Follow — and You Don’t – Andy Tanner, Del Denney

🎯 Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Most people spend their entire lives working for money—without realizing the rich play by completely different rules. In this episode of Stockcast, Andy Tanner and Del Denny break down the Rich Dad Rules of Money that separate investors from employees.

You’ll learn why the poor and middle class trade time for paychecks, while the rich focus on...

Read More »

Read More »

News zu den Credit-Suisse-Anleihen #at1

News zu den Credit-Suisse-Anleihen 🏦 #at1

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

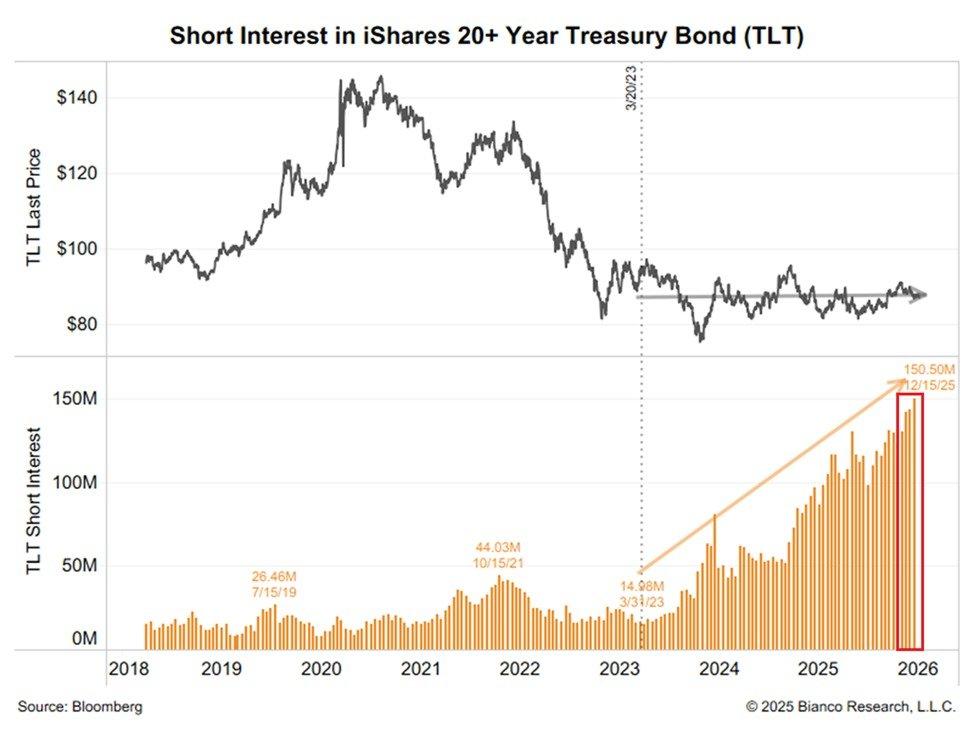

11-3-25 The Pavlovian Market: How Fed Trained Investors To Take Big Risks

Markets got addicted to the Fed.

In this Short video, I explain how years of interventions created a Pavlovian market where traders take bigger risks, expecting the Fed to save them every time — the essence of moral hazard.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »