Category Archive: 9a) Buy and Hold

Diese 3 Dinge solltest du noch in diesem Jahr erledigen! ️ #2023 #2024

Diese 3 Dinge solltest du noch in diesem Jahr erledigen! ?️ #2023 #2024

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Electric Vehicle Subsidies Exposed – Mike Mauceli, Ron Stein

How realistic is it for electricity alone to “fuel” this world? How ethical is it for the US government to subsidize the manufacturing of EVs and the mining of its parts overseas?

In this episode, Ron Stein joins Mike Mauceli in discovering why automakers are abandoning EV production, a breakdown of the different types of energy, and where we may be headed next.

-----

Please read carefully.

This is not financial advice. You may be asking, “What...

Read More »

Read More »

DARUM solltest du NICHT über Airbnb vermieten! ?#shorts

? https://gratis-workshop.com/yts ? Jetzt Gratis Workshop-Platz sichern!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den...

Read More »

Read More »

Is 2024 Optimism Misplaced? (12/5/23)

(12/5/23)

Hosted by RIA Advisors' Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

--------

The latest installment of our new feature, Before the Bell, "Is a Sell-off Nigh for the Magnificent Seven?" is here: &list=PLwNgo56zE4RAbkqxgdj-8GOvjZTp9_Zlz&index=1

-------

Our previous show is here: "Will You Be Visited by Ghosts of Financial Mistakes-past?"...

Read More »

Read More »

Errätst Du dieses Wort? #beamtendeutsch #quiz #verböserung

In der Welt der Steuern, Finanzämter und Aktenregale gibt es einige Wörter, die Normalsterbliche außerhalb noch nie gehört haben. "Verböserung" ist so eines. Errätst Du, was es bedeutet?

Die Lösung gibt's im Video zum Einspruch gegen den Steuerbescheid.

Read More »

Read More »

Wer viel verdient, wählt die FDP? Wer wenig verdient, die Linken? ️ #politik #shorts

Wer viel verdient, wählt die FDP. Wer wenig verdient, die Linken? ?️ #politik #shorts

Abonniere unseren Newsletter: https://www.finanzfluss.de/memo-sign-up/

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot-id755 *?

45 Min. Gratis-Webinar für Anfänger: ►► https://finanzfluss-campus.de/webinar-yt-ig/ ??

ℹ️ Ganz so extrem ist es natürlich nicht. Doch unser Einkommen beeinflusst, wie wir zu Parteien und zur Regierung allgemein...

Read More »

Read More »

Is the ‘Everything’ Rally Over?

(12/4/23) Welcome to the first full week of December trading; a review of Mrs. Roberts' Birthday Weekend; market-wise, the stock buy back window is closing; expectations for a hawkish Fed statement next week; mutual fund distributions are coming; be cautious about being overly bullish. Rotations from the Magnificent Seven are beginning; the 'Everything' Rally went too far, too fast. We're back where we were in July; losses were mitigated by the...

Read More »

Read More »

15 finanzielle To-Dos, die du zum Jahreswechsel beachten solltest!

15 Finanztipps, die du noch 2023 umsetzen solltest!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=757&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://finanzfluss-campus.de/angebot-youtube/?utm_source=youtube&utm_medium=757&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

Die niedrigste Rente in Deutschland ?? #altersarmut

Das ist die niedrigste Rente, die Du in Deutschland bekommen kannst: Gesetzliche Rente, Grundrente und Grundsicherung erklärt.

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=XvewpCdTlJU

Unsere ETF-Empfehlungen ► https://www.finanztip.de/indexfonds-etf/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=XvewpCdTlJU

? Jetzt Finanztip...

Read More »

Read More »

Wie wird man vom Angestellten zum Immobilien-Unternehmer? – Teil 2

?https://kurs.betongoldtraining.com/yt

?Wie Du Dir mit Immobilien ein Vermögen aufbaust

Viele träumen davon, ihre Arbeit aufzugeben, um als #Immobilieninvestor und #Unternehmer zu leben. Jürgen Nussbaumer und sein Bruder haben diesen Traum verwirklicht, dank harter Arbeit und fundiertem Wissen. In diesem Business Talk mit dem österreichischen Immobilieninvestor und Selfmade-Millionär Gerald Hörhan, auch bekannt als der "Investmentpunk",...

Read More »

Read More »

Millionär werden durch Pfand sammeln ?

Millionär werden durch Pfand sammeln ?

? 25 Cent erhält man für eine Einwegflasche, Mehrwegflaschen bringen einem 15 Cent ein. Geübte Sammler sollen pro Tag ungefähr 20 Flaschen sammeln, etwa 5€.

#️⃣ pfand #pfandsammeln #pfandgehörtdaneben #millionär

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre...

Read More »

Read More »

Teure Alt-Fonds im Depot: In ETF tauschen oder halten? | Saidis Senf

Teure Immobilienfonds: Lohnt sich der Tausch in ETFs?

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=ldTSzqF71LU

Unsere ETF-Empfehlungen ► https://www.finanztip.de/indexfonds-etf/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=ldTSzqF71LU

? Jetzt Finanztip Unterstützer werden:...

Read More »

Read More »

Immobilienkauf – war es früher wirklich leichter ️ #immobilien #shorts

Immobilienkauf - war es früher wirklich leichter ?️

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=756&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://finanzfluss-campus.de/angebot-youtube/?utm_source=youtube&utm_medium=756&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

?...

Read More »

Read More »

Expert: Why Single-Family Homes Won’t Crash – John MacGregor, Ken McElroy

John MacGregor hosts real estate mogul Ken McElroy who shares his journey from managing apartments in college to building a successful real estate empire. He emphasizes the importance of property managers in the buying process and shares his aggressive approach to real estate investing.

Ken also provides his insights on the current real estate market, the economy, and the impact of factors like interest rates. He discusses his philosophy of being...

Read More »

Read More »

Will You Be Visited by Ghosts of Financial Mistakes-past?

(12/1/23) The next James Bond movie should be called, "Convexity," starring Michael Lebowitz; looking at the Climate Summit: What's on Bill Gates' agenda? ESG is a farce; it's all about big business; eating bugs and drinking beetle juice. How to execute Thematic Investing; what are the rules needed to manage? The Magazine of Wall Street: How times have changed. Financial Ghosts-past: learning from your mistakes. Calculating your personal...

Read More »

Read More »

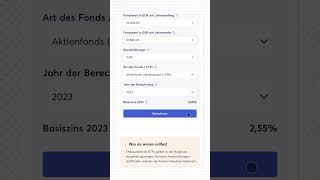

So berechnest du die Vorabpauschale ? #vorabpauschale #shorts

Nach 2 Jahren fällt 2023 nun wieder die Vorabpauschale auf Fonds und ETFs an. Die Vorabpauschale ist eine Steuer, die auf Investmentfonds anfällt. Sie wurde 2018 eingeführt, um sicherzustellen, dass Anleger ihren fairen Anteil an Steuern zahlen, auch wenn sie ihre Gewinne über Jahrzehnte nicht realisieren.

Kostenloses Depot eröffnen: ►►...

Read More »

Read More »

Doing the Bond Math Amid Fiscal Dysfunction

(11/30/23) Face-off Movie, Bond Math, and Market Preview: How does the Consumer continue to spend? Texas' Christmas spending habits = $817/avg. Budgeting for Christmas w price pressure in mind. Will interest rates be but next year (why wouild the Fed do that)? Michael Lebowitz helps crunch the Bond Math: What price changes mean in the Bond Market. What is the credit risk to consider? How will you be paid? Recession is inevitable; how long do you...

Read More »

Read More »

Is Suze Orman Right About Taking Vacations?

Some financial gurus say the only way out of debt is by cutting up your credit cards, forgoing your daily coffee (or avocado toast), or even putting your credit card in a freezer. Basically, what they’re saying is “Live below your means.”

At Rich Dad, we say you shouldn’t live below your means. Rather we say you should expand your means by purchasing assets so that eventually the income from your assets pays for things like clothes, an iPhone, a...

Read More »

Read More »

Der tiefe Fall des Rene Benko [Was passiert jetzt?] Investmentpunk LIVE!

?https://kurs.betongoldtraining.com/yt ??Wie Du Dir mit Immobilien ein Vermögen aufbaust

Die #Signa Holding vom Tiroler Immobilien Tycoon Rene #Benko meldet Insolvenz an. Insgesamt geht es um Schulden in Milliardenhöhe. Wer aller betroffen ist und welche Kreise der Bankrott nach sich ziehen könnte, analysiert heute der österreichische Selfmade Immobilien Millionär Gerald Hörhan aka. Der Investmentpunk.

Wer ist Gerald Hörhan?

Der österreichische...

Read More »

Read More »

Was versteckt sich hinter grünen ETF-Kürzeln? SRI & ESG erklärt

Grüne Aktien-ETFs gibt es viele – aber wie findest Du den, der Deiner Vorstellung von Nachhaltigkeit am ehesten entspricht? Saidi erklärt Dir kurz und knapp SRI, ESG und Co. und erleichtert Dir die Auswahl für Deine Geldanlage.

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=shorts

Unsere ETF-Empfehlungen ►...

Read More »

Read More »