Category Archive: 9a) Buy and Hold

Proof: How Inflation is Affecting the Economy

Super Tuesday seems to have locked-up the next Presidential contest pairing; economic data is not so good, yet market exuberance continues. Fed speakers abound today ahead of the Fed's blackout period. A record-setting Yield Curve Inversion is underway, still without recession. Markets continue to trade in a narrow range, like clockwork; volatility actually declined. Are we at the top, and not a bubble? Correction this year is very likely; Bitcoin...

Read More »

Read More »

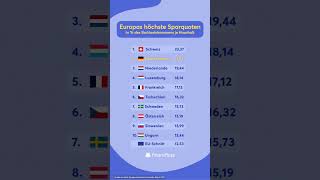

Europas höchste Sparquoten #sparen

Europas höchste Sparquoten ? #sparen

je Haushalt in Prozent des Bruttoeinkommens

? Quelle: eurostat, Sparquote privater Haushalte, Stand 2022

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du...

Read More »

Read More »

Can Green Energy Actually Work? – Mike Mauceli, Dan Kish

In this episode of 'The Energy Show', host Mike Mauceli discusses upcoming changes and potential costs related to transitioning to green energy, with guest Dan Kish, Senior Vice President of Policy at the Institute of Energy Research.

They discuss the drawbacks and challenges associated with the use of wind and solar energy, including issues related to grid capacity, energy prices, and foreign dependencies.

Kish reveals people in power know it...

Read More »

Read More »

Die Aktienrente kommt? ?

Die Aktienrente kommt? ?

? Die Bundesregierung hat ein neues Rentenpaket vorgestellt, in dem es auch neue Pläne für die Aktienrente gibt.

#️⃣ #aktienrente #deutschland #bundesregierung #altersvorsorge #rente

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle...

Read More »

Read More »

Ab welchem Alter lohnt sich die gesetzliche Rente? #rente

Ab welchem Alter lohnt sich die gesetzliche Rente? ??#rente

? Wir haben mal durchgerechnet, wann man mit der gesetzliche Rente Gewinn macht. Die Auszahlungen also höher sind als die Einzahlungen.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle...

Read More »

Read More »

5% aufs Tagesgeld: Wo ist der Haken? | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_ggKAoRXszpQ

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_ggKAoRXszpQ

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_ggKAoRXszpQ

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_ggKAoRXszpQ

Justtrade

Traders Place* ►...

Read More »

Read More »

Flugzeuge und Raketen – Funktionsweise und Antriebsprinzipen

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

#Flugzeuge fliegen per aerodynamischem #Auftrieb. Beim Antrieb gibt es schon zwei Möglichkeiten. Man kann ebenfalls mit Auftrieb (Propeller, Fan) oder mit Schub (Düsentriebwerk) und #Impulsantrieb fliegen. Bei Raketen gibt es wegen des luftleeren Raums nur...

Read More »

Read More »

Kinder im Studium sind teuer: So gehst Du damit um #shorts

Wenn die Kinder erwachsen werden ist man oft im Zwiespalt. Finanziell unterstützen oder eigene Selbstständigkeit fördern? Saidi zeigt Euch, wie Ihr einen Kompromiss finden könnt.

#Finanztip

Read More »

Read More »

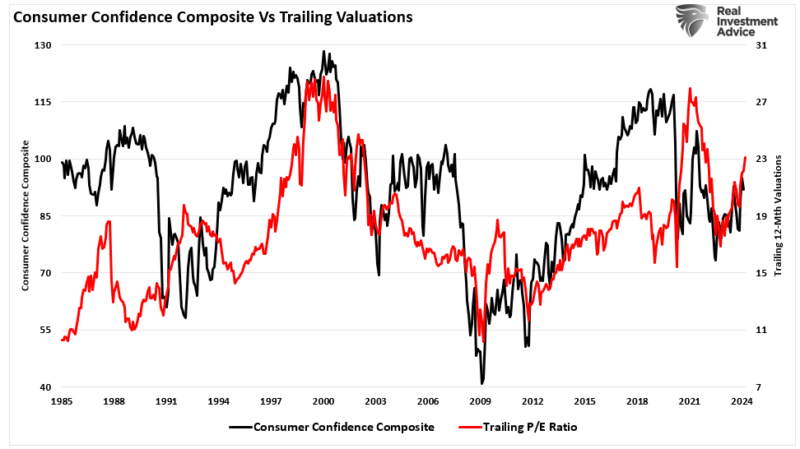

Valuation Metrics Suggest Investor Caution

Economic Data releases and Fed speeches today will resonate with a rising commentary of no rate cut(s) this year, thanks to sticky inflation. Target's earnings show the consumer is still spending; markets continue in 4-month advance, longest since 1970. Preceding a correction? Markets are operating in a narrow trend channel, with money rotating out of Magnificent Seven Stocks and into meme stocks. Markets are in the midst of bullish exuberance;...

Read More »

Read More »

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Millionär in 5 Schritten – Dein Blueprint zum Reichtum

Denken wie die reichsten 1%

?https://gratis-workshop.com/yt (Gratis Workshop)

??Mit Immobilien Vermögen aufbauen [Step by Step Anleitung]

?https://kurs.betongoldtraining.com/yt

Jeder, der fleißig und geschäftstüchtig ist, kann #Millionär oder Multi-Millionär werden!

Doch welche Schritte muss man konkret gehen um dieses #Ziel zu erreichen? Welche Fallen muss man umgehen? Das alles und viel mehr erklärt dir heute der österreichische...

Read More »

Read More »

Strom nur beziehen, wenn er billig ist? ️#strom

Strom nur beziehen, wenn er billig ist? ⚡️#strom

? Das versprechen sich viele von einem dynamischen Stromtarif: Statt dem Stromanbieter jeden Monat einen pauschalen Fixpreis zu zahlen, wird bei einem dynamischen Tarif der jeweils geltende Börsenpreis bezahlt - also der Preis, zu dem Strom gerade an der Energiebörse gehandelt wird.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen....

Read More »

Read More »

Spartipp für Sportfans: Trikots 50% günstiger bekommen #shorts

Josefine hat einen kleinen Tipp für Euch, wie Ihr als Sportfan auch beim Merch Eures Lieblingsvereins Geld sparen könnt.

#Finanztip

Read More »

Read More »

Warren Buffett’s Cash Dilemma

Markets are entering the three strgonest months of the year; what if interest arwets aren't cut? February was unusually strong for a "weak" month; what happens during Presidential Election years? Looking at Volatility risk. Markets have been up for 16 of the past 18-weeks; such activity generalluy heralds a correction. Warren Buffett's annual letter: What do to with $160-B in cash? The dilemma of cash and valuations; cash held by...

Read More »

Read More »

Rente: Ab welchem Alter lohnen sich die Beiträge?

Ab welchem Alter lohnt sich die gesetzliche Rentenversicherung?

Unser Depot-Testsieger: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=772&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

3 wichtigste Argumente für eine Kreditkarte #shorts

Egal ob für Mietwägen, Hotelzimmer oder Ähnliches. Im Ausland ist eine Kreditkarte deine beste Wahl. Xenia und Emil erklären dir, warum du damit zusätzliche Kosten vermeidest und mehr Schutz bei deinen Einkäufen hast.

#Finanztip

Read More »

Read More »

Sind Aktien und Börse Glücksspiel? #aktienmarkt

Sind Aktien und Börse Glücksspiel? ? #aktienmarkt

? An dieser These ist tatsächlich was dran, aber lass es mich erklären. Für unser Beispiel nehmen wir den MSCI World, ein Anlageprodukt, das in etwa 1600 Unternehmen aus 23 Ländern und in verschiedenen Branchen investiert. Im schlechtesten Jahr, 2008, hat der ETF einen Verlust von -42% gemacht, im besten Jahr hingegen +39% an Wert gewonnen...

? 2015 haben wir es uns zur Mission gemacht, Menschen...

Read More »

Read More »

In diese Krankenkassen solltet Ihr 2024 wechseln #shorts

Du möchtest deine Krankenkasse wechseln und weißt nicht, wo Du anfangen sollst? Wir haben sie miteinander verglichen und helfen Dir, die beste gesetzliche Krankenkasse für Deine Bedürfnisse zu finden.

#Finanztip

Read More »

Read More »

Mehr Gehalt rausholen: Komplette Beispiel-Verhandlung (Tipps & Fehler)

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_ElLlVoFlgYU

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_ElLlVoFlgYU

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_ElLlVoFlgYU

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_ElLlVoFlgYU

Justtrade

Traders Place* ►...

Read More »

Read More »

Moderne Kriegsführung – Die Demokratisierung des Krieges –

✘ Werbung:

Mein Buch Katastrohenzyklen ► htts://amazon.de/d/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► htt://ts.la/theresia5687

Mein Buch Allgemeinbildung ► htts://amazon.de/d/B09RFZH4W1/

-

Die technischen #Entwicklungen der vergangenen Jahrzehnte haben für eine umfassende Veränderung der #Rüstungsgüter und der #Kriegsführung geführt. Es ist ein neuer #Rüstungswettlauf entstanden, den der Westen wohl nicht gewinnen kann. Ganz im Gegenteil, der Westen...

Read More »

Read More »