Category Archive: 9a) Buy and Hold

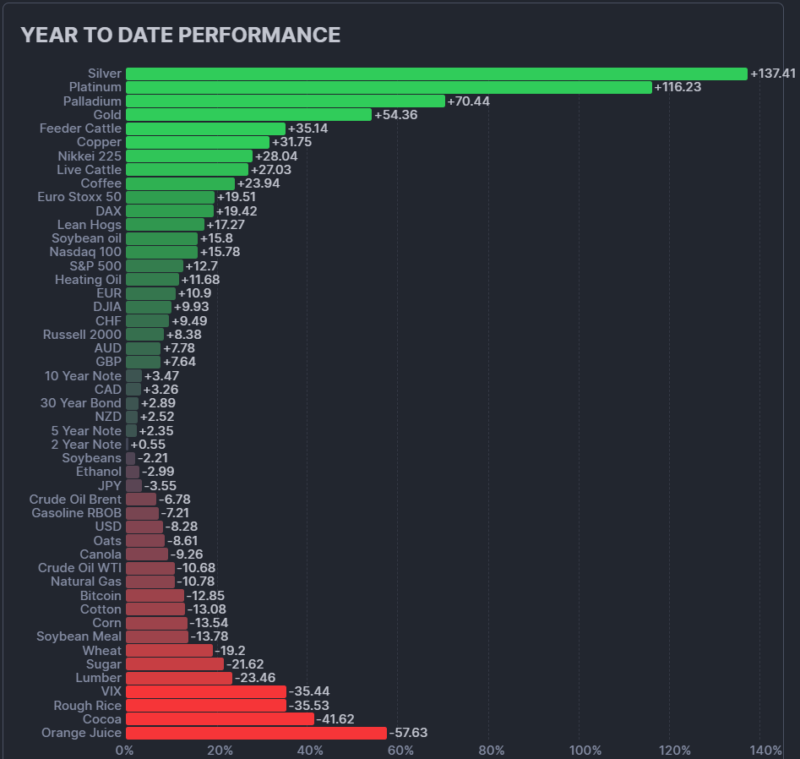

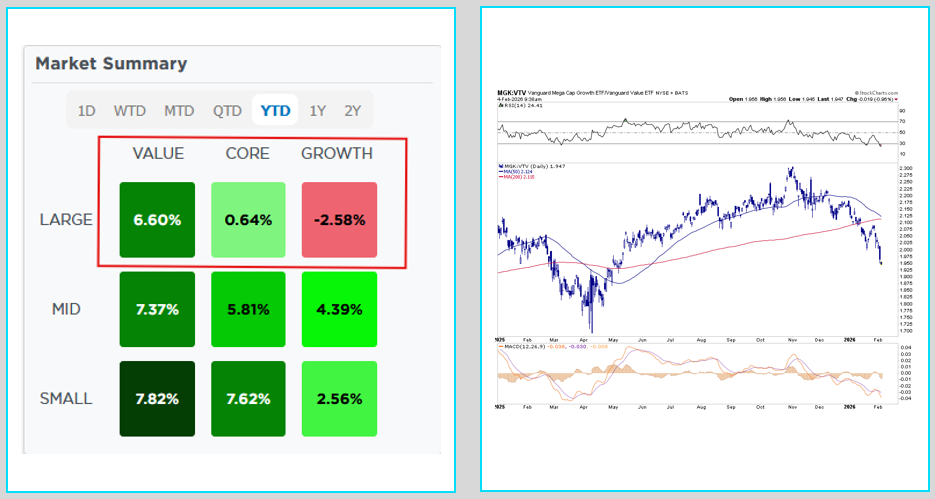

YTD Returns Highlight a Narrow Market

YTD returns across major U.S. asset classes continue to reflect a highly concentrated market. The Finviz chart below does a nice job illustrating YTD returns across a wide array of futures contracts. Large-caps dominate YTD equity returns, while small- and mid-cap stocks lag amid tighter financial conditions and slower earnings growth. Outside of equities, YTD …

Read More »

Read More »

Wann willst Du in Rente gehen?

Wann willst Du in Rente gehen? 🧓🏽👵🏼

📊 Das Renteneintrittsalter ist gestiegen – aber die gesetzliche Regelaltersgrenze steigt noch schneller!

🟠 Frauen und Männer gingen jahrzehntelang im Schnitt früher in Rente als gesetzlich vorgesehen.

📈 Seit ein paar Jahren klettern die tatsächlichen Eintrittsalter aber immer näher an die Regelgrenze heran.

👥 2020 lagen beide Geschlechter bei etwa 64,6 Jahren – Tendenz steigend. Die Regelaltersgrenze? Über 65...

Read More »

Read More »

Rente wird steigen, Krankenkassenbeiträge aber auch

Rente wird steigen, Krankenkassenbeiträge aber auch 📈

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

12-30-25 What People Get Wrong About Inflation & Prices ️

Prices aren’t meant to fall in a healthy economy. Inflation is necessary for growth and rising wages, which is why the Fed targets 2%. In this short video, Tom Zizka and I discuss why falling prices usually signal recession—not relief—and once prices reset higher, they rarely return to old lows. If you like this video, please ❤️like and 🔁share!

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

Multimillionär fliegt Ryanair (nicht was du denkst)

Von der Privatlimousine in den Ryanair-Flieger 😅

Direkt ins Private-Aviation-Terminal. An den Massen vorbei. ⏱️

Warum?

Weil Zeit mein knappstes Asset ist.

Ich kann es mir nicht leisten, 2 Stunden vor Abflug bei der Gepäckabgabe zu stehen, Verspätungen auszusitzen und meine Energie zu verbrennen.

Flugzeug war Ryanair. Mindset war Private Aviation.

#mindset

#zeitistgeld

#investmentpunk

Read More »

Read More »

Silber Boom erreicht 100$/oz? | Bärenfalle, Ghost Week und Unterschied New York und Shanghai

Silber hat einen extremen Anstieg von 170% in 2025 erreicht. Zum Jahresende kämpfen die Beteiligten und höhere und niedrigere Preise. Bei den einen geht es ums wirtschaftliche Überleben, bei den anderen um die Höhe der Boni. Wir sehen heute etwas hinter die Fassade.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ►...

Read More »

Read More »

2026 wird zum Wendepunkt: Diese Entscheidungen bestimmen die Märkte

Das Jahr 2025 war turbulent – politisch, wirtschaftlich und geopolitisch. 2026 könnte noch entscheidender werden. In diesem Jahresausblick analysiert Gerald Hörhan, der Investmentpunk, welche Faktoren darüber entscheiden, ob uns ein neuer Boom oder ein massiver Crash an den Finanzmärkten bevorsteht.

Im Fokus stehen dabei vor allem die US-Notenbank, die Geldpolitik nach dem Ende der Amtszeit von Jerome Powell, mögliche aggressive Zinssenkungen...

Read More »

Read More »

So viel Geld verballert Deutschland an Silvester

So viel Geld ballert Deutschland in die Luft 🎆

💥 2024 wurden voraussichtlich 197 Mio. € für Silvesterfeuerwerk ausgegeben – ein neuer Rekord!

📉 Während der Corona-Jahre 2020 und 2021 waren es nur 20 bzw. 21 Mio. €.

📈 Seitdem geht’s wieder steil nach oben: 2022 & 2023 lagen die Ausgaben schon bei 180 Mio. €.

💡 Wenn Du 30 € für Böller ausgibst, dann sind das auf 10 Jahre gerechnet 300 €, die wortwörtlich in Rauch aufgehen – da könnte auch ein...

Read More »

Read More »

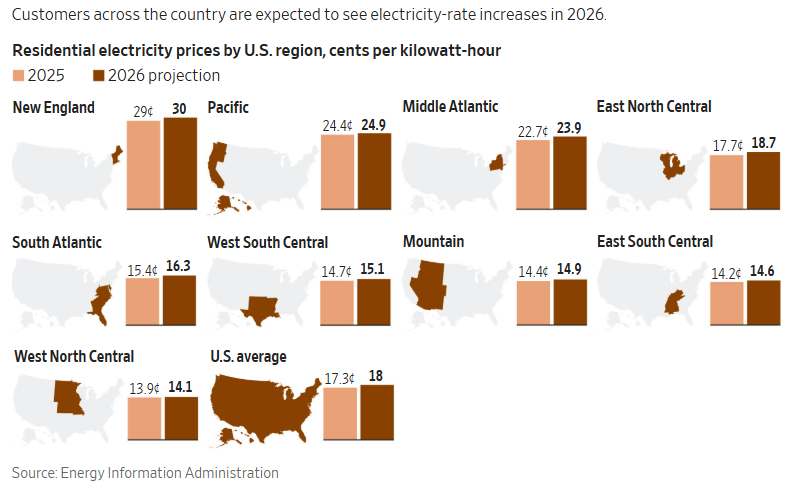

Electricity Prices Could Become a Structural Inflation Problem

Most Americans are paying higher electricity prices, and the pressure is unlikely to ease anytime soon. According to the Wall Street Journal, electricity prices have risen meaningfully across much of the country since 2022, and the drivers extend well beyond the frequently cited surge in data-center demand. While electricity prices had historically tracked inflation, that …

Read More »

Read More »

Du solltest die 72er Regel kennen!

🤑 Wann verdoppelt sich dein Vermögen? Die 72er-Regel erklärt.

Wer sollte die 72er-Regel noch kennen? Schick das Reel einem Freund.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine...

Read More »

Read More »

Financial Planning For Retirement In Your 50s

Financial Planning in Your 50s: Building a Secure Retirement Your 50s can feel like a financial crossroads. Earnings are often strong, responsibilities are real, and time starts acting a little less patient. College may be on the horizon (or underway). Aging parents might need support. Work is busy, life is full, and retirement is no …

Read More »

Read More »

Wie viel macht Eigenkapital bei Deinem Immobilienkauf aus?

Immobilie mit wenig Eigenkapital? Klingt smart – ist oft riskant 🏠💸

💡 Je weniger Eigenkapital Du mitbringst, desto höher der Zinssatz – und desto mehr Risiko.

Beispiel:

📉 50.000 € Eigenkapital = ca. 4,03 % Zins

📈 120.000 € Eigenkapital = ca. 3,64 % Zins

📌 Kaufnebenkosten (z. B. Notar, Grundsteuer, Makler) verschlingen schnell 6–12 % vom Kaufpreis – das musst Du erstmal abdecken.

⚠️ Und wenn Du verkaufen musst, aber die Schulden höher sind als...

Read More »

Read More »

So teuer ist Skifahren in Österreich für Dich

Skifahren wird zum Luxus ❄️🎿

💸 In der Hauptsaison zahlst Du in den Top-Skigebieten Österreichs bis zu 83 € pro Tag!

📍 Am teuersten: Sölden (83 €) und Ski Arlberg (81,50 €)

💡 Die günstigste Option im Ranking: SkiWelt Wilder Kaiser mit 76 €

Das sind allein für 5 Tage auf der Piste schon über 400 € nur fürs Ticket – ohne Unterkunft, Ausrüstung oder Essen.

💡 Wenn Du jetzt schon weißt, dass Du nächsten Winter fahren willst: Früh buchen, Angebote...

Read More »

Read More »

Deal oder kein Deal: Beziehung finanziell bewerten?

Schau das Video bis zum Ende: es erspart dir Tränen, Streit, zerstörte Jahre … und deinen Kindern das Chaos einer ungeklärten Trennung.

Klär die Finanzen mit deiner/m Beziehungspartner/in, bevor es zu spät ist.

Sonst sitzt du schneller mit einem McDonald’s-Burger in der Holzklasse, als du „Scheidungsanwalt“ (den du nicht absetzen kannst) sagen kannst.

#investmentpunk

#beziehungundgeld

#finanziellefreiheit

Read More »

Read More »

12-29-25 The Hidden Logic Behind Dollar Weakness

The U.S. doesn’t want a permanently strong dollar because it would choke the global economy and destabilize trade.

In this short video, Brent Johnson and I discuss why the U.S. has historically managed the dollar to stay range-bound and how dollar strength or weakness shapes global liquidity and growth.

📺Full interview: -SDg

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

2026 startet (möglicherweise) die Frühstartrente

2026 startet (möglicherweise) die Frühstartrente 👶

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

So “groß” waren vergangene Crashs auf lange Sicht

Crash? Ja. Absturz? Nein. 📉📈

So sieht der MSCI World über Jahrzehnte aus – mit allen großen Krisen:

🔻 Ölkrise 1973

🔻 Schwarzer Montag 1987

🔻 Dotcom-Blase, 9/11, Finanzkrise

🔻 Corona 2020

💡 Jeder dieser Einbrüche hat sich langfristig wieder erholt – und der Kurs ist weiter gestiegen.

👉 Wer langfristig investiert, muss nicht vor dem nächsten Crash zittern. Schwankungen gehören dazu – aber die Richtung stimmt.

⬇️ Teile dieses Video mit einer...

Read More »

Read More »

Die größten Geldfresser #sparen

Die größten Geldfresser 👹 #sparen

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen...

Read More »

Read More »

Das Finanzamt klopft im Januar an

Du hast 2024 brav in ETFs gespart – und plötzlich will das Finanzamt Kohle? 😳

💡 Auch wenn Du nix verkauft hast, verlangt das Finanzamt Steuern auf fiktive Gewinne – die sogenannte Vorabpauschale.

📅 Jeden Januar gilt:

👉 Pro 10.000 € im Aktien-ETF brauchst Du ca. 36 € auf dem Verrechnungskonto – sonst bucht das Finanzamt ins Leere.

📌 Alternativ: Freistellungsauftrag einrichten (z. B. 124 € bei 10.000 € ETF-Wert). Dann zahlst Du nichts – solange Du...

Read More »

Read More »

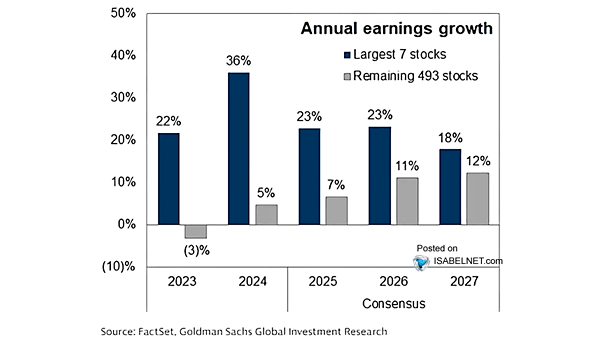

The Market Risk In 2026 If Growth Projections Fail

There is a rising market risk in 2026 that is largely overlooked as we wrap up this year. As discussed in the "Fed's Soft Landing Narrative," optimism about 2026 is running high. Currently, investors are pricing in strong economic growth, robust earnings, and a smooth path of disinflation. Notably, Wall Street estimates suggest a significant …

Read More »

Read More »