Category Archive: 9a) Buy and Hold

Warum vergangene Gewinne nichts zählen!

Rückblickend ist man immer schlauer. Aber wie vermeidest du typische Denkfehler bei deinen Investitionen? ?

Read More »

Read More »

Investing Challenges: Quick Corrections and Consistent Market Rises

Managing capital in a market with quick corrections is challenging. Stay alert as the market consistently rises with minimal #investment opportunities. ? #FinancialTips

Watch the entire show here: hhttps://https://cstu.io/11e1f0

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Der Barcode wird 50 Jahre alt! ≣ #barcode

Der Barcode wird 50 Jahre alt! ≣ #barcode

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Wie teuer ist eigentlich der Tod? #shorts

Hart aber wahr: Wenn Du stirbst hat das seinen Preis. Wie das gemeint ist, erfährst Du hier von Leo im Video.

#Finanztip

Read More »

Read More »

House Hacking 101: What It Is and How to Get Started

Sign Up for Jaren's FREE Event "How to Buy Profitable Real Estate Deals": https://bit.ly/4eFuLV8

In this episode of the Rich Dad Radio Show, host Jaren Sustar sits down with seasoned real estate investor Ryan Burnham to explore the power of house hacking as a strategy to achieve financial freedom. Ryan shares his inspiring journey from working a traditional job to building a thriving real estate portfolio through house hacking, offering...

Read More »

Read More »

Kleine Gewinne, großer Hebel ⏰

Die ersten Schritte im Vermögensaufbau fühlen sich langsam an – doch mit jedem Euro wird der Hebel größer ?

Read More »

Read More »

How to Navigate Perimenopause for Maximum Health & Vitality

In this episode of Ultra Healthy Now, Dr. Nicole Srednicki a high-performance health specialist, joins co-host Alexandra Gonzalez to discuss perimenopause and its impact on women's health. They explore the hormonal changes, symptoms like low energy and mood swings, and treatment options including bioidentical hormone replacement therapy (BHRT). Dr. Nikki emphasizes the importance of understanding hormonal health, careful monitoring of hormone...

Read More »

Read More »

#537 Die größten Börsenkrisen der Geschichte #börsencrash

#539 Investieren wie die Elite-Unis: Was ist das Endowment-Modell?

Endowment Funds managen das Vermögen von amerikanischen Elite-Universitäten. Dabei verfolgen sie eine besondere Strategie: Sie investieren nicht nur in Aktien, sondern vor allem in Private Equity und Hedgefonds. Markus und Max sprechen darüber, ob sich diese alternative Asset-Allokation auch für Privatanleger eignet, und was private Investoren von diesem besonderen Modell lernen...

Read More »

Read More »

Zuseherfrage: Ist die AfD böse? Journalistische Gegenpole zum rot-grünen Mainstream

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Ein Zuseher stellt mir Fragen über die politische Entwicklung des Landes. Ich beantworte Sie nach bestem Wissen und Gewissen und lasse mich auch auf die Beurteilung der Alternative für Deutschland #afd ein.

Im Teil 2 nenne ich journalistische #Medien (Papier...

Read More »

Read More »

The Significance of 4-5% Unemployment in Today’s Economy

? Did you know that historically, 4-5% unemployment is considered full employment? ? Keep watching to learn more about job trends with Jerome Powell! #economics #jobmarket ?

Watch the entire show here: https://www.youtube.com/live/lQWDEg-aQnI?si=d5KopPzMKAhxZPkB

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

20% Zuschuss auf ETF: Das neue Altersvorsorge-Depot

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_VHYfvcvtCXs

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_VHYfvcvtCXs

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_VHYfvcvtCXs

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_VHYfvcvtCXs

Justtrade

Traders Place* ►...

Read More »

Read More »

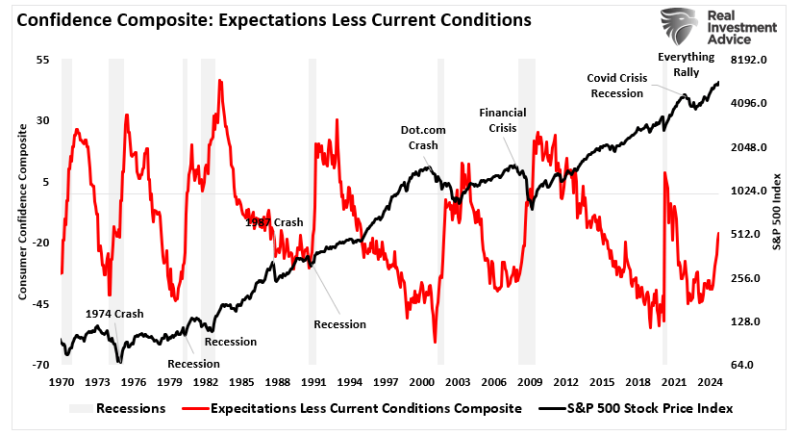

GDP Report Continues To Defy Recession Forecasts

The Bureau of Economic Analysis (BEA) recently released its second-quarter GDP report for 2024, showcasing a 2.96% growth rate. This number has sparked discussions among investors and analysts, particularly those predicting an imminent recession. There are certainly many supportive data points that have historically predicted recessionary downturns. The reversal of the yield curve inversion, the 6-month rate of change in the leading economic index,...

Read More »

Read More »

Das Problem mit Aktien Verlusten #shorts

Hast Du schon mal was von der sogenannten Prospect Theory gehört? Nein? Dann erklärt Dir Xenia hier, wie diese Theorie Deine Finanzentscheidungen beeinflussen kann.

#Finanztip

Read More »

Read More »

Gold Overbought: A Long Correction Expected After Fed Rate Cut

? Interesting insights on gold's overbought status! History shows a long correction may follow. Keep an eye on these dynamics! ? #InvestingTips #GoldMarket

Watch the show here: https://cstu.io/fae4b0

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

4 Types of Collaboration to Grow Your Business – Tom Wheelwright & Chad Jenkins

Republican vs. Democrat tax plans—? https://bit.ly/TomsTownHallYT?who will win, and how will it affect your money? Find out at Tom Wheelwright’s live town hall!

Tom Wheelwright's LIVE Town Hall ? https://bit.ly/TomsTownHallYT?

Your finances could be at stake—learn the truth about the Republican and Democrat tax proposals at Tom Wheelwright’s Town Hall October 16th.

The next election could impact your wealth?? https://bit.ly/TomsTownHallYT? Get...

Read More »

Read More »

Wie viel ist dein Unternehmen wirklich wert?

? https://dealmakingtraining.de/countdown-yt2 - Jetzt auf Warteliste eintragen!

?Lerne die Fähigkeiten, mit denen die Superreichen ihre Millionen verdienen!

In diesem Video zeigt dir Gerald Hörhan, Selfmade-Millionär, auch bekannt als der Investmentpunk, wie man den Wert eines Unternehmens richtig einschätzt.

Er erklärt die Unterschiede zwischen Dienstleistungsunternehmen und Firmen, die unabhängig vom Gründer funktionieren, und wie sich das...

Read More »

Read More »

Maximize Tax Deductions with THIS Investment – Mike Mauceli

In this episode of The Energy Show with REI Energy, host Michael Mauceli provides expert insights into oil and gas investing, focusing on strategies to maximize returns while minimizing risks. If you're looking to explore the lucrative world of oil and gas investments, this episode is packed with valuable information on how to approach the sector strategically. With nearly 35 years of experience, Michael explains how REI Energy helps investors...

Read More »

Read More »