Category Archive: 9a) Buy and Hold

Man kann sich gegen alles Mögliche versichern… Besonders kurios sind jedoch diese 3 Versicherungen

Man kann sich gegen alles Mögliche versichern… Besonders kurios sind jedoch diese drei Versicherungen. ? #versicherungen

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen...

Read More »

Read More »

Wealth Transfer & Capitalism Post Election – Tom Wheelwright, Ken Costa

Join Tom Wheelwright as he discovers how the next presidency may impact our country's wealth transfer and how capitalism may be revolutionized with his guest and author, Ken Costa.

Ken Costa has been a leading investment banker, author and philanthropist for the last 40 years. Born in South Africa, he was active in the anti-apartheid movement as a student leader in Johannesburg and went on to study law at Queens College, Cambridge, subsequently...

Read More »

Read More »

Deal Machine: How This Game-Changing Tool is Revolutionizing Real Estate Investing

Finding great real estate deals can be tough, but what if there was a tool that made it easier? In this episode of the Rich Dad Real Estate Show, Jaren Sustar chats with David Lecko, the founder of Deal Machine—a game-changing software that's revolutionizing how investors find off-market deals.

David shares his journey from tracking potential properties by hand to creating Deal Machine, a tool designed to help investors streamline the process of...

Read More »

Read More »

12-5-24 Is Another Liquidity Crisis Near

Portfolio Manager Michael Lebowitz makes a rare, in-studio appearance with Lance Roberts, discussing whether another market liquidity event might be on the horizon? While there is generally good liquidity in the financial system, there are some nascent signs that problems could arise. The ISM Services Index is showing weaknesses, and more economic reports to come this month are likely to mirrow such performance. A lack of stimulus money showing up...

Read More »

Read More »

How to Get the Most Out of Your Health Savings Account

Max out your Health Savings Account for triple tax benefits! Don't miss out on saving money for medical expenses. ?? #finance #healthcare

Watch the entire show here: https://cstu.io/3ca9ef

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Lilly Tops Nordisk In Weightloss Battle

The two market-leading weight loss/obesity drugs (GLP-1), Zepabound (Eli Lilly) and Wegovy (Novo Nordisk), just completed a clinical side-by-side trial. After 72 weeks of testing on 750 obese or overweight adults with at least one medical problem, Eli Lilly came out ahead by a substantial margin. Per Eli Lilly: Zepabound provided a 47% greater relative …

Read More »

Read More »

Diese Marken stecken hinter No-Name-Produkten

Liebst Du Prinzenrolle auch so sehr wie Saidi? Dann hat Tina hier vielleicht einen kleinen Spartip für Deinen Lieblings-Snack.

#Finanztip

Read More »

Read More »

Top 3 Investment Trends to Watch: AI, Quantum Computing, and Energy – Andy Tanner

? FREE Training with Andy Tanner: https://bit.ly/3U3HAPY

What if you could invest in the trends shaping the future? In this episode of the Cashflow Academy Podcast, host Andy Tanner sits down with trading experts Noah Davidson and Corey Halliday to explore three groundbreaking trends that could transform the market: Artificial Intelligence (AI), quantum computing, and energy.

They break down how AI is revolutionizing industries, why quantum...

Read More »

Read More »

Geschäftskonto Vergleich 2025: Die besten Konten für GmbH & Selbstständige!

Die besten Geschäftskonten im Vergleich!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=819&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Geschäftskonto Vergleich: ►► https://www.finanzfluss.de/vergleich/geschaeftskonto/ ?

ℹ️ Weitere Infos zum Video:

Wir haben für euch die Geschäftskonto Angebote verschiedener Anbieter miteinander verglichen. Welches...

Read More »

Read More »

Geldmarkt-ETF: Wie viel als Notgroschen? | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_VJEM8C_XlaE

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_VJEM8C_XlaE

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_VJEM8C_XlaE

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_VJEM8C_XlaE

Trade Republic

Justtrade

Flatex* ►...

Read More »

Read More »

Bitcoin Tax Secrets: How the Rich Avoid Paying More – Legally! – Robert Kiyosaki, Tom Wheelwright

Are you a Bitcoin investor worried about taxes? You’re not alone! In this episode of the Rich Dad Radio Show, Robert Kiyosaki and tax expert Tom Wheelwright break down the hidden secrets of cryptocurrency taxation and how savvy investors can avoid costly mistakes.

We’ll dive into everything from Bitcoin tax regulations to the IRS’s increased scrutiny on crypto transactions. Plus, Robert shares why he believes commodities like gold, silver, and oil...

Read More »

Read More »

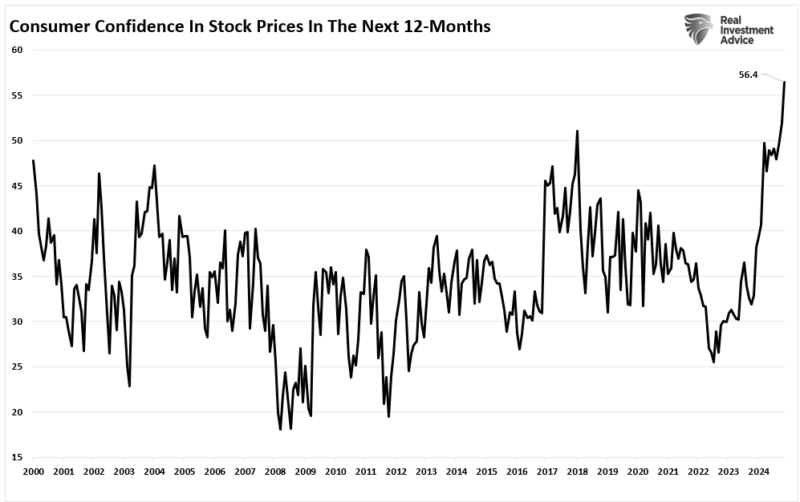

12-4-24 Time for a Portfolio Reality Check

Russia just learned of a near-miss from a passing meteor...TONIGHT! Lance discusses GDP estimates and other economic reports; Retail Sales are "okay," with no tell tale signs of Recession...for the moment. What will revisions to these reports show next year? What will be the impact of cutting government spending? Meanwhile, investors are very, very exuberant. What should investors expect for the rest of the year? Lance and Danny discuss...

Read More »

Read More »

The Dangers of Margin Investing: What You Need to Know

? Watch out for leverage! It can be fantastic on the way up but explosive on the way down. Stay informed and avoid the margin trap! ? #InvestingTips

Watch the entire show here: https://cstu.io/ea52f8

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Geld zu verschenken? Freibeträge bei Vermögensübertragen #erbe #schenkung

Geld zu verschenken? ? Freibeträge bei Vermögensübertragen #erbe #schenkung

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

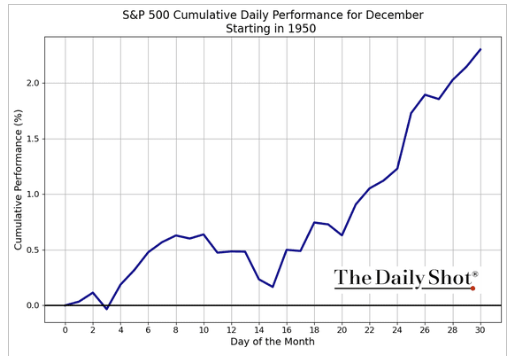

The Dollar And Oil Foresee A Santa Rally For Bonds

Bond yields are primarily driven by macroeconomic factors such as inflation and economic growth. Given their impact on inflation and the economy, the U.S. dollar and oil prices are frequently well correlated with bond yields. Therefore, bond traders often take their cue from the dollar and oil markets. The dollar (blue), as graphed on the …

Read More »

Read More »

Unsere Meinung zu Scalable Capital #shorts

Was halten wir bei Finanztip eigentlich von Scalable Capital? Saidi erklärt Dir hier, was wir generell zu Scalable Capital halten, welche Produkte wir empfehlen können und welche nicht.

#Finanztip

Read More »

Read More »

Core-Satellite: Die perfekte Strategie?

Das ist die beliebteste Anlagestrategie unserer Community. Was denkst du darüber? Schreib es in die Kommentare ?

Read More »

Read More »