Category Archive: 9a) Buy and Hold

Ist eine Unfallversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Unfallversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest...

Read More »

Read More »

The Stock Market Warning Of A Recession?

A Wall Street axiom states that the stock markets lead the economy by about six months. While not a perfect predictor, the stock market reacts to investor expectations about future corporate earnings, economic activity, interest rates, and inflation. When sentiment shifts due to anticipated weakness in any of these areas, equity prices often decline, reflecting …

Read More »

Read More »

Fair Trade Isn’t Equal Trade: Trump Breaks Key Economics Rule

Heading into April 2nd, investors were under the impression that Trump's goal was to set tariff rates that allow for fair trade with other nations. Trade impediments like tariffs, taxes, VATs, currency manipulation, and other methods that don't allow for fair trade would be offset with tariffs. More simply, Trump would level the playing field. …

Read More »

Read More »

Tesla meldet Rekordrückgang bei Autoverkäufen

2025 beginnt für Elon Musk und Tesla nicht so gut. Nach dem 1. Quartal muss die E-Auto-Marke einen ordentlichen Rückgang an Autoverkäufen feststellen.

#Finanztip

Read More »

Read More »

So schlägst Du den Aktienmarkt

Bestimmt hast Du auch schon eine dieser Werbungen bekommen die Dir empfehlen, dringend aktive Fonds bei Deiner Hausbank zu holen. Ob Du damit wirklich den Aktienmarkt schlägst oder nicht, das erfährst Du hier.

#Finanztip

Read More »

Read More »

Strafzölle: Trump macht Ernst | Saidis Senf der Woche

Es ist soweit: Trump verhängt wirklich Strafzölle. Welche Auswirkungen hat das jetzt konkret auf Dich und Dein Geld?

#Finanztip

Read More »

Read More »

Machen Amundis neue Lifecycle ETFs Sinn? 🤔 #amundi

Machen Amundis neue Lifecycle ETFs Sinn? 🤔 #amundi

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

Warum Dir im Alter 1 Million € fehlen: Rentenlücke neu berechnet

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_XEDBwfAKXBI

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_XEDBwfAKXBI

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_XEDBwfAKXBI

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_XEDBwfAKXBI

Justtrade* ►...

Read More »

Read More »

4-3-25 Markets’ Tariff Tizzy

President Donald Trump's tariff terrors were revealed Wednesday afternoon, and markets were not enthused. At all. The worse than expected tariff rates are the highest ever. Trade policy is still uncertain, however, as the tariffs are seen as a negotiating tactic, and subject to revision. But this makes it difficult for companies to re-calculate forward looking estimates of earnings. And as the ripple effects of higher expenses are felt in the...

Read More »

Read More »

Ist eine Ausbildungsversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Ausbildungsversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

The Definitive Guide to Estate Planning for Wealth Protection and Legacy

Estate planning is one of the most important yet often overlooked aspects of financial management. Without a comprehensive plan in place, your wealth and assets may not be distributed as intended, leading to unnecessary tax burdens, family disputes, or legal complications. Proper estate planning ensures that your legacy is protected, your family is financially secure, …

Read More »

Read More »

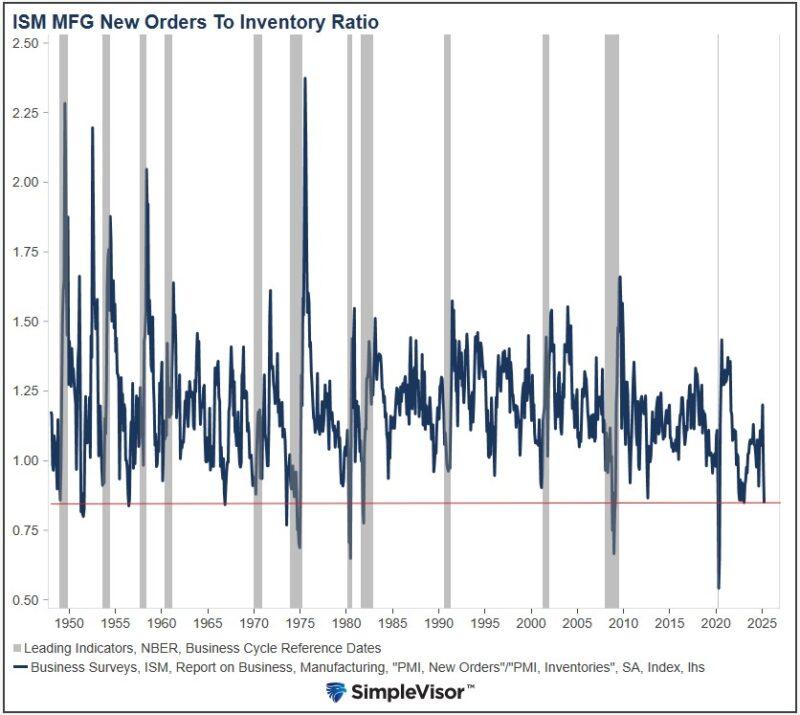

The Tariff Impact In One Graph

Over the past few weeks, we have discussed the sharp jump in the trade deficit due to a surge of imports trying to front-run potential tariffs. Thus far, the impact of front-running tariffs on economic data has only been significant in consumer and corporate surveys and the aforementioned trade deficit. That was until Tuesday. The …

Read More »

Read More »

So schlimm ist es, wenn Dein Hund jemanden beißt

Bei Finanztip sind wir der Meinung, zu viele Versicherungen lohnen sich nicht. Warum das hier anders ist, erfähst Du hier von Saidi

#Finanztip

Read More »

Read More »

Zins-Schock & 500 Mrd. Schulden – Das passiert jetzt mit dem Immobilienmarkt

Zinsen rauf, Immobilienpreise runter – oder doch nicht?

500 Milliarden Euro Sondervermögen der Bundesregierung und steigende Staatsanleihenzinsen bringen Bewegung in den Markt.

Gerald Hörhan analysiert klar, was das kurz-, mittel- und langfristig für Immobilienkäufer, Investoren und Kapitalanleger bedeutet.

✔️ Was bedeutet die neue Zinskurve für dich?

✔️ Warum Krypto, Aktien & Immobilien 2025 besonders turbulent werden

✔️ Und: Warum steigende...

Read More »

Read More »

Welche hast du in deinem Depot? Die 10 beliebtesten Aktien der Deutschen 🇩🇪 #top10

Welche hast du in deinem Depot? Die 10 beliebtesten Aktien der Deutschen 🇩🇪 #top10

Quelle: Analysiert wurden Depots von etwa 330.000 Nutzern von getquin in Deutschland. Stand: 6. Januar 2025.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Müssen Frauen anders investieren? | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_EhtA7ljoGRE

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_EhtA7ljoGRE

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_EhtA7ljoGRE

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_EhtA7ljoGRE

Justtrade* ►...

Read More »

Read More »

New Feature 🤫 & Portfolio | Finanzfluss Live

Die besten Finanzprodukte! ►► https://link.finanzfluss.de/extern/empfehlungen

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/extern/depot?utm_source=youtube&utm_medium=lNiy7Y32afs&utm_campaign=haupt-depot&utm_term=kostenlos&utm_content=yt-desc *📈

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

4-2-25 Liberation Day – What Does It Mean for You?

Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make Liberation Day look like a success? If that were the case, he might promise the worst regarding tariffs and underdeliver. In other words, the tariffs announced on Liberation Day may not be...

Read More »

Read More »

Ist eine Sterbegeldversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Sterbegeldversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »